Selecting the wrong CFB boiler supplier can lead to cost overruns, unstable operation, low efficiency, delayed delivery, and long-term maintenance problems. Because CFB boilers are technically complex systems involving combustion engineering, materials science, environmental compliance, and large-scale manufacturing, supplier capability directly determines project success. A purely price-driven decision often results in hidden risks and high lifecycle costs.

The best CFB boiler suppliers are evaluated based on proven project experience, engineering and design capability, fuel adaptability expertise, manufacturing quality, environmental compliance solutions, after-sales service, and EPC or lifecycle support capability. A systematic supplier evaluation ensures technical reliability, cost-effectiveness, and long-term operational stability.

Understanding how to assess CFB boiler suppliers helps project owners reduce risk, protect investment, and ensure sustainable boiler performance.

How Does Proven CFB Boiler Project Experience Indicate Supplier Reliability?

In the global power generation and industrial energy market, selecting a circulating fluidized bed (CFB) boiler supplier is one of the highest-stakes technical and commercial decisions an owner can make. CFB boilers are complex, highly integrated systems that must reliably handle variable fuels, strict emission limits, demanding availability targets, and long operating lifetimes. When projects fail—through chronic outages, performance shortfalls, excessive emissions, or escalating maintenance costs—the root cause is often not the CFB technology itself, but insufficient supplier experience in real, full-scale projects. Paper specifications, attractive proposals, and theoretical designs cannot substitute for proven execution. As a result, proven CFB boiler project experience has become one of the most reliable indicators of whether a supplier can truly deliver long-term performance, safety, and value.

Proven CFB boiler project experience indicates supplier reliability because it demonstrates the supplier’s ability to translate complex CFB theory into stable, efficient, compliant, and maintainable operating plants across different fuels, scales, and regulatory environments over the full project lifecycle.

To fully understand why project experience matters so much, it is necessary to examine how CFB boilers differ from conventional units, where risks typically arise, and how past execution history directly predicts future project outcomes.

CFB boiler technology is mature enough that supplier project experience has little impact on performance.False

Despite maturity, CFB boilers remain highly site- and fuel-specific, making supplier experience critical to successful execution.

Suppliers with multiple long-term operating CFB references are more likely to deliver reliable performance.True

Operating references prove that design, materials, and integration choices perform under real conditions over time.

Why CFB Boilers Demand Proven Experience

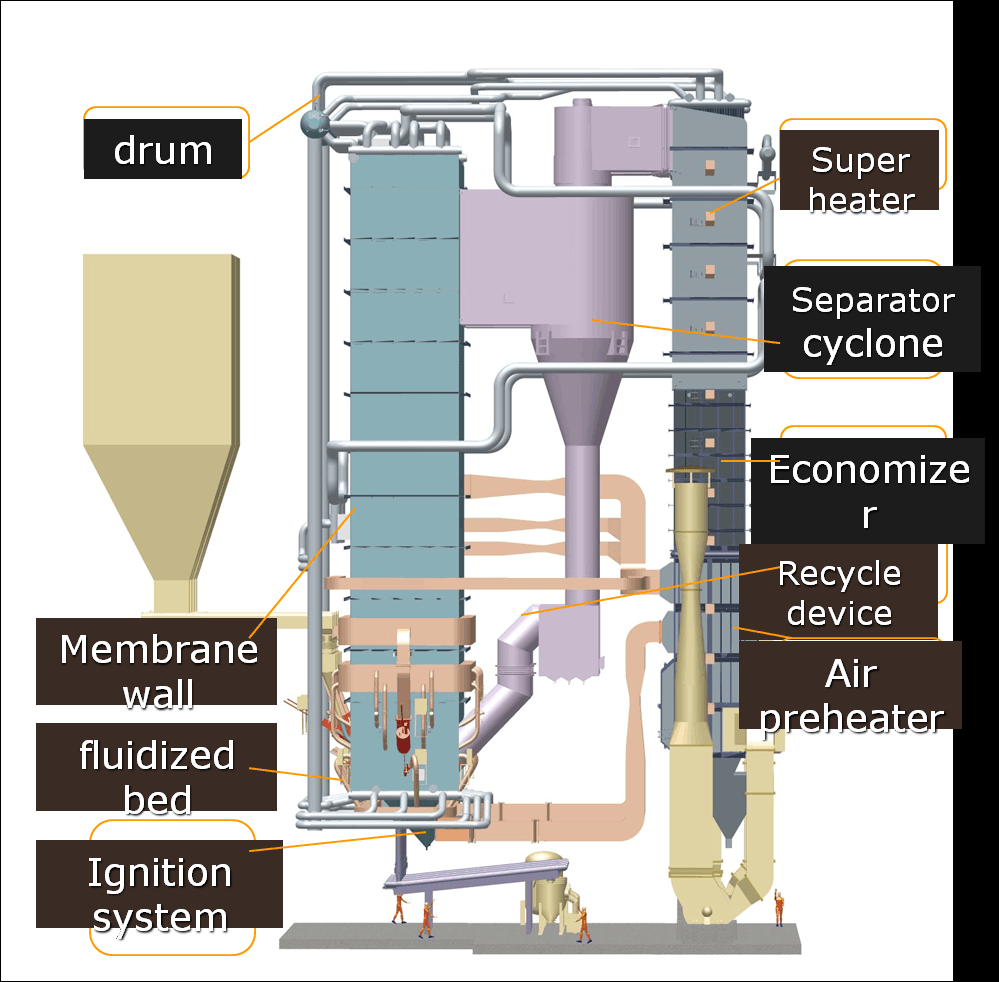

Circulating fluidized bed boilers are fundamentally different from pulverized coal or gas-fired boilers. Their performance depends on the dynamic interaction of fuel particles, bed material, air distribution, solids circulation, heat transfer surfaces, and advanced control systems.

Key characteristics that increase execution risk include:

- Strong dependence on fuel properties

- Complex solids circulation behavior

- Integrated combustion and emission control

- Sensitivity to geometry and refractory design

Small design or integration errors can produce large operational consequences, making experience a decisive factor.

From Theory to Reality: The Execution Gap

CFB boiler design is well understood academically, but execution is where reliability is proven.

Execution challenges include:

- Scaling designs from reference units

- Adapting to local fuel variability

- Managing construction tolerances

- Achieving stable start-up and load control

Suppliers without extensive project experience often underestimate these challenges.

Breadth of CFB Project Portfolio as a Reliability Signal

A supplier’s portfolio reveals much about reliability.

Key indicators include:

- Number of CFB units delivered

- Range of boiler capacities

- Diversity of fuels handled

- Geographic and regulatory diversity

Suppliers with broad portfolios have demonstrated adaptability, which is essential in CFB applications.

Fuel Flexibility Experience and Its Importance

One of the core advantages of CFB technology is fuel flexibility.

Proven experience handling:

- Low-grade coals

- Biomass and agricultural residues

- Waste-derived fuels

- High-ash or high-moisture fuels

demonstrates deep understanding of combustion behavior, ash chemistry, and bed management.

Table: Fuel Experience vs. Reliability Implications

| Fuel Type | Execution Challenge | Experience Benefit |

|---|---|---|

| High-ash coal | Erosion, slagging | Optimized solids circulation |

| Biomass | Alkali corrosion | Material and temperature control |

| RDF/Waste | Variability | Robust control strategies |

| Lignite | Moisture handling | Stable fluidization |

Suppliers without fuel-specific references often rely on assumptions that fail in practice.

Scale and Capacity References Matter

CFB behavior changes with scale.

Experience at:

- Small industrial units

- Medium CHP plants

- Large utility-scale boilers

demonstrates the supplier’s ability to manage scale-dependent phenomena such as solids residence time, cyclone efficiency, and heat transfer distribution.

Long-Term Operating References vs. Commissioning Success

Commissioning success alone is not enough.

Reliable suppliers can point to:

- Units operating for 5, 10, or 20+ years

- Stable availability and capacity factors

- Predictable maintenance patterns

Long-term operation validates refractory design, materials selection, and pressure part layout.

Availability and Reliability Data as Proof

Experienced suppliers often provide:

- Documented availability figures

- Forced outage statistics

- Performance guarantee histories

These metrics reflect real-world reliability, not theoretical capability.

Table: Project Experience Metrics That Matter

| Metric | Why It Matters |

|---|---|

| Availability | Indicates operational stability |

| Start-up time | Reflects design maturity |

| Emission compliance | Shows integration quality |

| Maintenance cost | Reveals lifecycle thinking |

Data-backed references are far more meaningful than generic claims.

Construction and Erection Experience

CFB boilers are large, complex structures with tight tolerances.

Suppliers with proven experience:

- Understand erection sequencing

- Design for constructability

- Anticipate alignment and refractory challenges

Poor construction integration often leads to chronic problems later.

Refractory and Erosion Control Experience

Refractory design is one of the most failure-prone aspects of CFB boilers.

Experienced suppliers:

- Select proven refractory systems

- Design geometries to minimize erosion

- Have documented lifetimes from past projects

Inexperienced suppliers often learn through costly failures on early projects.

Emission Control Integration Experience

CFB boilers rely on in-furnace and downstream emission control.

Experience proves capability in:

- SO₂ capture via limestone injection

- Low-NOx combustion control

- Integration with baghouses or ESPs

Poor integration leads to reagent overuse, emission exceedances, or unstable operation.

Control System and Automation Maturity

CFB boilers require sophisticated control strategies.

Suppliers with real project experience:

- Have refined control logic over multiple projects

- Understand transient behavior

- Provide stable load-following capability

Control immaturity is a common weakness of inexperienced suppliers.

Commissioning and Start-Up Track Record

Start-up is where theory meets reality.

Reliable suppliers demonstrate:

- Predictable commissioning timelines

- Structured tuning procedures

- Minimal post-startup modifications

Repeated smooth startups across projects indicate a mature engineering organization.

Problem Resolution and Learning Curve Evidence

No CFB project is entirely problem-free.

What matters is:

- How quickly issues are resolved

- Whether lessons are applied to future projects

Suppliers with long project histories show clear design evolution and reduced issue frequency.

Standardization Balanced with Customization

Experienced suppliers know what to standardize and what to customize.

They:

- Reuse proven design modules

- Adapt critical areas to site-specific needs

This balance reduces risk while maintaining flexibility.

Supply Chain and Manufacturing Reliability

CFB boilers involve many critical components.

Suppliers with proven experience:

- Have qualified manufacturing partners

- Control quality across the supply chain

- Avoid untested component substitutions

Supply chain maturity directly affects reliability.

After-Sales Support and Service Experience

Long-term reliability depends on support.

Experienced suppliers typically offer:

- Spare parts availability

- Technical support teams

- Upgrade and retrofit capability

Suppliers without service history often struggle after handover.

Reference Plant Accessibility and Transparency

Reliable suppliers are willing to:

- Share operating references

- Arrange site visits

- Provide owner contacts

Transparency is a strong indicator of confidence and reliability.

Risk Allocation and Contract Confidence

Suppliers with proven experience are more willing to:

- Offer performance guarantees

- Accept availability penalties

- Commit to emission limits

Unproven suppliers often limit liability due to uncertainty.

Financial Stability Linked to Project History

A long CFB project history often correlates with:

- Stable revenue streams

- Continued R&D investment

- Long-term market presence

Financial resilience supports long-term reliability.

Case Study Patterns in Successful CFB Suppliers

Across the industry, reliable CFB suppliers show common traits:

- Decades of accumulated project data

- Continuous design refinement

- Strong feedback loops between operations and engineering

These traits cannot be replicated quickly.

Red Flags When Experience Is Limited

Warning signs include:

- Few or no long-term operating references

- Overreliance on pilot or demo projects

- Frequent design changes between projects

Such indicators suggest higher project risk.

How Owners Should Evaluate CFB Experience

Effective evaluation includes:

- Reviewing reference lists critically

- Requesting performance data

- Visiting operating plants

- Speaking directly with operators

Due diligence based on real experience reduces risk dramatically.

The Difference Between “Has Built” and “Has Operated”

Some suppliers have built CFB boilers but lack operating insight.

True reliability comes from:

- Understanding how boilers behave years after handover

- Designing with maintenance and aging in mind

Operating experience is the highest-value experience.

Experience Across the Full Project Lifecycle

Reliability is proven across:

- Design

- Procurement

- Construction

- Commissioning

- Long-term operation

Suppliers strong in all phases deliver the most reliable outcomes.

Experience and Innovation Are Not Opposites

Proven suppliers can still innovate.

Their innovations are:

- Incremental

- Tested through pilot applications

- Rolled out carefully

This reduces the risk of unproven features compromising reliability.

The Owner’s Perspective: Risk Reduction Through Experience

From an owner’s standpoint, proven experience:

- Reduces technical uncertainty

- Improves schedule predictability

- Lowers lifecycle cost

These benefits often outweigh small differences in capital cost.

Strategic Value of Partnering with Experienced Suppliers

Long-term energy strategies benefit from:

- Suppliers who understand future regulatory trends

- Partners capable of upgrades and retrofits

Experience enables forward-looking reliability.

Summary of Experience-Based Reliability Indicators

Key indicators include:

- Number and age of operating references

- Fuel and scale diversity

- Documented performance data

- Strong service and support record

Together, these form a robust picture of supplier reliability.

Proven CFB boiler project experience is one of the strongest and most reliable indicators of supplier reliability because it demonstrates the supplier’s ability to deliver stable, efficient, compliant, and maintainable CFB boilers under real operating conditions over many years. Experience reveals whether a supplier truly understands fuel variability, solids circulation, refractory behavior, emission control integration, control system tuning, construction challenges, and long-term maintenance realities. Suppliers with extensive, transparent, and long-term CFB project references consistently show lower technical risk, higher availability, and better lifecycle performance. For owners investing in CFB technology, evaluating proven project experience is not a formality—it is a critical risk management step that directly determines the success or failure of the project over its entire operating life.

How Do Engineering Design Capability and Fuel Adaptability Affect Supplier Selection?

In today’s power generation and industrial energy markets, selecting a boiler or power plant supplier is no longer a matter of choosing the lowest bid or the most well-known brand. Owners are under intense pressure to manage fuel price volatility, comply with tightening environmental regulations, ensure long-term reliability, and protect capital investments over decades of operation. Many projects that initially appear successful later struggle with unstable combustion, excessive maintenance, fuel restrictions, or costly retrofits because the supplier’s engineering design capability and fuel adaptability were overestimated or misunderstood at the selection stage. These shortcomings rarely show up on datasheets or in marketing materials, but they emerge quickly once real fuels, real operating conditions, and real regulatory constraints are applied.

Engineering design capability and fuel adaptability affect supplier selection by determining whether a supplier can deliver a boiler system that operates safely, efficiently, and reliably across real-world fuel variations, load changes, and long-term regulatory and economic uncertainties—not just under ideal design assumptions.

Understanding this relationship is essential for owners who want to reduce technical risk, protect lifecycle value, and avoid being locked into inflexible or fragile energy systems.

Most modern boiler suppliers offer similar engineering design quality, making fuel adaptability a minor selection factor.False

Engineering depth and fuel adaptability vary widely among suppliers and strongly influence long-term performance, reliability, and operating cost.

Suppliers with strong engineering capability are better able to adapt boiler designs to changing fuel conditions over time.True

Advanced engineering enables flexible combustion design, material selection, and control strategies that accommodate fuel variability.

Engineering design capability and fuel adaptability are not abstract concepts; they directly shape how a boiler behaves throughout its operating life.

Why Engineering Design Capability Is a Core Supplier Differentiator

Engineering design capability refers to far more than producing drawings or meeting basic specifications. It encompasses the supplier’s ability to integrate thermodynamics, combustion science, materials engineering, fluid mechanics, controls, and operational experience into a coherent, robust system.

In boiler projects, weak engineering often manifests as:

- Overly narrow design margins

- Poor integration between subsystems

- Sensitivity to minor fuel or load changes

- Accelerated wear and maintenance issues

Strong engineering capability, by contrast, creates systems that tolerate uncertainty and change.

Design Capability as Risk Management

From an owner’s perspective, engineering quality is fundamentally about risk.

High-quality engineering:

- Anticipates variability rather than assuming ideal conditions

- Designs margins where consequences are severe

- Prioritizes stable operation over theoretical peak efficiency

Suppliers with limited engineering depth often rely on optimistic assumptions that only hold under laboratory-like conditions.

Fuel Adaptability: A Strategic Requirement, Not a Feature

Fuel adaptability is no longer optional. Global energy markets are volatile, and many plants must operate on:

- Multiple fuel grades

- Blended fuels

- Fuels that change over time

A supplier’s ability to design for fuel adaptability determines whether the plant remains viable when market conditions shift.

The Link Between Engineering and Fuel Adaptability

Fuel adaptability is not achieved through control logic alone. It is embedded in the physical and thermal design of the boiler.

Key design areas affected include:

- Furnace geometry

- Air distribution systems

- Heat transfer surface arrangement

- Material selection and corrosion allowances

- Emission control integration

Only suppliers with strong engineering foundations can balance these elements effectively.

Understanding Fuel Variability and Its Consequences

Real fuels rarely match design specifications perfectly.

Variability includes:

- Moisture content fluctuations

- Ash composition and melting behavior

- Particle size distribution

- Heating value inconsistency

Suppliers that design narrowly around nominal fuel values expose owners to significant operational risk.

Engineering Design for Combustion Stability

Combustion stability is the first casualty of poor fuel adaptability.

Strong engineering design:

- Maintains stable flame or bed conditions

- Prevents localized overheating

- Ensures uniform heat release

Weak designs often struggle with flame instability, CO excursions, or frequent trips when fuel quality drifts.

Fuel Adaptability and Heat Transfer Design

Fuel changes alter heat release patterns.

Engineering capability is demonstrated by:

- Designing flexible heat transfer layouts

- Avoiding hot spots under high-volatile fuels

- Maintaining efficiency under low-grade fuels

This requires deep understanding of combustion-heat transfer coupling.

Table: Engineering Design Elements vs. Fuel Adaptability

| Design Element | Role in Fuel Adaptability | Risk if Poorly Designed |

|---|---|---|

| Furnace volume | Handles volatile release | Flame instability |

| Air staging | Controls combustion rate | CO/NOx excursions |

| Heat surfaces | Absorb variable heat | Tube overheating |

| Materials | Resist ash chemistry | Corrosion failures |

Fuel adaptability is engineered, not added later.

Materials Engineering as a Fuel Adaptability Indicator

Different fuels produce different ash chemistries and corrosion mechanisms.

Experienced engineering teams:

- Select materials based on fuel ash analysis

- Design corrosion allowances into pressure parts

- Anticipate long-term degradation

Suppliers lacking materials expertise often rely on generic selections that fail prematurely.

Fuel Adaptability and Emission Control Integration

Changing fuels changes emission profiles.

Engineering capability determines:

- Whether SO₂ capture remains effective

- How NOx formation responds to fuel nitrogen

- Whether particulate systems can handle ash changes

Integrated engineering avoids costly retrofits when fuel changes occur.

Control System Design Reflects Engineering Maturity

Fuel adaptability places heavy demands on control systems.

Strong engineering teams:

- Design robust control architectures

- Anticipate transient fuel behavior

- Avoid over-reliance on operator intervention

Control instability under fuel variation is a hallmark of weak engineering.

Engineering Capability Revealed During Start-Up and Commissioning

Commissioning exposes design assumptions.

Suppliers with strong engineering:

- Achieve stable operation quickly

- Require minimal post-start modifications

- Adapt tuning logically and predictably

Inexperienced suppliers often discover fundamental design issues during commissioning.

Scaling and Engineering Depth

Engineering capability becomes increasingly important as boiler size increases.

Large units amplify:

- Thermal gradients

- Solids circulation challenges

- Control complexity

Suppliers without experience across multiple scales struggle to manage these effects.

Fuel Adaptability and Maintenance Burden

Poor fuel adaptability increases maintenance costs.

Engineering-driven adaptability:

- Reduces slagging and fouling

- Minimizes refractory damage

- Stabilizes wear patterns

Maintenance predictability is a strong indicator of design quality.

Lifecycle Thinking as an Engineering Capability Marker

True engineering capability considers the entire lifecycle.

This includes:

- Start-up and shutdown frequency

- Load cycling impacts

- Fuel evolution over decades

Suppliers focused only on initial performance often neglect long-term consequences.

Engineering Design Documentation and Transparency

Reliable suppliers can explain their design logic clearly.

Indicators include:

- Detailed design calculations

- Clear fuel tolerance envelopes

- Transparent trade-off explanations

Vague or generic explanations often signal limited engineering depth.

Fuel Adaptability as Financial Risk Mitigation

Fuel adaptability protects against:

- Fuel price spikes

- Supply disruptions

- Regulatory changes

Engineering capability directly influences financial resilience.

Case Patterns: When Engineering Capability Is Weak

Projects with weak engineering often show:

- Narrow fuel acceptance windows

- Frequent derating under off-design fuels

- Unexpected corrosion or fouling

These issues erode project economics rapidly.

Supplier Engineering Teams vs. Outsourced Design

In-house engineering capability matters.

Suppliers with strong internal teams:

- Retain institutional knowledge

- Learn from operating feedback

- Improve designs continuously

Over-reliance on outsourced engineering often limits learning and adaptability.

Proven Design Platforms vs. One-Off Designs

Engineering maturity is visible in design platforms.

Reliable suppliers:

- Use proven base designs

- Customize critical areas thoughtfully

Unproven one-off designs increase risk significantly.

Engineering Capability and Contractual Confidence

Suppliers confident in their engineering are more willing to:

- Guarantee fuel flexibility

- Commit to availability targets

- Accept performance penalties

Contract terms often reflect true engineering confidence.

Evaluating Engineering Capability During Supplier Selection

Owners should assess:

- Depth of engineering teams

- Reference projects with similar fuels

- Ability to explain design trade-offs

Engineering interviews often reveal more than proposals.

Fuel Adaptability in the Context of Energy Transition

As energy systems evolve, fuel mixes will continue to change.

Engineering capability enables:

- Co-firing strategies

- Gradual fuel transitions

- Retrofit readiness

Rigid designs become stranded assets.

Engineering Innovation Balanced by Experience

The best suppliers combine:

- Innovation grounded in experience

- Incremental improvements

- Controlled deployment of new concepts

Reckless innovation without engineering maturity increases risk.

The Hidden Cost of Poor Engineering

Upfront savings from weaker suppliers often lead to:

- Higher fuel costs

- Increased downtime

- Expensive retrofits

Total lifecycle cost favors strong engineering.

Organizational Culture and Engineering Quality

Engineering capability reflects culture.

Strong cultures:

- Encourage peer review

- Learn from failures

- Value conservative margins where needed

This culture directly affects fuel adaptability outcomes.

Fuel Adaptability as a Measure of Supplier Partnership Value

Suppliers with strong engineering become long-term partners.

They:

- Support fuel changes proactively

- Offer upgrades and optimization

- Share operational insights

Transactional suppliers rarely add this value.

Red Flags in Supplier Engineering Claims

Warning signs include:

- Overly optimistic fuel ranges without data

- Lack of operating references

- Simplistic explanations of complex phenomena

These suggest limited engineering depth.

Integrating Engineering Capability into Selection Criteria

Best practice is to weight:

- Engineering competence

- Fuel adaptability

- Long-term support

more heavily than initial price alone.

Engineering Capability and Reputation in the Market

Over time, engineering quality shapes reputation.

Suppliers known for strong engineering:

- Attract repeat customers

- Maintain stable market positions

- Invest continuously in R&D

Reputation is built on delivered performance.

Summary of Key Relationships

Engineering design capability:

- Enables fuel adaptability

- Reduces operational risk

- Protects lifecycle economics

Fuel adaptability:

- Depends on deep engineering

- Determines long-term viability

The two cannot be separated.

Engineering design capability and fuel adaptability are decisive factors in supplier selection because they determine whether a boiler system can operate reliably, efficiently, and safely under real-world conditions that inevitably differ from initial design assumptions. Strong engineering capability enables suppliers to anticipate fuel variability, integrate robust combustion and heat transfer designs, select appropriate materials, and implement control strategies that maintain stability as fuels, loads, and regulations evolve. Fuel adaptability, in turn, protects owners from market volatility, regulatory change, and long-term operational risk. Suppliers that demonstrate deep engineering expertise and proven fuel adaptability consistently deliver lower lifecycle costs, higher availability, and greater strategic flexibility. For owners making long-term energy investments, prioritizing engineering capability and fuel adaptability is not a technical preference—it is a fundamental risk management decision.

Why Are Manufacturing Facilities, Quality Control, and Certifications Critical for CFB Boilers?

In the global power generation and industrial energy sector, circulating fluidized bed (CFB) boilers are recognized as one of the most technically demanding boiler technologies to design, manufacture, and operate. While much attention is often placed on combustion theory, fuel flexibility, or emission performance, many long-term project failures can be traced back to a more fundamental issue: insufficient manufacturing capability, weak quality control systems, or inadequate certifications on the supplier side. When manufacturing defects, material inconsistencies, or undocumented processes emerge during operation, they lead to tube leaks, refractory failures, erosion problems, forced outages, and safety risks—often years after commissioning, when corrective actions become extremely costly. For CFB boilers, which operate under severe thermal, mechanical, and chemical conditions, manufacturing discipline and verified quality systems are not optional; they are foundational to reliability, safety, and lifecycle value.

Manufacturing facilities, quality control, and certifications are critical for CFB boilers because they determine whether complex designs can be consistently translated into safe, durable, and compliant physical equipment capable of withstanding harsh operating conditions over decades of service.

To fully appreciate why these factors matter so much in supplier evaluation, it is necessary to understand the unique characteristics of CFB boilers, the risks associated with poor manufacturing execution, and how certifications and quality systems directly reduce technical and commercial uncertainty for project owners.

CFB boiler performance is mainly determined by design, while manufacturing quality has limited long-term impact.False

Manufacturing quality directly affects pressure integrity, erosion resistance, and fatigue life, which are critical to long-term CFB boiler reliability.

Certified manufacturing facilities with strict quality control significantly reduce failure risks in CFB boilers.True

Certifications and quality systems ensure repeatable processes, traceable materials, and compliance with international safety standards.

Why CFB Boilers Place Exceptional Demands on Manufacturing

CFB boilers differ fundamentally from conventional boilers in both structure and operating environment. They contain large furnaces, complex solids circulation loops, cyclones, loop seals, extensive refractory systems, and dense networks of pressure parts exposed to continuous particle erosion.

These characteristics create manufacturing challenges such as:

- Large-scale welded structures with tight tolerances

- High-temperature, erosion-prone pressure parts

- Complex interfaces between steel, refractory, and insulation

- Long operating hours under cyclic loads

Only well-equipped manufacturing facilities with proven processes can reliably meet these demands.

Manufacturing Facilities as a Reflection of Real Capability

A supplier’s manufacturing facilities are a direct, tangible indicator of its true technical strength.

Advanced facilities demonstrate:

- Capability to fabricate large pressure components in-house

- Control over critical welding and heat treatment processes

- Capacity to handle large volumes without outsourcing key steps

Suppliers lacking adequate facilities often rely heavily on subcontractors, increasing variability and risk.

Pressure Part Manufacturing: The Heart of CFB Reliability

Pressure parts such as water walls, superheaters, reheaters, and economizers operate under high pressure and temperature while exposed to erosion and corrosion.

Manufacturing excellence ensures:

- Proper material selection and verification

- High-quality welds with minimal defects

- Accurate tube spacing and alignment

Defects introduced during fabrication often remain hidden until catastrophic failure occurs in service.

Welding Quality and Its Long-Term Consequences

CFB boilers contain thousands of welds, many in high-stress areas.

High-quality facilities:

- Employ certified welders

- Use qualified welding procedures

- Apply strict non-destructive testing (NDT)

Poor welding quality leads to fatigue cracks, leaks, and unplanned outages that severely impact availability.

Heat Treatment Capability as a Differentiator

Post-weld heat treatment is critical for many pressure parts.

Facilities with full heat treatment capability:

- Relieve residual stresses

- Improve material toughness

- Reduce long-term creep and fatigue damage

Incomplete or outsourced heat treatment increases the risk of premature failure.

Erosion-Resistant Component Manufacturing

CFB boilers expose tubes, bends, and headers to continuous particle erosion.

Manufacturing quality affects:

- Tube wall thickness consistency

- Overlay and cladding quality

- Dimensional accuracy

Small deviations can dramatically shorten component life.

Table: Manufacturing Quality vs. Operational Risk

| Manufacturing Aspect | Impact on CFB Operation | Risk if Poor |

|---|---|---|

| Welding quality | Pressure integrity | Tube leaks |

| Material traceability | Corrosion resistance | Premature failure |

| Dimensional accuracy | Solids flow stability | Erosion hotspots |

| Heat treatment | Fatigue life | Cracking |

Manufacturing precision translates directly into operational stability.

Refractory Interfaces and Manufacturing Discipline

CFB boilers rely heavily on refractory linings.

Manufacturing and fabrication accuracy:

- Ensures correct anchoring systems

- Maintains design clearances

- Prevents premature refractory detachment

Poor steel fabrication often causes refractory failures, even when refractory materials are high quality.

Quality Control as a System, Not an Inspection

Quality control is not limited to final inspection.

Effective QC systems include:

- Incoming material verification

- Process control during fabrication

- Documented inspection checkpoints

Suppliers with mature QC systems prevent defects rather than detecting them too late.

Material Traceability and Its Importance

CFB boilers use a wide range of alloys.

Traceability ensures:

- Materials meet design specifications

- Substitutions are prevented

- Root causes can be identified if failures occur

Without traceability, long-term reliability cannot be assured.

Non-Destructive Testing and Defect Prevention

Advanced manufacturing facilities integrate NDT into production.

Common methods include:

- Radiographic testing

- Ultrasonic testing

- Magnetic particle inspection

These techniques catch hidden defects that visual inspection cannot detect.

Quality Documentation as Risk Mitigation

Comprehensive documentation provides:

- Proof of compliance

- Confidence for insurers and regulators

- A baseline for future maintenance

Incomplete documentation increases legal and operational risk.

Certifications as Independent Verification

Certifications provide third-party validation of manufacturing and quality systems.

Key certifications include:

- ASME “S” and “U” stamps

- ISO 9001 quality management

- ISO 14001 environmental management

These certifications reduce uncertainty for owners and financiers.

ASME Certification and Pressure Safety

ASME certification is especially critical for CFB boilers.

It ensures:

- Compliance with international pressure vessel codes

- Standardized design and fabrication practices

- Legal acceptance in many jurisdictions

Non-certified equipment may face regulatory rejection or insurance limitations.

ISO Quality Systems and Consistency

ISO-certified quality systems promote:

- Repeatable processes

- Continuous improvement

- Organizational accountability

Consistency across projects is essential for suppliers delivering multiple CFB units.

Certification as a Market Access Requirement

Many projects require certified suppliers by contract.

Certifications:

- Enable participation in international tenders

- Satisfy lender and insurer requirements

- Reduce owner due diligence burden

Lack of certification limits project bankability.

Manufacturing Scale and Capacity Considerations

CFB boilers are large, heavy structures.

Facilities must handle:

- Large components and assemblies

- Heavy lifting and logistics

- Parallel production schedules

Insufficient capacity leads to delays and quality compromises.

Integration Between Engineering and Manufacturing

Strong suppliers integrate engineering and manufacturing closely.

Benefits include:

- Design optimized for fabrication

- Faster issue resolution

- Reduced rework

Separation between design and manufacturing often causes execution errors.

Learning Curve Effects in Manufacturing

Experienced facilities benefit from repetition.

They:

- Improve productivity

- Reduce defect rates

- Refine fabrication techniques

Infrequent or one-off manufacturing increases risk.

Quality Control in Subcontracted Work

Even when subcontracting is necessary, strong suppliers:

- Qualify subcontractors rigorously

- Apply the same QC standards

- Maintain oversight

Weak control over subcontractors undermines overall quality.

Factory Acceptance Testing (FAT)

Advanced facilities support FAT activities.

FAT allows:

- Early verification of assemblies

- Functional checks where applicable

- Issue resolution before shipment

This reduces site risk significantly.

Transportation and Packaging Quality

CFB components are large and sensitive.

Manufacturing discipline extends to:

- Protective packaging

- Transport planning

- Damage prevention

Transport damage is often linked to poor manufacturing logistics planning.

Quality Control and Long-Term Maintenance

High-quality manufacturing simplifies maintenance.

Benefits include:

- Predictable wear patterns

- Standardized spare parts

- Easier inspections

Poor quality increases maintenance complexity and cost.

Safety Implications of Manufacturing Quality

Pressure equipment failures pose serious safety risks.

Certified manufacturing and QC:

- Reduce accident probability

- Protect personnel and assets

- Ensure regulatory compliance

Safety is inseparable from manufacturing quality.

Quality Culture as an Organizational Indicator

Facilities with strong quality culture:

- Empower inspectors

- Encourage reporting of issues

- Prioritize long-term reliability

Culture often matters more than equipment alone.

Auditing Manufacturing Facilities During Supplier Selection

Owners should:

- Visit factories

- Review QC procedures

- Examine certification scope

On-site audits often reveal capabilities not visible in proposals.

Red Flags in Manufacturing and QC

Warning signs include:

- Limited in-house fabrication

- Missing or expired certifications

- Incomplete quality records

These indicate elevated project risk.

Manufacturing Quality and Lifecycle Cost

Upfront manufacturing quality reduces:

- Forced outages

- Repair costs

- Retrofit needs

Lifecycle economics favor high-quality suppliers.

Financial and Insurance Perspectives

Insurers and lenders scrutinize manufacturing quality.

Certified facilities:

- Lower insurance premiums

- Improve financing terms

- Reduce contingency requirements

Quality directly affects project bankability.

Manufacturing Facilities and Technology Evolution

Advanced facilities support:

- New materials

- Improved fabrication techniques

- Continuous product improvement

This enables suppliers to evolve with market demands.

Case Patterns in Reliable CFB Suppliers

Consistently reliable suppliers share:

- Large, modern manufacturing bases

- Robust QC systems

- Comprehensive certifications

These traits correlate strongly with project success.

The Cost of Poor Manufacturing Discipline

Consequences include:

- Chronic tube leaks

- Refractory failures

- Regulatory non-compliance

These costs often exceed initial capital savings many times over.

Strategic Value of Manufacturing Transparency

Suppliers willing to demonstrate facilities:

- Build trust

- Reduce perceived risk

- Strengthen partnerships

Transparency is a hallmark of confidence.

Manufacturing Capability as a Long-Term Commitment

Facilities represent long-term investment.

They signal:

- Market commitment

- Financial stability

- Willingness to support products over decades

Short-term players rarely invest at this level.

Aligning Manufacturing Quality with Owner Expectations

Owners expect:

- Safe operation

- Predictable performance

- Long service life

Manufacturing quality is essential to meeting these expectations.

Integrating Manufacturing Evaluation into Supplier Selection

Best practice includes:

- Weighting manufacturing and QC heavily

- Verifying certifications

- Auditing facilities

This reduces downstream surprises.

Summary of Why These Factors Are Critical

Manufacturing facilities:

- Enable complex fabrication

- Ensure dimensional and material accuracy

Quality control:

- Prevents defects

- Ensures consistency

Certifications:

- Provide independent validation

- Enable regulatory and financial acceptance

Together, they form the backbone of reliable CFB boiler delivery.

Manufacturing facilities, quality control systems, and certifications are critical for CFB boilers because they determine whether sophisticated engineering designs can be executed consistently, safely, and durably under the severe operating conditions unique to CFB technology. High-quality manufacturing facilities provide the physical capability to fabricate large, complex, and erosion-resistant components with precision. Robust quality control systems ensure that materials, welding, heat treatment, and assembly meet stringent standards throughout the production process. Recognized certifications offer independent verification of compliance, reduce regulatory and financial risk, and build confidence among owners, insurers, and lenders. For CFB boiler projects, these factors are not secondary considerations—they are fundamental indicators of supplier reliability, lifecycle performance, and long-term project success.

How Should Environmental Compliance and Emission Control Solutions Be Evaluated?

In the current global energy landscape, environmental compliance has become one of the most decisive and risk-sensitive aspects of boiler and power plant projects. Owners today face tightening emission regulations, increasing public scrutiny, carbon-related policies, and growing financial exposure tied to environmental performance. Projects that underestimate emission control complexity often encounter unexpected shutdowns, derating, fines, reputational damage, or costly retrofits shortly after commissioning. The core challenge is that environmental compliance is not achieved simply by adding emission control equipment; it depends on how well emission solutions are engineered, integrated, operated, and maintained under real-world conditions. Therefore, evaluating environmental compliance and emission control solutions requires a systematic, lifecycle-oriented approach rather than a checklist-based comparison of technologies.

Environmental compliance and emission control solutions should be evaluated based on regulatory alignment, technical integration with the boiler, fuel adaptability, operational stability, lifecycle cost, and proven performance under real operating conditions—not solely on nominal removal efficiency claims.

To make sound decisions, owners must understand how emission control systems interact with combustion processes, fuels, operating regimes, and long-term regulatory uncertainty.

Emission control performance can be evaluated primarily by comparing guaranteed removal efficiencies.False

Removal efficiency alone ignores integration, operational stability, fuel variability, and long-term compliance risks.

Well-integrated emission control solutions significantly improve compliance reliability and reduce lifecycle cost.True

Integrated designs align combustion, flue gas treatment, and controls, reducing operational disruptions and retrofit risk.

Why Environmental Compliance Evaluation Is More Complex Than It Appears

Environmental compliance is often treated as a downstream problem, addressed after boiler design is finalized. In reality, emissions are created in the combustion process and shaped by fuel properties, operating conditions, and system integration.

Poor evaluation typically leads to:

- Overdesigned or underperforming systems

- High reagent consumption

- Frequent emission excursions

- Limited operational flexibility

Effective evaluation requires understanding the entire emissions pathway from fuel input to stack discharge.

Regulatory Framework Alignment as the First Evaluation Step

Environmental compliance begins with regulation.

Evaluation must consider:

- Current emission limits

- Future tightening trends

- Regional and national enforcement practices

- Monitoring and reporting requirements

Suppliers that design only to current limits expose owners to early obsolescence.

Understanding the Full Emission Spectrum

Compliance is not limited to a single pollutant.

A comprehensive evaluation covers:

- NOx

- SO₂

- Particulate matter

- CO

- Heavy metals

- Acid gases

- Greenhouse gases (where applicable)

Focusing on one pollutant often creates trade-offs that worsen others.

Combustion Design as the Foundation of Emission Control

The most effective emission control starts inside the furnace.

Strong solutions prioritize:

- Low-NOx combustion strategies

- In-furnace sulfur capture (where applicable)

- Stable combustion to minimize CO and unburned carbon

Downstream equipment should complement, not compensate for, weak combustion design.

Integration Between Boiler and Emission Systems

Emission control systems must be evaluated as part of the boiler system.

Key integration aspects include:

- Flue gas temperature windows

- Residence time requirements

- Ash characteristics and loading

- Pressure drop impacts

Poor integration reduces efficiency and reliability.

Table: Integration Factors and Evaluation Focus

| Integration Aspect | Why It Matters | Risk if Ignored |

|---|---|---|

| Temperature control | Catalyst activity | Low NOx removal |

| Ash handling | Fouling/plugging | High maintenance |

| Pressure drop | Fan power | Efficiency loss |

| Layout | Accessibility | Downtime |

Integration quality often determines real compliance success.

Fuel Variability and Its Impact on Emission Performance

Fuel properties directly influence emissions.

Evaluation must consider:

- Sulfur variability

- Fuel nitrogen content

- Ash composition

- Moisture content

Emission systems that perform well on design fuel may fail under real fuel variation.

Evaluating NOx Control Solutions

NOx control options include:

- Combustion staging

- SNCR

- SCR

Each has different implications for:

- Load flexibility

- Reagent consumption

- Ammonia slip

- Capital and operating cost

Selection must align with operating profile and fuel characteristics.

SCR and Catalyst Management Considerations

For SCR systems, evaluation should include:

- Catalyst type and volume

- Expected catalyst life

- Sensitivity to ash and poisons

- Replacement strategy

Catalyst degradation is a major hidden cost if poorly evaluated.

SO₂ and Acid Gas Control Evaluation

Desulfurization solutions vary widely.

Evaluation criteria include:

- Removal efficiency under variable sulfur

- Byproduct handling

- Reagent supply logistics

- Water usage and wastewater treatment

Simplistic comparisons often underestimate operational complexity.

Particulate Control and Ash Characteristics

Particulate systems must handle real ash behavior.

Evaluation should consider:

- Particle size distribution

- Resistivity

- Abrasiveness

- Load fluctuations

Baghouse or ESP selection must match ash properties, not assumptions.

Table: Particulate Control Evaluation Factors

| Factor | Impact on Design | Risk |

|---|---|---|

| Ash resistivity | ESP performance | Emission exceedance |

| Particle size | Filtration efficiency | High PM |

| Abrasiveness | Wear rate | Frequent replacement |

| Moisture | Blinding | Pressure drop |

Mismatch between ash behavior and equipment design is common.

Multi-Pollutant Interaction Effects

Emission control systems interact.

Examples include:

- SCR affecting SO₃ formation

- Ammonia slip impacting particulate control

- Desulfurization influencing mercury capture

Evaluation must consider system-level effects, not isolated components.

Load Flexibility and Transient Operation

Modern plants rarely operate at steady base load.

Evaluation should include:

- Startup and shutdown emissions

- Low-load performance

- Ramp rate impacts

Systems optimized only for steady operation often fail compliance during transients.

Control Systems and Automation Evaluation

Emission compliance depends on control quality.

Strong solutions feature:

- Integrated emission and combustion control

- Adaptive tuning

- Minimal operator dependency

Manual or poorly automated systems increase compliance risk.

Continuous Emission Monitoring System (CEMS) Integration

Compliance evaluation must include monitoring.

Key aspects:

- Measurement accuracy

- Redundancy

- Data reporting compliance

Inadequate monitoring can result in penalties even when emissions are low.

Reliability and Availability of Emission Systems

Emission systems must match plant availability targets.

Evaluation criteria include:

- Mean time between failures

- Maintenance requirements

- Spare part availability

Unreliable emission equipment directly reduces plant availability.

Lifecycle Cost vs. Capital Cost Evaluation

Lowest capital cost rarely equals lowest lifecycle cost.

Lifecycle evaluation includes:

- Reagent consumption

- Energy penalty

- Maintenance labor

- Replacement intervals

True compliance cost is cumulative over decades.

Proven Operating References as Evaluation Evidence

The most reliable indicator of performance is operating history.

Evaluation should seek:

- Similar fuel references

- Similar regulatory limits

- Long-term performance data

Paper guarantees cannot replace operating evidence.

Environmental Compliance Under Future Regulations

Forward-looking evaluation considers:

- Margin to future limits

- Upgrade paths

- Modular expansion capability

Designing only to current limits risks early retrofits.

Maintenance Accessibility and Downtime Risk

Emission systems must be maintainable.

Evaluation includes:

- Access for inspection

- Isolation capability

- On-line maintenance options

Maintenance-driven outages often dominate compliance risk.

Waste and Byproduct Management

Emission control creates secondary streams.

Evaluation must include:

- Solid byproducts

- Wastewater

- Disposal or reuse options

Ignoring these aspects shifts environmental burden elsewhere.

Water and Energy Penalties

Many emission systems consume water and power.

Evaluation considers:

- Water availability

- Cooling requirements

- Auxiliary power consumption

Resource constraints can limit long-term operability.

Safety and Environmental Risk Assessment

Emission systems involve hazardous materials.

Evaluation includes:

- Ammonia handling

- Lime or reagent dust

- High-temperature equipment

Safety performance is part of compliance credibility.

Supplier Engineering Capability in Emission Design

Strong suppliers:

- Integrate emission control early

- Optimize system interactions

- Balance efficiency and reliability

Weak engineering leads to fragmented solutions.

Certification and Regulatory Acceptance

Evaluation includes:

- Compliance with local codes

- Environmental permits compatibility

- Third-party certifications

Regulatory acceptance reduces approval risk.

Financial and Insurance Implications

Lenders and insurers evaluate emission risk.

Well-evaluated solutions:

- Improve financing terms

- Reduce contingency requirements

Compliance credibility has direct financial value.

Red Flags in Emission Control Proposals

Warning signs include:

- Overly optimistic efficiency claims

- Lack of operating references

- Minimal discussion of fuel variability

These indicate elevated compliance risk.

Structuring a Comprehensive Evaluation Process

Best practice includes:

- Multidisciplinary technical review

- Lifecycle cost modeling

- Reference plant validation

This approach reduces blind spots.

Environmental Compliance as a Strategic Asset

Strong compliance capability:

- Enhances corporate reputation

- Improves social license to operate

- Supports long-term asset value

It is not merely a regulatory obligation.

Integration With Digital Monitoring and Optimization

Advanced evaluation includes:

- Data analytics readiness

- Predictive compliance monitoring

- Continuous optimization capability

Digital tools increasingly define compliance success.

Learning From Past Compliance Failures

Many failures share common causes:

- Late integration

- Narrow design assumptions

- Insufficient operating margins

Learning from industry experience improves evaluation quality.

Alignment With Corporate Sustainability Goals

Emission solutions should align with:

- ESG targets

- Carbon strategies

- Public commitments

Misalignment creates internal conflict and risk.

Summary of Key Evaluation Principles

Effective evaluation requires:

- System-level integration focus

- Fuel and load adaptability

- Lifecycle cost perspective

- Proven operating evidence

These principles separate robust solutions from fragile ones.

Environmental compliance and emission control solutions should be evaluated through a holistic, lifecycle-based framework that goes far beyond nominal removal efficiencies or lowest upfront cost. Effective evaluation begins with regulatory alignment and extends through combustion integration, fuel adaptability, operational flexibility, reliability, monitoring, and long-term cost. Proven operating references, robust control systems, and forward-looking design margins are essential indicators of compliance credibility. In an era of tightening regulations and rising environmental expectations, well-evaluated emission control solutions protect not only regulatory compliance but also plant availability, financial performance, and long-term asset value.

What Role Do After-Sales Service, Spare Parts, and Technical Support Play in Supplier Assessment?

In large-scale boiler and power plant projects, many owners discover too late that the real test of a supplier does not occur at commissioning, but years later during routine operation, unexpected load changes, fuel quality fluctuations, component aging, or unplanned failures. Boilers are long-life assets expected to operate reliably for 20 to 40 years, often under increasingly demanding regulatory, fuel, and market conditions. When after-sales service is slow, spare parts are unavailable, or technical support lacks depth, even a well-designed boiler can become a chronic operational problem. Downtime increases, maintenance costs escalate, and operators lose confidence in the equipment. For this reason, after-sales service, spare parts availability, and technical support are not secondary commercial add-ons—they are core criteria in supplier assessment that directly determine lifecycle performance and financial outcomes.

After-sales service, spare parts, and technical support play a decisive role in supplier assessment because they determine whether a boiler system can sustain safe, efficient, and compliant operation throughout its full lifecycle, not just during initial startup.

Understanding their true impact requires shifting perspective from project delivery to long-term asset ownership.

Once a boiler is commissioned, supplier involvement has minimal impact on long-term performance.False

Ongoing supplier support strongly influences reliability, maintenance effectiveness, and the ability to respond to operational challenges over time.

Suppliers with strong after-sales service and spare parts support significantly reduce lifecycle cost and operational risk.True

Rapid technical support and reliable spare parts availability minimize downtime, prevent secondary damage, and stabilize maintenance planning.

Why Supplier Assessment Must Extend Beyond Delivery

Boiler projects are often evaluated primarily on:

- Capital cost

- Efficiency guarantees

- Delivery schedule

However, most lifecycle cost and risk emerge after handover, during decades of operation. Supplier assessment that ignores after-sales capability creates a structural blind spot.

After-Sales Service as an Indicator of Long-Term Commitment

After-sales service reflects whether a supplier views the project as a transaction or a long-term partnership.

Strong after-sales organizations demonstrate:

- Dedicated service teams

- Long-term product support strategies

- Continuous engagement with operating plants

Weak after-sales capability often signals short-term market participation.

The Reality of Boiler Operation Over Decades

Boilers do not operate under static conditions.

Over time, plants experience:

- Fuel quality changes

- Load cycling and partial-load operation

- Regulatory tightening

- Component aging and wear

After-sales service is essential to adapt the system to these evolving realities.

Technical Support as a Risk Mitigation Tool

High-quality technical support reduces both technical and financial risk.

It provides:

- Rapid troubleshooting

- Root cause analysis

- Guidance on operational optimization

Without expert support, minor issues often escalate into major failures.

Spare Parts Availability and Downtime Economics

Downtime costs in power and industrial plants are substantial.

Spare parts availability directly affects:

- Outage duration

- Forced outage frequency

- Secondary equipment damage

Delays caused by unavailable parts often cost far more than the parts themselves.

Original Equipment Manufacturer (OEM) vs. Generic Parts

Supplier assessment must distinguish between:

- OEM spare parts

- Qualified alternatives

- Unverified generic components

OEM-backed spare parts ensure:

- Material compatibility

- Dimensional accuracy

- Predictable performance

Generic parts may reduce short-term cost but increase long-term risk.

Table: Spare Parts Strategy and Operational Impact

| Spare Parts Strategy | Short-Term Cost | Long-Term Risk |

|---|---|---|

| OEM recommended | Moderate | Low |

| Qualified alternatives | Lower | Medium |

| Unverified generic | Low | High |

A robust spare parts strategy supports operational stability.

Lead Time and Logistics Capability

Spare parts are only useful if delivered on time.

Key assessment factors include:

- Typical lead times

- Regional warehouses

- Emergency logistics capability

Suppliers with global or regional stock reduce outage risk significantly.

Critical vs. Consumable Spare Parts Planning

Experienced suppliers help owners distinguish between:

- Critical spares requiring on-site storage

- Consumables with predictable replacement

- Long-lead items needing advance planning

This planning reduces both inventory cost and operational risk.

Technical Support Depth vs. Call-Center Support

Not all technical support is equal.

High-value technical support includes:

- Access to original designers

- Field engineers with commissioning experience

- Specialists in combustion, materials, and controls

Basic call-center support is insufficient for complex boiler issues.

Root Cause Analysis Capability

Recurring problems indicate weak support.

Strong suppliers:

- Perform structured root cause analysis

- Document findings

- Implement design or operational improvements

This learning loop improves reliability over time.

Digital Diagnostics and Remote Support

Modern after-sales service increasingly relies on digital tools.

Advanced suppliers offer:

- Remote monitoring

- Performance diagnostics

- Predictive maintenance insights

Digital capability enhances response speed and problem prevention.

Training as a Component of After-Sales Support

Operator and maintenance training is critical.

Effective after-sales programs include:

- Initial and refresher training

- Updates following modifications

- Knowledge transfer as staff changes

Training reduces human-error-related failures.

Documentation and Knowledge Continuity

Over decades, personnel change.

After-sales support ensures:

- Updated technical documentation

- Maintenance procedures

- Lessons learned from similar plants

Without this continuity, operational quality degrades.

Support During Fuel or Operating Changes

Many plants modify fuels or operating profiles.

Strong technical support:

- Re-evaluates combustion and heat transfer

- Adjusts control strategies

- Advises on material and maintenance implications

This adaptability protects asset value.

Planned Outage Support vs. Emergency Response

Supplier assessment should differentiate:

- Routine outage planning support

- Emergency response capability

Both are important, but emergency response often defines perceived reliability.

Service Level Agreements (SLAs) as Evidence of Confidence

Suppliers confident in their support capability often offer:

- Guaranteed response times

- Defined escalation paths

- Performance-based service contracts

SLAs provide tangible risk reduction for owners.

Spare Parts Obsolescence Management

Over long lifetimes, components become obsolete.

Strong suppliers:

- Manage design changes proactively

- Offer retrofit solutions

- Maintain backward compatibility where possible

Obsolescence planning is a critical but often overlooked factor.

Integration of After-Sales Feedback Into Design

The best suppliers close the loop between service and engineering.

They:

- Feed operating issues back into design improvements

- Update standards based on field experience

This continuous improvement benefits both existing and future projects.

Cost Transparency in After-Sales Services

Unclear service pricing creates friction.

Reliable suppliers provide:

- Transparent spare parts pricing

- Clear service rate structures

- Predictable maintenance cost models

Cost predictability supports long-term budgeting.

Local Presence vs. Remote Support

Geographic proximity matters.

Local service presence offers:

- Faster response

- Cultural and regulatory familiarity

- Reduced travel delays

Supplier assessment should consider regional support coverage.

Quality of Field Service Engineers

Field engineers represent the supplier on site.

High-quality engineers demonstrate:

- Strong technical knowledge

- Practical problem-solving ability

- Clear communication with operators

Poor field support undermines trust quickly.

After-Sales Support During Warranty and Beyond

Some suppliers provide strong warranty support but fade afterward.

Assessment should consider:

- Post-warranty service capability

- Long-term support contracts

- Commitment beyond initial years

Boiler life extends far beyond warranty periods.

Impact on Availability and Capacity Factor

After-sales performance directly influences:

- Forced outage rates

- Mean time to repair

- Overall plant availability

Availability losses translate directly into revenue loss.

Safety and Compliance Support

Technical support also affects:

- Safety incident prevention

- Environmental compliance maintenance

- Regulatory inspections

Suppliers play a key role in sustaining compliance over time.

Financial Perspective: Lifecycle Cost Control

Strong after-sales support reduces:

- Emergency repair cost

- Secondary damage

- Insurance claims

Lifecycle cost optimization depends heavily on service quality.

Reference Feedback as a Supplier Assessment Tool

Owners should speak with existing customers.

Key questions include:

- Response time satisfaction

- Spare parts availability

- Technical competence

Real feedback often reveals more than proposals.

Red Flags in After-Sales Capability

Warning signs include:

- No dedicated service organization

- Long spare parts lead times

- Limited technical depth

These indicate elevated long-term risk.

After-Sales Service as a Competitive Differentiator

In mature boiler markets, technology differences narrow.

Service quality increasingly:

- Differentiates suppliers

- Drives repeat business

- Builds long-term reputation

Strong service is a strategic asset.

Alignment With Owner’s Operational Philosophy

Different owners prioritize different support models.

Good suppliers adapt:

- From hands-on support to advisory roles

- From full-service to owner-led maintenance

Flexibility improves partnership value.

The Hidden Cost of Weak After-Sales Support

Projects with weak support often experience:

- Repeated outages

- Escalating maintenance budgets

- Loss of operational confidence

These costs accumulate silently over time.

Strategic Value of Long-Term Service Partnerships

Long-term service agreements provide:

- Predictable costs

- Continuous improvement

- Shared performance incentives

They align supplier and owner interests.

After-Sales Capability in Supplier Evaluation Weighting

Best practice assigns significant weight to:

- Service organization strength

- Spare parts logistics

- Technical expertise

This balances capital cost considerations.

Cultural Indicators of Service Quality

Service quality reflects corporate culture.

Strong cultures:

- Value customer feedback

- Empower service teams

- Invest in long-term relationships

Culture often predicts future support quality.

Digitalization and the Future of After-Sales Support

Advanced suppliers are evolving toward:

- Predictive maintenance

- Data-driven optimization

- Remote expert support

Assessment should consider future readiness.

Summary of the Role in Supplier Assessment

After-sales service ensures:

- Rapid problem resolution

Spare parts availability ensures:

- Minimal downtime

Technical support ensures:

- Long-term performance optimization

Together, they define real supplier reliability.

After-sales service, spare parts availability, and technical support play a central role in supplier assessment because they determine whether a boiler system can sustain safe, efficient, and compliant operation throughout its entire lifecycle. While design and manufacturing quality set the foundation, long-term performance depends on how effectively a supplier supports the equipment as conditions change, components age, and unexpected challenges arise. Suppliers with strong service organizations, reliable spare parts logistics, and deep technical expertise consistently deliver higher availability, lower lifecycle cost, and greater operational confidence. For owners making long-term investments in boiler and power plant assets, evaluating after-sales capability is not a secondary consideration—it is a core risk management and value protection decision.

How Does EPC Capability and Lifecycle Support Influence the Long-Term Value of a CFB Boiler Supplier?

In the investment-heavy and technically complex world of circulating fluidized bed (CFB) boiler projects, many owners initially focus on technology selection, efficiency guarantees, or capital cost. However, long-term project success—or failure—is far more often determined by how well the project is executed as a system and how effectively the asset is supported over its entire operating life. Projects with strong boiler technology but weak EPC execution frequently suffer from delays, interface disputes, cost overruns, and chronic performance issues. Similarly, plants that perform well in early years may lose value rapidly if lifecycle support is insufficient to handle fuel changes, regulatory tightening, component aging, or operational optimization. As a result, EPC capability and lifecycle support have become decisive factors that directly influence the long-term value of a CFB boiler supplier.

EPC capability and lifecycle support influence the long-term value of a CFB boiler supplier by determining whether complex CFB technology can be delivered on time, integrated correctly, and sustained efficiently, safely, and compliantly throughout decades of operation.

Understanding this influence requires viewing a CFB boiler not as a standalone piece of equipment, but as a long-life industrial system whose value depends on execution quality and long-term partnership.

CFB boiler value is primarily determined by initial efficiency and capital cost, with limited impact from EPC capability.False

Poor EPC execution often leads to delays, integration failures, and long-term performance losses that outweigh initial efficiency or cost advantages.

Suppliers with strong EPC capability and lifecycle support consistently deliver higher long-term asset value for CFB boiler projects.True

Integrated EPC execution and long-term support reduce risk, stabilize performance, and lower total lifecycle cost.

Why EPC Capability Matters More for CFB Boilers Than Many Other Technologies

CFB boilers are among the most system-intensive boiler technologies in the market. Their performance depends on the precise integration of combustion, solids circulation, heat transfer, refractory, emissions control, balance-of-plant systems, and control logic.

EPC capability is critical because:

- Design errors propagate across multiple subsystems

- Construction tolerances strongly affect fluidization and erosion

- Interface mismatches can destabilize operation

Weak EPC execution amplifies these risks.

EPC as the Bridge Between Design and Reality

Engineering excellence alone does not guarantee success.

EPC capability ensures that:

- Engineering intent is preserved during procurement

- Components meet design assumptions

- Construction and erection align with system requirements

Without this bridge, even proven designs can fail in practice.

Integrated Engineering in EPC Execution

Strong EPC suppliers integrate:

- Boiler design

- Emission control systems

- Balance-of-plant engineering

This integration minimizes gaps and conflicting assumptions between disciplines.

Fragmented EPC approaches often lead to:

- Misaligned temperature windows

- Incorrect pressure drop allocation

- Control system instability

Integration is a core value driver.

Procurement Strength and Supply Chain Control

CFB boilers require thousands of components, many of which are critical.

EPC capability includes:

- Qualified vendor networks

- Material and quality control

- Logistics planning

Poor procurement decisions often create long-term reliability problems that are impossible to fix later.

Construction Management and Schedule Certainty

Construction quality directly affects long-term performance.

Strong EPC execution ensures:

- Correct erection sequences

- Proper refractory installation

- Accurate alignment of cyclones and ducts

Schedule delays and rework often signal deeper execution problems.

Interface Management: A Hidden Source of Risk

CFB projects involve many interfaces:

- Boiler and turbine

- Boiler and emission systems

- Boiler and control systems

EPC-capable suppliers manage these interfaces proactively, reducing disputes and technical gaps.

Table: EPC Capability vs. Project Risk

| EPC Capability Area | Impact on Project | Risk if Weak |

|---|---|---|

| Integrated design | System stability | Performance shortfall |

| Procurement control | Component quality | Premature failures |

| Construction management | Schedule and quality | Delays, rework |

| Interface coordination | Functional integration | Operational instability |

EPC maturity directly reduces execution risk.

Commissioning as a Measure of EPC Strength

Commissioning is where EPC capability becomes visible.

Strong EPC suppliers deliver:

- Predictable startup schedules

- Structured testing procedures

- Rapid stabilization

Extended commissioning often indicates poor integration upstream.

Cost Control and Change Management

CFB projects are vulnerable to scope changes.

EPC capability influences:

- Change identification

- Cost transparency

- Fair risk allocation

Suppliers with weak EPC discipline often lose cost control, harming project value.

Lifecycle Support: Extending Value Beyond Handover

While EPC defines how the asset is delivered, lifecycle support defines how its value is preserved.

Lifecycle support includes:

- Technical service

- Spare parts

- Upgrades and retrofits

- Performance optimization

Without strong lifecycle support, asset value erodes steadily.

CFB Boilers as Long-Life Assets

CFB boilers typically operate for 25–40 years.

Over this period:

- Fuels change

- Regulations tighten

- Components age

Lifecycle support ensures the boiler remains competitive and compliant.

Knowledge Retention Through Lifecycle Support

Original design knowledge fades over time.

Strong suppliers:

- Retain design data

- Maintain engineering continuity

- Support troubleshooting decades later

This knowledge retention is invaluable during major events or modifications.

Fuel Evolution and Lifecycle Value

Fuel flexibility is a key advantage of CFB technology.

Lifecycle support enables:

- Fuel switching

- Co-firing strategies

- Optimization under new fuel conditions

Suppliers without lifecycle capability cannot unlock this value fully.

Regulatory Change and Retrofit Readiness

Environmental regulations rarely remain static.

Lifecycle support includes:

- Emission upgrade planning

- Integration of new control technologies

- Permit support

Proactive suppliers protect asset value by anticipating change.

Maintenance Strategy Optimization

CFB boilers require specialized maintenance planning.

Lifecycle support improves:

- Inspection intervals

- Wear prediction

- Spare parts strategy

Optimized maintenance reduces downtime and cost.

Digital Tools and Long-Term Performance

Modern lifecycle support increasingly uses digitalization.

Advanced suppliers offer:

- Performance monitoring

- Predictive maintenance

- Remote diagnostics

These tools enhance availability and efficiency over time.

Spare Parts and Obsolescence Management

Over decades, components become obsolete.

Lifecycle support addresses:

- Replacement planning

- Retrofit solutions

- Backward compatibility