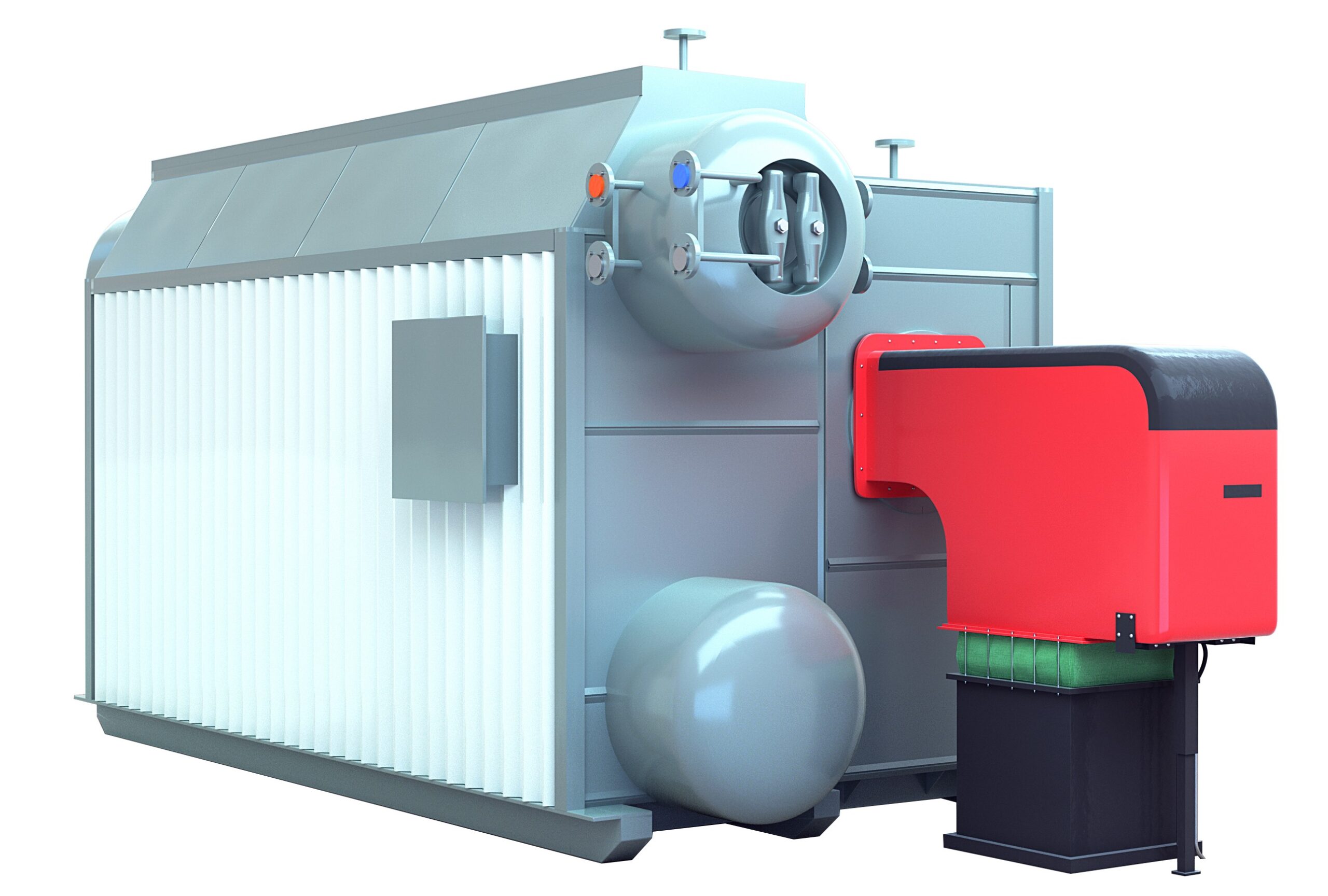

Industrial gas-fired boilers are known for their high efficiency, low emissions, and stable performance, making them a popular choice across manufacturing, food processing, and commercial sectors. However, selecting the right boiler isn’t just about the initial purchase price. A Lifecycle Cost Analysis (LCCA) provides a full financial picture by evaluating both upfront investment and long-term operating costs, ensuring you make a smart, cost-effective decision.

To perform a lifecycle cost analysis for an industrial gas-fired boiler, calculate all direct and indirect costs over the boiler’s useful life. This includes capital expenses (boiler, burner, controls), installation, fuel consumption, maintenance, water treatment, emissions compliance, operator labor, and eventual system replacement or decommissioning. Use this data to compute the Total Cost of Ownership (TCO), Net Present Value (NPV), Return on Investment (ROI), and Payback Period. These metrics allow for accurate financial forecasting and technology comparisons.

Here’s a practical guide to structuring an effective lifecycle cost analysis for gas-fired boilers.

What Is Lifecycle Cost Analysis (LCCA), and Why Is It Important for Gas Boiler Procurement?

Gas boilers remain a popular choice for heating and steam generation in commercial, industrial, and institutional settings due to their reliability, scalability, and relatively low fuel cost. However, focusing solely on the purchase price when evaluating a gas boiler can lead to costly long-term consequences, including excessive fuel bills, frequent maintenance, and premature equipment replacement. That’s why a Lifecycle Cost Analysis (LCCA) is critical in gas boiler procurement. It provides a full picture of the boiler’s financial performance over its entire useful life, allowing for better-informed investment decisions.

Lifecycle Cost Analysis (LCCA) is a financial evaluation method that assesses the total cost of ownership of a gas boiler system, including initial capital cost, installation, operation, maintenance, fuel consumption, downtime, and eventual disposal. It helps decision-makers compare alternatives not just on price but on long-term economic value, ensuring that the most cost-effective and energy-efficient boiler is selected over its full operational lifespan.

By incorporating all costs, LCCA ensures procurement choices align with budget realities, regulatory compliance, and performance goals—especially in projects with 10–25 year operating horizons.

LCCA only evaluates the initial purchase price of a gas boiler.False

LCCA includes all costs over the equipment's life—purchase, operation, maintenance, fuel, and disposal—not just the upfront price.

Let’s explore how LCCA works and how it improves boiler procurement decisions.

🔍 Components of Lifecycle Cost Analysis for Gas Boilers

| Cost Component | Description | Example Values |

|---|---|---|

| Capital Cost | Equipment purchase + installation | $40,000–$400,000 depending on size |

| Fuel Cost | Based on efficiency and runtime | Up to 60–70% of total lifecycle cost |

| Operation & Maintenance (O&M) | Routine servicing, parts, labor | $2,000–$10,000/year |

| Downtime & Reliability | Lost productivity due to failure | $5,000–$50,000/event |

| Depreciation / Residual Value | Asset write-off or resale | 10–20% residual after 15 years |

| Disposal & Replacement | Decommissioning or recycling | $2,000–$15,000 |

This analysis spans the useful life of the boiler, typically 15–25 years depending on usage and quality.

📊 Sample LCCA Comparison: Two Gas Boilers

| Item | Boiler A (Cheaper Upfront) | Boiler B (High Efficiency) |

|---|---|---|

| Initial Cost | $150,000 | $220,000 |

| Annual Fuel Cost | $75,000 | $58,000 |

| Annual Maintenance | $7,000 | $5,000 |

| Lifecycle (20 years) Cost | $2.01 million | $1.74 million |

Boiler B, despite higher initial cost, delivers 13.4% lower total ownership cost due to improved efficiency and lower O&M.

More efficient gas boilers usually have a lower lifecycle cost despite higher upfront prices.True

Lower fuel consumption and reduced maintenance often result in significant long-term savings that outweigh initial capital differences.

✅ Benefits of Using LCCA in Gas Boiler Procurement

Optimizes ROI: Avoids “cheap today, expensive tomorrow” decisions

Improves Budget Accuracy: Projects total expenditures over time

Supports Energy Efficiency Goals: Encourages selection of higher-performing systems

Ensures Regulatory Compliance: Aligns with public procurement and ESG mandates

Minimizes Risk: Considers unplanned costs from breakdowns or early replacement

🧾 Best Practices for LCCA Implementation

Use realistic operating hours and local gas prices

Include annual inflation and discount rate for net present value (NPV) calculations

Consider fuel escalation scenarios

Model multiple boiler sizes or configurations

Use tools like ASHRAE 90.1, EnergyPlus, or RETScreen for precision

Lifecycle cost analysis is only required for public sector projects.False

While mandated in many public tenders, private-sector companies also use LCCA to ensure smart long-term capital investments.

🔚 Summary

Lifecycle Cost Analysis (LCCA) is a critical tool in the procurement of gas boiler systems, offering a full-spectrum financial perspective that goes beyond the sticker price. By accounting for fuel consumption, maintenance, reliability, and disposal costs, LCCA empowers facility managers and procurement teams to choose boilers that offer the greatest long-term value. Whether you’re outfitting a new industrial plant or upgrading school heating systems, LCCA ensures your investment delivers reliable performance and financial efficiency for years to come.

What Capital and Installation Costs Should Be Included in the Analysis for Gas Boilers?

When procuring a gas boiler system—whether for a manufacturing plant, hospital, or commercial building—it’s vital to understand the full spectrum of capital and installation costs beyond the quoted price of the boiler unit. Overlooking key cost components during budgeting or lifecycle cost analysis (LCCA) can result in cost overruns, delays, and underperforming systems. By capturing all relevant costs in your investment planning, you not only enhance budget accuracy but also support sound financial comparisons across competing technologies.

Capital and installation costs for gas boilers include the boiler unit itself, associated components (burners, controls), delivery, foundation work, piping, gas supply connection, flue stack construction, water treatment system, labor, permits, and commissioning. All these costs must be incorporated in the total installed cost for accurate lifecycle and ROI analysis.

This comprehensive view ensures that decisions are based on full ownership impact, not just the equipment invoice.

Only the boiler unit cost needs to be included when calculating gas boiler investment.False

The boiler unit typically accounts for only 40–60% of total installed cost. Installation and infrastructure significantly add to total investment.

Let’s detail every key cost category to include in your procurement and LCCA model.

🧮 Detailed Breakdown of Capital and Installation Costs

| Cost Category | Description | Typical Share of Total Cost |

|---|---|---|

| Boiler Unit | Core equipment with pressure vessel, burner, and casing | 40–60% |

| Burner System | High-efficiency burner, gas valve train, and controls | 5–10% |

| Control & Automation | Sensors, PLCs, SCADA integration, remote monitoring | 3–6% |

| Delivery & Handling | Crating, freight, crane offloading | 2–4% |

| Foundation & Structural | Concrete base, vibration isolation, mounting frames | 4–8% |

| Gas Piping & Metering | Internal connection to building gas line; regulators, safety valves | 3–6% |

| Water Piping & Steam Headers | Connection to feedwater, deaerator, blowdown tank | 5–10% |

| Flue Stack / Chimney | Ventilation ductwork, stack height, insulation, dampers | 5–8% |

| Water Treatment Equipment | Softener, chemical dosing, blowdown separators | 2–5% |

| Electrical Installation | Cabling, panels, drives, backup power links | 2–4% |

| Labor & Site Supervision | Skilled technicians, engineers, QA/QC | 8–12% |

| Commissioning & Testing | Startup checks, calibration, emissions testing | 1–3% |

| Permits & Compliance | Safety certifications, emissions licenses, fire code approval | 1–2% |

📊 Sample Project: 5 TPH Gas Boiler System (Commercial Facility)

| Item | Cost Estimate |

|---|---|

| Boiler Unit | $85,000 |

| Burner & Controls | $18,000 |

| Foundation & Structure | $12,000 |

| Gas + Water Piping | $20,000 |

| Flue Stack | $10,000 |

| Electrical + Automation | $8,000 |

| Labor & Supervision | $22,000 |

| Commissioning | $5,000 |

| Permits & Inspections | $3,000 |

| Total Installed Cost | $183,000 |

This example shows that installation and ancillary costs account for nearly 50% of total project cost, highlighting the need for a complete cost inclusion in your procurement planning.

Commissioning costs are often excluded in gas boiler project budgeting.True

Many facilities overlook final commissioning costs, which can result in last-minute budget increases or startup delays.

✅ Best Practices for Capital Cost Planning

Use itemized vendor quotations—not just lump-sum estimates

Involve a mechanical consultant or EPC early

Include contingency (~10%) for scope changes or inflation

Model with TCO software or Excel LCCA templates

Factor in regional cost variation (urban vs. rural, U.S. vs. Asia)

🔚 Summary

Accurate capital and installation cost analysis is essential for informed gas boiler procurement. By accounting for not just the equipment, but also installation, infrastructure, compliance, and commissioning, buyers can produce precise lifecycle cost models and avoid unpleasant budget surprises. Including these detailed costs ensures smarter investment decisions and supports long-term operational and financial efficiency.

How Do You Accurately Estimate Long-Term Natural Gas Consumption and Price Variability for Gas Boilers?

When planning a gas boiler investment—especially in industrial, institutional, or large commercial facilities—accurate estimation of natural gas consumption and price variability is critical to financial modeling. Misjudging these variables can skew lifecycle cost analysis, disrupt budgets, and lead to flawed ROI expectations. Natural gas, while relatively stable compared to oil, is still subject to global commodity markets, regional supply-demand shifts, and regulatory policies. Therefore, understanding how to model both fuel use and pricing volatility is essential for robust gas boiler project planning.

To accurately estimate long-term natural gas consumption and price variability for gas boilers, project owners must calculate heat load demand profiles, apply boiler efficiency factors, use historical consumption patterns, and simulate price scenarios using market indices and escalation rates. Incorporating seasonal fluctuations, regional utility pricing, and projected energy inflation ensures reliable lifecycle cost modeling and risk assessment.

Combining engineering precision with economic forecasting enables decision-makers to plan not just for initial costs, but for the fuel expenses that often make up over 60% of a boiler’s total ownership cost.

Fuel consumption and price volatility must be accurately modeled to perform reliable lifecycle cost analysis for gas boilers.True

Gas costs represent the largest operating expense in boiler systems, and price swings significantly impact long-term financial projections.

Here’s how to approach both parts of this critical estimation.

🔍 Part 1: Estimating Long-Term Natural Gas Consumption

| Step | Action | Formula or Tool |

|---|---|---|

| 1. Calculate Thermal Load | Determine the required output in MMBtu/hr or TPH | Energy demand × operating hours/year |

| 2. Apply Boiler Efficiency | Adjust gross energy input to reflect system performance | Input = Output ÷ Efficiency (%) |

| 3. Add Standby & Loss Factors | Account for cycling losses, ambient loss, and part-load inefficiency | +5–10% depending on operation |

| 4. Normalize Seasonal Use | Apply monthly usage factors for heating vs. non-heating seasons | Load Profile Charts or EMS data |

| 5. Convert to Volume | Convert MMBtu to standard cubic feet (scf) of gas | 1 MMBtu ≈ 1,037 scf (US standard) |

Example: Annual Gas Consumption Model

| Parameter | Value |

|---|---|

| Peak Boiler Load | 4 MMBtu/hr |

| Operating Hours | 6,000 hours/year |

| Efficiency | 85% |

| Gross Input Energy | 28,235 MMBtu/year |

| Estimated Gas Volume | 29.3 million scf/year |

Boiler efficiency has little impact on gas consumption estimates.False

Efficiency directly affects how much fuel is needed to produce the required thermal energy—lower efficiency means higher gas use.

📈 Part 2: Modeling Price Variability and Risk

Gas prices fluctuate based on:

Regional supply contracts (fixed vs. variable)

Utility tariffs

Global LNG and pipeline markets

Weather trends and heating demand

Carbon pricing or gas surcharges

Methods to Estimate Long-Term Price Scenarios

| Method | Description | Usage |

|---|---|---|

| Historical Averaging | Analyze 5–10 years of price data | Establish baseline trend |

| Escalation Modeling | Apply inflation or escalation rates (e.g., 2–6%/year) | Forecast future budgets |

| Forward Market Contracts | Use NYMEX or Henry Hub futures data | Reflect current market sentiment |

| Monte Carlo Simulations | Model multiple price paths under probability | For risk management or financing proposals |

Real-World Example: Price Forecasting Model

| Year | Base Price ($/MMBtu) | Escalation (4%) | Adjusted Price |

|---|---|---|---|

| Year 1 | $5.00 | – | $5.00 |

| Year 3 | – | – | $5.41 |

| Year 5 | – | – | $6.08 |

| Year 10 | – | – | $7.40 |

Applied to consumption, this model allows accurate 10–20 year projections of gas cost in LCCA and project finance evaluations.

Natural gas prices are stable enough to ignore escalation in financial models.False

Even modest annual increases in gas price significantly impact long-term boiler operating costs and should always be included.

✅ Best Practices for Reliable Forecasting

Use utility billing history if replacing an old boiler

Integrate smart meters or EMS data for real load curves

Include redundancy scenarios (part-load, peak-load split systems)

Review local gas utility forecasts or bulk supply contracts

Update assumptions annually to refine projections

🔚 Summary

Accurately estimating natural gas consumption and price variability is crucial for planning and evaluating gas boiler investments. By using load calculations, efficiency modeling, and economic forecasting, project owners can anticipate long-term fuel expenses, mitigate price risks, and present stronger cases for funding or internal approvals. Whether you’re developing a lifecycle cost model or structuring a supply contract, this dual-layered approach ensures your decisions are grounded in realistic, data-driven projections.

What Are the Recurring Maintenance, Inspection, and Burner Tuning Costs?

Gas boilers are valued for their thermal efficiency and operational stability across industrial and commercial sectors. However, maintaining this performance depends heavily on consistent upkeep. Recurring costs for maintenance, inspections, and burner tuning are not only essential for safe and efficient operation—they also impact your total cost of ownership (TCO) and system longevity. Skipping these services can lead to inefficiency, emissions non-compliance, unplanned shutdowns, and even catastrophic equipment failure.

Recurring costs for gas boiler maintenance typically range from $0.50 to $2.00 per boiler horsepower (BHP) monthly, including scheduled inspections, burner tuning, safety testing, water treatment, and spare part replacement. Annual burner tuning alone costs between $1,000–$5,000 depending on boiler size, while comprehensive maintenance can reach $5,000–$25,000 per year for medium-scale systems.

These recurring expenses should be integrated into financial planning, LCCA models, and preventive maintenance contracts for accurate lifecycle budgeting.

Gas boilers require annual inspections, burner tuning, and water treatment to maintain efficiency and safety.True

Manufacturers and safety authorities recommend and often mandate routine service intervals for gas-fired boiler systems.

Let’s analyze the individual cost elements and how they scale with boiler capacity.

🔍 Breakdown of Recurring Maintenance and Service Costs

| Service Category | Frequency | Typical Cost Range | Description |

|---|---|---|---|

| Annual Burner Tuning | Once per year | $1,000–$5,000 | Calibration of air/gas ratio, O₂/CO₂ optimization, combustion efficiency testing |

| Combustion Safety Inspection | Yearly | $500–$2,000 | Testing flame sensors, pressure switches, gas valves, shutoff interlocks |

| Water Chemistry Testing | Monthly or biweekly | $300–$1,500/year | Testing pH, TDS, alkalinity, oxygen scavengers |

| Boiler Tube Cleaning (Chemical or Mechanical) | Biannual or annual | $1,000–$5,000 | Prevents fouling and corrosion |

| Gasket, Valve, and Sensor Replacement | Every 2–3 years | $500–$3,000 | Preventive wear part replacements |

| Control System Calibration | Annually | $750–$2,000 | PLC, SCADA, and thermostat recalibration |

| State/Local Safety Inspection Fee | Annually or biannually | $250–$1,000 | Legal compliance; required by AHJs |

| Remote Monitoring Subscription | Ongoing | $500–$1,500/year | Optional for digital boiler management systems |

📊 Example: 500 BHP Gas Boiler System – Annual Service Budget

| Item | Cost Estimate |

|---|---|

| Burner Tuning & Combustion Analysis | $2,400 |

| Water Treatment Service Contract | $1,200 |

| Control System Maintenance | $1,100 |

| Tube Cleaning | $3,500 |

| Inspection & Compliance Testing | $1,000 |

| Gaskets and Flame Rod Replacement | $850 |

| Total Annual Recurring Cost | $10,050 |

This equates to $20.10 per BHP annually, or about $840/month, not including emergency call-outs or unscheduled repairs.

Burner tuning is only necessary when gas boilers show performance problems.False

Annual burner tuning is a proactive measure to maintain efficiency, prevent fuel waste, and ensure emissions compliance—regardless of visible issues.

🧾 Factors Affecting Recurring Costs

Boiler Size (BHP or TPH): Larger units incur higher servicing costs

Load Profile: Frequent cycling increases wear

Ambient Conditions: Dust, humidity, and altitude affect maintenance needs

Operator Training: Well-trained teams reduce service contractor reliance

Fuel Quality: Gas purity influences burner longevity

✅ Best Practices to Minimize Long-Term Costs

Bundle maintenance contracts with boiler OEMs or ESCOs

Use predictive analytics tools for maintenance timing

Perform monthly in-house checks to catch early issues

Adhere to manufacturer service intervals

Budget for 5–10% of boiler CAPEX annually for service

Water chemistry control is optional for modern gas boilers.False

Poor water quality leads to corrosion, scaling, and boiler failure; regular testing is mandatory for efficient operation.

🔚 Summary

Recurring maintenance, inspection, and burner tuning costs are unavoidable yet essential components of operating gas boiler systems. These services ensure safety, efficiency, and compliance while extending equipment life. Budgeting $5,000–$25,000 annually for medium to large systems ensures uninterrupted performance and avoids costly breakdowns. Integrating these costs into lifecycle analysis and procurement models supports accurate long-term financial planning and risk mitigation.

How Do Emissions Compliance, Carbon Taxes, and Monitoring Systems Factor into Lifecycle Costs for Gas Boilers?

Gas boilers are increasingly subject to stringent emissions regulations, particularly as climate policies and carbon pricing mechanisms accelerate globally. While natural gas is considered cleaner than coal or oil, it still produces CO₂, NOₓ, and other pollutants, all of which have financial implications across a boiler’s operational life. Ignoring these costs during procurement or lifecycle cost analysis (LCCA) leads to underestimated project expenses and compliance risk. Therefore, integrating emissions compliance, carbon taxes, and monitoring systems into lifecycle financial models is essential for realistic budgeting and sustainable decision-making.

Emissions compliance, carbon taxes, and monitoring systems significantly impact the lifecycle costs of gas boilers by introducing operational expenses, capital outlays for emissions controls, and penalties or carbon pricing for excess emissions. These elements can add 5–20% to the total cost of ownership, depending on local regulations and boiler capacity. Accurate LCCA must account for these to ensure budget accuracy and regulatory alignment.

Failing to consider these elements may lead to fines, retrofit expenses, and reputational damage—especially for industrial or public-sector energy users.

Carbon taxes and emissions control systems must be factored into gas boiler lifecycle costs.True

Regulatory-driven emissions costs and required compliance technology represent real, recurring expenses that affect total ownership cost.

Let’s examine how each factor plays into the long-term financial equation.

🔍 1. Emissions Compliance Costs

Governments mandate limits on NOₓ, SO₂, CO, and particulate matter, with regular inspections and required technology upgrades.

| Compliance Element | Description | Typical Cost |

|---|---|---|

| Low-NOₓ Burners | Required in most new installations | $3,000–$10,000 |

| Flue Gas Recirculation (FGR) | Reduces NOₓ emissions by 50–70% | $5,000–$20,000 |

| SCR/Selective Catalytic Reduction | Advanced NOₓ control (large boilers) | $25,000–$100,000 |

| Annual Emissions Testing | Required for permits and renewals | $1,000–$3,000/year |

| Permit Fees / Renewals | Environmental regulatory filings | $500–$2,500/year |

Boilers operating in air-quality-sensitive areas (e.g., California, EU urban zones) face stricter limits, with non-compliance resulting in shutdown orders or fines.

Gas boilers do not require NOₓ emissions controls.False

Modern emissions standards require NOₓ-reduction systems such as low-NOₓ burners or FGR in most jurisdictions.

💰 2. Carbon Taxes and Emissions Penalties

Carbon pricing programs assign a cost per ton of CO₂ emitted. While natural gas emits less CO₂ than coal, its carbon footprint still triggers taxation in regulated markets.

| Region | Carbon Price (2025 forecast) | Impact on Gas Boilers |

|---|---|---|

| EU ETS | €80–€110/ton CO₂ | Industrial boilers >20 MW |

| Canada | CAD $80 rising to $170/ton by 2030 | Applied to all fossil heat systems |

| California (Cap & Trade) | ~$40/ton CO₂ | Large emitters (Title V facilities) |

| Japan, South Korea | Sectoral carbon schemes | Varies by district and scope |

| Proposed US Programs | Under Inflation Reduction Act | TBD – incentives over penalties |

Example Calculation: 500 HP Boiler

| Emissions | Value |

|---|---|

| Annual CO₂ | ~2,200 metric tons |

| At $50/ton tax | $110,000/year in carbon cost |

This cost must be added to annual fuel budgets and included in sensitivity analysis in LCCA models.

Carbon taxes are only relevant to coal plants and not gas-fired boilers.False

Carbon pricing applies to all fossil fuels—including natural gas—and affects industrial-scale gas boilers in regulated jurisdictions.

📊 3. Monitoring & Reporting System Costs

To stay compliant and manage emissions, most large gas boilers require automated monitoring systems.

| System Type | Purpose | Cost Range |

|---|---|---|

| Continuous Emissions Monitoring System (CEMS) | Tracks NOₓ, CO, O₂, and sometimes CO₂ | $15,000–$50,000 upfront + $2,000–$5,000/year |

| Remote Performance Monitoring (SCADA or IoT) | Monitors combustion efficiency & faults | $3,000–$10,000 |

| Manual Stack Testing | Used in smaller systems annually or biannually | $1,000–$3,000 per test |

Some systems are mandatory based on boiler size and location, while others are voluntary but help reduce emissions and optimize fuel use.

🧾 Integration Into Lifecycle Cost Analysis

| Cost Type | Frequency | Sample Annual Cost (500 HP Boiler) |

|---|---|---|

| Emissions Testing & Permits | Annual | $2,500 |

| Monitoring System O&M | Ongoing | $3,000 |

| Carbon Tax (at $50/ton) | Annual | $110,000 |

| NOₓ Control Maintenance | Biennial | $3,000 |

| Total Emissions-Linked Cost | – | $115,500/year |

Over 15 years, this adds nearly $1.7 million to ownership cost—more than the boiler’s capital value in some cases.

✅ Strategies to Control Emissions-Linked Costs

Use high-efficiency condensing boilers to lower fuel and CO₂ output

Bundle emissions control in CAPEX stage to avoid retrofits

Enroll in carbon offset programs to reduce effective taxation

Negotiate low-emissions gas contracts with utility providers

Apply for green or ESG-linked financing to offset compliance costs

Emissions control systems offer no long-term ROI.False

Efficient emissions controls improve fuel economy, reduce maintenance, and prevent regulatory penalties—offering measurable ROI.

🔚 Summary

Emissions compliance, carbon taxes, and monitoring systems are no longer optional add-ons for gas boiler systems—they are integral cost elements that can significantly affect lifecycle economics. By integrating these costs into procurement, LCCA, and energy strategy decisions, project owners can ensure regulatory readiness, financial predictability, and environmental accountability. Ignoring them risks underestimating total cost of ownership and facing expensive consequences down the line.

How Can You Calculate TCO, NPV, ROI, and Payback Period for Gas-Fired Boiler Investments?

Gas-fired boilers are widely used for thermal energy generation in manufacturing, processing, and commercial facilities due to their reliability and fuel efficiency. However, purchasing a boiler is a long-term capital commitment, and evaluating the true financial value of such an investment requires more than just considering upfront price. To accurately assess economic viability, project owners must calculate Total Cost of Ownership (TCO), Net Present Value (NPV), Return on Investment (ROI), and Payback Period. These metrics form the foundation of smart capital budgeting and financial planning.

To calculate TCO, NPV, ROI, and Payback Period for gas-fired boiler investments, project owners must include capital cost, operating expenses (fuel, maintenance, emissions), tax benefits, depreciation, and future cash flows. TCO reflects lifetime cost, NPV quantifies value over time, ROI measures profitability, and Payback Period indicates the time to recover investment. Together, these KPIs support informed procurement decisions.

Using these tools ensures stakeholders can compare boiler systems, justify budget requests, and choose configurations with optimal financial and operational outcomes.

Lifecycle financial metrics like NPV and ROI are critical for evaluating gas boiler investments.True

These metrics quantify long-term value and help compare different technologies, especially in energy-intensive sectors.

Let’s walk through how to compute each of these step by step.

🔢 1. Total Cost of Ownership (TCO)

Definition: The total expenditure over the asset’s useful life, including purchase, operation, and disposal.

Formula:

TCO = CAPEX + Σ (Annual OPEX + Maintenance + Fuel + Compliance + Monitoring) – Residual Value

Example:

| Cost Item | Value |

|---|---|

| Capital Cost (CAPEX) | $180,000 |

| Operating Costs (15 yrs @ $30,000/year) | $450,000 |

| Maintenance ($8,000/year) | $120,000 |

| Emissions Compliance | $90,000 |

| Residual Value | ($20,000) |

| Total TCO | $820,000 |

📉 2. Net Present Value (NPV)

Definition: The present value of cash inflows and outflows over time, discounted at a required rate of return.

Formula:

NPV = Σ [ (Net Cash Flow in Year t) / (1 + r)^t ] – Initial Investment

r = Discount rate (e.g., 8%)

t = Year index

Example:

| Year | Net Cash Flow | Discount Factor (8%) | Present Value |

|---|---|---|---|

| 1–15 | $40,000/year | 8.559 | $342,360 |

| CAPEX | ($180,000) | – | ($180,000) |

| NPV | – | – | $162,360 |

A positive NPV means the boiler investment adds value over its lifecycle.

📈 3. Return on Investment (ROI)

Definition: A percentage measure of profitability.

Formula:

ROI = (Total Net Savings or Gain – Initial Investment) / Initial Investment × 100%

Example:

| Net Benefit Over 15 Years | $600,000 |

| Initial Investment | $180,000 |

| ROI | (600,000 – 180,000) / 180,000 × 100% = 233% |

This metric helps compare multiple boiler or energy technology options.

⏳ 4. Payback Period

Definition: Time needed to recover initial investment from cash flow savings.

Formula:

Payback Period = Initial Investment / Annual Net Savings

Example:

| Initial CAPEX | $180,000 |

| Annual Savings (fuel + maintenance) | $40,000 |

| Payback Period | 180,000 / 40,000 = 4.5 years |

Many projects target a payback ≤ 5 years for approval.

Gas boiler investments with long payback periods can still be profitable if NPV is positive.True

A longer payback doesn't negate profitability if discounted cash flows still yield a positive return over the equipment’s life.

🧾 Best Practices for Boiler Investment Modeling

Use real utility bills and O&M quotes to model accurate cash flows

Include emissions costs (e.g., carbon taxes) where applicable

Apply sensitivity analysis to model price changes or load shifts

Consider depreciation and tax impacts for a full financial picture

Choose models based on facility-specific conditions (load profile, hours)

📊 Comparison Table: Metrics at a Glance

| Metric | What It Shows | Target Outcome |

|---|---|---|

| TCO | Total life cost | Lower = better |

| NPV | Project value over time | Positive = invest |

| ROI | Profitability ratio | 100%+ preferred |

| Payback | Time to breakeven | <5 years typical |

🔚 Summary

Calculating TCO, NPV, ROI, and Payback Period is essential for evaluating the financial viability of gas-fired boiler projects. These metrics allow project owners to assess cost-effectiveness, forecast returns, and make informed procurement choices. By modeling real-world data and considering both short-term and long-term factors, you can optimize boiler investments for performance, profitability, and sustainability.

🔍 Conclusion

A lifecycle cost analysis allows you to evaluate the true economic and operational impact of your gas-fired boiler over 15–30 years of use. While these boilers often offer lower maintenance and emissions control costs, fuel remains a major long-term expense. By conducting a thorough LCCA, you can select a boiler that delivers optimal efficiency, regulatory compliance, and financial performance.

📞 Contact Us

💡 Need support with LCCA for your gas-fired boiler project? Our team provides custom lifecycle models, energy forecasting, and capital budgeting services to guide your investment decisions.

🔹 Let us help you make a smart, long-term investment in efficient gas boiler technology. 🔥💼📊

FAQ

What is a lifecycle cost analysis (LCCA) for a gas-fired boiler?

LCCA is a method for estimating the total cost of ownership (TCO) for an industrial gas-fired boiler over its expected life (typically 20–25 years). It includes:

Capital costs (purchase + installation)

Fuel expenses

Maintenance and repairs

Compliance and monitoring costs

Decommissioning or replacement

This approach provides a clear view of long-term financial performance and supports smarter investment decisions.

What are the main cost components in a gas-fired boiler LCCA?

Capital Cost – Equipment, burners, controls, and installation

Fuel Cost – Based on boiler efficiency, run hours, and gas price per MMBtu

O&M Costs – Burner cleaning, part replacement, tuning, and inspections

Emissions Compliance – NOx reduction systems, monitoring, permits

End-of-Life – Decommissioning, salvage, or replacement

How is fuel cost calculated in lifecycle cost analysis?

Annual Fuel Cost = Fuel Use Rate × Operating Hours × Fuel Price

For example, a 10 MMBtu/hr boiler running 6,000 hours/year at $8/MMBtu:

10 × 6,000 × $8 = $480,000/year

Multiply this by 20–25 years and adjust for inflation and efficiency degradation over time.

What are typical maintenance costs for gas-fired boilers?

Maintenance costs are generally 2–4% of the capital cost per year, including:

Heat exchanger cleaning

Gasket and burner part replacements

Sensor calibration

Flue gas testing and tuning

Over a 20–25 year life, total O&M costs can reach $100,000–$400,000, depending on system complexity and usage.

Why is lifecycle analysis important for gas boiler investments?

Gas-fired boilers have lower emissions, high thermal efficiency, and relatively stable fuel prices. LCCA helps assess whether to invest in higher-efficiency models (e.g., condensing boilers) by comparing higher upfront costs with long-term fuel savings, emissions compliance, and operational reliability.

References

DOE Lifecycle Costing Guidelines for Industrial Boilers – https://www.energy.gov

Natural Gas Price and Consumption Forecasts – https://www.eia.gov

IEA Industrial Boiler Cost Evaluation Reports – https://www.iea.org

ASME Boiler Efficiency and TCO Standards – https://www.asme.org

Gas Boiler Maintenance Cost Analysis – https://www.sciencedirect.com

EPA Guidelines for Boiler Emissions Compliance – https://www.epa.gov

Condensing vs. Non-Condensing Boiler LCCA Comparison – https://www.researchgate.net

Energy Efficiency and Boiler Upgrade Economics – https://www.energystar.gov

Automation and Control Impacts on Boiler LCCA – https://www.automation.com

State Incentives Impacting Lifecycle Costs – https://www.dsireusa.org