Industrial gas-fired boilers are widely adopted for their clean combustion, high efficiency, and operational flexibility, but many buyers still question whether they deliver real economic value over decades of operation. Focusing only on initial purchase price can be misleading, as fuel costs, efficiency, maintenance, and regulatory compliance ultimately determine long-term cost-effectiveness.

In the long run, industrial gas-fired boilers are highly cost-effective due to their high thermal efficiency (often 90–95% or higher), low maintenance requirements, and reduced environmental compliance costs. Compared with coal- and oil-fired boilers, gas-fired systems offer lower fuel handling costs, fewer emissions penalties, and higher automation levels. Over a typical 15–25 year lifecycle, savings from fuel efficiency, reduced downtime, and simpler maintenance often outweigh the initial investment, delivering a strong and predictable return on investment (ROI).

When evaluated from a lifecycle cost perspective, gas-fired boilers are among the most economically balanced solutions for modern industrial steam and heat generation.

Looking beyond upfront costs to long-term performance reveals why gas-fired boilers continue to gain market share across multiple industries.

How Do Fuel Efficiency and Gas Pricing Affect Long-Term Operating Costs?

For industrial steam users, energy cost volatility is one of the most persistent and damaging operational pain points. Many facilities focus heavily on initial boiler purchase price while underestimating how fuel efficiency and gas pricing dominate long-term operating costs over the life of a boiler system. The consequence of this oversight is severe: equipment that appears affordable upfront can become a long-term financial burden as fuel prices fluctuate and inefficiencies compound year after year. In an era of rising energy uncertainty and tightening margins, understanding the interaction between fuel efficiency and gas pricing is no longer optional—it is central to sustainable cost control. The solution lies in quantifying how efficiency losses amplify gas price exposure and how high-efficiency systems protect facilities from long-term operating cost escalation.

Fuel efficiency and gas pricing directly determine long-term operating costs because fuel expenses typically account for 70–90% of a boiler’s lifetime cost; even small efficiency differences significantly magnify the financial impact of gas price fluctuations over time.

This insight reframes boiler investment decisions from short-term capital expense to long-term cost resilience.

Fuel costs usually represent the largest portion of an industrial boiler’s lifetime operating expense.True

Over a 20–30 year lifespan, fuel typically accounts for the majority of total boiler ownership cost.

Gas price volatility has minimal impact on high-efficiency boiler operating economics.False

While efficiency reduces exposure, price volatility still significantly affects total fuel spend, especially at high consumption volumes.

Fuel Efficiency as the Primary Cost Multiplier

From a professional manufacturer’s and supplier’s perspective, fuel efficiency is the single most powerful lever affecting long-term boiler operating costs. Boiler efficiency defines how much useful steam energy is produced from each unit of fuel. Even modest efficiency differences—often perceived as negligible during procurement—translate into substantial cost gaps over years of operation.

For example, the difference between an 82% efficient boiler and a 92% efficient boiler may appear small at first glance. However, over a full operating year, the less efficient boiler must burn approximately 12% more gas to produce the same amount of steam. Over a 20-year lifecycle, this inefficiency compounds into millions of dollars in additional fuel expense for medium- to large-scale industrial users.

Fuel efficiency also influences auxiliary energy consumption. Poor combustion efficiency, excessive excess air, and fouled heat transfer surfaces increase flue gas losses and fan power demand. These secondary energy penalties further raise operating costs and are often overlooked in basic efficiency comparisons.

Gas Pricing: The Volatility Factor

Gas pricing introduces a second, equally critical dimension to long-term operating cost analysis. Natural gas prices are influenced by global supply-demand dynamics, geopolitical factors, seasonal demand, and regulatory policies. While prices may appear stable in the short term, long-term trends are inherently uncertain.

From a lifecycle cost standpoint, efficiency and gas pricing interact multiplicatively rather than independently. Higher gas prices amplify the cost impact of inefficiency, while lower prices temporarily mask it. Facilities that invest in high-efficiency boilers effectively hedge against future gas price increases by reducing total consumption.

The table below illustrates how gas pricing interacts with efficiency.

| Boiler Efficiency | Gas Price (Low) | Gas Price (High) | Relative Cost Impact |

|---|---|---|---|

| Low efficiency | Moderate cost | Very high cost | High exposure |

| High efficiency | Lower cost | Controlled cost | Reduced exposure |

This relationship explains why efficiency investments become increasingly valuable in volatile or rising gas price environments.

Long-Term Cost Modeling: Efficiency Versus Price Sensitivity

When evaluating long-term operating costs, experienced engineers rely on sensitivity analysis rather than single-price assumptions. This approach models how operating costs change under different gas price scenarios and efficiency levels.

For example, consider a boiler consuming 1 million MMBtu of gas annually. At a gas price of USD 5/MMBtu, a 5% efficiency loss equates to USD 250,000 in additional annual fuel cost. At USD 10/MMBtu, the same inefficiency doubles its financial impact. Over a decade, this difference becomes a strategic financial risk rather than a minor operational detail.

The table below demonstrates this compounding effect.

| Gas Price (USD/MMBtu) | Annual Fuel Cost Impact of 5% Efficiency Loss |

|---|---|

| 4 | Low |

| 6 | Moderate |

| 8 | High |

| 10 | Very high |

From a supplier’s perspective, this is why high-efficiency boilers are often positioned not just as energy-saving equipment, but as risk-management assets.

Efficiency Degradation Over Time

Another critical factor often ignored in operating cost projections is efficiency degradation. Boilers do not maintain nameplate efficiency indefinitely. Fouling, scaling, burner wear, and control drift gradually reduce real-world efficiency if not actively managed.

Older or lower-quality boilers tend to degrade faster, increasing fuel consumption year after year. This means that long-term operating costs are not static; they trend upward unless efficiency is actively preserved. High-efficiency modern boilers are designed with materials, controls, and heat exchanger configurations that slow efficiency degradation and make performance easier to maintain.

From a lifecycle perspective, the true cost difference between efficient and inefficient boilers widens over time rather than remaining constant.

Contracting and Fuel Purchasing Strategies

Fuel efficiency also affects how facilities manage gas purchasing and contracting strategies. High-efficiency boilers consume less gas, reducing exposure to spot market volatility and enabling more flexible procurement strategies. Facilities can lock in smaller volumes, diversify supply contracts, or absorb short-term price spikes with less financial stress.

In contrast, inefficient boilers require higher baseline gas volumes, forcing operators into larger contracts and greater exposure to unfavorable pricing terms. This hidden financial rigidity is rarely accounted for in boiler selection decisions but has long-term cost implications.

Impact on Carbon and Regulatory Costs

In many regions, gas pricing is increasingly linked to carbon-related costs such as emissions trading, carbon taxes, or reporting obligations. Fuel efficiency directly reduces carbon emissions per unit of steam, lowering both direct fuel cost and indirect regulatory expense.

From a long-term operating cost perspective, efficiency improvements deliver a double benefit: reduced gas consumption and reduced carbon-related financial exposure. As carbon pricing mechanisms expand, this linkage will become even more pronounced.

Case Example: Efficiency as a Hedge Against Price Volatility

A manufacturing facility replaced an older gas-fired boiler operating at approximately 80% efficiency with a modern unit exceeding 92% efficiency. While gas prices were relatively low at the time, long-term analysis showed that fuel savings alone would justify the investment within eight years. When gas prices increased significantly three years later, the facility’s operating costs rose far less than competitors running older equipment. The replacement decision proved valuable not only for energy savings, but for insulating the business from price volatility.

Strategic Implications for Boiler Investment Decisions

From a professional manufacturer’s and supplier’s viewpoint, fuel efficiency and gas pricing should be treated as strategic variables rather than operational afterthoughts. High-efficiency boilers are not merely “greener” options; they fundamentally reshape the long-term cost structure of steam generation.

Facilities that base decisions solely on current gas prices risk underestimating future operating costs. In contrast, lifecycle-focused decision-making recognizes that efficiency investments pay dividends across a wide range of pricing scenarios, making them robust against uncertainty.

In conclusion, fuel efficiency and gas pricing jointly determine long-term operating costs by controlling how much fuel is consumed and how sensitive total expenses are to price fluctuations. Because fuel dominates boiler lifecycle cost, even small efficiency differences create large financial consequences over time. From a professional manufacturer’s and supplier’s perspective, investing in high-efficiency boiler technology is one of the most effective ways to stabilize operating costs, reduce risk, and protect profitability in an uncertain energy market.

How Does the Initial Capital Cost Compare With Coal- and Oil-Fired Boilers?

For many industrial decision-makers, the first and most visible factor in boiler selection is the initial capital cost. The pain point is clear: coal-fired boilers appear robust and familiar, oil-fired boilers promise fuel flexibility, while gas-fired boilers are often marketed as modern and efficient—but how do their upfront costs really compare? The consequence of misunderstanding this comparison is costly. Choosing a boiler based purely on perceived capital savings can lock a facility into higher long-term expenses, regulatory risk, and inflexible operations. The solution is a clear, professional understanding of how initial capital costs differ between coal-fired, oil-fired, and gas-fired boilers, and what those differences truly represent.

In general, gas-fired boilers have the lowest initial capital cost, oil-fired boilers fall in the mid-range, and coal-fired boilers require the highest upfront investment due to fuel handling systems, emissions controls, and larger physical infrastructure.

This comparison provides a foundation for rational boiler investment decisions based on total system complexity rather than headline equipment price alone.

Coal-fired boilers typically have the lowest initial capital cost because coal is a cheap fuel.False

Coal fuel cost does not reduce the upfront capital investment required for complex handling, storage, and emissions control systems.

Gas-fired boilers generally require less auxiliary equipment than coal- or oil-fired boilers.True

Gas-fired systems eliminate solid fuel handling and simplify combustion and emissions control infrastructure.

Understanding What “Initial Capital Cost” Really Includes

From a professional manufacturer’s and supplier’s perspective, initial capital cost is not limited to the boiler pressure vessel itself. It includes the complete installed system required to safely and reliably generate steam. This encompasses fuel handling and storage, combustion systems, emissions controls, ash or waste handling, civil works, and installation complexity.

Coal-fired boilers, oil-fired boilers, and gas-fired boilers differ dramatically in system scope. While the boiler core may appear similar in price at first glance, the supporting infrastructure often dominates total capital expenditure.

Failing to consider total installed cost leads to misleading comparisons and suboptimal investment decisions.

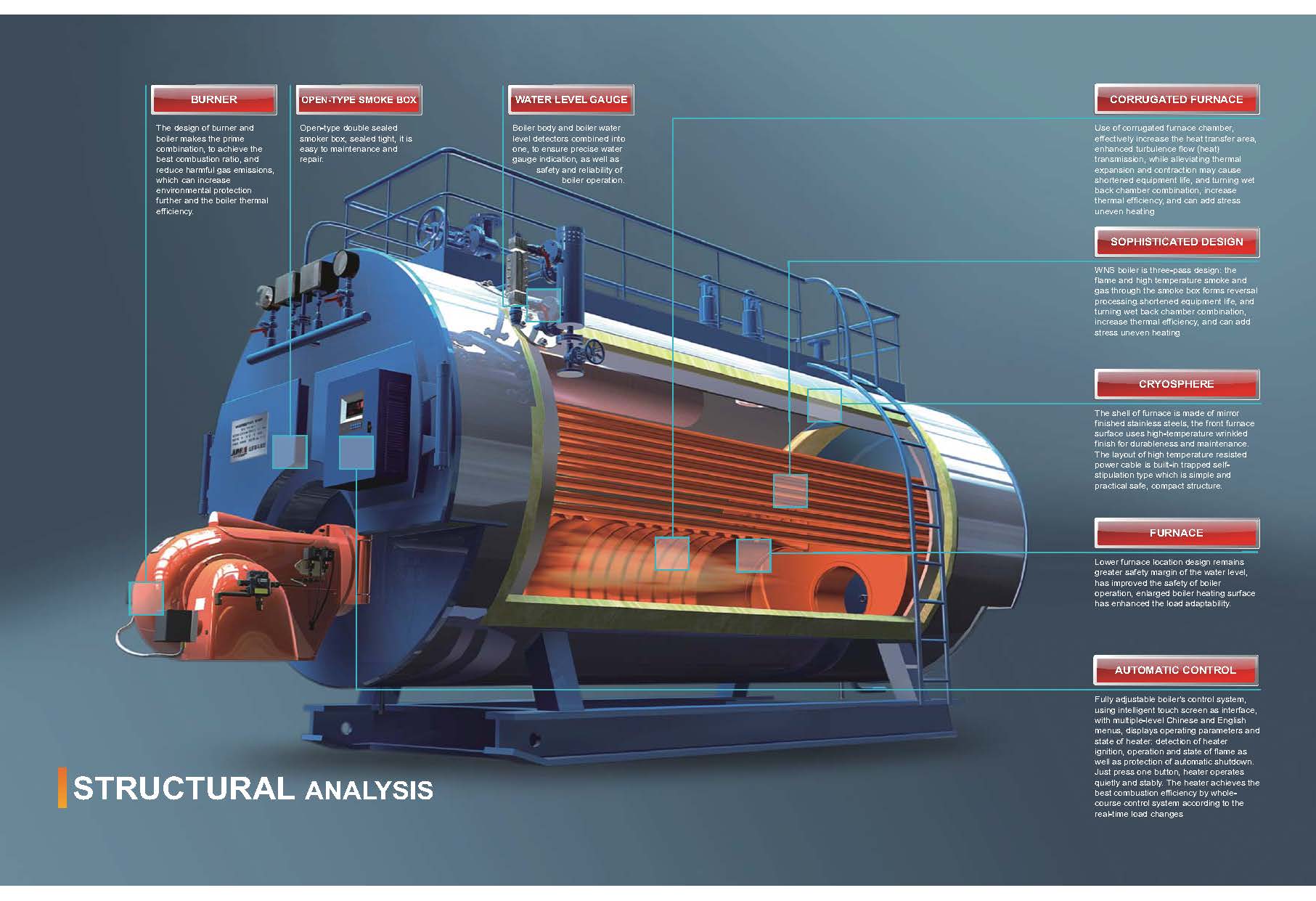

Gas-Fired Boilers: Lowest Capital Entry Point

Gas-fired industrial boilers consistently offer the lowest initial capital cost among fossil-fuel-fired options. This advantage stems from system simplicity. Natural gas arrives at the facility via pipeline, requiring minimal on-site storage and handling. Combustion systems are compact, clean-burning, and easily controlled.

From an installation standpoint, gas-fired boilers require fewer auxiliary systems, less structural steel, and smaller footprints. Emissions control equipment is often limited to basic NOₓ reduction technologies, which are relatively inexpensive compared to coal emissions systems.

Typical capital cost characteristics of gas-fired boilers include:

– Compact boiler and burner design

– No solid fuel storage or handling

– Minimal waste or ash management

– Simplified installation and commissioning

This simplicity translates directly into lower upfront investment and faster project timelines.

Oil-Fired Boilers: Moderate Capital Cost with Added Complexity

Oil-fired boilers occupy a middle position in terms of initial capital cost. While liquid fuel is easier to handle than solid coal, oil systems still require significant infrastructure that gas-fired boilers do not.

Oil-fired systems require on-site fuel storage tanks, pumping systems, heating systems (for heavy fuel oils), spill containment, and fire protection measures. These requirements increase both equipment and civil costs. Additionally, oil combustion produces higher particulate and sulfur emissions than natural gas, often necessitating additional emissions control measures.

From a supplier’s perspective, oil-fired boilers are typically 10–30% more expensive to install than comparable gas-fired systems, depending on fuel type and storage requirements.

Coal-Fired Boilers: Highest Initial Capital Investment

Coal-fired boilers require the highest initial capital investment due to their inherent complexity. Coal is a solid fuel that must be delivered, stored, conveyed, pulverized or prepared, combusted, and managed after combustion as ash. Each of these steps requires dedicated systems.

In addition to fuel handling, coal-fired boilers require extensive emissions control equipment to meet modern standards, including particulate removal, sulfur control, and NOₓ reduction systems. These systems significantly increase capital cost, footprint, and installation time.

From an engineering standpoint, coal-fired boiler projects often resemble infrastructure developments rather than equipment installations.

Comparative Capital Cost Overview

The table below provides a high-level comparison of relative initial capital costs for industrial steam boilers of similar output.

| Boiler Type | Relative Initial Capital Cost | Key Cost Drivers |

|---|---|---|

| Gas-fired | Low | Simple fuel supply, compact design |

| Oil-fired | Medium | Fuel storage, pumping, emissions |

| Coal-fired | High | Fuel handling, emissions control, ash management |

This comparison reflects total installed cost, not just the boiler unit price.

Why Coal-Fired Boilers Remain Capital-Intensive

From a manufacturer’s perspective, coal-fired boilers are capital-intensive because they must manage variability in fuel quality, combustion behavior, and emissions. To maintain stable operation, systems must be oversized and robust, increasing material and installation costs.

Additionally, coal-fired projects often require:

– Large foundations and structures

– Extended construction schedules

– Complex permitting and environmental approvals

These factors drive capital cost upward even before fuel is burned for the first time.

The Hidden Capital Cost of Future Compliance

Initial capital cost should also consider future regulatory compliance. Coal-fired boilers often require additional capital investment over time to meet evolving emissions standards. Oil-fired systems face similar, though typically smaller, risks.

Gas-fired boilers generally offer the longest compliance horizon, reducing the likelihood of future capital retrofits. From a lifecycle investment perspective, this makes gas-fired boilers more predictable and less capital-intensive over time.

Case Example: Capital Cost Comparison in Practice

A manufacturing facility evaluated three boiler options for a new plant: gas-fired, oil-fired, and coal-fired. While the coal-fired boiler unit price was only modestly higher than the gas-fired unit, the total installed cost—including coal handling, emissions controls, and civil works—was more than double. The oil-fired option fell between the two but still exceeded the gas-fired system by a significant margin. The project ultimately selected gas-fired boilers due to lower capital requirements, faster commissioning, and reduced regulatory risk.

Strategic Implications for Boiler Selection

From a professional supplier’s standpoint, initial capital cost is often the first filter—but it should never be the final decision criterion. Lower capital cost improves cash flow, reduces project risk, and shortens payback periods. This is why gas-fired boilers dominate new industrial installations in regions with reliable gas supply.

Coal-fired boilers are increasingly difficult to justify on capital cost grounds alone, while oil-fired boilers serve niche applications where gas is unavailable or fuel flexibility is critical.

In conclusion, the initial capital cost comparison is clear: gas-fired boilers generally offer the lowest upfront investment, oil-fired boilers require moderate capital, and coal-fired boilers demand the highest initial expenditure due to system complexity and regulatory requirements. From a professional manufacturer’s and supplier’s perspective, understanding this hierarchy helps decision-makers align boiler technology with financial constraints, project risk tolerance, and long-term operational strategy.

What Role Does Low Maintenance and High Automation Play in Lifecycle Savings?

For industrial steam users, the real cost of a boiler is rarely determined on the day it is purchased. The most persistent pain point emerges years later, when maintenance workloads increase, skilled labor becomes scarce, and unplanned shutdowns begin to erode productivity and profit. Many facilities underestimate how manual operation, frequent intervention, and maintenance-intensive equipment quietly inflate total ownership costs over decades. The consequence is a boiler system that appears economical on paper but becomes a financial drain in real operation. The solution lies in understanding how low maintenance design and high automation fundamentally reshape lifecycle economics, transforming boilers from labor-intensive assets into predictable, cost-controlled infrastructure.

Low maintenance and high automation play a decisive role in lifecycle savings by reducing labor costs, minimizing unplanned downtime, stabilizing efficiency, extending equipment life, and lowering operational risk over the entire service life of a boiler system.

This perspective reframes automation not as a luxury, but as a core cost-control strategy.

Highly automated boilers eliminate the need for skilled operators.False

Automation reduces operator workload but does not eliminate the need for skilled oversight, especially for safety and optimization.

Maintenance and labor costs can rival fuel costs in poorly automated boiler systems over long lifecycles.True

Manual operation, frequent failures, and reactive maintenance significantly increase total ownership cost.

Lifecycle Cost Structure: Where Maintenance and Automation Matter Most

From a professional manufacturer’s and supplier’s standpoint, boiler lifecycle cost is dominated by three elements: fuel, maintenance and labor, and downtime-related losses. While fuel typically accounts for the largest share, maintenance and labor costs are the most controllable through design and technology choices. Automation directly influences how often human intervention is required, how predictable maintenance becomes, and how consistently the boiler operates at optimal efficiency.

Low-maintenance, highly automated boilers shift cost from variable and unpredictable categories into stable, manageable ones. Instead of responding to failures, operators focus on supervision and optimization. Instead of emergency repairs, maintenance becomes planned and condition-based. Over a 20–30 year lifespan, this structural shift generates substantial financial savings.

Labor Cost Reduction Through Automation

One of the most immediate lifecycle savings delivered by automation is reduced labor intensity. Traditional boilers often require constant manual adjustment of combustion, feedwater, blowdown, and load response. Each adjustment consumes operator time and introduces the possibility of error. Over years of operation, these labor hours accumulate into a significant cost burden.

Highly automated boilers integrate combustion control, feedwater regulation, safety interlocks, and load management into centralized control systems. This allows a single operator to oversee multiple boilers or additional plant systems simultaneously. In many facilities, automation enables a transition from dedicated boiler operators to multi-skilled technicians, reducing staffing requirements without compromising safety.

From a lifecycle perspective, even modest reductions in daily labor hours translate into large savings when multiplied across decades of operation, especially in regions with rising labor costs or shortages of experienced boiler personnel.

Maintenance Intensity and Predictability

Low maintenance design is not simply about fewer repairs—it is about predictability. Aging or poorly designed boilers require frequent inspection, adjustment, and component replacement. Each intervention increases labor cost and downtime risk. In contrast, modern boilers engineered for low maintenance use improved materials, modular components, and simplified mechanical layouts that reduce wear and failure rates.

Automation enhances this advantage by enabling condition-based maintenance. Sensors monitor pressure, temperature, flow, combustion quality, and vibration in real time. Deviations are detected early, allowing maintenance to be scheduled before failures occur. This shifts maintenance from reactive to proactive, dramatically reducing emergency repairs and unplanned outages.

The table below illustrates how maintenance profiles differ across automation levels.

| Boiler Design Level | Maintenance Style | Downtime Risk | Lifecycle Cost Impact |

|---|---|---|---|

| Low automation | Reactive | High | High |

| Moderate automation | Preventive | Medium | Moderate |

| High automation | Condition-based | Low | Low |

From a supplier’s perspective, predictability is often more valuable than absolute cost reduction, because it stabilizes budgets and operational planning.

Downtime Avoidance as a Major Savings Driver

Unplanned downtime is one of the most expensive consequences of manual operation and maintenance-intensive equipment. Each unexpected shutdown can result in lost production, overtime labor, inefficient restarts, and safety exposure. These costs often exceed direct repair expenses.

Highly automated boilers reduce downtime risk in several ways. Advanced control systems maintain stable combustion across load variations, preventing flame instability and trips. Automated startup and shutdown sequences reduce thermal stress and operator error. Integrated diagnostics provide early warning of abnormal conditions, allowing intervention before a shutdown occurs.

From a lifecycle cost standpoint, avoiding even a few major unplanned outages can justify the incremental cost of automation. Over decades, the cumulative savings from improved availability often rival or exceed fuel efficiency gains.

Efficiency Stability Over Time

Automation plays a critical role in preserving efficiency over the life of a boiler. Manual systems rely on operator judgment to maintain optimal excess air levels, fuel-air ratios, and heat transfer conditions. As personnel change and equipment ages, efficiency tends to drift downward.

Automated combustion control continuously adjusts firing parameters to maintain optimal efficiency under changing conditions. This prevents the gradual efficiency degradation that silently increases fuel consumption year after year. While the initial efficiency difference between manual and automated systems may appear small, the long-term effect is substantial.

From a lifecycle perspective, maintaining efficiency stability is as important as achieving high efficiency at commissioning. Automation ensures that efficiency gains persist rather than erode.

Extended Equipment Life and Deferred Replacement

Low maintenance and high automation also extend usable equipment life. Stable operation reduces thermal cycling, pressure fluctuations, and localized overheating—all major contributors to material fatigue and failure. By minimizing these stresses, automated boilers age more slowly and predictably.

This extension of service life has direct financial value. Delaying replacement by even a few years can significantly improve capital efficiency and return on investment. Moreover, when replacement eventually occurs, it can be planned strategically rather than forced by failure.

From a professional standpoint, lifecycle savings are maximized when automation reduces not only annual operating cost but also the frequency and urgency of capital replacement events.

Safety, Risk Reduction, and Insurance Costs

Automation enhances safety by reducing reliance on manual intervention during high-risk conditions such as startups, shutdowns, and load transitions. Automated interlocks and shutdown systems respond faster and more consistently than human operators, reducing the likelihood of accidents.

Lower risk profiles often translate into indirect lifecycle savings through reduced insurance premiums, fewer regulatory incidents, and less exposure to liability. While these savings are difficult to quantify precisely, they contribute meaningfully to total cost reduction over time.

Case Example: Automation-Driven Lifecycle Savings

A mid-sized industrial plant upgraded from a manually operated boiler to a highly automated system designed for low maintenance. Operator staffing was reduced by one full-time equivalent, unplanned downtime dropped by over 60%, and fuel efficiency remained stable over five years of operation. While the automated boiler had a higher initial capital cost, lifecycle analysis showed payback within six years driven primarily by labor and downtime savings rather than fuel alone. This example illustrates how automation reshapes the cost structure of boiler ownership.

Strategic Perspective: Automation as a Long-Term Investment

From a manufacturer’s and supplier’s perspective, low maintenance and high automation should be viewed as long-term investments rather than optional features. In an environment of rising labor costs, stricter safety expectations, and increasing operational complexity, automation delivers resilience. It reduces dependence on individual expertise, stabilizes performance, and makes costs more predictable.

Facilities that prioritize automation often find themselves better positioned to adapt to future challenges, including workforce transitions, digital integration, and regulatory scrutiny.

In conclusion, low maintenance and high automation play a central role in lifecycle savings by reducing labor demand, minimizing downtime, stabilizing efficiency, extending equipment life, and lowering operational risk. While these features may increase initial capital cost, their impact on long-term operating economics is profound. From a professional manufacturer’s and supplier’s perspective, the most cost-effective boiler systems are not those with the lowest purchase price, but those engineered to operate reliably, efficiently, and predictably for decades.

How Do Environmental Compliance and Emission Costs Impact Long-Term Economics?

For industrial steam and power users, environmental compliance is no longer a peripheral concern—it has become a core economic driver. Many facilities initially view emission controls, permits, and reporting obligations as unavoidable regulatory burdens rather than long-term financial variables. The pain point emerges when compliance costs begin to escalate unpredictably, eating into margins year after year. The consequence of underestimating these costs is profound: boilers that appear affordable in early years become financial liabilities as emission limits tighten, carbon pricing expands, and monitoring requirements intensify. The solution lies in understanding how environmental compliance and emission-related costs directly shape long-term economics and why they must be treated as lifecycle cost components rather than external constraints.

Environmental compliance and emission costs significantly impact long-term economics by increasing capital expenditure, raising operating and maintenance costs, exposing facilities to regulatory and carbon price risk, and shortening the economic life of high-emission boiler systems.

This understanding transforms compliance from a reactive obligation into a strategic factor in boiler investment and replacement decisions.

Environmental compliance costs are fixed and predictable once a boiler meets current regulations.False

Environmental regulations evolve over time, often increasing compliance costs through tighter standards, new pollutants, and additional monitoring requirements.

Emission-related costs can exceed maintenance expenses over a boiler’s lifecycle.True

Retrofits, carbon pricing, monitoring systems, and compliance labor can collectively surpass traditional maintenance costs over decades of operation.

Environmental Compliance as a Lifecycle Cost Component

From a professional manufacturer’s and supplier’s perspective, environmental compliance must be treated as an integral part of total cost of ownership. Historically, compliance costs were relatively modest and focused on visible pollutants such as smoke and dust. Modern regulatory frameworks are far more comprehensive, targeting multiple pollutants simultaneously and requiring continuous measurement, documentation, and verification.

These requirements introduce both direct and indirect costs. Direct costs include emissions control equipment, monitoring systems, consumables, and regulatory fees. Indirect costs include increased auxiliary power consumption, reduced efficiency, higher maintenance intensity, and additional staffing or consultancy expenses. Over a 20–30 year boiler lifecycle, these costs accumulate steadily, often rivaling or exceeding fuel and maintenance expenditures.

Facilities that fail to incorporate compliance costs into long-term economic models risk systematically underestimating the true cost of operating certain boiler technologies, particularly coal- and oil-fired systems.

Capital Expenditure Driven by Emission Controls

One of the most visible economic impacts of environmental compliance is increased capital expenditure. Boilers with higher inherent emissions require additional equipment to meet regulatory limits. This includes particulate control systems, sulfur removal units, NOₓ reduction technologies, and increasingly sophisticated monitoring infrastructure.

From an engineering standpoint, these systems are not passive add-ons. They require space, structural support, power supply, integration with control systems, and ongoing maintenance. Each layer of emissions control increases upfront investment while also adding complexity and long-term operating cost.

The table below summarizes typical capital impacts associated with compliance-driven equipment.

| Compliance Requirement | Capital Cost Impact | Economic Implication |

|---|---|---|

| Particulate control | Moderate | Higher installation and maintenance |

| SO₂ control | High | Significant capex and operating cost |

| NOₓ reduction | Moderate | Increased complexity and consumables |

| Continuous monitoring | Low–moderate | Ongoing calibration and reporting |

From a lifecycle perspective, capital spent on compliance does not directly improve productivity or efficiency, making its economic return fundamentally defensive rather than value-generating.

Operating Cost Escalation and Efficiency Penalties

Environmental compliance does not end at installation. Emission control systems impose ongoing operating costs that grow over time. Fans, pumps, reagent injection systems, and monitoring equipment consume power and require regular servicing. These auxiliary loads reduce net system efficiency, increasing fuel consumption per unit of useful steam.

For example, flue gas treatment systems introduce pressure losses that require higher fan power. Chemical reagents used for emissions reduction must be purchased, handled, and disposed of. Over years of operation, these incremental costs accumulate into a substantial operating expense category.

From a long-term economic standpoint, even small efficiency penalties associated with compliance equipment can dramatically increase fuel cost exposure—especially in volatile energy markets. This is why compliance-heavy boiler systems often experience rising operating costs even when fuel prices remain stable.

Carbon Emissions and Pricing Mechanisms

Carbon emissions represent a rapidly growing component of environmental cost. In many regions, carbon pricing mechanisms such as emissions trading systems, carbon taxes, or mandatory reporting schemes directly link CO₂ output to financial liability. Boilers with lower efficiency or higher carbon intensity face escalating costs as carbon prices rise.

From a professional standpoint, carbon cost exposure introduces long-term uncertainty into boiler economics. Unlike traditional maintenance costs, carbon prices are influenced by political, social, and global market forces that are difficult to predict but tend to trend upward over time.

High-efficiency and low-carbon boiler technologies effectively reduce this exposure by lowering emissions per unit of steam. Over decades of operation, the avoided carbon cost can represent a major economic advantage, particularly for facilities with high steam demand.

Compliance Risk and Economic Uncertainty

Another critical economic impact of environmental compliance is risk. Boilers operating close to regulatory limits face ongoing uncertainty regarding future standards. Each regulatory update introduces the possibility of additional retrofits, operational constraints, or even forced shutdowns.

From an investment perspective, this uncertainty shortens the economic life of high-emission boilers. Capital investments in retrofits may not be recoverable if regulations tighten again before payback is achieved. This creates a phenomenon known as stranded assets—equipment that is technically functional but economically obsolete.

The table below illustrates how compliance risk affects economic planning.

| Compliance Outlook | Economic Stability | Investment Risk |

|---|---|---|

| Long-term compliant | High | Low |

| Marginal compliance | Medium | Moderate |

| High-emission system | Low | High |

From a supplier’s perspective, systems with longer compliance horizons consistently deliver better long-term economic outcomes.

Administrative and Labor Costs of Compliance

Environmental compliance also introduces administrative and labor costs that are often overlooked in economic analysis. Continuous emissions monitoring requires calibration, data validation, recordkeeping, and reporting. Environmental audits and inspections demand staff time and external consultancy support.

In older or complex boiler systems, maintaining compliance can become a daily operational focus rather than a background activity. This diverts skilled personnel away from productivity-enhancing tasks and increases dependence on specialized expertise. Over time, these labor costs add another layer to the total economic burden of compliance.

Impact on Financing, Insurance, and Asset Value

Environmental performance increasingly influences financing conditions and insurance costs. High-emission boiler systems may face higher insurance premiums, stricter loan conditions, or reduced access to financing altogether. Conversely, compliant and low-emission systems often benefit from favorable financing terms and improved asset valuation.

From a long-term economic standpoint, boilers that align with environmental expectations retain value and flexibility, while non-compliant assets depreciate faster and carry higher financial friction.

Case Example: Compliance Costs Reshaping Economics

An industrial facility operating a coal-fired boiler initially focused on fuel cost savings. Over time, successive emissions regulations required installation of particulate and sulfur controls, followed by NOₓ reduction and continuous monitoring systems. Operating costs rose steadily due to auxiliary power use, maintenance, and compliance labor. When carbon pricing was introduced, total compliance-related costs exceeded original fuel savings. A lifecycle analysis revealed that replacing the boiler with a lower-emission alternative would have been more economical over the long term. In this case, environmental compliance costs—not fuel price—ultimately determined economic viability.

Strategic Implications for Long-Term Decision-Making

From a professional manufacturer’s and supplier’s perspective, environmental compliance should be viewed as a strategic economic variable. Boiler technologies with lower inherent emissions offer not only regulatory advantages but also greater cost predictability, reduced risk, and longer economic life.

Facilities that proactively account for future compliance trends make more resilient investment decisions. Those that focus narrowly on short-term operating costs often face escalating expenses and forced capital spending later.

In conclusion, environmental compliance and emission costs profoundly impact long-term economics by increasing capital and operating expenses, introducing regulatory and carbon price risk, and shortening the economic life of high-emission boiler systems. These costs are cumulative, dynamic, and closely tied to policy trends. From a professional manufacturer’s and supplier’s perspective, the most economically sustainable boiler solutions are those designed to minimize emissions at the source, reducing compliance burden and protecting long-term profitability.

What Is the Typical Payback Period for an Industrial Gas-Fired Boiler?

For many industrial enterprises, the decision to invest in a new gas-fired boiler is driven by one pressing concern: how quickly the investment will pay for itself. The pain point is familiar—capital budgets are tight, energy prices are volatile, and management demands measurable returns. When payback expectations are unclear, projects are delayed or rejected, even when the technical benefits are obvious. The consequence is continued reliance on aging, inefficient boiler systems that quietly drain operating budgets. The solution is a clear understanding of the typical payback period for industrial gas-fired boilers and the factors that most strongly influence it.

The typical payback period for an industrial gas-fired boiler ranges from 2 to 5 years, depending on fuel savings, efficiency gains, maintenance reduction, operating hours, and local energy pricing.

This payback window explains why gas-fired boilers are widely adopted in both boiler replacement and capacity expansion projects.

Industrial gas-fired boilers usually take more than 10 years to recover their investment cost.False

In most industrial applications, fuel and maintenance savings enable payback within 2–5 years.

Fuel savings are the largest contributor to gas-fired boiler payback.True

Higher combustion efficiency and lower excess air losses significantly reduce long-term fuel expenses.

Understanding Payback Period in Industrial Boiler Projects

From a professional manufacturer’s and supplier’s perspective, payback period refers to the time required for cumulative savings to equal the initial investment cost of the boiler system. These savings typically come from reduced fuel consumption, lower maintenance costs, decreased labor requirements, and improved operational reliability.

Unlike simple equipment purchases, industrial boilers operate continuously and consume large quantities of energy. Even modest efficiency improvements can generate substantial annual savings, compressing the payback timeline. This is why gas-fired boilers, with their inherently high efficiency and low operational complexity, often achieve rapid returns on investment.

Fuel Efficiency as the Primary Payback Driver

Gas-fired boilers generally operate at higher thermal efficiencies than coal- or oil-fired alternatives. Modern industrial gas boilers routinely achieve efficiencies above 90%, compared with significantly lower figures for older solid-fuel systems. This efficiency advantage translates directly into reduced fuel consumption per ton of steam produced.

Over thousands of operating hours per year, the cumulative fuel savings become substantial. In energy-intensive industries, fuel cost reductions alone can account for more than half of the total payback value. As natural gas pricing remains relatively stable and predictable in many regions, these savings are also easier to forecast, reducing financial risk.

Maintenance and Labor Savings

Another critical contributor to payback is reduced maintenance and labor cost. Gas-fired boilers eliminate solid fuel handling, ash disposal, soot cleaning, and many mechanical subsystems associated with coal- and oil-fired boilers. This simplification lowers routine maintenance frequency and reduces spare parts consumption.

High automation further amplifies these savings by reducing operator intervention. In many facilities, a single operator can supervise multiple gas-fired boilers, dramatically lowering labor cost per unit of steam. Over the lifecycle of the boiler, these recurring savings significantly shorten the payback period.

Typical Payback Period Ranges by Application

The table below summarizes common payback ranges observed across industrial sectors.

| Application Type | Operating Hours | Typical Payback Period |

|---|---|---|

| Manufacturing | Medium–high | 2–4 years |

| Food & Beverage | High | 2–3 years |

| Chemical Plants | Continuous | 2–3 years |

| General Industry | Medium | 3–5 years |

Facilities with continuous or high-load operation tend to achieve the fastest payback because savings accumulate more rapidly.

Impact of Replacing Older Boilers

Payback periods are shortest when gas-fired boilers replace aging, inefficient systems. Older boilers often suffer from declining efficiency, rising maintenance costs, and frequent downtime. Replacing them with modern gas-fired units delivers immediate and measurable savings across multiple cost categories simultaneously.

In retrofit scenarios, payback periods closer to the lower end of the 2–5 year range are common, particularly when fuel switching from coal or oil to gas is involved.

Capital Cost Versus Savings Balance

While gas-fired boilers typically have lower initial capital cost than coal-fired systems, the payback calculation still depends on the balance between upfront investment and annual savings. Higher-capacity boilers with advanced automation may require more capital, but they also deliver larger absolute savings.

From a supplier’s standpoint, the optimal payback is achieved not by minimizing capital cost, but by maximizing net annual savings through efficiency, reliability, and automation. This approach consistently produces stronger long-term economic performance.

Influence of Energy Pricing and Policy

Natural gas pricing plays an important role in payback calculations. Regions with stable gas supply and competitive pricing experience faster payback. In addition, environmental regulations and carbon pricing increasingly favor gas-fired boilers, indirectly improving payback by reducing compliance and emission-related costs compared with higher-carbon alternatives.

These external factors reinforce the economic case for gas-fired boilers and help protect payback assumptions over time.

Case Example: Payback in Practice

A mid-sized industrial plant replaced an aging coal-fired boiler with a modern gas-fired steam boiler. The project required a moderate capital investment but reduced fuel consumption by over 25%, eliminated ash handling, and cut maintenance labor by nearly half. Annual operating savings exceeded expectations, resulting in a payback period of approximately 3 years. After payback, the facility benefited from sustained cost reductions and improved operational reliability.

Strategic Value Beyond Simple Payback

From a professional manufacturer’s and supplier’s perspective, payback period is an important but incomplete metric. Gas-fired boilers also deliver strategic value through improved compliance, reduced operational risk, and greater flexibility for future expansion or integration with energy management systems.

These benefits enhance long-term competitiveness and often justify investment even when payback approaches the upper end of the typical range.

In conclusion, the typical payback period for an industrial gas-fired boiler is 2 to 5 years, driven primarily by fuel efficiency gains, reduced maintenance and labor costs, and improved reliability. Facilities with high operating hours or aging boiler systems often achieve even faster returns. From a professional manufacturer’s and supplier’s standpoint, gas-fired boilers offer one of the most predictable and attractive payback profiles among industrial steam generation technologies.

In Which Industrial Applications Are Gas-Fired Boilers Most Cost-Effective?

Across global industry, steam remains a critical utility—but not all steam users extract the same economic value from gas-fired boiler technology. The core pain point for decision-makers is uncertainty: while gas-fired boilers are widely promoted as efficient and clean, many plant managers struggle to determine whether their specific application truly justifies the investment. The consequence of this uncertainty is either delayed upgrades or poorly matched boiler selections that underperform financially. The solution is a clear, application-focused understanding of where gas-fired boilers deliver the strongest cost advantage and why certain industries consistently achieve superior returns.

Gas-fired boilers are most cost-effective in industries with high operating hours, stable steam demand, strict environmental requirements, and sensitivity to downtime—such as food and beverage, chemical processing, pharmaceuticals, textiles, and general manufacturing.

This cost-effectiveness is driven by efficiency stability, low maintenance, rapid load response, and long-term compliance advantages.

Gas-fired boilers are only cost-effective for small-scale industrial users.False

Gas-fired boilers are highly scalable and often deliver the greatest economic benefits in medium to large continuous industrial applications.

Industries with continuous steam demand benefit most from gas-fired boiler efficiency.True

High utilization allows efficiency and maintenance savings to accumulate rapidly, shortening payback periods.

Why Application Context Determines Cost-Effectiveness

From a professional manufacturer’s and supplier’s perspective, cost-effectiveness is not determined by boiler type alone but by how well the boiler’s characteristics align with the operational profile of an industry. Gas-fired boilers excel in environments where reliability, controllability, cleanliness, and automation translate directly into financial value.

Key application factors include operating hours, load variability, product sensitivity, regulatory pressure, and labor availability. Industries that score highly across these dimensions consistently experience lower lifecycle costs with gas-fired boilers compared with coal-, oil-, or biomass-fired alternatives.

Food and Beverage Industry: High Hygiene, High Utilization

The food and beverage industry is one of the most cost-effective application areas for gas-fired boilers. Steam is used extensively for cooking, sterilization, cleaning, and packaging processes, often around the clock. Any downtime directly disrupts production and risks product spoilage.

Gas-fired boilers offer clean combustion with no ash or soot, minimizing contamination risk. High automation ensures consistent steam quality and rapid response to fluctuating production loads. From an economic standpoint, fuel efficiency and reduced cleaning and maintenance labor generate significant lifecycle savings.

| Factor | Economic Impact in Food Industry |

|---|---|

| Clean combustion | Reduced sanitation cost |

| Fast load response | Less energy waste |

| High reliability | Minimal production loss |

These advantages explain why gas-fired boilers dominate modern food processing facilities.

Chemical and Petrochemical Processing: Precision and Reliability

Chemical plants rely on steam for heating, distillation, and reaction control. Steam conditions must be precise and stable, as deviations can affect product quality or safety. Gas-fired boilers provide superior controllability compared with solid-fuel systems, allowing fine-tuned pressure and temperature regulation.

From a cost perspective, continuous operation magnifies efficiency savings. Additionally, chemical plants face strict emissions regulations, making the low inherent emissions of gas-fired boilers economically attractive. Reduced compliance costs and predictable operating expenses strengthen long-term returns.

In this sector, gas-fired boilers are not just cost-effective—they are often the lowest-risk option from both financial and safety standpoints.

Pharmaceutical and Biotechnology Facilities: Compliance-Driven Economics

Pharmaceutical and biotech facilities operate under some of the strictest regulatory frameworks in industry. Steam purity, reliability, and documentation are critical. Gas-fired boilers align naturally with these requirements due to their clean operation and advanced automation.

While initial capital cost is important, lifecycle economics dominate decision-making in this sector. The cost of a single contamination event or compliance failure can dwarf boiler investment costs. Gas-fired boilers reduce these risks while also lowering maintenance and labor demands.

| Requirement | Gas-Fired Boiler Advantage |

|---|---|

| Clean steam | No combustion residues |

| Automation | Consistent validated operation |

| Emissions | Easier regulatory compliance |

These factors make gas-fired boilers the most cost-effective choice despite higher performance expectations.

Textile and Garment Manufacturing: Load Flexibility Matters

Textile operations require steam for dyeing, finishing, and drying processes, often with highly variable load profiles. Gas-fired boilers excel in this environment due to rapid startup and flexible turndown ratios. This flexibility reduces fuel waste during partial-load operation, a common inefficiency in coal-fired systems.

From an economic standpoint, textiles benefit from reduced operator intervention and lower downtime risk. Energy savings achieved through efficient part-load performance significantly improve cost-effectiveness, particularly in competitive markets with tight margins.

General Manufacturing and Industrial Parks

In general manufacturing, gas-fired boilers are most cost-effective where steam demand is steady but not extreme, and where multiple processes rely on shared utilities. Industrial parks and multi-tenant facilities particularly benefit from centralized gas-fired boiler plants due to simplicity, scalability, and ease of automation.

Lower capital cost compared with coal-fired systems, combined with reduced environmental compliance burden, improves project feasibility. Over time, predictable operating costs enhance budget control for facility operators.

Industries with High Sensitivity to Downtime

Across all sectors, gas-fired boilers are most cost-effective where downtime carries high financial penalties. Industries such as electronics manufacturing, automotive production, and packaging rely on uninterrupted utilities. Gas-fired boilers offer high availability due to fewer mechanical subsystems and simpler maintenance regimes.

The economic value of avoided downtime often exceeds fuel savings, making gas-fired boilers the preferred solution even in applications where fuel price differences are modest.

Comparative Cost-Effectiveness by Industry

The table below summarizes relative cost-effectiveness across major industrial sectors.

| Industry | Gas-Fired Boiler Cost-Effectiveness |

|---|---|

| Food & Beverage | Very High |

| Chemical | Very High |

| Pharmaceutical | Very High |

| Textile | High |

| General Manufacturing | High |

| Heavy Industry (coal-based) | Moderate |

This ranking reflects total lifecycle cost rather than initial investment alone.

Role of Energy Infrastructure and Policy

Cost-effectiveness is further enhanced in regions with reliable gas infrastructure and supportive environmental policies. Access to stable gas supply reduces price volatility, while emissions regulations increasingly penalize higher-carbon alternatives. These external factors reinforce the economic advantage of gas-fired boilers across many applications.

From a supplier’s standpoint, industries that align operational needs with infrastructure realities consistently achieve the best financial outcomes.

Case Example: Application-Driven Cost Advantage

A large food processing plant replaced multiple small coal-fired boilers with a centralized gas-fired boiler system. The facility operated continuously and required strict hygiene standards. Fuel efficiency improved by over 20%, maintenance labor dropped significantly, and compliance costs were reduced. The project achieved payback in under three years, demonstrating how application alignment drives cost-effectiveness.

Strategic Perspective: Matching Technology to Use Case

From a professional manufacturer’s and supplier’s perspective, gas-fired boilers deliver maximum economic value when their strengths—cleanliness, efficiency, automation, and reliability—directly support the core needs of the application. Industries that demand precision, uptime, and compliance consistently outperform others in lifecycle cost metrics when adopting gas-fired technology.

In conclusion, gas-fired boilers are most cost-effective in industrial applications with high operating hours, stringent environmental or hygiene requirements, variable steam loads, and high sensitivity to downtime. Food and beverage, chemical, pharmaceutical, textile, and general manufacturing industries consistently achieve the strongest lifecycle returns. Understanding application-specific economics is essential to unlocking the full financial benefits of gas-fired boiler technology.

🔍 Conclusion

Industrial gas-fired boilers offer excellent long-term cost-effectiveness by combining high efficiency, clean combustion, and low maintenance demands. For industries with stable gas supply and strict environmental requirements, they provide predictable operating costs, fast payback, and reduced regulatory risk, making them a sound long-term investment.

🔹 Contact us today to evaluate whether an industrial gas-fired boiler is the most cost-effective solution for your long-term energy needs. ⚙️🔥🏭✅

FAQ

Q1: Are industrial gas-fired boilers cost-effective in the long run?

A1: Industrial gas-fired boilers are highly cost-effective in the long run, particularly for industries that prioritize efficiency, reliability, and environmental compliance. Although natural gas prices can fluctuate, gas-fired boilers offer high thermal efficiency (90–95%), low maintenance requirements, and clean combustion. Over a typical 20–25 year lifespan, their lower operating and compliance costs often outweigh the initial investment, resulting in strong overall return on investment (ROI), especially in regions with stable or competitively priced natural gas supply.

Q2: How do fuel costs influence the long-term economics of gas-fired boilers?

A2: Fuel cost is the largest operating expense for gas-fired boilers, accounting for 60–70% of total lifecycle costs. Compared with oil, natural gas is usually cheaper and more price-stable, while also delivering higher combustion efficiency. In many markets, long-term gas supply contracts and pipeline infrastructure help reduce price volatility. Additionally, gas-fired boilers avoid costs related to ash handling, fuel storage, and slag removal, further improving long-term cost predictability compared to coal- or biomass-fired systems.

Q3: How do maintenance and operational costs compare with other boiler types?

A3: Maintenance costs for industrial gas-fired boilers are among the lowest of all boiler types. Clean combustion results in minimal fouling, corrosion, and wear on heat transfer surfaces. Modern gas boilers use fully automated burners, digital control systems, and remote monitoring, reducing labor requirements and unplanned downtime. Annual operation and maintenance costs typically represent only 1–2% of total system investment, making gas-fired boilers especially attractive for continuous industrial operations.

Q4: How do environmental regulations affect long-term cost-effectiveness?

A4: Gas-fired boilers are well-positioned for long-term compliance with increasingly strict environmental regulations. They produce significantly lower CO₂, SO₂, particulate matter, and NOx emissions compared to coal- and oil-fired boilers. Many systems meet emission limits using low-NOx burners without the need for complex flue gas treatment equipment. This reduces both capital and future retrofit costs, protecting owners from regulatory risk and improving long-term financial stability.

Q5: Which industries benefit most from long-term investment in gas-fired boilers?

A5: Industrial gas-fired boilers are most cost-effective for sectors requiring high steam quality, fast response, and uninterrupted operation, such as:

- Food and beverage processing

- Pharmaceutical and chemical manufacturing

- Textiles and dyeing plants

- Electronics and semiconductor facilities

- District heating and commercial complexes

They are also widely used for combined heat and power (CHP) systems, where high efficiency and low emissions significantly enhance long-term economic and environmental performance.

References

- International Energy Agency (IEA) – Natural Gas in Industrial Heat – https://www.iea.org/ – IEA

- U.S. Department of Energy – High-Efficiency Gas Boiler Systems – https://www.energy.gov/ – DOE

- ASME Boiler and Pressure Vessel Code (BPVC) – https://www.asme.org/ – ASME

- Carbon Trust – Gas Boiler Efficiency and Emissions – https://www.carbontrust.com/ – Carbon Trust

- Spirax Sarco – Gas-Fired Boiler Lifecycle Cost Analysis – https://www.spiraxsarco.com/ – Spirax Sarco

- Engineering Toolbox – Natural Gas Boiler Efficiency – https://www.engineeringtoolbox.com/ – Engineering Toolbox

- ScienceDirect – Economic Performance of Gas-Fired Boilers – https://www.sciencedirect.com/ – ScienceDirect

- ISO 50001 – Energy Management for Industrial Heating – https://www.iso.org/ – ISO

- MarketsandMarkets – Industrial Boiler Market Outlook – https://www.marketsandmarkets.com/ – Markets and Markets

- World Bank – Industrial Energy Efficiency and Fuel Switching – https://www.worldbank.org/ – World Bank

-300x225.jpg)