For many industries, oil-fired boilers remain a practical choice when natural gas is unavailable or when fuel flexibility is required. However, buyers often face confusion due to the wide cost range influenced by boiler size, pressure rating, efficiency, and auxiliary equipment. Underestimating the total investment may lead to budget overruns or improper system selection.

The cost of an industrial oil-fired boiler typically ranges from $20,000 to over $200,000, depending on capacity (1–100+ tons of steam per hour), design type (fire-tube or water-tube), operating pressure, and efficiency features. Additional expenses come from auxiliary equipment such as burners, economizers, feedwater systems, and installation works. For a complete turnkey oil-fired boiler system, including auxiliaries and setup, the total investment may reach $100,000 to $1,000,000+.

Understanding these variables ensures businesses can budget accurately and select the right boiler system for long-term efficiency.

What Factors Influence the Base Cost of an Industrial Oil-Fired Boiler?

When buyers first inquire about an oil-fired boiler, the natural focus is often on the purchase price of the boiler unit itself. However, the base cost is not a fixed figure—it varies significantly depending on several technical and design parameters. Choosing the wrong configuration can either inflate capital costs unnecessarily or limit efficiency and performance, leading to higher operating expenses in the long run. To make an informed investment, it is essential to understand which factors shape the base cost of an industrial oil-fired boiler.

The base cost of an industrial oil-fired boiler is influenced by capacity (steam output), working pressure, fuel type and quality, boiler design (fire-tube vs. water-tube), efficiency features (burners, economizers), materials of construction, and compliance with emission regulations. Larger capacities, higher pressures, and advanced efficiency or emission-control features raise the initial cost but reduce lifecycle expenses.

This means buyers must balance initial investment vs. long-term savings, selecting the right boiler size and configuration for their process needs.

The base cost of an oil-fired boiler depends only on its steam output capacity.False

While capacity is a major factor, pressure rating, design type, material quality, burner technology, and emission standards also strongly influence the base cost.

Water-tube oil-fired boilers generally cost more than fire-tube designs at the same capacity.True

Water-tube designs handle higher pressure and temperature applications, requiring more complex engineering and materials, which increases base cost.

1. Steam Capacity and Working Pressure

Capacity (t/h or MW): A higher steam output requires larger furnace volume, more heat exchange surface, and a stronger structure.

Working Pressure: High-pressure boilers (>40 bar) demand thicker steel plates, advanced welding, and stricter quality control, driving costs higher.

| Boiler Rating | Typical Application | Base Cost Range (USD per ton/hr) |

|---|---|---|

| 1–10 t/h | Small industrial heating | $18,000 – $35,000 |

| 10–50 t/h | Medium manufacturing | $35,000 – $75,000 |

| 50–150 t/h | Large process/utility | $75,000 – $150,000+ |

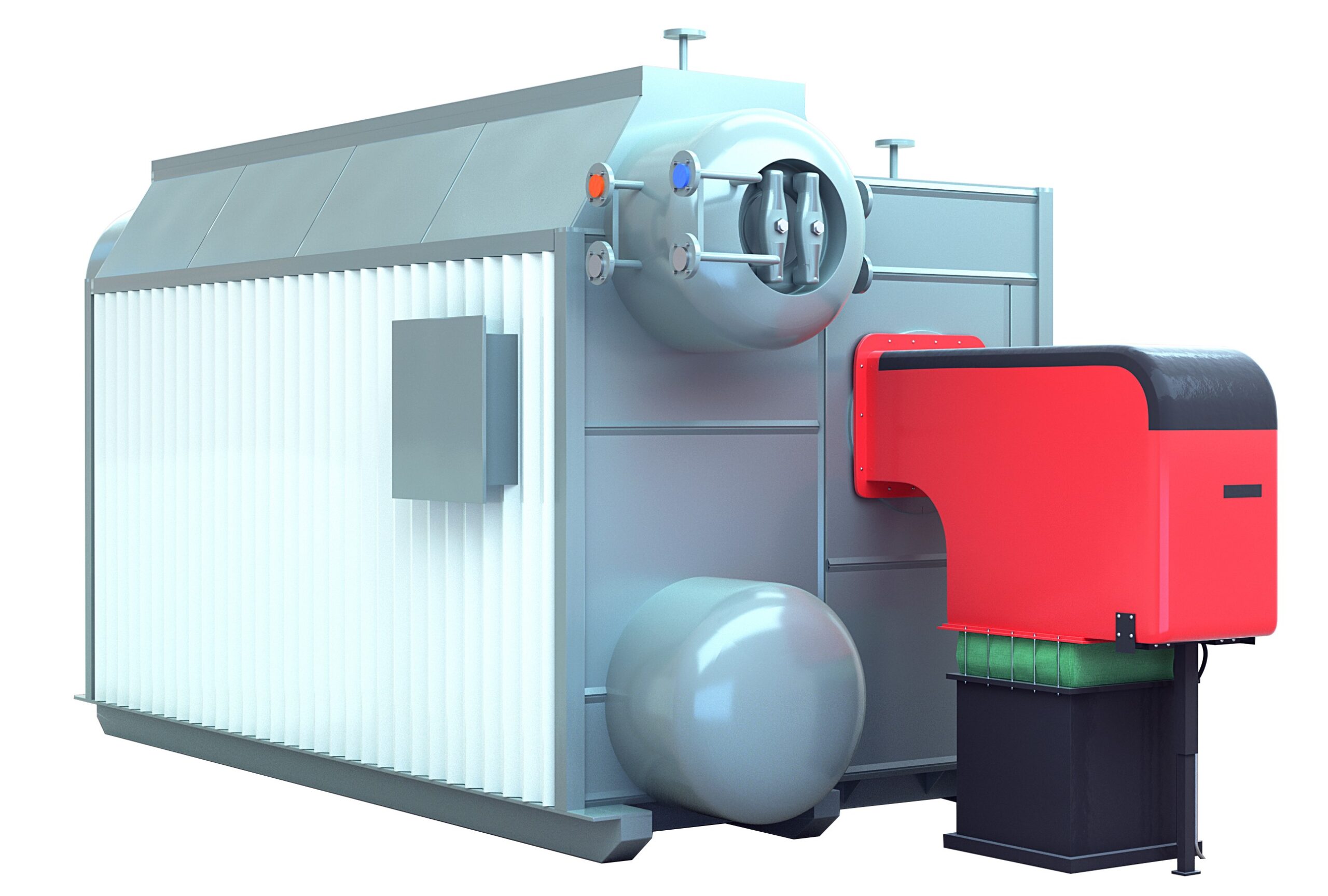

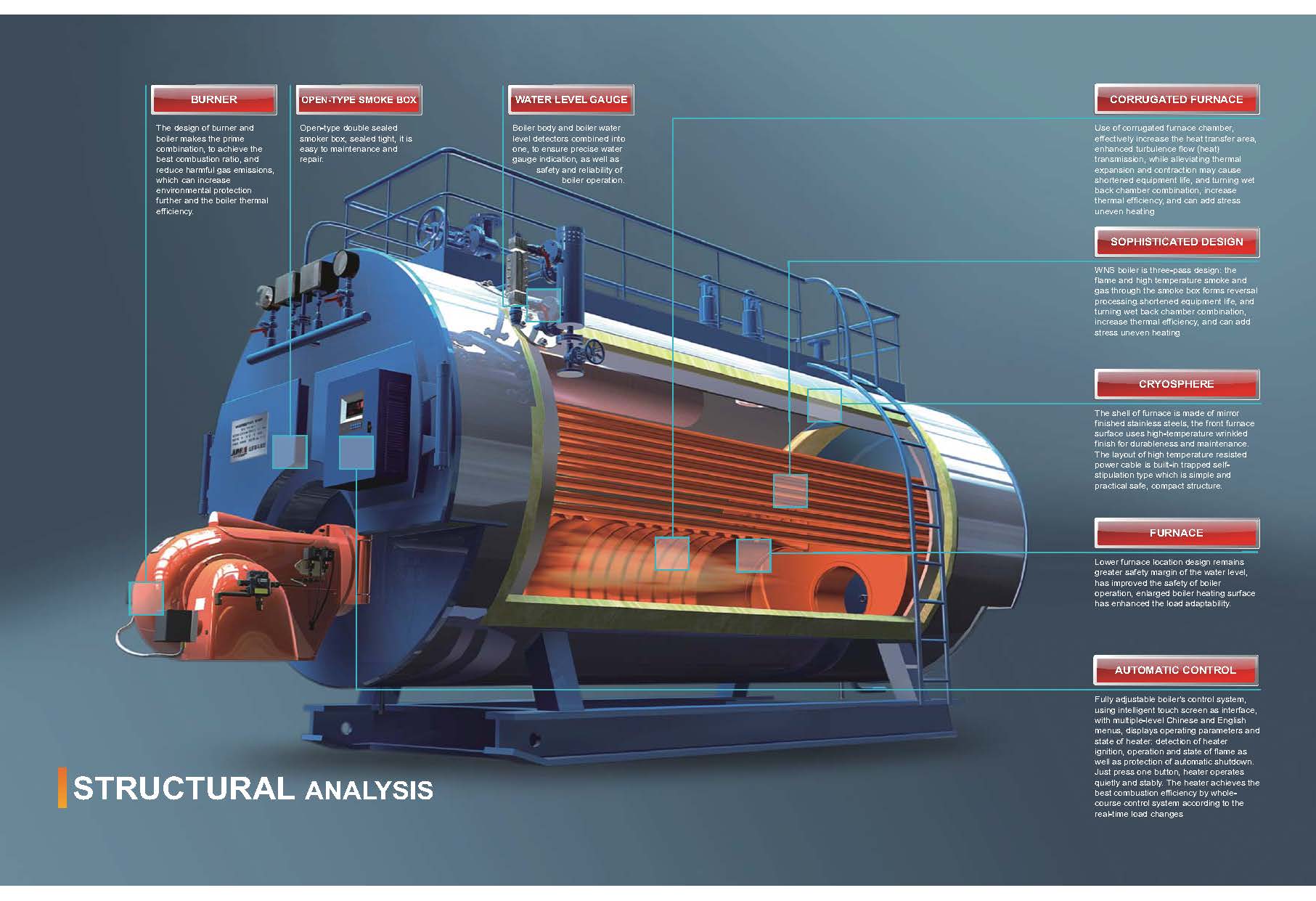

2. Boiler Design Type

Fire-Tube Boilers: Lower cost, simple design, suitable up to ~25 bar and small-to-medium capacity.

Water-Tube Boilers: More expensive, handle higher pressures/temperatures, better for continuous large-scale process or power generation.

Condensing Oil Boilers: Higher upfront cost due to stainless steel heat exchangers but maximize efficiency by recovering latent heat.

3. Fuel Type and Quality

Heavy Fuel Oil (HFO): Requires heating and treatment systems (filters, preheaters), raising equipment cost.

Diesel/Light Oil: Cleaner and easier to handle but more expensive per unit of fuel.

Low-Sulfur Oil: May be mandated for emission compliance, impacting both fuel and equipment cost.

4. Efficiency and Heat Recovery Features

Burner Technology: Modulating or low-NOx burners add cost but increase efficiency and compliance.

Economizers & Air Preheaters: Add-on equipment increases boiler price by 5–15% but reduces fuel consumption by 5–10%.

Control Systems: Advanced PLC or oxygen-trim systems raise base cost but optimize efficiency.

5. Material and Manufacturing Standards

Higher-grade steels and corrosion-resistant alloys for superheaters, economizers, and pressure parts raise material costs.

Compliance with ASME, EN, or ISO standards requires additional testing and certification.

6. Emission Compliance Requirements

Stricter regional emission laws (e.g., EU, US EPA Tier) may require:

Low-NOx burners

Flue gas recirculation (FGR)

ESP or baghouse filters for particulates

SCR systems for NOx reduction

Each adds significantly to the base cost.

Conclusion

The base cost of an oil-fired boiler is not a one-size-fits-all figure—it is shaped by capacity, design type, pressure rating, fuel handling needs, efficiency features, and compliance standards. While higher-specification units carry greater upfront costs, they often deliver lower fuel consumption, higher reliability, and regulatory compliance, resulting in better lifecycle economics.

How Do Boiler Capacity and Steam Pressure Affect Pricing?

When evaluating boiler investments, many buyers wonder why two boilers of similar appearance may have very different prices. The answer often lies in steam capacity and working pressure—the two most fundamental parameters that define a boiler’s size, design complexity, and cost. If these factors are misjudged, you risk either overspending on an oversized unit or facing operational inefficiencies and safety issues with an undersized one. Understanding their impact on pricing is essential for accurate budgeting.

Boiler capacity and steam pressure directly affect pricing because higher outputs require larger heat exchange surfaces, stronger materials, and more complex designs, while higher pressures demand thicker steel plates, advanced welding, and rigorous certification. As capacity and pressure increase, the cost curve rises exponentially rather than linearly, making high-pressure, large-capacity boilers significantly more expensive.

This means buyers should carefully match boiler size and pressure to actual process needs, avoiding unnecessary capital and operating expenses.

Boiler cost increases in direct proportion to steam capacity and pressure.False

Costs increase exponentially, not linearly, because higher capacities and pressures require stronger materials, stricter design codes, and larger auxiliary systems.

Higher steam pressure requires more advanced materials and certification, raising boiler cost.True

High-pressure designs must comply with ASME/EN standards, thicker plates, and more robust welds, increasing both material and manufacturing costs.

1. Impact of Boiler Capacity on Pricing

Capacity Definition: Expressed in tons of steam per hour (t/h) or MW thermal.

Cost Drivers: Larger capacity means a bigger furnace, more tubes, larger drums, and stronger structural support.

Auxiliary Systems: Bigger capacity needs larger burners, pumps, fans, and water treatment units, further raising cost.

| Boiler Capacity | Typical Application | Price Range (USD per ton/hr) |

|---|---|---|

| 1–10 t/h | Small factories, food, textile | $18,000 – $35,000 |

| 10–50 t/h | Chemicals, paper, light industry | $35,000 – $75,000 |

| 50–150 t/h | Power plants, steel, refineries | $75,000 – $150,000+ |

2. Impact of Steam Pressure on Pricing

Low Pressure (up to 15 bar): Simple fire-tube designs, economical for heating and small processes.

Medium Pressure (16–40 bar): More robust construction, often water-tube designs for industry.

High Pressure (40–100 bar+): Advanced metallurgy, thicker drum walls, heat-resistant alloys, higher quality control.

Supercritical (>220 bar): Utility-scale power plants with extremely high costs.

| Pressure Range | Boiler Design Type | Relative Cost Impact |

|---|---|---|

| Low Pressure (≤15 bar) | Fire-tube | Lowest |

| Medium Pressure (16–40 bar) | Water-tube | +20–40% higher |

| High Pressure (40–100 bar) | Advanced water-tube | +60–100% higher |

| Supercritical (>220 bar) | CFB/utility | 2–3x base cost |

3. Combined Effect of Capacity and Pressure

The most expensive boilers are those that combine large capacity with high pressure—commonly found in utility-scale power plants. For example, a 100 t/h, 15 bar boiler may cost half as much as a 100 t/h, 65 bar boiler, due to the additional requirements in steel thickness, welding, and certification.

4. Case Study Example

A textile plant compared two options:

Option A: 15 t/h, 10 bar fire-tube boiler → Cost ~$600,000.

Option B: 15 t/h, 40 bar water-tube boiler → Cost ~$1.2 million.

Though capacity was the same, the higher-pressure unit cost double, reflecting material and safety compliance requirements.

Conclusion

Boiler capacity and steam pressure are the core pricing drivers. Higher capacity means larger equipment and auxiliaries, while higher pressure demands stronger materials, stricter standards, and more complex engineering. The key is balancing process requirements with economic feasibility, ensuring you do not overpay for capacity or pressure you don’t actually need.

What Is the Cost Difference Between Fire-Tube and Water-Tube Oil-Fired Boilers?

When choosing an oil-fired boiler, one of the most important decisions is whether to select a fire-tube or water-tube design. While both generate steam efficiently, they differ in construction, pressure limits, and cost structure. Many buyers mistakenly assume water-tube boilers are always “better,” but the reality is that each type is suited to different applications—and their costs reflect these differences.

Fire-tube oil-fired boilers are generally cheaper, simpler, and suitable for lower capacities and pressures, while water-tube boilers are more expensive due to their ability to handle higher steam output and pressure. On average, water-tube boilers cost 30–60% more than fire-tube boilers of equivalent capacity, but they deliver superior performance for large-scale and high-pressure applications.

This makes careful evaluation essential: overspending on a water-tube boiler when a fire-tube would suffice can inflate capital costs, while underestimating requirements may lead to inefficiency and safety risks.

Fire-tube boilers are always more efficient than water-tube boilers.False

Water-tube boilers are generally more efficient at higher pressures and capacities, while fire-tube boilers are cost-effective for smaller loads.

Water-tube oil-fired boilers cost significantly more due to higher pressure ratings and complex designs.True

They require stronger materials, advanced welding, and more auxiliary systems, increasing capital costs compared to fire-tube units.

1. Fire-Tube vs. Water-Tube: Cost and Application Overview

| Parameter | Fire-Tube Boiler | Water-Tube Boiler |

|---|---|---|

| Capacity Range | 1–25 t/h | 10–500+ t/h |

| Pressure Range | Up to 25 bar | Up to 160 bar+ |

| Base Cost (USD per ton/hr) | $18,000 – $40,000 | $35,000 – $75,000+ |

| Efficiency | 75–85% (typical) | 80–92% (with economizers) |

| Best Use | Small–medium industries (textile, food, laundry, chemical) | Large process industries, refineries, power generation |

2. Why Fire-Tube Boilers Cost Less

Simpler construction (tubes inside water-filled shell).

Lower pressure vessel requirements.

Fewer auxiliary systems.

Easier to manufacture, install, and maintain.

Example: A 10 t/h, 15 bar oil-fired fire-tube boiler may cost around $350,000, while a water-tube unit of the same output and pressure would cost $500,000–$600,000.

3. Why Water-Tube Boilers Cost More

Designed for high pressure and large capacity.

Require thicker plates, advanced metallurgy, and welding.

More complex support systems (feedwater treatment, economizers, soot blowers, controls).

Stricter ASME/EN standards testing and certification.

Example: For a 50 t/h, 40 bar boiler:

Fire-tube option would be impractical or oversized.

Water-tube option costs $3.5–4.5 million, but delivers safe, reliable high-pressure steam.

4. Long-Term Cost Considerations

Fuel Efficiency: Water-tube boilers with advanced burners and economizers often save more on fuel, offsetting higher capital cost.

Maintenance: Fire-tube boilers are easier and cheaper to maintain, but water-tube designs last longer under high loads.

Downtime Costs: In industries where downtime is extremely costly, water-tube boilers are often the better investment.

Conclusion

The cost difference between fire-tube and water-tube oil-fired boilers comes down to capacity, pressure, and performance requirements. Fire-tube units are the economical choice for smaller, low-to-medium pressure applications, while water-tube units, though 30–60% more expensive, are essential for large-scale, high-pressure, and continuous-duty operations.

How Do Efficiency Features (Economizers, Condensing Design) Impact Investment?

One of the biggest challenges in boiler investment decisions is balancing upfront capital cost with long-term operating savings. Many buyers hesitate to add efficiency-enhancing features such as economizers or condensing designs because they increase the initial price of the boiler package. However, ignoring them often results in significantly higher fuel expenses, which represent the largest portion of a boiler’s lifecycle cost. Understanding how these efficiency features affect both investment and return is crucial to making the right choice.

Efficiency features like economizers and condensing designs raise initial boiler investment by 10–25%, but they reduce fuel consumption by 5–15%, leading to substantial lifecycle savings. In most industrial applications, the payback period for these upgrades is 1–3 years, after which the plant benefits from permanently lower operating costs.

This means that while the upfront cost is higher, efficiency features usually pay for themselves quickly and improve competitiveness in fuel-intensive industries.

Adding an economizer to an oil or gas boiler increases fuel consumption.False

Economizers recover waste heat from flue gases, preheating feedwater and reducing total fuel consumption.

Condensing boilers achieve higher efficiency by recovering latent heat from water vapor in flue gases.True

By condensing exhaust steam and capturing latent heat, condensing boilers can achieve efficiency levels up to 95% or higher.

1. Economizers – Heat Recovery for Fuel Savings

An economizer is a heat exchanger installed in the boiler’s flue gas path to preheat feedwater.

Fuel Savings: 4–7% improvement in efficiency.

Investment Impact: Increases boiler package cost by 8–15%.

Payback Period: Typically 12–24 months.

| Capacity | Without Economizer Efficiency | With Economizer Efficiency | Annual Fuel Saving (for natural gas) |

|---|---|---|---|

| 10 t/h | 82% | 87% | ~$75,000 |

| 20 t/h | 81% | 86% | ~$150,000 |

| 50 t/h | 80% | 86–87% | ~$350,000+ |

2. Condensing Design – Maximum Efficiency from Latent Heat

A condensing boiler cools flue gases below the dew point, recovering latent heat of vaporization.

Fuel Savings: 8–15% improvement compared to non-condensing boilers.

Investment Impact: Adds 15–25% to initial cost due to stainless steel heat exchangers and corrosion-resistant materials.

Payback Period: 2–3 years (faster where fuel costs are high).

Example: A 15 t/h gas-fired condensing boiler may cost $120,000 more than a standard design, but it saves ~$80,000 annually in fuel. Payback = ~18 months.

3. Combined Features for Maximum ROI

Many modern boiler systems combine economizers, condensing design, and advanced controls to push efficiency above 90–95%. Although this raises CAPEX, it drastically reduces OPEX.

| Feature | Added CAPEX | Efficiency Gain | Payback Period |

|---|---|---|---|

| Economizer | +10–15% | +4–7% | 1–2 years |

| Condensing Design | +15–25% | +8–15% | 2–3 years |

| Combined (Economizer + Condensing + Controls) | +25–35% | +12–20% | 1.5–2.5 years |

4. Long-Term Benefits Beyond Fuel Savings

Lower Emissions: Reduced CO₂, NOx, and SO₂ per ton of steam.

Extended Boiler Life: Lower thermal stress due to preheated feedwater.

Sustainability Goals: Helps industries meet green certifications and regulatory compliance.

Conclusion

Efficiency features like economizers and condensing designs do increase the upfront boiler cost, but they are proven investments that pay back within a few years and deliver long-term fuel savings, emission reductions, and system reliability. In fuel-intensive industries, not investing in these features often costs far more over the boiler’s lifecycle.

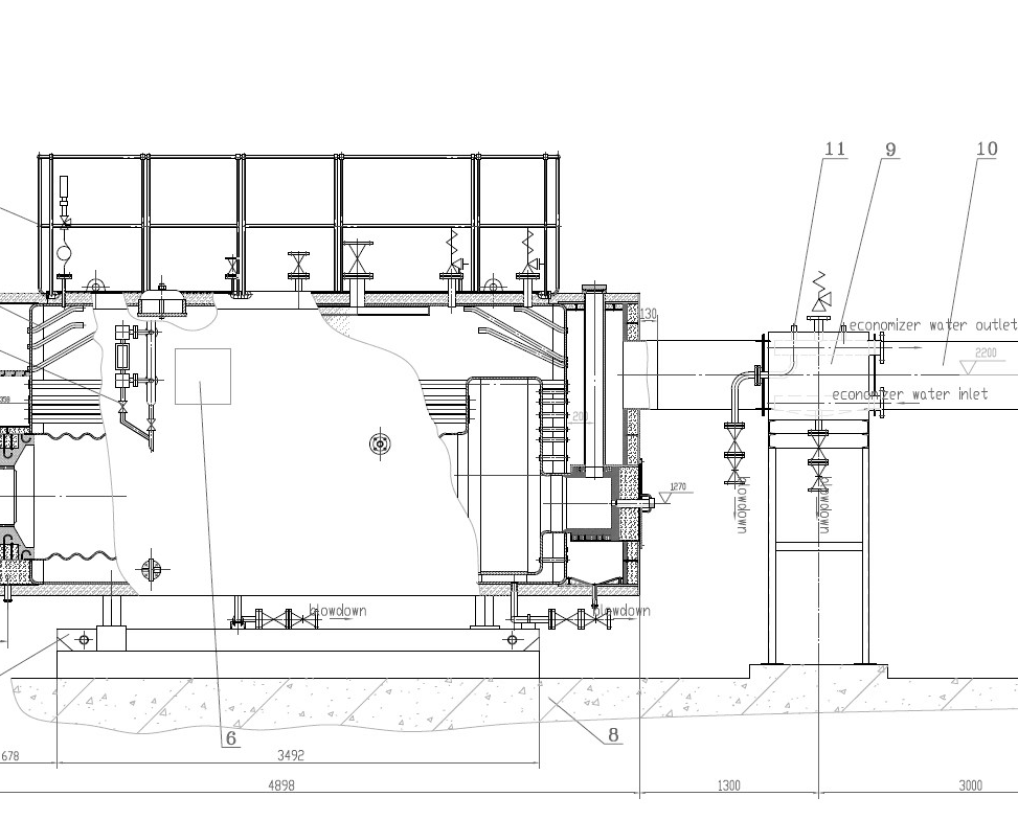

What Are the Additional Costs of Auxiliary Systems and Installation?

When budgeting for a new boiler project, many buyers make the mistake of only considering the base boiler price. In reality, the boiler itself may account for just 50–70% of the total project cost. The rest comes from auxiliary systems and installation, which are essential for safe, efficient, and compliant operation. Ignoring these costs early in planning often leads to budget overruns, project delays, or underperforming systems.

Auxiliary systems and installation typically add 30–60% to the base cost of an industrial boiler. These include burners, economizers, pumps, water treatment units, control systems, fuel handling, emission controls, and the actual installation work (civil, piping, electrical). While they increase upfront investment, these systems ensure efficiency, reliability, compliance, and long-term cost savings.

This means that evaluating the total installed cost (TIC) rather than just the boiler price is critical for accurate budgeting and decision-making.

The boiler base unit alone is sufficient to run an industrial steam system.False

A boiler requires multiple auxiliary systems like burners, pumps, feedwater treatment, and controls to operate safely and efficiently.

Auxiliary systems and installation can double the base price of a boiler in complex projects.True

In utility-scale or high-efficiency plants, auxiliaries and installation often equal or exceed the boiler equipment cost.

1. Auxiliary Systems and Their Costs

| Auxiliary System | Function | Cost Impact (as % of base boiler price) |

|---|---|---|

| Burner System | Ensures fuel-air mixing and combustion control | +10–15% |

| Economizer | Recovers flue gas heat for feedwater | +8–15% |

| Feedwater Pumps & Deaerator | Supplies and treats boiler feedwater | +10–12% |

| Water Treatment System | Prevents scaling, corrosion, fouling | +5–10% |

| Control & Automation System | Optimizes efficiency and ensures safety | +8–12% |

| Fuel Handling & Storage | Oil tanks, coal conveyors, biomass feeders | +10–20% (fuel-dependent) |

| Emission Control Equipment | ESP, bag filters, SCR, FGD | +15–30% (regulation-dependent) |

Example: A 20 t/h oil-fired boiler costing $700,000 may require $300,000–450,000 in auxiliary equipment.

2. Installation Costs

Installation includes everything needed to integrate the boiler and auxiliaries into a working plant:

Civil Works: Foundations, housing, and structural supports. (+10–15%)

Mechanical Installation: Boiler mounting, piping, ducting, insulation. (+15–20%)

Electrical & Instrumentation: Power cabling, control wiring, DCS integration. (+5–10%)

Commissioning & Testing: Performance tuning, training, certifications. (+3–5%)

Example: Installation for a mid-size 20 t/h boiler may add $200,000–350,000, depending on site conditions.

3. Total Installed Cost (TIC) Breakdown

| Component | Share of TIC |

|---|---|

| Boiler Base Unit | 50–70% |

| Auxiliary Systems | 20–35% |

| Installation & Commissioning | 10–25% |

Thus, a boiler priced at $700,000 may end up with a TIC of $1.1–1.5 million, depending on auxiliaries and installation scope.

4. Case Study Example

A chemical plant installed a 15 t/h gas-fired water-tube boiler:

Boiler Base Price: $500,000

Auxiliaries (burner, economizer, pumps, controls, water treatment): $280,000

Installation & Commissioning: $200,000

TIC = $980,000 (almost double the base cost).

Conclusion

The base boiler cost is only part of the investment. Auxiliary systems and installation typically add 30–60% to the budget, and in complex projects, even more. These systems are not optional—they are essential for efficiency, compliance, and reliability. Factoring them in from the start ensures realistic budgeting and prevents costly surprises.

How Do You Estimate the Total Lifecycle Cost of an Oil-Fired Boiler?

Escalating fuel prices and compliance requirements make “sticker price” thinking risky. Plants that buy on upfront cost alone often discover later that fuel, maintenance, and downtime dominate the budget. The result is a boiler that looks cheap on day one but becomes very expensive across 10–20 years. The remedy is to estimate Total Lifecycle Cost (LCC) before purchase so you can select the capacity, pressure rating, and efficiency features that minimize long-term cash outflow.

To estimate the lifecycle cost of an oil-fired boiler, build a cash-flow model that sums: (1) capital expenditure (boiler + auxiliaries + installation), (2) annual fuel cost based on efficiency and load profile, (3) operations & maintenance (routine + major overhauls), (4) water/chemicals and power for auxiliaries, (5) emissions compliance and monitoring, (6) expected downtime cost, and (7) end-of-life costs or residual value. Discount these yearly costs to present value and compare alternatives (e.g., with/without economizer, fire-tube vs. water-tube).

If you keep reading, you’ll get a practical formula set, default assumptions, and a worked 10-year example you can copy into your spreadsheet to make confident, defensible purchase decisions.

Fuel typically represents the largest share of lifecycle cost for an oil-fired boiler.True

Even modest efficiency differences compound over thousands of operating hours, making fuel the dominant cost driver over 10–20 years.

Installation and auxiliaries are minor and can be ignored in lifecycle analysis.False

Auxiliaries and installation often add 30–60% to the base boiler price and materially affect efficiency, reliability, and OPEX.

Core LCC Structure (What to Include and How to Calculate)

| Cost Block | What It Covers | Typical Share of 10–15 yr LCC* | How to Estimate |

|---|---|---|---|

| CAPEX | Boiler, burner, economizer, controls, water treatment, emission gear, installation/commissioning | 15–35% | Vendor quotes + installation factors |

| Fuel | Oil consumption driven by load & efficiency | 50–70% | Hourly load × hours × heat rate ÷ efficiency × fuel price |

| O&M | Routine service, spares, inspections, tube work, burner tuning | 8–15% | % of CAPEX + event-based allowances |

| Utilities & Water | Power for fans/pumps, water, chemicals, blowdown losses | 2–6% | kWh per t steam, water cost per m³, chemicals per t steam |

| Compliance | CEMS, lube/reagent, stack testing, fees | 1–4% | Annual contracts + periodic test costs |

| Downtime | Lost margin during outages | 0–10% (highly specific) | (Lost margin $/h) × expected outage hours |

| End of Life | Decommissioning minus resale scrap | −2% to +2% | Removal cost – scrap value |

*Ranges vary by duty, fuel price, and efficiency options.

Simplified One-Line Excel Formulas

Annual fuel use (kg/yr)

= (Steam_tph * Hours_year * 2250000) / (Oil_LHV * Efficiency)

Annual fuel cost ($/yr)

= Fuel_kg_year * Oil_Price

Present Value of a recurring annual cost (C) over n years at discount rate r

= C * (1 - (1 + r)^(-n)) / r

Net Present Cost (NPC)

= CAPEX + PV_Fuel + PV_OM + PV_Utilities + PV_Water + PV_Compliance + PV_Downtime + PV_EndOfLife

Levelized Steam Cost ($/t)

= NPC / (Steam_tph * Hours_year * Years)

👉 Example: If you have a 15 t/h boiler, running 7500 h/yr, η = 0.85, Oil LHV = 42000000 J/kg, Oil Price = 0.85 $/kg, just replace the variables in the first formula.

Step-By-Step Estimation Workflow (Engineer’s Checklist)

Define duty: peak load, average load, operating hours, growth/seasonality.

Pick a credible efficiency for shortlisted designs (base, with economizer, condensing).

Fix fuel price scenarios (base, +20%, +40%).

Quantify O&M: annual routine (% of CAPEX) + scheduled major overhauls (year 5/10).

Add utilities, water, and chemicals based on expected specific consumptions.

Model downtime: planned + unplanned hours; monetize using lost margin or rental boiler cost.

Include compliance: CEMS lease/service, stack testing, low-NOx burner upkeep.

Discount and compare NPC and levelized $/t for each technical option.

Run sensitivities on oil price, hours, efficiency, discount rate.

Choose the minimum NPC that still meets reliability and compliance constraints.

Default Engineering Assumptions (Use or Replace with Your Data)

| Parameter | Conservative Default | Notes |

|---|---|---|

| Boiler efficiency (non-condensing, no economizer) | 82% | Typical fire-tube baseline |

| Boiler efficiency (with economizer) | 87% | Common upgrade gain +4–6% |

| Boiler efficiency (condensing, low return) | 92–95% | Feasible if return temp low and sulfur controlled |

| Oil LHV | 42 MJ/kg | For No. 2/Light fuel oil |

| Operating hours | 7,500 h/yr | 5×24/yr with planned outages |

| Discount rate (real) | 6–10% | Use your corporate WACC |

| Routine O&M | 2–3% of CAPEX/yr | Excludes major overhauls |

| Major overhaul | 8–12% of CAPEX at yr 5/10 | Tubes, burner, controls |

| Electricity for auxiliaries | 9–14 kWh per ton steam | Fans, pumps, controls |

| Water & chemicals | 0.8–1.5 $/t steam | Depends on TDS/RO/DA setup |

| Downtime cost | Site-specific | Use lost margin or rental cost |

Worked Example: 15 t/h Oil-Fired Boiler, 10-Year Horizon

Case A: Fire-tube, 10 bar, no economizer (η = 82%)

Case B: Same boiler with economizer (η = 87%)

Case C: Water-tube with economizer + O₂ trim (η = 89%)

Assumptions: Load 12 t/h average, 7,500 h/yr, oil price $0.85/kg, LHV 42 MJ/kg, r = 8% (real), electricity $0.12/kWh, water/chemicals $1.1/t, routine O&M 2.5% of CAPEX/yr, major overhaul 10% CAPEX in years 5 & 10, downtime $400/h with 60 h/yr for A, 45 h/yr for B, 35 h/yr for C. CAPEX: A=$650k, B=$720k, C=$980k (installed). CEMS & compliance $18k/yr for all.

Steam/year = 12 × 7,500 = 90,000 t

Fuel energy per ton steam ≈ 2,250 MJ/t ÷ η

A: 2,743.9 MJ/t; B: 2,586.2 MJ/t; C: 2,528.1 MJ/t

Fuel mass per ton = above ÷ 42 →

A: 65.3 kg/t; B: 61.6 kg/t; C: 60.2 kg/t

Annual fuel = per-ton × 90,000 t →

A: 5,878 t; B: 5,546 t; C: 5,418 t

Annual fuel cost (× $0.85/kg):

A: $4.996M; B: $4.714M; C: $4.605M

Annual utilities

Power (assume 11 kWh/t for A, 10.5 for B, 10 for C):

A: 990,000 kWh → $119k; B: 945,000 → $113k; C: 900,000 → $108kWater & chemicals ($1.1/t): $99k for all

O&M (routine 2.5% CAPEX):

A: $16k/yr; B: $18k/yr; C: $24.5k/yr (approx.)

Overhauls (10% CAPEX at yr 5 & 10, discounted in model)

Compliance: $18k/yr

Downtime

A: 60 h × $400 = $24k/yr; B: $18k/yr; C: $14k/yr

Annual Operating Snapshot (Undiscounted)

| Cost Item | Case A | Case B | Case C |

|---|---|---|---|

| Fuel | $4,996,000 | $4,714,000 | $4,605,000 |

| Power | $119,000 | $113,000 | $108,000 |

| Water & Chemicals | $99,000 | $99,000 | $99,000 |

| Routine O&M | $16,000 | $18,000 | $24,500 |

| Compliance | $18,000 | $18,000 | $18,000 |

| Downtime | $24,000 | $18,000 | $14,000 |

| Total/yr | $5,272,000 | $4,980,000 | $4,868,500 |

10-Year Net Present Cost (NPC) Summary (8% real)

| Component | Case A | Case B | Case C |

|---|---|---|---|

| CAPEX (Year 0) | $650,000 | $720,000 | $980,000 |

| PV Fuel | $35.2M | $33.2M | $32.5M |

| PV Power | $0.84M | $0.80M | $0.76M |

| PV Water/Chem | $0.70M | $0.70M | $0.70M |

| PV Routine O&M | $0.11M | $0.12M | $0.17M |

| PV Compliance | $0.13M | $0.13M | $0.13M |

| PV Downtime | $0.17M | $0.12M | $0.09M |

| PV Overhauls | $0.12M | $0.13M | $0.18M |

| Total NPC (10 yr) | $37.0M | $35.9M | $35.5M |

| Levelized $/t (900k t) | $41.1/t | $39.9/t | $39.4/t |

Takeaway: Despite higher CAPEX, Cases B and C win on total cost. The economizer alone trims ~3% off NPC; moving to higher baseline efficiency with better controls trims another ~1.5%. In high fuel-price environments, savings grow further.

Sensitivity: What Moves the Needle Most?

Fuel price: ±20% fuel price shifts NPC by ~±9–10%.

Efficiency: +3 points η often beats +$100–$200k CAPEX.

Operating hours: Fewer hours favor lower-CAPEX options; baseload service rewards higher-efficiency packages.

Downtime cost: Where lost margin exceeds ~$1,000/h, reliability upgrades (water-tube, redundancy, premium controls) are usually justified.

Comparing Technical Options via Lifecycle Lens

| Option | Typical CAPEX Impact | OPEX/Fuel Impact | Notes |

|---|---|---|---|

| Economizer | +8–15% | −4–7% fuel | Short 1–2 yr payback in most cases |

| O₂ Trim + Parallel Positioning | +2–5% | −1.5–3% fuel; steadier CO/NOx | Also stabilizes steam quality |

| Low-NOx Burner | +3–8% | Neutral to slight fuel cut | May reduce reagent/compliance costs |

| Condensing Heat Recovery* | +15–25% | −8–12% fuel | Viable with low return temps & low sulfur |

| VFDs on fans/pumps | +1–3% | −15–30% aux power | Quietly lowers parasitic load |

| Water Treatment Upgrade (RO/DA) | +3–6% | Efficiency preserved; tube life up | Avoids fouling that erodes η |

*Condensing with oil requires attention to sulfur/acid corrosion and condensate neutralization.

Building Your Spreadsheet (Column Guide)

Inputs: capacity (t/h), average load (t/h), hours/yr, efficiency, LHV, oil price, CAPEX, O&M %, discount rate, power intensity, $/kWh, water $/t, downtime $/h & hours, overhaul schedule.

Year columns (0..n): CAPEX at 0; recurring annuals; overhauls in chosen years; optional residual value in final year.

Outputs: NPC, levelized $/t, breakeven years between options, tornado chart for sensitivities.

Practical Tips from the Field

Model two credible efficiencies per vendor (w/ and w/o economizer). Ask for guaranteed η at your test conditions.

Include installation scope early. Hidden civil/electrical work frequently adds 10–20% to CAPEX.

Quantify reliability: If a design reduces unplanned outages by even 20–30 h/yr, it often pays for itself.

Escalation: Run fuel price and labor inflation separately from discount rate for realism.

Document assumptions: So procurement, finance, and operations align on the decision.

Summary (What Good Looks Like)

A robust oil-fired boiler LCC estimate:

captures all cost blocks;

uses site-specific load and prices;

tests sensitivity to fuel and hours; and

compares technical alternatives on NPC and levelized $/t—not on sticker price.

🔍 Conclusion

The cost of an industrial oil-fired boiler varies widely, but with the right evaluation of capacity, efficiency, and auxiliary systems, companies can strike the best balance between initial investment and long-term operating savings.

📞 Contact Us

💡 Need a precise oil-fired boiler quotation? We provide custom system design, cost estimation, and turnkey supply solutions based on your project needs.

🔹 Contact us today for a tailored oil-fired boiler cost estimate and technical consultation. 🛢🔥🏭✅

FAQ

How much does an industrial oil-fired boiler cost?

The cost of an industrial oil-fired boiler varies based on size, pressure, and design:

Small-capacity units (1–10 t/h): $30,000 – $80,000

Medium-capacity units (10–30 t/h): $80,000 – $250,000

Large-capacity units (30–75 t/h): $250,000 – $600,000+

Prices typically exclude auxiliary equipment and installation.

What factors affect the cost of an oil-fired industrial boiler?

Key cost drivers include:

Boiler capacity and pressure rating – Higher ratings cost more.

Type (fire-tube vs. water-tube) – Water-tube boilers are more expensive but suitable for high capacity.

Efficiency level – High-efficiency condensing models cost more upfront but save fuel long-term.

Auxiliary systems – Economizers, feedwater pumps, burners, and control systems add to total cost.

Customization – Special materials for corrosive or high-temperature environments increase costs.

What is the total installed cost of an oil-fired boiler system?

Installed cost can be 1.5–2.5 times the boiler purchase price because it includes:

Civil works & foundations

Piping & ducting

Burner and fuel system installation

Control systems integration

Labor and commissioning

For example, a $200,000 boiler may have a total installed cost of $300,000–$500,000.

What are the operating costs of an oil-fired boiler?

Operating costs depend on:

Fuel consumption – Oil costs $0.70–$1.20 per liter (region dependent).

Boiler efficiency – 85–92% efficiency reduces fuel use.

Maintenance & servicing – Annual servicing averages $5,000–$20,000.

Auxiliary power consumption – Pumps, fans, and controls contribute to running costs.

Is an oil-fired boiler cost-effective compared to gas or biomass?

Oil-fired boilers are often more expensive to operate than natural gas but cheaper than electric boilers.

Biomass boilers may have lower long-term fuel costs but require more storage and handling.

Oil-fired boilers are a practical choice where gas supply is unavailable and space for biomass storage is limited.

References

U.S. Department of Energy – Industrial Boiler Costs – https://www.energy.gov

IEA – Heating Systems and Fuel Costs – https://www.iea.org

Forbes Marshall – Industrial Boiler Pricing Factors – https://www.forbesmarshall.com

Babcock & Wilcox – Oil-Fired Boiler Solutions – https://www.babcock.com

Cleaver-Brooks – Boiler Cost Estimator – https://www.cleaverbrooks.com

Engineering Toolbox – Fuel Cost Calculations – https://www.engineeringtoolbox.com

ResearchGate – Industrial Boiler Economics – https://www.researchgate.net

ScienceDirect – Boiler Efficiency Studies – https://www.sciencedirect.com

Thermax – Oil-Fired Boiler Applications – https://www.thermaxglobal.com

BioEnergy Consult – Fuel Comparison for Boilers – https://www.bioenergyconsult.com