What Affects Industrial Oil-Fired Boiler Pricing?

Industrial oil-fired boilers are valued for their stable combustion, wide adaptability, and reliable steam output, especially in regions with limited gas supply. However, pricing for oil-fired boilers can vary significantly, often causing confusion during budgeting and procurement. Without understanding the underlying cost drivers, buyers may either overpay for unnecessary specifications or underestimate the true project investment.

Industrial oil-fired boiler pricing is influenced by multiple factors, including boiler capacity and pressure, fuel type (diesel, heavy oil, light oil), efficiency level, materials and manufacturing standards, automation and control systems, emission compliance requirements, and project scope. Higher capacity, stricter emission limits, advanced automation, and turnkey delivery models all increase the overall price. Recognizing these variables helps users achieve the best balance between cost, performance, and long-term reliability.

A clear understanding of pricing factors enables more accurate budgeting and smarter equipment selection.

How Do Boiler Capacity, Steam Pressure, and Temperature Affect Oil-Fired Boiler Pricing?

For industrial buyers considering oil-fired steam boilers, pricing often appears confusing and inconsistent. Two oil-fired boilers using the same fuel can differ in price by several multiples, leading to uncertainty and procurement risk. The core pain point is misunderstanding how boiler capacity, steam pressure, and steam temperature fundamentally reshape design complexity and cost. The consequence of ignoring these parameters is either overspending on over-specified equipment or underinvesting in a boiler that cannot meet long-term operational demands. The solution is a clear, technical understanding of how capacity, pressure, and temperature directly influence oil-fired boiler pricing and total investment.

Oil-fired boiler pricing rises significantly with increasing steam capacity, higher pressure ratings, and elevated steam temperatures, because these parameters drive material strength requirements, heat-transfer surface area, fabrication complexity, safety systems, and compliance costs.

These three variables form the backbone of oil-fired boiler cost structure.

Oil-fired boiler pricing is primarily determined by fuel type rather than pressure or temperature.False

While fuel type influences combustion systems, pressure and temperature dominate material, design, and safety cost.

Higher steam pressure has a disproportionate impact on oil-fired boiler cost compared to capacity increases.True

Pressure increases require thicker walls, higher-grade alloys, and stricter manufacturing standards.

Understanding these effects enables accurate budgeting and optimized boiler selection.

How Boiler Capacity Influences Oil-Fired Boiler Pricing

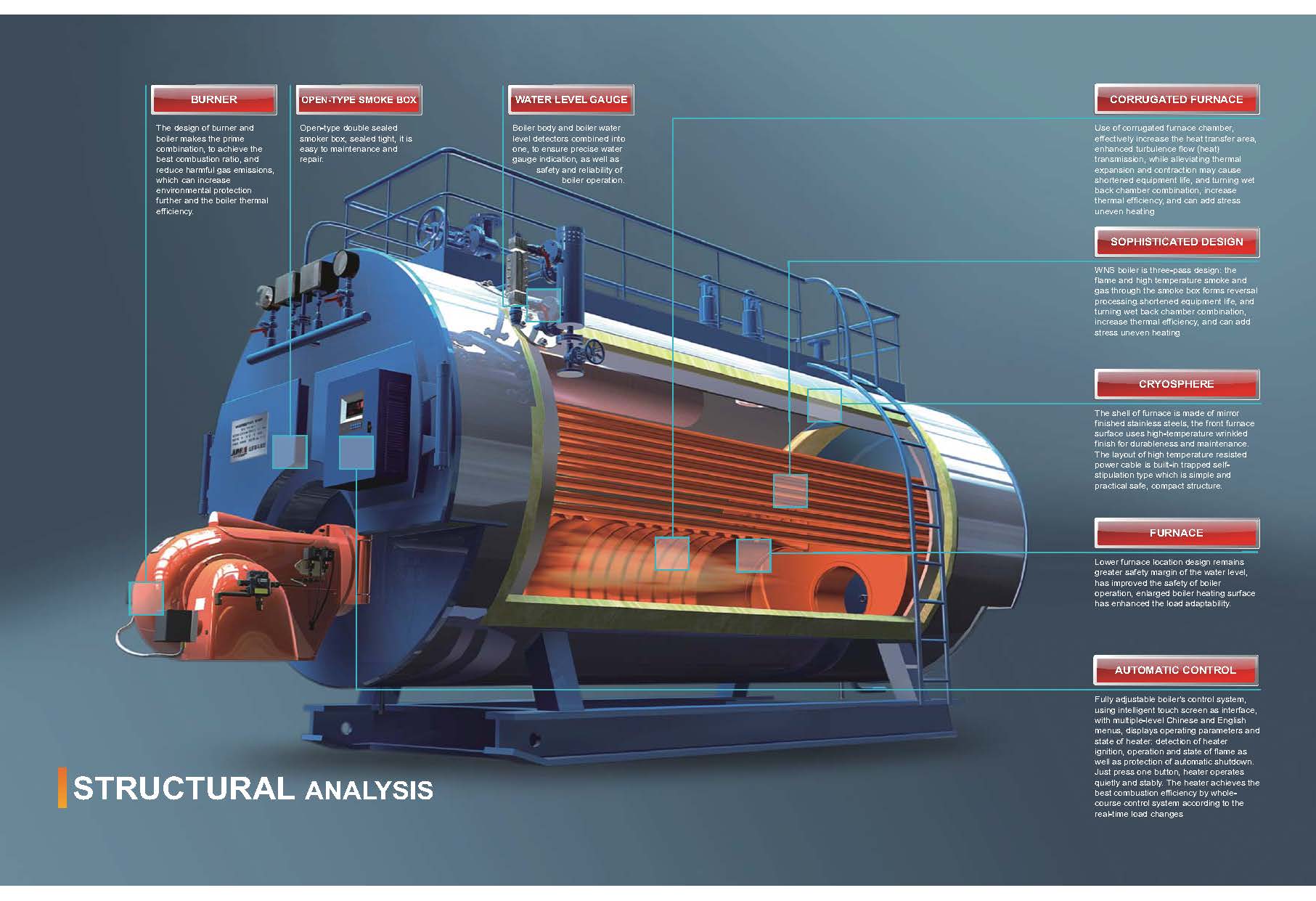

From a professional manufacturer’s and supplier’s perspective, boiler capacity determines the physical scale of the system. Capacity affects furnace volume, heating surface area, fuel firing rate, flue gas flow, and auxiliary equipment size.

As capacity increases:

– Steel consumption rises

– Burner size and redundancy increase

– Fans, pumps, and piping scale up

– Foundations and installation cost increase

| Steam Capacity (t/h) | Typical Price Trend |

|---|---|

| 1–5 t/h | Low |

| 10–20 t/h | Medium |

| 25–50 t/h | High |

| 75–100+ t/h | Very High |

Although larger boilers cost more in absolute terms, cost per ton of steam often decreases due to economies of scale.

Capacity and Combustion System Complexity

High-capacity oil-fired boilers often require multiple burners, staged combustion, or dual-fuel capability. These additions increase capital cost but improve reliability and turndown performance.

Capacity therefore influences not only size but also system redundancy and control complexity.

Steam Pressure as a Primary Cost Multiplier

Steam pressure is one of the most powerful cost drivers in oil-fired boiler design. Higher pressure requires thicker drums, headers, and tubes, as well as higher-grade alloy steels to withstand mechanical stress.

| Steam Pressure Class | Material Requirement | Relative Cost Impact |

|---|---|---|

| ≤1.25 MPa | Carbon steel | Baseline |

| 1.6–2.5 MPa | Thick carbon steel | +15–30% |

| 3.82–5.3 MPa | Alloy steel | +35–60% |

| Superheated / power | Advanced alloys | +70%+ |

Pressure increases trigger stricter welding procedures, non-destructive testing, and certification, all of which add cost.

Why Pressure Costs Escalate Faster Than Capacity

Unlike capacity, which mainly affects size, pressure affects every pressure-retaining component simultaneously. Even a moderate pressure increase can require a complete redesign of drums, headers, and safety valves.

From a cost-engineering standpoint, pressure upgrades produce exponential cost growth rather than linear scaling.

Impact of Steam Temperature on Oil-Fired Boiler Cost

Steam temperature is closely linked to pressure but introduces additional cost drivers. Higher steam temperature increases thermal stress and oxidation risk, requiring advanced materials and tighter design margins.

Temperature-related cost drivers include:

– Superheater material upgrades

– Tube spacing and support redesign

– Enhanced insulation systems

| Steam Temperature | Design Complexity | Cost Impact |

|---|---|---|

| Saturated steam | Low | Baseline |

| 350–400°C | Medium | +10–20% |

| 450–540°C | High | +25–50% |

High-temperature superheated steam is common in power and cogeneration applications, significantly increasing boiler price.

Interaction Between Pressure and Temperature

Pressure and temperature effects compound rather than add linearly. High-pressure, high-temperature oil-fired boilers require both thick pressure parts and heat-resistant alloys, making them substantially more expensive than saturated steam units.

This interaction explains why power-generation oil-fired boilers cost far more than industrial process boilers.

Safety Systems and Compliance Costs

Higher capacity, pressure, and temperature require more advanced safety systems, including:

– Redundant safety valves

– Flame monitoring and burner management systems

– Emergency shutdown logic

These systems add capital cost but are essential for safe and compliant operation.

Automation and Control Scaling

As capacity and pressure increase, automation requirements become more stringent. High-pressure oil-fired boilers demand precise fuel–air ratio control and fast response to load changes.

Advanced PLC or DCS systems increase upfront cost but protect equipment and efficiency.

Emission Control Implications

Oil-fired boilers operating at higher capacities and temperatures may require enhanced NOx control systems. Low-NOx burners, flue gas recirculation, or SCR systems add further cost, especially under strict environmental regulations.

Lifecycle Cost Perspective

While higher capacity, pressure, and temperature increase capital cost, they can improve overall efficiency and process integration. When matched correctly to application demand, higher-spec boilers can reduce fuel cost per unit of steam.

Poorly matched specifications, however, result in unnecessary capital expense without proportional economic benefit.

Case Example: Cost Optimization Through Specification Balance

An industrial plant initially specified a high-pressure, high-temperature oil-fired boiler for process steam. Engineering analysis revealed that saturated steam at lower pressure met all requirements, reducing boiler cost by over 25% without affecting production. Correct specification delivered immediate capital savings and lower maintenance cost.

Manufacturer’s Strategic Perspective

From a professional manufacturer’s standpoint, oil-fired boiler pricing reflects engineering reality. The most cost-effective boiler is not the one with the highest capacity, pressure, or temperature—but the one precisely matched to actual process needs and regulatory requirements.

In conclusion, boiler capacity, steam pressure, and steam temperature are the three dominant factors shaping oil-fired boiler pricing. Capacity determines physical scale, pressure drives material and safety cost, and temperature increases thermal and metallurgical complexity. Their combined effect defines the final investment level. Understanding these relationships allows industrial users to avoid overdesign, control capital expenditure, and achieve optimal long-term performance.

How Does Fuel Type (Diesel, Light Oil, Heavy Oil) Influence Design and Cost?

For industrial users selecting oil-fired steam boilers, fuel choice is often underestimated as a simple procurement decision. In reality, choosing between diesel, light oil, and heavy oil fundamentally reshapes boiler design, auxiliary systems, capital investment, and long-term operating costs. The pain point arises when a boiler is priced based on one fuel assumption but later operated with another, leading to efficiency loss, reliability issues, or unexpected retrofitting costs. The consequence can be higher capital expenditure, increased maintenance, and unstable operation. The solution is a clear understanding of how different oil fuel types influence boiler design requirements and overall cost structure.

Fuel type—diesel, light oil, or heavy oil—directly influences oil-fired boiler design complexity, auxiliary system requirements, combustion efficiency, emission control needs, and both initial and lifecycle costs.

Fuel selection is therefore a strategic engineering and economic decision.

All oil-fired boilers have similar design and cost regardless of whether diesel, light oil, or heavy oil is used.False

Different oil fuels require distinct handling, combustion, and preheating systems that significantly affect boiler design and cost.

Heavy oil-fired boilers generally have higher capital and maintenance costs than diesel-fired boilers.True

Heavy oil requires fuel heating, advanced burners, and more intensive maintenance due to viscosity and impurities.

Understanding these differences prevents costly misalignment between fuel strategy and boiler design.

Overview of Oil Fuel Types Used in Industrial Boilers

From a professional manufacturer’s and supplier’s perspective, oil fuels are broadly categorized by viscosity, calorific value, and impurity content.

| Fuel Type | Typical Characteristics | Common Use |

|---|---|---|

| Diesel oil | Low viscosity, clean | Small to medium boilers |

| Light oil (LDO) | Moderate viscosity | Industrial process boilers |

| Heavy oil (HFO) | High viscosity, impurities | Large industrial boilers |

Each fuel type drives distinct engineering and cost implications.

Diesel-Fired Boiler Design and Cost Characteristics

Diesel is the cleanest and easiest oil fuel to handle. It requires minimal pre-treatment and can be fired at ambient temperature.

Design implications include:

– Simple fuel supply system

– Standard pressure atomizing burners

– Minimal filtration and heating

Cost impact:

– Lower initial boiler and auxiliary cost

– Reduced maintenance requirements

– Higher fuel unit price

Diesel-fired boilers are often selected where operational simplicity and reliability outweigh fuel cost concerns.

Light Oil (LDO) Boiler Design Considerations

Light oil occupies a middle ground between diesel and heavy oil. It has higher viscosity than diesel but remains relatively easy to atomize with modest heating.

Design requirements include:

– Fuel preheating (mild)

– Enhanced filtration

– More robust burner systems

Cost implications:

– Moderate increase in auxiliary system cost

– Balanced fuel price and efficiency

– Moderate maintenance effort

Light oil boilers are popular in medium-scale industrial applications seeking a balance between capital cost and fuel economics.

Heavy Oil (HFO) Boiler Design Complexity

Heavy oil presents the greatest design and cost challenges due to its high viscosity, sulfur content, and impurities.

Design requirements include:

– High-temperature fuel preheating systems

– Heated fuel storage tanks and pipelines

– Advanced burners with steam or air atomization

– Robust soot blowing and ash handling systems

| Design Element | Diesel | Light Oil | Heavy Oil |

|---|---|---|---|

| Fuel heating | None | Low | High |

| Burner complexity | Low | Medium | High |

| Filtration | Basic | Medium | Advanced |

| Soot blowing | Minimal | Moderate | Extensive |

These systems significantly increase capital investment.

Capital Cost Comparison by Fuel Type

Fuel choice has a direct effect on initial boiler and balance-of-plant cost.

| Fuel Type | Relative Capital Cost |

|---|---|

| Diesel | Low |

| Light Oil | Medium |

| Heavy Oil | High (+15–30%) |

Heavy oil-fired boilers often require 15–30% higher capital investment than diesel-fired units of similar capacity due to auxiliary systems alone.

Impact on Combustion Efficiency

Fuel type influences combustion stability and achievable efficiency. Diesel and light oil burn more cleanly, enabling stable flame and higher efficiency.

Heavy oil combustion often produces:

– Higher fouling rates

– Slagging on heat-transfer surfaces

– Increased excess air requirement

These factors reduce effective efficiency unless advanced design measures are implemented.

Maintenance and Spare Parts Cost Differences

From a lifecycle perspective, maintenance cost varies substantially by fuel type.

| Fuel Type | Maintenance Intensity | Spare Parts Cost |

|---|---|---|

| Diesel | Low | Low |

| Light Oil | Medium | Medium |

| Heavy Oil | High | High |

Heavy oil systems require frequent cleaning of burners, filters, and heat-transfer surfaces, increasing downtime and labor cost.

Emission Control and Environmental Cost Implications

Heavy oil typically contains higher sulfur and ash content, increasing SO₂ and particulate emissions. Compliance with emission regulations often requires:

– Larger flue gas treatment systems

– Higher reagent consumption

– Increased monitoring cost

Diesel and light oil boilers generally face lower emission control cost, improving total ownership economics under strict regulations.

Fuel Price Versus System Cost Trade-Off

Although heavy oil often has a lower unit fuel price, this advantage is partially offset by:

– Higher capital cost

– Higher maintenance expense

– Lower efficiency stability

– Higher emission compliance cost

The true economic comparison must therefore consider total cost of ownership, not fuel price alone.

Operational Flexibility and Reliability

Diesel and light oil systems offer rapid startup and flexible operation, making them suitable for variable load applications. Heavy oil systems require longer startup times and tighter operational discipline.

In applications demanding high availability and fast response, lighter fuels often deliver superior economic performance.

Case Example: Fuel Choice Impact on Cost

An industrial plant selected heavy oil for its lower fuel price but underestimated preheating and maintenance costs. Over ten years, total operating cost exceeded that of a comparable light oil boiler due to higher downtime and compliance expense. Fuel choice directly shaped long-term economics.

Manufacturer’s Strategic Perspective

From a professional manufacturer’s standpoint, fuel type selection must align with plant scale, operating profile, environmental requirements, and maintenance capability. The lowest fuel price does not guarantee the lowest cost steam.

In conclusion, diesel, light oil, and heavy oil influence oil-fired boiler design and cost in fundamentally different ways. Diesel offers simplicity and low capital cost but higher fuel expense. Light oil provides a balanced solution with moderate design complexity and operating cost. Heavy oil delivers potential fuel savings but demands higher capital investment, more complex systems, and increased maintenance and compliance costs. The most economical choice depends on a holistic evaluation of design requirements, operating conditions, and long-term ownership cost.

What Impact Do Efficiency Requirements and Heat Recovery Systems Have on Price?

For industrial boiler buyers, efficiency requirements are often promoted as “energy-saving features,” but their real impact on price is frequently misunderstood. Many users face a painful dilemma: higher-efficiency boilers come with higher upfront costs, while lower-priced boilers promise savings that later disappear through fuel waste. The consequence of misjudging efficiency requirements and heat recovery systems is either overspending on unnecessary upgrades or suffering long-term operating losses that far exceed the initial savings. The solution lies in understanding how efficiency targets and heat recovery systems influence boiler design, capital price, and total cost of ownership.

Higher efficiency requirements and integrated heat recovery systems increase the initial price of industrial steam boilers by adding equipment, materials, and engineering complexity, but they significantly reduce long-term fuel and operating costs—often delivering strong economic payback over the boiler’s lifecycle.

Efficiency is therefore not just a technical specification; it is a strategic financial decision.

Efficiency improvements always make industrial steam boilers too expensive to justify.False

Although efficiency upgrades increase initial price, lifecycle fuel savings often outweigh the added capital cost.

Heat recovery systems such as economizers are among the most cost-effective efficiency investments in industrial boilers.True

Economizers typically offer short payback periods by recovering waste heat from flue gas.

Understanding this balance is essential for rational boiler investment.

Efficiency Requirements as a Design Driver

From a professional manufacturer’s and supplier’s perspective, efficiency requirements directly shape boiler architecture. Higher efficiency targets demand improved heat transfer, reduced losses, and tighter combustion control.

Key efficiency-driven design changes include:

– Increased heating surface area

– Optimized furnace geometry

– Advanced insulation

– Precise air–fuel ratio control

Each of these elements increases manufacturing complexity and material cost, directly affecting boiler price.

Baseline Efficiency vs High-Efficiency Boilers

Industrial steam boilers are typically offered in multiple efficiency tiers. The price difference between tiers reflects additional components and engineering.

| Efficiency Level | Typical Features | Relative Price |

|---|---|---|

| Standard | Basic design, no recovery | Baseline |

| Medium | Economizer, better insulation | +5–10% |

| High | Economizer + air preheater | +10–20% |

| Ultra-high | Multiple recovery systems | +20–30% |

While higher tiers cost more upfront, they dramatically reduce fuel consumption.

Role of Economizers in Boiler Pricing

Economizers are the most common heat recovery systems used in industrial steam boilers. They recover sensible heat from flue gas to preheat feedwater.

Price impact:

– Additional heat exchanger surface

– Structural support and piping

– Control and safety integration

Typical economizer systems increase boiler price by 3–8%, but they often improve efficiency by 3–6%, making them one of the most economically attractive upgrades.

Air Preheaters and Combustion Efficiency

Air preheaters recover heat from flue gas to warm combustion air, improving flame stability and reducing fuel consumption.

Cost implications include:

– Larger flue gas ducting

– Corrosion-resistant materials

– Advanced temperature control

Air preheaters typically add 5–10% to boiler price but can raise efficiency by an additional 2–4%, especially in solid-fuel boilers.

Condensate and Blowdown Heat Recovery

Advanced efficiency requirements often include recovery of heat from condensate and blowdown.

These systems require:

– Heat exchangers

– Storage tanks

– Control valves and automation

While their individual cost impact is moderate, combined systems contribute significantly to overall boiler package price.

Material and Manufacturing Cost Escalation

Higher efficiency often demands better materials to handle lower flue gas temperatures and avoid corrosion, especially in economizers and air preheaters.

From a cost standpoint:

– Alloy steels replace carbon steel

– Thicker tubes may be required

– Manufacturing tolerances tighten

These material upgrades increase both component cost and fabrication labor.

Automation and Control Cost

High-efficiency boilers require precise control of combustion, feedwater temperature, and load response. Advanced PLC or DCS systems are often necessary.

Automation-related price increases include:

– Sensors and transmitters

– Control logic development

– Commissioning and tuning

Although automation raises initial cost, it protects efficiency performance over time.

Efficiency Requirements and Emission Compliance

Higher efficiency reduces fuel consumption and emissions per unit of steam, often lowering the size and operating cost of emission control systems.

This indirect cost benefit partially offsets the higher initial price of efficiency upgrades, especially under strict environmental regulations.

Economic Trade-Off: Capital Cost vs Fuel Savings

The most important question for buyers is whether efficiency-driven price increases are justified.

| Efficiency Upgrade | Typical Payback Period |

|---|---|

| Economizer | 1–2 years |

| Air preheater | 2–4 years |

| Full heat recovery package | 3–6 years |

After payback, efficiency improvements deliver continuous cost savings.

Impact on Boiler Size and Footprint

Heat recovery systems increase boiler system size and footprint, sometimes requiring larger buildings or foundations. This adds indirect project cost, particularly in retrofit projects.

However, these costs are typically small compared to long-term fuel savings.

Efficiency Degradation and Long-Term Value

Low-efficiency boilers often suffer faster efficiency degradation due to fouling and uncontrolled excess air. High-efficiency designs, when properly maintained, retain performance longer.

From a lifecycle cost perspective, efficiency stability is as important as initial efficiency.

Case Example: Price vs Efficiency Decision

An industrial plant compared a standard boiler and a high-efficiency boiler with economizer and air preheater. The high-efficiency option increased capital cost by 15% but reduced annual fuel cost by 12%. Payback was achieved in less than three years, after which the plant enjoyed permanent operating cost reduction.

Manufacturer’s Strategic Perspective

From a professional manufacturer’s standpoint, efficiency and heat recovery should be optimized—not maximized blindly. The most cost-effective solution balances efficiency gains with realistic operating hours, fuel price, and maintenance capability.

Over-specifying efficiency in low-utilization plants can be uneconomical, while under-specifying in continuous operations is financially damaging.

When High Efficiency Is Most Economical

Efficiency upgrades deliver the strongest economic return when:

– Operating hours exceed 5,000–6,000 per year

– Fuel costs are high or volatile

– Emission regulations are strict

– Steam demand is continuous

Under these conditions, higher upfront price yields superior long-term economics.

In conclusion, higher efficiency requirements and heat recovery systems increase the initial price of industrial steam boilers by adding equipment, materials, and engineering complexity. However, these investments significantly reduce fuel consumption, operating costs, and emission-related expenses over the boiler’s life. For most continuous industrial applications, efficiency-driven price increases are not costs but value-generating investments that lower total cost of ownership and improve long-term competitiveness.

How Do Materials, Manufacturing Quality, and Certification Standards Affect Cost?

When industrial buyers compare steam boiler quotations, price gaps of 20–50% for seemingly similar specifications are common and often confusing. The core pain point lies in hidden differences: materials selection, manufacturing quality, and certification standards that are not always obvious in basic datasheets. The consequence of overlooking these factors is severe—premature failures, higher maintenance costs, compliance risks, and even safety incidents. The solution is to clearly understand how materials, manufacturing quality, and certification standards fundamentally shape boiler cost and long-term value.

Higher-grade materials, stricter manufacturing quality control, and internationally recognized certification standards significantly increase the upfront cost of industrial steam boilers, but they deliver superior safety, reliability, efficiency retention, and lower lifecycle cost.

These three factors form the structural backbone of boiler pricing and must be evaluated together, not in isolation.

Boiler cost differences are mainly driven by brand name rather than material or certification quality.False

Material grade, fabrication quality, and certification standards directly affect manufacturing cost, safety margin, and lifespan.

International certifications such as ASME or EN standards increase boiler cost but reduce long-term operational risk.True

Stricter certification requires higher material quality, testing, and documentation, increasing upfront cost while improving safety and reliability.

Understanding these drivers protects buyers from false economy.

Materials Selection as a Primary Cost Driver

From a professional boiler manufacturer’s perspective, materials represent one of the largest cost components in an industrial steam boiler. Material choice directly determines pressure resistance, thermal durability, corrosion tolerance, and service life.

Key material categories include:

– Pressure parts (drums, headers, tubes)

– Structural steel

– Furnace and refractory materials

– Insulation and casing

Higher-grade materials significantly increase raw material and processing cost.

Carbon Steel vs Alloy Steel: Cost and Performance Impact

Most low- to medium-pressure boilers use carbon steel, while higher pressure and temperature boilers require alloy steels.

| Material Type | Typical Application | Relative Cost |

|---|---|---|

| Carbon steel | Low-pressure saturated steam | Baseline |

| Low-alloy steel | Medium pressure/temperature | +15–30% |

| High-alloy steel | High pressure/superheated | +40–70% |

Alloy steels increase cost not only due to raw material price but also due to stricter welding and heat treatment requirements.

Tube Material Quality and Cost Implications

Boiler tubes are critical heat-transfer components and a common failure point in low-quality boilers.

High-quality tube materials offer:

– Uniform wall thickness

– Superior creep resistance

– Better corrosion resistance

Inferior tubes reduce initial cost but often result in early leakage, efficiency loss, and unplanned shutdowns, driving up lifecycle cost.

Refractory and Insulation Material Impact

High-quality refractory and insulation materials reduce heat loss and protect furnace structures. Advanced ceramic fiber and high-density castables cost more than basic materials but significantly improve efficiency stability and service life.

From a cost perspective:

– Better insulation raises material cost by 3–6%

– Heat loss reduction saves fuel continuously

Manufacturing Quality and Fabrication Standards

Manufacturing quality goes far beyond appearance. It defines how well a boiler performs under pressure, thermal cycling, and long-term operation.

Key manufacturing quality factors include:

– Welding procedures and welder qualification

– Dimensional accuracy

– Stress relief heat treatment

– Assembly precision

High manufacturing quality requires skilled labor, specialized equipment, and longer production time—raising cost.

Welding Quality as a Cost Multiplier

Pressure-part welding is one of the most cost-intensive processes in boiler manufacturing.

High-quality welding involves:

– Qualified welders

– Certified welding procedures (WPS)

– Multi-pass welds

– 100% inspection in critical areas

| Welding Level | Inspection Scope | Cost Impact |

|---|---|---|

| Basic | Visual only | Low |

| Standard | Partial NDT | Medium |

| Premium | Full NDT + PWHT | High |

Premium welding standards significantly increase manufacturing cost but dramatically improve safety and durability.

Non-Destructive Testing (NDT) and Quality Control

High-quality boilers undergo extensive NDT, including:

– Radiographic testing (RT)

– Ultrasonic testing (UT)

– Magnetic particle testing (MT)

– Dye penetrant testing (PT)

Each test adds cost but ensures defect-free pressure parts. Lower-cost boilers often limit inspection, increasing hidden risk.

Certification Standards and Their Cost Impact

Certification standards define the legal and technical framework under which boilers are designed and manufactured.

Common standards include:

– ASME (USA)

– EN / PED (Europe)

– GB (China)

– ISO quality systems

ASME and EN standards are among the most demanding and expensive to comply with.

| Certification | Relative Cost Impact |

|---|---|

| Local standard | Low |

| National standard | Medium |

| ASME / EN | High (+10–25%) |

These standards require higher material traceability, documentation, inspection, and third-party audits.

Material Traceability and Documentation Cost

Certified boilers require full material traceability:

– Mill certificates

– Heat number tracking

– Welding records

– Inspection reports

Documentation does not improve visible performance but is essential for legal compliance, insurance, and long-term asset management—adding indirect cost.

Factory Quality Systems and Audit Requirements

Manufacturers producing certified boilers must maintain:

– ISO 9001 quality systems

– Approved fabrication facilities

– Regular third-party audits

These overhead costs are embedded in boiler pricing but ensure consistent quality and accountability.

Impact on Safety and Risk Management

From a risk perspective, higher material quality, manufacturing standards, and certification dramatically reduce:

– Explosion risk

– Tube rupture incidents

– Structural failures

Lower-risk equipment often qualifies for:

– Lower insurance premiums

– Easier regulatory approval

– Reduced downtime cost

These benefits are rarely reflected in initial price comparisons.

Lifecycle Cost vs Initial Cost Comparison

| Boiler Quality Level | Initial Cost | Lifecycle Cost |

|---|---|---|

| Low-grade | Low | Very High |

| Mid-grade | Medium | Medium |

| High-grade | High | Low |

What appears expensive upfront often proves economical over 20–30 years of operation.

Case Example: Certification Value in Practice

A plant selected a low-cost, non-certified boiler to save capital. After regulatory changes, the boiler required costly retrofitting and additional inspection, ultimately exceeding the cost of a certified unit. Certification upfront would have minimized long-term expense and risk.

Manufacturer’s Professional Perspective

As a professional boiler manufacturer and supplier, we emphasize that materials, manufacturing quality, and certification are not optional upgrades—they are fundamental determinants of safety, durability, and cost stability. Price-driven compromises in these areas inevitably resurface as operational and financial losses.

When Higher Standards Are Most Justified

Premium materials and certifications are especially cost-effective when:

– Operating pressure and temperature are high

– Continuous or critical production depends on steam

– Regulatory scrutiny is strict

– Long service life is expected

In such cases, higher upfront cost delivers superior economic performance.

In conclusion, materials, manufacturing quality, and certification standards have a profound impact on industrial steam boiler cost. Higher-grade materials increase raw and processing cost, superior manufacturing quality raises labor and inspection expense, and recognized certification standards add compliance overhead. However, these costs translate directly into enhanced safety, reliability, efficiency retention, and lower total cost of ownership. For industrial users focused on long-term value rather than short-term savings, investing in quality and certification is not an expense—it is a strategic safeguard.

How Do Automation Level and Control Systems Change the Overall Boiler Price?

For many industrial buyers, boiler automation is often seen as an optional “add-on” rather than a core design decision. This misunderstanding creates a major pain point: low-automation boilers appear cheaper at first glance but later suffer from higher labor costs, unstable operation, safety incidents, and efficiency losses. The consequence is a boiler that costs less to buy but far more to own and operate. The solution is to understand how different automation levels and control system architectures directly affect boiler price, performance, safety, and lifecycle economics.

Higher automation levels and advanced control systems increase the initial price of industrial steam boilers due to added instrumentation, control hardware, software engineering, and commissioning, but they significantly reduce operating labor, fuel waste, downtime, and safety risk—often lowering total cost of ownership.

Automation is therefore not merely a technical feature but a strategic economic lever.

Boiler automation only affects operational convenience and has little influence on total cost.False

Automation strongly affects labor cost, efficiency stability, safety, and downtime, all of which shape lifecycle cost.

Highly automated boilers typically achieve more stable efficiency and lower unplanned downtime.True

Advanced control systems maintain optimal combustion and protect equipment through real-time monitoring and interlocks.

Understanding automation cost impact enables rational boiler investment decisions.

Levels of Boiler Automation: An Overview

From a professional boiler manufacturer’s perspective, automation can be divided into several maturity levels, each with distinct cost implications.

| Automation Level | Typical Description | Relative Price |

|---|---|---|

| Manual | Operator-controlled | Baseline |

| Semi-automatic | Basic interlocks | +5–10% |

| Fully automatic | PLC-based control | +10–20% |

| Advanced / DCS | Integrated plant control | +20–35% |

Each step upward adds hardware, software, and engineering effort.

Manual and Low-Automation Boilers

Low-automation boilers rely heavily on operator experience. Fuel flow, air supply, and water level adjustments are often manual or semi-manual.

Cost characteristics:

– Minimal instrumentation

– Simple control panels

– Low initial price

However, these systems suffer from:

– High labor dependence

– Inconsistent efficiency

– Higher safety risk

The apparent price advantage often disappears in continuous industrial operations.

Semi-Automatic Control Systems

Semi-automatic boilers introduce basic safety interlocks and automatic regulation of key parameters such as water level and pressure.

Design features include:

– Simple controllers

– Limited sensors

– Alarm-based supervision

These systems modestly increase boiler price but significantly improve safety and compliance compared to manual operation.

Fully Automatic PLC-Based Boilers

Fully automatic boilers use PLC (Programmable Logic Controller) systems to manage combustion, feedwater, pressure, and safety logic.

Cost drivers include:

– PLC hardware and I/O modules

– Field instrumentation (pressure, flow, temperature)

– Burner management systems (BMS)

| Control Component | Cost Impact |

|---|---|

| PLC hardware | Medium |

| Sensors & actuators | Medium |

| Burner management | High |

PLC automation typically increases boiler price by 10–20% but drastically reduces operator workload.

Advanced DCS and Integrated Control Systems

In large or critical applications, boilers are integrated into plant-wide DCS (Distributed Control Systems).

Additional cost elements include:

– Redundant controllers

– Network infrastructure

– Cybersecurity measures

– Advanced diagnostics and data logging

DCS-based automation delivers superior visibility and reliability but commands the highest upfront cost.

Impact of Automation on Combustion Efficiency

Advanced automation enables precise air–fuel ratio control and load following.

Efficiency benefits include:

– Reduced excess air

– Stable flame conditions

– Lower fuel consumption

Poorly controlled boilers often lose 3–8% efficiency due to manual adjustment errors—far exceeding the cost of automation over time.

Safety Systems as a Cost Factor

Automation significantly expands safety systems:

– Flame detection

– Automatic shutdown

– Pressure and temperature interlocks

– Emergency response logic

These systems increase capital cost but are essential for modern safety and insurance requirements.

Labor Cost Reduction Through Automation

One of the most powerful economic drivers of automation is labor reduction.

| Automation Level | Typical Staffing Requirement |

|---|---|

| Manual | Continuous operator presence |

| Semi-automatic | Frequent supervision |

| Fully automatic | Periodic monitoring |

| Advanced | Remote supervision |

Labor savings over 10–20 years often exceed the initial automation investment.

Maintenance and Downtime Implications

Automation systems enable predictive maintenance through alarms, trends, and fault diagnostics.

Benefits include:

– Early fault detection

– Reduced catastrophic failures

– Shorter downtime duration

Lower automation often results in reactive maintenance, increasing long-term cost.

Integration With Emission Control Systems

Modern emission control systems require automated coordination with combustion controls.

Automation adds cost but enables:

– Stable emission compliance

– Reduced reagent consumption

– Automatic reporting

Manual systems struggle to maintain compliance under variable load conditions.

Impact on Commissioning and Engineering Cost

Higher automation levels require:

– Control logic development

– Factory acceptance testing (FAT)

– Site acceptance testing (SAT)

These engineering services increase upfront price but ensure reliable startup and stable operation.

Scalability and Future Expansion

Advanced automation allows future expansion or integration with energy management systems.

While this adds initial cost, it protects long-term investment value and operational flexibility.

Case Example: Automation ROI in Practice

A manufacturing plant upgraded from semi-automatic to fully automated boiler control. Capital cost increased by 15%, but labor requirements dropped by 40% and fuel consumption decreased by 6%. Payback was achieved in less than three years.

Manufacturer’s Professional Perspective

From a professional manufacturer’s standpoint, automation should be matched to operating hours, fuel type, safety requirements, and workforce skill level. Under-automation creates hidden costs, while over-automation can waste capital if operational complexity is low.

When High Automation Is Most Cost-Effective

Higher automation delivers the greatest value when:

– Boilers operate continuously

– Fuel costs are high

– Skilled operators are scarce

– Safety and compliance requirements are strict

In these scenarios, higher upfront price translates into strong economic advantage.

In conclusion, automation level and control systems significantly influence the overall price of industrial steam boilers. Higher automation increases initial investment through additional hardware, software, and engineering, but it dramatically reduces labor cost, fuel waste, downtime, and safety risk. For most modern industrial applications, automation-driven price increases are not expenses but investments that improve reliability and lower total cost of ownership.

How Do Emission Regulations and Project Scope (Supply vs. EPC) Impact Total Investment?

For industrial boiler investors, total project cost is often far higher than the boiler quotation alone. Many users experience a painful gap between expected and actual investment because two critical factors are underestimated: emission regulations and project scope definition. The consequence is budget overruns, delayed commissioning, regulatory non-compliance, or costly redesigns after installation. The solution lies in understanding how environmental regulations and whether a project is supply-only or EPC (Engineering, Procurement, and Construction) fundamentally reshape total boiler investment.

Stricter emission regulations significantly increase total boiler investment through added flue gas treatment systems and compliance engineering, while EPC project scope substantially raises upfront cost compared to equipment-only supply—but greatly reduces execution risk, schedule uncertainty, and hidden expenses.

These two dimensions define not only capital expenditure but also risk exposure.

Emission regulations only affect operating cost and have minimal impact on boiler capital investment.False

Modern emission standards require expensive control systems that significantly increase initial project cost.

EPC boiler projects typically cost more upfront but reduce total project risk and lifecycle uncertainty.True

EPC scope consolidates engineering, procurement, and construction responsibilities, reducing hidden costs and delays.

Understanding these impacts is essential for realistic budgeting.

Emission Regulations as a Major Capital Cost Driver

From a professional boiler manufacturer’s perspective, emission regulations are no longer peripheral requirements. They are central design constraints that drive equipment selection, system complexity, and total investment.

Key regulated emissions include:

– Particulate matter (PM)

– Sulfur oxides (SO₂)

– Nitrogen oxides (NOx)

– Carbon monoxide (CO)

Stricter limits require more sophisticated control technologies.

Capital Cost Impact of Emission Control Systems

Emission compliance systems add significant cost beyond the boiler itself.

| Emission Control System | Typical Capital Cost Impact |

|---|---|

| Multicyclone | Low |

| Baghouse / ESP | Medium |

| Wet scrubber | Medium–High |

| SCR / SNCR (NOx) | High |

Depending on regulation stringency, emission systems can add 20–50% to total boiler island investment.

Fuel Type and Regulatory Severity

Emission regulation impact varies by fuel:

– Gas-fired boilers face moderate NOx control cost

– Oil-fired boilers require SO₂ and particulate control

– Coal and biomass boilers require the most extensive systems

Thus, identical boiler capacities can have vastly different total investment depending on regulatory environment.

Engineering Cost of Compliance

Compliance extends beyond equipment purchase. Engineering tasks include:

– Dispersion modeling

– Stack height calculation

– Emission monitoring integration

– Regulatory documentation

These engineering services add indirect cost often overlooked in early budgeting.

Continuous Emission Monitoring Systems (CEMS)

Many jurisdictions mandate CEMS for large boilers.

CEMS impact includes:

– Analyzer hardware

– Sampling systems

– Data reporting infrastructure

Although CEMS do not improve efficiency, they significantly increase both capital and operating cost.

Retrofitting vs New Compliance Design

Projects that underestimate emission requirements often face retrofitting, which is significantly more expensive than integrated design.

Retrofitting consequences include:

– Space constraints

– Additional downtime

– Redesign cost

Integrated compliance design minimizes these hidden costs.

Project Scope Definition: Supply-Only vs EPC

Project scope determines who bears responsibility for design, coordination, and execution.

| Scope Type | Responsibility | Cost Level |

|---|---|---|

| Supply-only | Owner | Low upfront |

| Partial EPC | Shared | Medium |

| Full EPC | Contractor | Highest upfront |

While supply-only projects appear cheaper, they often carry higher hidden risk.

Supply-Only Boiler Projects: Cost Characteristics

Supply-only scope typically includes:

– Boiler equipment

– Basic documentation

Excluded costs often include:

– Civil works

– Piping and electrical installation

– Emission systems integration

These exclusions shift cost and risk to the owner.

EPC Projects: Higher Price, Lower Risk

EPC scope includes:

– Engineering

– Procurement

– Construction

– Commissioning

Capital cost is higher because the contractor prices risk, coordination, and schedule guarantees.

However, EPC significantly reduces:

– Interface conflicts

– Cost overruns

– Commissioning delays

Emission Compliance Under EPC Scope

In EPC projects, emission compliance responsibility is transferred to the contractor.

Benefits include:

– Single-point accountability

– Guaranteed emission performance

– Integrated system optimization

This reduces regulatory risk and protects investment.

Schedule and Delay Cost Implications

Supply-only projects often face delays due to coordination issues between vendors.

Delays increase:

– Financing cost

– Lost production

– Regulatory penalties

EPC projects typically deliver faster and more predictably, offsetting higher upfront cost.

Hidden Cost Comparison

| Cost Category | Supply-Only | EPC |

|---|---|---|

| Initial price | Low | High |

| Coordination cost | High | Low |

| Delay risk | High | Low |

| Compliance risk | Owner | Contractor |

| Final cost certainty | Low | High |

Total investment certainty is often more valuable than lowest quoted price.

Emission Regulations and EPC Synergy

Under strict emission regimes, EPC scope becomes more attractive because compliance integration is complex.

EPC contractors optimize:

– Boiler-emission system interfaces

– Control logic

– Space utilization

This optimization reduces long-term compliance cost.

Lifecycle Cost Perspective

Stricter emission systems increase:

– Reagent consumption

– Power use

– Maintenance

EPC designs often minimize lifecycle cost through integrated optimization, while supply-only projects may suffer inefficiencies.

Case Example: Scope Impact on Investment Outcome

An industrial plant selected supply-only scope to reduce initial cost. Emission system integration issues caused delays and retrofits, increasing total cost by over 30%. A comparable EPC project delivered on schedule with predictable cost and faster regulatory approval.

Manufacturer’s Strategic Perspective

From a professional manufacturer and supplier standpoint, emission regulations and project scope must be evaluated together. Underestimating either leads to cost escalation. The lowest boiler price rarely equals the lowest total investment.

When EPC Scope Is Most Economical

EPC scope delivers the greatest value when:

– Emission limits are strict

– Project scale is large

– Owner engineering resources are limited

– Schedule certainty is critical

In such cases, higher upfront cost delivers superior financial control.

In conclusion, emission regulations and project scope profoundly impact total boiler investment. Stricter environmental standards increase capital cost through advanced control systems and compliance engineering. EPC project scope raises upfront price compared to supply-only procurement but significantly reduces execution risk, compliance uncertainty, and hidden expenses. For modern industrial boiler projects, especially under strict regulatory environments, total investment optimization depends on integrating emission compliance and scope strategy from the earliest planning stage.

🔍 Conclusion

Industrial oil-fired boiler pricing is determined by a combination of technical specifications, compliance requirements, and delivery scope. While basic models offer lower upfront costs, advanced designs with high efficiency, automation, and emission control deliver better long-term value and operational stability. Selecting the right configuration ensures optimal performance without unnecessary capital expenditure.

🔹 Contact us today to receive a professional, application-specific oil-fired boiler pricing proposal with no hidden costs. ⚙️🔥🏭✅

FAQ

Q1: What are the main factors that affect industrial oil-fired boiler pricing?

A1: Industrial oil-fired boiler pricing is influenced by multiple technical and commercial factors. The most critical include boiler capacity, steam pressure and temperature, fuel type (diesel, light oil, heavy oil), thermal efficiency, and emission control requirements. Larger-capacity and higher-pressure boilers require more materials, stronger pressure parts, and advanced engineering, which significantly increases cost. Additionally, customization for specific industrial processes and compliance with regional standards also impacts pricing.

Q2: How does boiler capacity and output influence the price?

A2: Boiler capacity—measured in tons of steam per hour or thermal output—is one of the strongest cost drivers. As capacity increases, the size of the furnace, heat exchange surfaces, burners, and auxiliary equipment grows rapidly. For example, a small 2–5 t/h oil-fired boiler may cost significantly less than a 20–50 t/h unit, even if the design is similar. Higher output boilers also require more robust foundations, pumps, and control systems, adding to the overall project cost.

Q3: How does fuel type (diesel, light oil, heavy oil) affect boiler pricing?

A3: Different oil fuels require different combustion and fuel-handling systems. Diesel and light oil boilers generally have simpler burners and fuel systems, resulting in lower initial cost. Heavy oil-fired boilers, however, require preheating systems, insulated fuel lines, and specialized burners to handle higher viscosity fuel. These additional components increase capital cost but may reduce long-term fuel expenses in regions where heavy oil is cheaper or more readily available.

Q4: How do efficiency and emission standards impact oil-fired boiler cost?

A4: Higher thermal efficiency and stricter emission standards directly increase boiler pricing. High-efficiency oil-fired boilers often include economizers, advanced burners, oxygen trim controls, and automated combustion management systems. To meet environmental regulations for NOx, SO₂, and particulate emissions, additional equipment such as low-NOx burners or flue gas treatment systems may be required. While these features raise upfront cost, they lower long-term fuel consumption and compliance risks.

Q5: What project and commercial factors influence final pricing?

A5: Beyond technical design, several project-related factors affect industrial oil-fired boiler pricing. These include certification requirements (ASME, CE, ISO), manufacturing location, transportation distance, installation scope, and after-sales service agreements. Turnkey EPC projects typically cost more than boiler-only supply but reduce execution and operational risks. Warranty terms, spare parts availability, and supplier experience should also be considered when evaluating price versus long-term value.

References

- U.S. Department of Energy – Industrial Boiler Cost and Efficiency – https://www.energy.gov/ – DOE

- ASME – Boiler and Pressure Vessel Code (BPVC) – https://www.asme.org/ – ASME

- International Energy Agency (IEA) – Oil Use in Industrial Heat – https://www.iea.org/ – IEA

- Spirax Sarco – Oil-Fired Boiler Design and Costs – https://www.spiraxsarco.com/ – Spirax Sarco

- Engineering Toolbox – Oil-Fired Boiler Systems – https://www.engineeringtoolbox.com/ – Engineering Toolbox

- ScienceDirect – Economic Analysis of Oil-Fired Boilers – https://www.sciencedirect.com/ – ScienceDirect

- ISO – Industrial Boiler Standards – https://www.iso.org/ – ISO

- Carbon Trust – Boiler Efficiency and Emissions – https://www.carbontrust.com/ – Carbon Trust

- MarketsandMarkets – Industrial Boiler Market Insights – https://www.marketsandmarkets.com/ – Markets and Markets

- World Bank – Industrial Energy and Fuel Cost Studies – https://www.worldbank.org/ – World Bank

What Affects Industrial Oil-Fired Boiler Pricing? Read More »