Latest Trends in Industrial Oil-Fired Boiler Technology and Market Demand

Industrial oil-fired boilers are operating in a rapidly changing energy environment. While oil-fired systems were once considered a traditional and transitional solution, rising fuel costs, stricter emission regulations, and competition from gas and electric boilers are reshaping both technology development and market demand. Companies that fail to understand these trends risk investing in outdated systems with declining competitiveness and higher long-term costs.

The latest trends in industrial oil-fired boiler technology focus on higher thermal efficiency, ultra-low-emission combustion, intelligent control systems, fuel flexibility (light oil, heavy oil, dual-fuel), and compact modular design. Market demand is shifting toward high-efficiency, low-emission, and flexible oil-fired boilers used mainly for backup power, peak-load operation, and regions with limited gas infrastructure. These trends are redefining the role of oil-fired boilers in modern industrial energy systems.

Understanding both technological and market trends helps users make future-proof investment decisions and deploy oil-fired boilers where they offer the greatest value.

How Are High-Efficiency Burners and Heat Recovery Technologies Shaping Oil-Fired Boiler Design Trends?

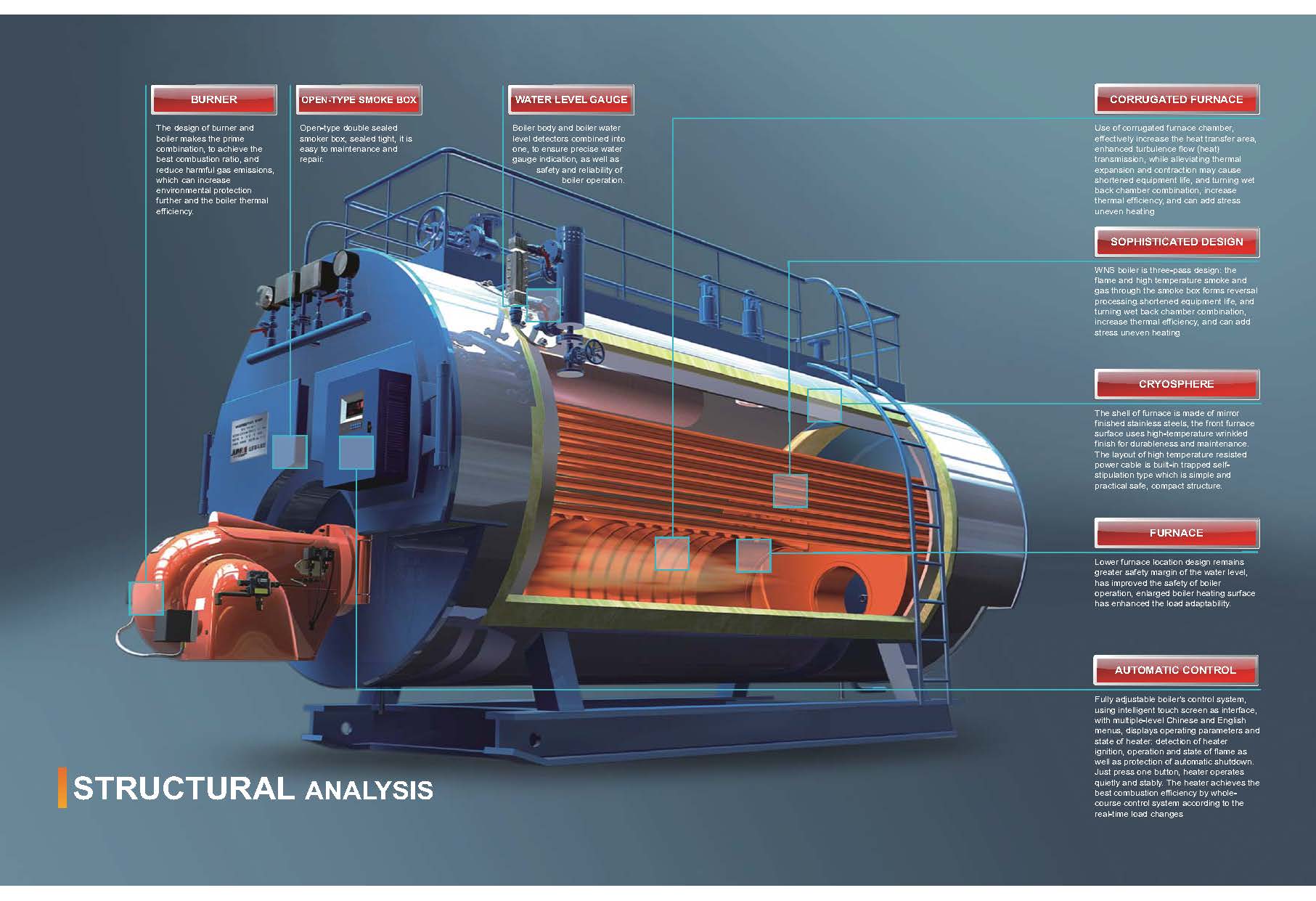

In industries where fuel oil remains a critical energy source—particularly in regions with limited access to natural gas—improving oil-fired boiler efficiency is vital for reducing fuel costs, emissions, and carbon footprint. Traditionally viewed as moderate-efficiency heat generators, oil-fired boilers have undergone a major transformation with the integration of high-efficiency burner technology and advanced heat recovery systems. These innovations are now central to modern oil boiler design, significantly improving their performance and competitiveness in high-demand industrial applications.

High-efficiency burners and heat recovery technologies are reshaping oil-fired boiler design by increasing combustion efficiency, minimizing flue gas losses, and improving fuel-to-steam conversion rates. Modern low-NOx and modulating burners reduce excess air and achieve near-complete combustion, while heat recovery systems such as economizers and condensing units reclaim waste heat from flue gases, pushing total thermal efficiency from 82–88% in traditional systems to over 92–95% in next-generation oil boilers.

These advancements are not only improving energy use efficiency but also ensuring compliance with stricter emission regulations and helping industries lower operational costs in fuel-heavy operations.

Oil-fired boilers cannot achieve high efficiency due to inherent combustion limitations.False

With high-efficiency burners and advanced flue gas heat recovery systems, modern oil-fired boilers can achieve efficiencies over 92%, making them competitive with other thermal systems.

Evolution of Burner Technology in Oil-Fired Boilers

From Conventional to High-Efficiency Burners

| Burner Type | Efficiency Potential (%) | Key Features |

|---|---|---|

| Simple Pressure Jet Burner | 78–82 | Fixed output, high excess air |

| Two-Stage Burner | 82–85 | Basic modulation, reduced startup loss |

| Fully Modulating Burner | 85–90 | Continuously adjusts flame to load demand |

| Low-NOx Burner | 85–90 | Reduced nitrogen oxide formation |

| Ultra-Low-NOx Burner | 88–92 | Advanced atomization, staged combustion |

High-efficiency burners improve combustion by:

- Reducing excess air (from 30–40% down to 10–15%)

- Enhancing atomization of heavy fuel oil for better mixing

- Utilizing variable-speed fans and O₂ trim controls

- Enabling precise load-following operation

These features result in more complete fuel burning, less soot formation, and lower unburned hydrocarbon emissions.

Burner Emission Reductions

| Emission Type | Conventional Burner (mg/Nm³) | Low-NOx Burner (mg/Nm³) | Ultra-Low-NOx Burner (mg/Nm³) |

|---|---|---|---|

| NOx | 250–400 | 120–180 | <80 |

| CO | 100–150 | 30–60 | <30 |

| HC | 50–100 | <50 | <20 |

Advanced burners support compliance with global emission standards, including EPA, EU Ecodesign, and China’s GB 13271 standards.

Heat Recovery Technologies Elevating Boiler Efficiency

Heat recovery maximizes the usable energy from combustion by capturing waste heat from flue gases.

1. Economizers

- Installed in the flue path after the boiler exit

- Preheat feedwater using flue gas (180–250°C)

- Efficiency gain: +3% to +6%

- Reduces fuel input for same steam output

2. Condensing Heat Exchangers

- Recover latent heat by condensing water vapor in flue gas

- Works best when return water temp < 60°C

- Particularly effective in low-temperature steam or hot water systems

- Efficiency gain: +5% to +8%

| System Type | Efficiency (Gross) | Heat Recovery Element |

|---|---|---|

| Standard Oil-Fired Boiler | 82–88% | None or basic economizer |

| High-Efficiency with Economizer | 88–91% | Flue gas economizer |

| Condensing Oil-Fired Boiler | 92–95% | Condensing heat exchanger + O₂ trim |

Advanced Control Systems Enhance Both Burner and Heat Recovery Effectiveness

| Control Technology | Efficiency/Performance Role |

|---|---|

| O₂ Trim System | Adjusts combustion air in real-time for optimal air/fuel ratio |

| Variable-Speed Fan Drives | Matches airflow to load, reducing parasitic power losses |

| Integrated PLC + HMI | Monitors burner, flue gas temps, economizer performance |

| Load Modulation Sensors | Reduce cycling, increase part-load efficiency |

These intelligent systems ensure consistent peak performance, reducing operational variability and enhancing safety.

Real-World Efficiency Gains: Industrial Case Study

A 10 TPH oil-fired steam boiler at a textile plant underwent upgrades:

- Original setup: Pressure jet burner + no heat recovery

- Efficiency: 84%, Fuel usage: 870 liters/hr

- Upgraded setup: Modulating burner + economizer + O₂ trim

- Efficiency: 91.5%, Fuel usage: 790 liters/hr

Savings:

- Fuel Reduction: 9.2%

- Annual Fuel Savings: ~195,000 liters

- ROI: ~2.7 years

Summary of Trends Shaping Oil-Fired Boiler Design

| Design Trend | Impact |

|---|---|

| Burner Modulation | Enhances combustion precision, reduces fuel usage |

| Flue Gas Heat Recovery (Economizer) | Cuts stack losses, increases feedwater enthalpy |

| Condensing Recovery | Captures latent heat, boosts low-temp system efficiency |

| Emission-Limiting Burner Design | Meets NOx, CO, and particulate regulations |

| Integrated Digital Controls | Enables smart fuel-air management and efficiency tracking |

Summary

As the industry moves toward greater thermal performance and regulatory compliance, oil-fired boilers are no longer limited by old design standards. The integration of high-efficiency burner systems—paired with economizers, condensing heat exchangers, and intelligent control units—has brought oil-fired systems into the modern era. These innovations are pushing boiler thermal efficiency past 92%, improving environmental performance, and delivering meaningful fuel savings in large-scale heating and steam generation processes.

In sectors such as textiles, pharmaceuticals, food processing, and remote industrial plants, these new-generation oil-fired boilers remain a reliable and now highly efficient solution, especially when cleaner alternatives are not yet viable.

How Do Ultra-Low-Emission and Environmental Compliance Requirements Influence Oil-Fired Boiler Technology?

As governments and environmental agencies enforce ever-stricter emissions standards to curb industrial air pollution and climate impact, oil-fired boiler systems have undergone a significant transformation. Once considered moderate polluters, oil boilers now face regulatory pressure to drastically reduce NOₓ, SO₂, CO₂, and particulate matter (PM) emissions. These ultra-low-emission and compliance demands have pushed the development of cleaner combustion technologies, sophisticated flue gas treatment systems, and real-time monitoring platforms, resulting in a new generation of high-efficiency, low-emission oil-fired boilers.

Ultra-low-emission and environmental compliance requirements are driving innovation in oil-fired boiler technology by mandating the integration of low-NOx burners, flue gas desulfurization systems, electronic emissions monitoring, and smarter combustion control. These upgrades not only reduce NOₓ emissions to below 30 mg/Nm³ and SO₂ to under 100 mg/Nm³ but also ensure alignment with global regulatory standards such as the EU Ecodesign Directive, U.S. EPA MACT standards, and China’s GB 13271, while improving overall thermal efficiency and safety.

This transformation reflects a broader industrial shift toward sustainable thermal energy, even for fossil-based systems that still serve critical roles in heat-intensive sectors such as textiles, pharmaceuticals, petrochemicals, and district heating.

Oil-fired boilers cannot comply with modern environmental emission standards.False

Advanced oil-fired boilers equipped with ultra-low-NOx burners, desulfurization systems, and emissions monitoring can meet or exceed modern global environmental standards.

Key Emission Targets Shaping Oil Boiler Innovation

| Emission Type | Traditional Oil Boilers | Ultra-Low-Emission Targets | Key Control Strategy |

|---|---|---|---|

| NOₓ | 150–400 mg/Nm³ | ≤30–80 mg/Nm³ | Low-NOx / staged combustion burners |

| SO₂ | 200–2,000 mg/Nm³ | ≤100 mg/Nm³ | Low-sulfur fuel + Flue Gas Desulfurization (FGD) |

| CO | 100–200 mg/Nm³ | ≤50 mg/Nm³ | Precision combustion control |

| PM | 30–100 mg/Nm³ | ≤10–30 mg/Nm³ | Cyclone separators, ESPs, condensing systems |

| CO₂ (kg/MWh) | 300–400 | Minimized via efficiency gains | High-efficiency burners + heat recovery |

1. Low-NOx and Ultra-Low-NOx Burner Technologies

Modern oil burners are designed to limit nitrogen oxide (NOₓ) formation, which arises primarily from high flame temperatures during combustion.

Techniques used:

- Staged combustion: Separates the combustion into zones to reduce peak flame temperature

- Flame shaping and recirculation: Controls thermal NOₓ formation

- Flue gas recirculation (FGR): Lowers oxygen concentration and flame temperature

- Fully modulating burners: Minimize excess air at part-load conditions

| Burner Type | NOₓ Emissions (mg/Nm³) | Efficiency (%) |

|---|---|---|

| Conventional pressure jet | 300–400 | 82–85 |

| Low-NOx burner | 120–180 | 85–90 |

| Ultra-low-NOx burner | <80 | 88–92 |

Result: Cleaner combustion with better thermal performance and easier permitting under regional NOₓ caps.

2. SO₂ Control and Fuel Quality Compliance

SO₂ emissions are directly linked to the sulfur content in fuel oil. Compliance strategies include:

- Switching to low-sulfur or ultra-low-sulfur fuel oil (ULSFO)

- <0.1% S content now common in EU and maritime applications

- Flue Gas Desulfurization (FGD)

- Wet or dry scrubbers use lime/limestone to capture SO₂

- Hybrid approaches: Low-sulfur fuels with post-combustion polishing

Real-world example:

| Fuel Sulfur Content (%) | SO₂ Emission (mg/Nm³) | After FGD (mg/Nm³) |

|---|---|---|

| 2.0% | 1,800–2,400 | 100–150 |

| 0.5% | 500–800 | <100 |

| 0.1% (ULSFO) | 80–120 | Often compliant without FGD |

Compliance: Aligns with IMO MARPOL VI, EU IED, and US MACT emission caps.

3. Particulate Matter (PM) and VOC Controls

Although oil combustion emits less PM than coal, unburned hydrocarbons, ash, and condensable particles must still be controlled.

Technologies employed:

- Multi-cyclone collectors

- Electrostatic precipitators (ESP)

- Condensing heat exchangers (capture fine PM and recover heat)

- Catalytic oxidizers for VOCs

| PM Emission Without Control | 50–100 mg/Nm³ |

|---|---|

| With ESP or condensing unit | 10–30 mg/Nm³ |

These systems ensure compliance with air quality regulations in urban and industrial zones.

4. Flue Gas Monitoring and Smart Compliance Tools

Continuous Emissions Monitoring Systems (CEMS) are now required in many regions for real-time compliance data.

Features:

- NOₓ, SO₂, CO, PM, and O₂ tracking

- Data logging for EPA, EU, or local environmental bodies

- Integration with PLC systems for auto-adjustment of burner parameters

Example Integration Architecture:

| System Component | Function |

|---|---|

| CEMS Analyzer | Measures stack emissions |

| PLC Control Unit | Modulates burner air/fuel ratio |

| SCADA Interface | Operator display and remote logging |

| Alarm System | Warns on threshold breaches |

5. Emission Compliance Impact on Design Trends

| Design Trend | Compliance Benefit |

|---|---|

| Ultra-low-NOx Burners | Meets urban or industrial air quality standards |

| High-Efficiency Heat Recovery | Lowers CO₂ output per unit of steam |

| Low-Sulfur Fuel Adaptability | Avoids need for expensive desulfurization in some regions |

| Condensing Flue Gas Systems | Reduces PM, improves efficiency |

| Real-Time Monitoring & Automation | Ensures continuous compliance, optimizes combustion |

Summary

Environmental regulations are no longer an external consideration—they now directly shape the internal architecture and operation of oil-fired boiler systems. Ultra-low-emission technologies have transitioned from optional upgrades to core design features, influencing burner construction, fuel selection, heat recovery layout, and system intelligence.

As a result, modern oil-fired boilers are significantly cleaner, smarter, and more efficient than legacy units, capable of operating within the world’s strictest emission frameworks. These advancements help ensure that oil-fired boilers remain viable and compliant in industries that still require reliable thermal power—but now with a reduced environmental footprint.

How Are Digitalization, Automation, and Intelligent Control Systems Transforming Oil-Fired Boilers?

In the age of Industry 4.0, even traditional thermal systems like oil-fired boilers are being reshaped by digital transformation. With rising pressure to optimize energy use, reduce emissions, and minimize downtime, digitalization, automation, and intelligent control systems are now core enablers of performance, safety, and efficiency in boiler operations. The once manually tuned, analog oil boilers are evolving into smart, self-regulating thermal systems that can react in real-time to load changes, fuel variability, and regulatory requirements.

Digitalization, automation, and intelligent control systems are transforming oil-fired boilers by enabling real-time combustion optimization, predictive maintenance, adaptive load control, remote monitoring, and full system integration. These innovations increase fuel efficiency by 5–10%, reduce NOx and CO emissions, minimize unplanned outages, and support compliance with environmental and safety standards. Through PLCs, IoT sensors, AI algorithms, and cloud platforms, oil-fired boilers are now smarter, safer, and more economically efficient than ever before.

This revolution is not just technical—it reshapes how boilers are managed across industries, from food processing and textiles to chemical manufacturing and district heating.

Digitalization has minimal impact on oil-fired boiler performance because combustion is a physical process.False

Digital technologies significantly improve oil-fired boiler performance by optimizing combustion, reducing emissions, automating controls, and enabling predictive maintenance through data analytics.

Core Digitalization Components in Modern Oil-Fired Boiler Systems

| Technology | Functionality | Efficiency/Performance Benefit |

|---|---|---|

| PLC (Programmable Logic Controller) | Central automation unit for burner and auxiliaries | Improves control accuracy, reduces human error |

| SCADA (Supervisory Control and Data Acquisition) | Real-time process visualization, alarms, logging | Enables operational transparency and quick response |

| IoT Sensors | Monitor temperature, pressure, O₂, flue gas, flow rates | Data-rich environment enables smart adjustments |

| O₂ Trim Systems | Automatically adjust air/fuel ratio in real-time | Boosts combustion efficiency by 2–3% |

| Variable Frequency Drives (VFDs) | Control motor speeds on fans, pumps | Reduce parasitic energy losses |

| AI/ML Algorithms | Predictive load response, emission forecasting, maintenance | Enhances efficiency, reliability, and compliance |

| Cloud-Based Monitoring | Remote access, data logging, benchmarking | Enables centralized boiler fleet management |

Real-Time Combustion Optimization with AI-Based Controls

Traditionally, combustion was manually tuned based on fixed setpoints, often leading to over- or under-firing, inefficient burning, and excess emissions.

Now, AI-enhanced combustion management systems use:

- Real-time flue gas analysis (O₂, CO, NOx, SO₂)

- Historical fuel quality data

- Dynamic boiler load inputs

- Ambient temperature/pressure changes

This enables adaptive control, where the system continuously adjusts:

- Burner modulation

- Air damper position

- Fuel valve opening

- Recirculation fan speeds

Efficiency Impact:

| Without Digital Optimization | With Intelligent Combustion Control |

|---|---|

| Excess air: 25–30% | Reduced to 10–15% |

| NOx emissions: 150–250 mg/Nm³ | Reduced to 80–120 mg/Nm³ |

| Combustion efficiency: 82–85% | Raised to 88–91% |

| Soot buildup: Frequent cleaning | Minimized due to clean burn |

Predictive Maintenance and Asset Health Monitoring

Digitalization has made condition-based maintenance a reality. IoT sensors track boiler health parameters like:

- Burner flame intensity and stability

- Pump vibration levels

- Feedwater temperature and pressure fluctuations

- Stack temperature anomalies

Advanced analytics flag potential issues such as:

- Fouling

- Leaks

- Soot buildup

- Fuel nozzle wear

This predictive maintenance approach helps reduce:

- Unplanned shutdowns by up to 60%

- Maintenance cost by 20–30%

- Downtime hours per year by hundreds in large plants

Remote Monitoring and Smart Alerts

With cloud connectivity, operators can monitor multiple boiler sites from a centralized interface. Dashboards provide:

- Real-time efficiency metrics

- Fuel consumption trends

- Alarm/event logs

- Emission compliance status

Alerts are sent via SMS/email in case of:

- Burner flameout

- Pressure excursions

- Water level alarms

- Emissions threshold breaches

This level of proactive supervision ensures 24/7 reliability, even in remote or unmanned facilities.

Integration with Energy Management Systems (EMS)

Smart oil-fired boilers can now be integrated with broader factory Energy Management Systems, enabling:

- Load shifting during peak electricity hours

- Demand-side response participation

- Real-time energy performance benchmarking

- Integration with BMS (Building Management Systems) in commercial/urban environments

Case Study Snapshot: Digital Transformation Impact

Industry: Food Processing Plant

Boiler: 5 TPH oil-fired steam boiler

Upgrades: PLC + IoT sensors + AI-based O₂ trim + remote dashboard

| Before | After |

|---|---|

| Efficiency: 84% | Efficiency: 91.3% |

| Fuel use: 720 L/hr | Fuel use: 660 L/hr |

| NOx: 200 mg/Nm³ | NOx: 120 mg/Nm³ |

| Annual fuel cost: $420,000 | Annual fuel cost: $386,000 |

| Downtime: 10 days/year | Downtime: 2 days/year |

ROI achieved in 18 months, with increased safety, reliability, and emissions compliance.

Summary

Digitalization and intelligent automation are redefining the capabilities of oil-fired boilers, enabling them to operate with unprecedented precision, efficiency, and responsiveness. By integrating sensors, control systems, analytics, and cloud platforms, modern oil boilers deliver:

- 5–10% higher thermal efficiency

- Significantly reduced NOx, CO, and fuel waste

- Predictive maintenance and longer service life

- Full transparency and regulatory readiness

These technologies ensure that oil-fired boilers remain technologically competitive and environmentally compliant, even in an era of increasingly complex energy and emissions landscapes. As Industry 4.0 reshapes industrial heat generation, digital oil boilers are here to stay—and getting smarter every year.

How Does Dual-Fuel and Multi-Fuel Capability Affect Market Demand for Oil-Fired Boilers?

In today’s volatile energy landscape, industrial facilities face increasingly complex challenges related to fuel pricing, availability, emissions compliance, and supply chain disruptions. This environment has sharply increased interest in dual-fuel and multi-fuel oil-fired boilers, which offer operational flexibility by allowing the use of multiple fuel sources—typically fuel oil and natural gas, or oil and biogas/other liquids. For many industries, this adaptability has become a strategic asset, shaping purchasing decisions and influencing global boiler demand trends.

Dual-fuel and multi-fuel capability significantly enhances market demand for oil-fired boilers by offering energy flexibility, fuel cost optimization, improved operational resilience, and compliance with regional fuel mandates. These adaptable systems appeal to industries seeking fuel-switching capability between fuel oil and alternatives such as natural gas, LPG, or biogas, enabling them to respond to fuel price fluctuations, emissions regulations, or supply interruptions—thereby ensuring continuous, cost-effective, and compliant thermal energy generation.

Boiler buyers now increasingly prioritize flexibility and fuel optionality over single-fuel optimization, making dual-fuel systems a cornerstone of modern industrial boiler design strategies.

Dual-fuel oil-fired boilers have limited demand because most industries prefer single-fuel systems.False

Demand for dual-fuel oil-fired boilers is growing, especially in industries and regions where fuel availability, price volatility, or emissions regulations necessitate flexible fuel usage.

Why Dual-Fuel Capability Is a Major Purchasing Driver

Key Benefits That Attract Buyers:

| Benefit | Explanation |

|---|---|

| Fuel Price Arbitrage | Switch between fuels (e.g., fuel oil vs. natural gas) based on market pricing |

| Energy Security | Maintain operation if one fuel is unavailable or restricted |

| Emissions Compliance | Use cleaner-burning fuel (e.g., gas) to meet NOx/SOx regulations |

| Fuel Mandates/Policies | Adapt to regional fuel transition laws or incentives |

| Process Optimization | Match fuel type to specific steam/thermal needs for efficiency |

Growing Market Demand Segments for Dual-Fuel Boilers

| Industry | Why Dual-Fuel is Preferred |

|---|---|

| Textiles | Balancing fuel cost with seasonal steam demand; gas in summer, oil in peak winter |

| Food & Beverage | Biogas + oil use for sustainability and cost reduction |

| Pharmaceuticals | Emissions control with gas, backup readiness with oil |

| Chemical Processing | Continuous steam needs; avoid production halts from fuel supply issues |

| District Heating | Load-based fuel selection, grid integration, fuel flexibility |

| Remote Industry | LPG/oil mix for locations without stable gas grid |

Dual-Fuel Configuration Options

| Configuration | Primary Fuels | Switching Capability |

|---|---|---|

| Oil + Natural Gas (most common) | Diesel / Heavy Fuel Oil + Natural Gas | Automatic or manual switching |

| Oil + LPG | Diesel + Propane | Manual or semi-automatic |

| Oil + Biogas | HFO + Digester Gas | Custom control tuning required |

| Tri-Fuel (Oil + Gas + Biomass) | Multi-fuel platforms for CHP plants | Advanced burner + fuel handling |

Systems can either auto-switch based on fuel availability or cost, or be manually changed based on operational strategy.

Market Trends Supporting Multi-Fuel Demand

1. Fuel Price Volatility

| Fuel Type | Typical Price Range ($/GJ) | Volatility (2021–2025) |

|---|---|---|

| Fuel Oil | $12–20 | High |

| Natural Gas | $6–18 | Very High |

| Biogas | $0–5 (if self-generated) | Low |

| LPG | $15–25 | Moderate |

Having a dual-fuel option allows companies to optimize OPEX, especially in volatile or deregulated energy markets.

2. Emissions Regulations Driving Cleaner Fuel Use

Switching from fuel oil to gas or biogas can help facilities immediately lower SO₂, NOx, and particulate emissions without changing core boiler hardware.

| Fuel Type | NOₓ (mg/Nm³) | SO₂ (mg/Nm³) | CO₂ Intensity (kg/MWh) |

|---|---|---|---|

| Heavy Fuel Oil | 300–400 | 1,000–2,000 | ~320 |

| Natural Gas | 80–120 | <10 | ~200 |

| Biogas | 50–90 | Negligible | ~150 |

This is especially critical in urban or emissions-regulated zones, where facilities must meet strict limits without infrastructure overhauls.

3. Decarbonization Pressures

Many regions now mandate partial use of renewables or low-carbon fuels (e.g., EU RED II, U.S. renewable mandates, Asia Pacific LNG incentives).

Dual-fuel boilers allow blending or transitioning without replacing core systems, enabling facilities to comply while planning for long-term decarbonization.

Impact on Design and Control Systems

Modern dual-fuel oil-fired boilers feature:

- Specialized dual-fuel burners with automated fuel switchover

- Fuel selector logic in the PLC system

- O₂ trim adjustments per fuel type

- Separate fuel handling systems (tanks, pumps, gas regulators)

- Flame safeguard systems capable of recognizing both fuels

- Emission control tuning per fuel (e.g., SOx scrubbers on oil only)

These smart systems ensure safe, seamless switching and consistently optimized combustion across fuels.

Global Market Indicators

| Region | Dual-Fuel Adoption Growth (2020–2025 CAGR) | Main Drivers |

|---|---|---|

| Asia-Pacific | 6.5% | Oil-gas switching, energy security |

| Europe | 7.2% | Renewable integration, gas transition targets |

| Middle East | 5.8% | Infrastructure flexibility, industrial growth |

| North America | 6.1% | Emissions compliance, LNG adoption |

| Latin America | 5.5% | Oil dependency reduction, biomass integration |

Result: Global oil boiler OEMs now routinely offer dual-fuel versions, with rising demand in medium- and large-capacity systems.

Summary

Dual-fuel and multi-fuel capabilities are reshaping the oil-fired boiler market, driving demand in regions and industries that prioritize fuel flexibility, cost control, emissions compliance, and operational continuity. Whether it’s to hedge against fuel price shocks, comply with tightening regulations, or integrate future renewable fuels, multi-fuel readiness is now a major buying criterion.

In today’s energy-fluid economy, oil-fired boilers that offer fuel versatility—not just thermal output—are commanding more attention and gaining stronger adoption in industrial thermal system planning.

In Which Industries and Regions Is Demand for Industrial Oil-Fired Boilers Still Growing?

Despite global trends toward electrification and cleaner fuels, industrial oil-fired boilers remain in strong demand in specific industries and regions, where they offer unmatched thermal stability, fuel flexibility, and operational independence. As natural gas infrastructure remains underdeveloped or inconsistent in many countries—and where biomass or electric systems are impractical—oil-fired systems continue to be the most reliable and cost-effective choice for delivering high-pressure steam and thermal heat in core industrial operations.

Demand for industrial oil-fired boilers is still growing in industries such as textiles, food and beverage processing, pharmaceuticals, chemicals, and agro-processing—especially in regions like Southeast Asia, South Asia, Africa, the Middle East, and Latin America. In these markets, oil-fired boilers remain vital due to underdeveloped gas grids, cost-effective fuel oil availability, the need for high-temperature steam, and limited access to cleaner alternatives.

Rather than being phased out entirely, oil-fired boiler systems are being refined and redeployed with better burners, emissions controls, and smart automation—ensuring they stay relevant, efficient, and compliant with evolving environmental expectations.

Industrial oil-fired boilers are no longer in demand anywhere in the world.False

Oil-fired boilers continue to see demand growth in specific industries and emerging regions where natural gas infrastructure is lacking, biomass is impractical, or consistent high-temperature steam is required.

Top Industries Driving Oil-Fired Boiler Growth

| Industry | Reason for Continued Growth in Oil Boiler Use |

|---|---|

| Textiles & Garments | Require high-pressure steam for dyeing, washing, drying; oil is cost-effective and responsive |

| Food & Beverage | Consistent thermal load for sterilization, cooking, pasteurization; oil is reliable and mobile |

| Pharmaceuticals | Requires clean steam and 24/7 reliability; oil ensures autonomy and backup |

| Chemicals & Plastics | High-temperature process heating, especially where continuous operation is critical |

| Agro-Processing | Steam for drying, cleaning, milling in remote areas where oil is easier to store and transport |

| Pulp & Paper (small scale) | Uses oil where biomass or black liquor is unavailable or inconsistent |

In these sectors, oil-fired boilers are often part of captive power or steam systems, and their independence from the national grid or fuel pipelines offers key advantages.

Regional Markets with Rising or Sustained Demand

| Region | Growth Drivers |

|---|---|

| South Asia (India, Bangladesh, Pakistan) | Expanding textile and garment sectors; inconsistent gas supply |

| Southeast Asia (Vietnam, Indonesia, Philippines) | Strong manufacturing growth; port access to fuel oil |

| Africa (Nigeria, Kenya, Ethiopia, Ghana) | Lack of gas grid; oil easier to import, store, and control |

| Middle East (Jordan, Egypt, Iraq) | Industrial expansion; heavy fuel oil remains affordable and accessible |

| Latin America (Peru, Bolivia, Paraguay) | Industrial zones in remote or off-grid areas; oil provides autonomy |

| Island Economies (Caribbean, Pacific Islands) | Oil is dominant due to logistics and absence of alternatives |

Fuel Accessibility and Infrastructure Limitations

| Region | Natural Gas Grid Penetration (%) | Fuel Oil Access |

|---|---|---|

| Sub-Saharan Africa | <20% | High (port-based import) |

| Southeast Asia | 30–60% (inconsistent by nation) | High (bunker fuel, diesel) |

| South Asia | ~50% in industrial zones | High (rail and truck delivery) |

| Caribbean & Islands | <15% | Very high (fuel oil dominant) |

| Andean Latin America | 20–40% | Moderate to High |

In regions with low gas penetration, oil-fired boilers offer predictable, high-heat energy with minimal infrastructure investment.

Market Segment Growth: Small to Mid-Size Boilers (0.5–20 TPH)

| Capacity Range | Primary Market Use Case |

|---|---|

| 0.5–5 TPH | Textiles, hospitals, small food factories in Asia/Africa |

| 5–10 TPH | Medium-size agro or beverage plants |

| 10–20 TPH | Chemical factories, district heating in off-grid regions |

Demand in these ranges remains strong due to manageable fuel logistics, lower CAPEX vs. gas systems, and faster deployment timelines.

Supporting Trends Boosting Demand

1. Dual-Fuel Integration

Many new oil boilers are now dual-fuel capable (oil + gas or oil + biogas), increasing their appeal in transition economies where future gas supply is expected but not yet stable.

2. Mobile and Containerized Boiler Systems

Prefabricated oil-fired boiler units are being deployed in disaster relief, mobile hospitals, and temporary industrial operations, especially across Africa, Central Asia, and island nations.

3. Government Support for Local Industry

In Bangladesh, India, and Ethiopia, national industrial growth policies continue to drive steam demand for garments, textiles, and agro-processing—sectors that heavily rely on cost-effective oil-fired steam boilers.

Real-World Case: Textile Cluster in South Asia

Location: Dhaka, Bangladesh

Industry: Textile and dyeing

Fuel Situation: Gas rationing during peak seasons; unreliable biomass availability

Boiler Installed: 6 TPH dual-fuel (diesel + gas) oil-fired boiler

Outcome:

- 24/7 steam supply maintained regardless of gas availability

- NOx emissions cut by 40% with new low-NOx burner

- Fuel switching saved 12% in annual fuel cost

- Enabled uninterrupted export fulfillment

This case highlights why operational certainty and adaptability drive continued oil boiler investments.

Summary

While the global narrative favors low-carbon energy, the ground-level reality in many regions and industries ensures that oil-fired boilers remain essential. Their fuel flexibility, deployment simplicity, cost-effectiveness, and independence from gas infrastructure make them a continued favorite in:

- Textile and food sectors

- Remote and island economies

- Developing industrial regions

With modern designs incorporating low-emission technologies, digital automation, and dual-fuel capability, the oil-fired boiler is far from obsolete—it’s evolving to meet modern industrial challenges and is poised to continue fueling growth in global heat-dependent industries.

How Do Global Energy Transition Policies Impact the Future Market of Oil-Fired Boilers?

The global shift toward decarbonization is accelerating through climate agreements, emissions regulations, and fossil fuel reduction targets, making a profound impact on the future of oil-fired industrial boilers. As carbon pricing, green incentives, and renewable energy mandates gain momentum, oil-based thermal systems are increasingly under scrutiny. However, rather than facing instant extinction, the market trajectory of oil-fired boilers is diverging—with decline in some regions, transformation in others, and even resilience in specific industrial niches.

Global energy transition policies are reshaping the oil-fired boiler market by reducing long-term demand in developed economies through carbon pricing, fuel bans, and efficiency mandates, while simultaneously creating opportunities for hybrid, dual-fuel, and emission-optimized systems in developing and transitional markets. As a result, oil-fired boilers are shifting from default thermal systems to niche, flexible, and policy-responsive equipment—especially in regions where gas infrastructure is lacking or energy resilience is prioritized over decarbonization speed.

The future of oil-fired boilers lies not in disappearance, but in strategic reinvention—driven by regulation, technology, and market segmentation.

Energy transition policies are forcing a complete and immediate global phase-out of oil-fired boilers.False

While energy transition policies are reducing oil-fired boiler demand in certain regions, these systems still have a role in industrial applications where infrastructure or operational requirements limit alternatives.

1. Regulatory Pressures Driving Market Shifts

| Policy Mechanism | Impact on Oil-Fired Boilers |

|---|---|

| Carbon Tax / Emissions Trading | Increases operating cost of oil-fired boilers in regulated markets |

| Fuel Switching Mandates | Forces transition to gas or renewables in new or retrofit installations |

| Efficiency Standards (e.g. Ecodesign) | Phases out low-efficiency legacy oil boilers |

| Air Quality Emission Caps | Reduces NOx, SO₂ limits; favors low-emission alternatives |

| Net-Zero Commitments | Discourages long-term investments in fossil fuel-based thermal systems |

| Subsidies for Clean Energy | Makes alternatives (e.g. biomass, heat pumps, solar thermal) more economically attractive |

2. Regional Impacts: Diverging Market Futures

Developed Economies (EU, U.S., Japan)

- Stringent climate laws (e.g., EU Fit for 55, IRA in the U.S.)

- Fuel bans in new building codes (e.g., Netherlands bans oil boilers in new buildings)

- Carbon pricing regimes penalize oil use heavily

- Outcome: Declining market, with demand shifting to electric, gas, or biomass systems

Emerging Economies (South Asia, Africa, parts of Latin America)

- Policy prioritizes energy access and industrial growth

- Oil remains reliable, logistically viable, and less capex-intensive

- Limited enforcement of global standards

- Outcome: Sustained or growing demand for oil-fired systems, especially in dual-fuel configurations

| Region | Policy Pressure Level | Oil Boiler Market Trend |

|---|---|---|

| Western Europe | High | Rapid Decline |

| North America | Moderate-High | Gradual Decline / Retrofit Only |

| Southeast Asia | Low-Moderate | Steady or Slight Growth |

| Sub-Saharan Africa | Low | Growing |

| South Asia | Moderate | Transitional (dual-fuel favored) |

| Latin America | Moderate-Low | Steady |

| Middle East | Low | Stable with oil-gas flexibility |

3. The Role of Carbon Pricing and Emissions Cost

| Fuel Type | CO₂ Emissions (kg/GJ) | Carbon Cost @ $50/ton CO₂ | Extra Operating Cost ($/GJ) |

|---|---|---|---|

| Heavy Fuel Oil | 77 | $3.85 | +$3.85 |

| Natural Gas | 56 | $2.80 | +$2.80 |

| Biomass (neutral) | 0 | $0.00 | $0.00 |

With carbon pricing tightening in OECD nations, oil-fired systems become less financially viable, accelerating retirement or retrofit timelines.

4. Adaptive Market Responses from Manufacturers

| Industry Trend | Purpose |

|---|---|

| Dual-Fuel Boiler Expansion | Allows operators to transition gradually to cleaner fuels |

| Integration of Low-NOx & Condensing Tech | Ensures emissions compliance while improving efficiency |

| Smart Controls and O₂ Trim Systems | Optimize combustion to lower emissions and fuel use |

| Mobile & Modular Oil Boiler Systems | Address off-grid and temporary heat needs sustainably |

Boiler OEMs are shifting their oil-fired product strategies toward hybridization, emissions minimization, and digital flexibility, especially in regions with uncertain fuel futures.

5. Niche Markets Still Supporting Oil-Fired Boiler Growth

| Market Segment | Why Oil Still Plays a Role |

|---|---|

| Remote Industrial Zones | No gas pipeline access; power grid unreliable |

| Mobile Heat Plants | Emergency or temporary deployment; oil is transportable |

| Island Economies | No infrastructure for renewables or gas; oil remains dominant |

| Standby/Backup Boilers | Required for resilience in critical systems (hospitals, pharma, etc.) |

| Dual-Fuel Export Markets | Products tailored for transition economies needing fuel flexibility |

These segments preserve short- to mid-term demand and continue to justify R&D investment in cleaner oil-fired boiler technologies.

6. Forecasting the Oil-Fired Boiler Market Through 2030

| Scenario | 2023 Market Size ($B) | 2030 Forecast ($B) | Trend |

|---|---|---|---|

| High Regulation, Net-Zero | $12.5 | $6.2 | ~50% decline in developed markets |

| Transition-Flexible (Balanced) | $12.5 | $10.3 | Moderate decline with niche growth |

| Infrastructure-Limited Regions | $12.5 | $13.1 | Slight growth due to industrialization |

Summary

Global energy transition policies are undeniably reshaping the market landscape for oil-fired boilers. In developed economies, aggressive decarbonization goals, carbon pricing, and fuel bans are accelerating market decline and pushing users toward cleaner alternatives or hybrid systems. However, in emerging and transitional economies, where infrastructure limitations, energy resilience, and industrial growth dominate policy, oil-fired boilers—especially dual-fuel and clean-tech-enhanced models—continue to find market space.

Thus, while the volume and nature of demand are changing, oil-fired boilers are not disappearing—they are evolving in response to a new energy and regulatory era. Their future lies in adaptation, flexibility, and smarter integration within an energy landscape that increasingly demands efficiency, compliance, and sustainability.

🔍 Conclusion

Industrial oil-fired boilers are transitioning toward cleaner, smarter, and more specialized solutions. While their role in baseload energy supply is shrinking in some markets, demand remains strong for high-efficiency, low-emission, and flexible oil-fired boilers in backup, peak-load, and infrastructure-limited applications. Technological innovation ensures that oil-fired boilers continue to deliver reliable performance and economic value where they are best suited.

🔹 Contact us today to explore next-generation industrial oil-fired boiler solutions designed for efficiency, compliance, and long-term reliability. ⚙️🔥🏭✅

FAQ

Q1: What are the key technological trends in modern industrial oil-fired boilers?

A1: Modern industrial oil-fired boiler technology is evolving toward higher efficiency, lower emissions, and smarter operation. Key trends include advanced low-NOx burners, improved heat transfer surfaces, and integrated economizers that recover waste heat from flue gases. Automation and digital control systems are increasingly standard, enabling precise air–fuel ratio control and stable combustion across varying loads. Additionally, modular boiler designs are gaining popularity, allowing faster installation, easier maintenance, and flexible capacity expansion for industrial users.

Q2: How are environmental regulations influencing oil-fired boiler technology?

A2: Stricter environmental regulations are a major driver of innovation in oil-fired boilers. Manufacturers are focusing on ultra-low NOx combustion, reduced particulate emissions, and improved fuel atomization to meet tightening emission limits. Advanced monitoring systems help operators track emissions in real time and ensure compliance. In some markets, oil-fired boilers are being designed to support dual-fuel or hybrid operation, enabling users to switch to cleaner fuels when regulations or fuel prices change, thereby extending the relevance of oil-fired systems.

Q3: What role does digitalization play in the latest oil-fired boiler designs?

A3: Digitalization is reshaping the performance and reliability of industrial oil-fired boilers. Smart sensors, PLC or DCS-based controls, and remote monitoring platforms allow real-time optimization of combustion efficiency and early detection of faults. Predictive maintenance tools analyze operating data to forecast component wear, reducing unplanned downtime and maintenance costs. These digital features are particularly attractive to industries seeking higher uptime, lower operating expenses, and improved energy management across their facilities.

Q4: What are the current market demand trends for industrial oil-fired boilers?

A4: Market demand for industrial oil-fired boilers remains steady in regions with limited natural gas infrastructure or unreliable electricity supply. Industries such as chemicals, food processing, textiles, and pharmaceuticals continue to rely on oil-fired boilers for their high reliability, rapid startup, and stable steam output. Demand is also driven by replacement of aging boiler systems with more efficient, low-emission models. In emerging markets, oil-fired boilers are often chosen as a transitional solution while cleaner fuel infrastructure is still under development.

Q5: How is competition from alternative boiler types affecting oil-fired boiler demand?

A5: Competition from gas-fired, biomass, and electric boilers is influencing oil-fired boiler market dynamics. Gas-fired boilers are often preferred where gas is affordable and available, while biomass boilers attract users seeking renewable energy solutions. However, oil-fired boilers remain competitive due to their fuel availability, high energy density, and operational flexibility. Manufacturers are responding by improving efficiency, reducing emissions, and lowering lifecycle costs, ensuring oil-fired boilers continue to meet industrial needs where alternatives are not yet viable.

References

- International Energy Agency (IEA) – Industrial Heat and Boiler Trends – https://www.iea.org/ – IEA

- U.S. Department of Energy – Industrial Boiler Technology Updates – https://www.energy.gov/ – DOE

- ASME – Boiler and Pressure Vessel Code (BPVC) – https://www.asme.org/ – ASME

- Spirax Sarco – Oil-Fired Boiler Technology and Efficiency – https://www.spiraxsarco.com/ – Spirax Sarco

- Engineering Toolbox – Oil-Fired Boiler Performance Data – https://www.engineeringtoolbox.com/ – Engineering Toolbox

- ScienceDirect – Advances in Oil-Fired Boiler Combustion – https://www.sciencedirect.com/ – ScienceDirect

- ISO – Industrial Boiler Efficiency and Emissions Standards – https://www.iso.org/ – ISO

- Carbon Trust – Industrial Heating and Boiler Market Trends – https://www.carbontrust.com/ – Carbon Trust

- MarketsandMarkets – Industrial Boiler Market Forecast – https://www.marketsandmarkets.com/ – Markets and Markets

- World Bank – Industrial Energy and Heating System Developments – https://www.worldbank.org/ – World Bank

Latest Trends in Industrial Oil-Fired Boiler Technology and Market Demand Read More »