Financing and Incentive Options for Circulating Fluidized Bed Boiler Purchases

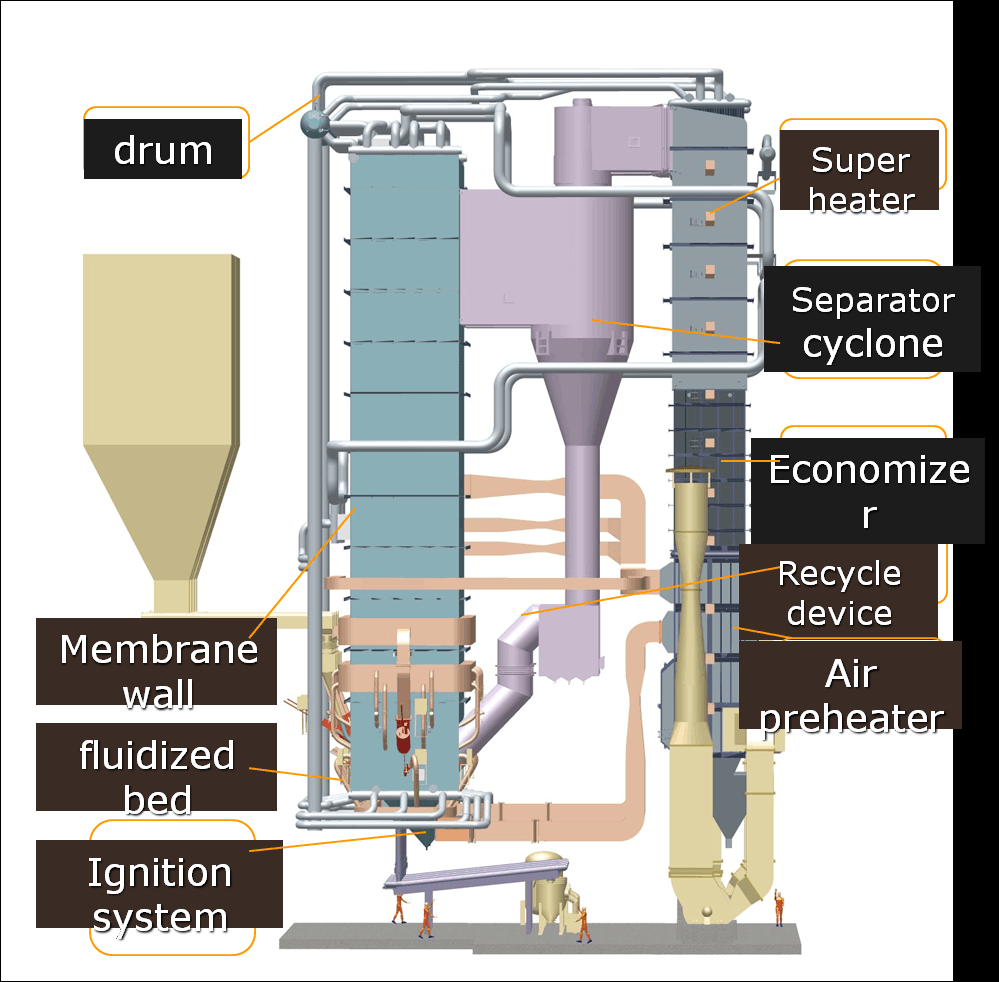

Circulating Fluidized Bed (CFB) boilers are advanced combustion systems known for their fuel flexibility, low emissions, and high efficiency. They are ideal for industrial users and power generators looking to burn a wide range of fuels—such as coal, biomass, and waste—while complying with environmental regulations. However, CFB boilers typically involve higher upfront costs due to their sophisticated design and auxiliary systems. To offset these expenses and improve investment viability, businesses can explore a variety of financing and incentive mechanisms.

Financing and incentive options for CFB boiler purchases include industrial equipment loans, leasing programs, green infrastructure financing, energy transition funds, emissions reduction grants, and performance-based contracts. In many regions, government subsidies, low-interest loans, or public-private partnership (PPP) models support clean combustion technologies like CFB—especially when they help lower SOx, NOx, and CO₂ emissions. The availability of such programs depends on fuel type, boiler size, and local environmental targets.

Here’s how you can explore and benefit from available financing and incentive options for your CFB boiler project.

What Commercial Financing Options Are Available for CFB Boiler Procurement (Loans, Leases, EPC)?

Circulating Fluidized Bed (CFB) boilers are high-efficiency, fuel-flexible systems widely used in coal, biomass, and waste-fired power generation. However, due to their complexity, emissions controls, and large scale, CFB boilers represent major capital investments, often exceeding $50 million for utility-size installations. Procuring such equipment without a viable financing strategy can delay projects or impair cash flow. Fortunately, multiple commercial financing mechanisms—such as asset-backed loans, capital leases, and EPC/turnkey financing models—are available to support CFB boiler procurement.

Commercial financing options for CFB boiler procurement include long-term project loans from banks or development institutions, equipment leases with purchase options, and EPC-backed financing models such as deferred payment contracts or build-own-operate-transfer (BOOT) structures. These tools reduce upfront capital burden, align payments with commissioning or cash flows, and are tailored for industrial and utility-scale deployments.

Understanding these financing routes allows developers, EPCs, and energy buyers to execute projects without tying up working capital or incurring major early-stage equity risk.

CFB boiler procurement can be financed using structured commercial loans and lease models.True

These large-scale industrial assets qualify for project-level financing or leasing based on performance guarantees and purchase contracts.

Let’s examine each major financing model and its advantages.

💰 1. Commercial Term Loans (Asset-Backed or Project-Based)

Definition: Loans provided by banks, export-import banks, or development finance institutions (DFIs), secured by the boiler asset or project cash flow.

| Feature | Details |

|---|---|

| Loan Size | $10M–$200M |

| Term | 7–20 years |

| Security | Project assets, PPAs, parent guarantees |

| Sources | IFC, local banks, EXIM banks, green finance agencies |

| Repayment | Monthly/quarterly during operation phase |

Suitable For:

Government utilities

IPPs (Independent Power Producers)

Heavy industry boilers with long-term steam/heat contracts

📃 2. Capital Leases or Operating Leases

Definition: Equipment vendors or financiers lease CFB boiler systems with structured payments over time; ownership may transfer at end-of-term.

| Lease Type | Term | Ownership | Accounting |

|---|---|---|---|

| Capital Lease | 10–15 years | Buyer at end | On-balance sheet |

| Operating Lease | 5–10 years | Lessor | Off-balance sheet (for lessee) |

| Key Benefits |

|---|

| Lower upfront cost (typically 5–20%) |

| Payments aligned with steam production or revenue |

| Flexible buyout options at term-end |

Example: A paper mill leases a $15M CFB system over 12 years, paying ~$150k/month instead of full CAPEX up front.

Leasing options are not available for utility-scale boilers.False

CFB boilers can be leased through specialized energy infrastructure lessors or OEM-linked finance divisions.

🏗️ 3. EPC-Backed Deferred Payment Models

Definition: Boiler vendor or EPC firm builds and installs the system, with full or partial payment deferred post-commissioning.

| EPC Model | Payment Structure | Notes |

|---|---|---|

| Turnkey EPC + Deferred Payment | 10–30% upfront; 70–90% spread over 3–7 years | Financing arranged by EPC or third party |

| Build-Operate-Transfer (BOT) | EPC owns/operates until client repays | Used in public-sector infrastructure |

| Build-Own-Lease-Transfer (BOLT) | EPC leases unit to client during operation | Minimizes client financial exposure early on |

This is ideal for:

Municipal or state-owned thermal power plants

Industrial users with multi-year fuel cost savings

📊 Comparison Table: CFB Boiler Commercial Financing Options

| Financing Model | Upfront Payment | Ownership | Typical Use Case |

|---|---|---|---|

| Bank Loan | 0–20% | Immediate | Private utilities, industrial firms |

| Capital Lease | 5–15% | End-of-term | Manufacturers, food/bev plants |

| Operating Lease | <5% | Lessor holds | PPP or cost-avoidance structures |

| EPC + Deferred Payment | 10–30% | At transfer | Utility and public-sector projects |

| BOOT Model | Zero | EPC owns | Long-term concessions (10–30 years) |

EPC contractors often include deferred payment structures in large boiler projects.True

To win contracts and ease financing, EPCs increasingly offer deferred or performance-tied payment models to reduce client capital burden.

✅ Financing Optimization Strategies

Bundle EPC + O&M: Combine operations with equipment financing for lower risk

Leverage government incentives: Apply clean energy funds or tax breaks for biomass co-firing CFBs

Use PPAs or off-take contracts: Strengthen bankability of loan models

Explore vendor-linked financing: Many boiler OEMs offer lease or loan packages through finance divisions

Apply multilateral climate funds: CFB retrofits often qualify for emissions reduction financing

🔚 Summary

CFB boiler procurement can be financed through a range of commercial mechanisms, from traditional project loans to structured leases and EPC-backed payment plans. Each method is suited to different project types, client credit profiles, and risk-sharing preferences. By choosing the right model, developers can reduce upfront capital requirements, de-risk their balance sheets, and accelerate the deployment of high-efficiency boiler technology in power generation and industrial energy systems.

Are There Government Subsidies or Grants for Low-Emission or Multi-Fuel Boiler Technologies?

Low-emission and multi-fuel boilers—especially those using biomass, natural gas, or combined fuel sources—are rapidly gaining popularity in response to decarbonization mandates and rising fuel flexibility needs. Despite their advantages in emissions reduction and operational adaptability, these systems often involve higher upfront capital due to emissions controls, fuel handling infrastructure, or hybrid burner technology. Fortunately, many government and regional programs offer grants, rebates, and tax incentives to support adoption of these advanced boiler technologies in both industrial and commercial sectors.

Yes, government subsidies and grants are available for low-emission and multi-fuel boiler technologies across several regions, including the U.S., U.K., Canada, and parts of the EU. These programs provide direct capital grants (up to 40–100% of installation cost), tax relief (such as zero-VAT), or utility rebates to encourage cleaner heat generation. Qualified systems typically include biomass boilers, hybrid gas-biomass boilers, and circulating fluidized bed (CFB) units with emissions control.

These subsidies reduce financial barriers, accelerate project timelines, and are often bundled with energy efficiency or renewable heat initiatives.

Governments offer funding programs to promote low-emission and multi-fuel boiler installations.True

To meet climate targets and reduce fossil dependency, many countries fund the transition to efficient, clean boiler systems.

🌍 Overview of Active Subsidy Programs by Region

| Region | Program Name | Target Boiler Types | Key Benefits |

|---|---|---|---|

| USA – Federal | EECBG (DOE) | Low-NOx gas, biomass, hybrid | Funding for municipal and tribal energy upgrades |

| USA – State | PUC Biomass Grants (NH, ME) | Pellet/wood chip boilers | 30–40% rebates, up to $65,000 |

| Canada – Québec | Énergir Incentives | High-efficiency gas and hybrid boilers | Rebate for equipment and installation |

| UK – National | Boiler Upgrade Scheme (BUS) | Biomass boilers (rural, off-grid) | £5,000 upfront capital grant |

| UK – National | Zero VAT Relief | Biomass, hybrid boilers | 5-year VAT exemption on eligible installs |

| EU – Local/EU Funds | ERDF, Just Transition Fund | CFB, biomass CHP, district heat | 40–100% cost grants via regional authorities |

Biomass boilers and hybrid fuel boilers are excluded from UK government incentive schemes.False

Biomass systems qualify under the Boiler Upgrade Scheme and zero-VAT installation policy in eligible rural and off-grid zones.

🧾 Eligibility Criteria and Application Guidelines

Most programs require:

Certified equipment (EN303-5 Class 5, EPA Step 2, etc.)

Approved contractors or installers (e.g., MCS in the UK)

Proof of emissions reduction (e.g., NOx, SOx, CO₂ targets)

Feasibility or energy audit documentation

Sustainable fuel sourcing (FSC, ENplus, ISCC-certified biomass)

Industrial and commercial facilities, especially in rural, off-grid, or high-emission sectors (e.g., food processing, district heating), are often prioritized.

Low-emission boiler projects must meet strict emissions and installation standards to qualify for subsidies.True

Most government grants require documented compliance with emissions, efficiency, and certified installation standards.

📊 Example Incentive Scenarios

| Project Type | Boiler Tech | Grant Program | Subsidy Value |

|---|---|---|---|

| Food factory in Québec | High-efficiency gas boiler | Énergir | $50,000+ rebate |

| School district in Maine | Biomass boiler | PUC Biomass Grant | 30–40% CAPEX funded |

| Public building in rural UK | Biomass pellet boiler | Boiler Upgrade Scheme | £5,000 upfront |

| EU-funded district heating retrofit | CFB hybrid boiler | Just Transition Fund | 60–100% installation grant |

✅ How to Maximize Grant Success

Apply early—many programs operate on first-come, first-served or annual cycles.

Bundle energy efficiency upgrades (e.g., insulation, digital controls) to enhance scoring.

Ensure third-party emissions validation to prove compliance.

Combine with PACE or green financing for cost stacking.

Use experienced grant writers or consultants to navigate documentation.

You must pay 100% of installation cost upfront to access government boiler grants.False

Most grants disburse funds during or after project milestones; many offer partial upfront support or reimbursements.

🔚 Summary

Government and regional subsidies for low-emission and multi-fuel boiler technologies are widely available, with programs offering grants, tax relief, and performance-based incentives to reduce capital burden and promote clean heat adoption. Whether you’re a commercial energy manager, municipal utility, or industrial plant operator, tapping into these resources can cut boiler investment costs by 30–70% and fast-track your transition to a more sustainable heating future.

How Can Energy Transition and Climate Mitigation Funds Support CFB Investments?

Circulating Fluidized Bed (CFB) boilers are among the most advanced combustion technologies for thermal power and industrial heat, offering high efficiency, fuel flexibility, and lower emissions. Despite their technical advantages, these systems face high capital intensity and emissions compliance costs, particularly when designed to co-fire biomass, incorporate flue gas desulfurization (FGD), or support carbon capture. Energy transition and climate mitigation funds—including multilateral development programs and national green banks—can dramatically enhance the financial viability of CFB projects.

Energy transition and climate mitigation funds support CFB boiler investments by providing concessional loans, capital grants, risk guarantees, and co-financing mechanisms that reduce project cost, improve bankability, and accelerate deployment of low-emission thermal technologies. These funds target industrial decarbonization, biomass adoption, and emissions control retrofits—areas where CFB boilers are uniquely effective.

These financial tools are essential to closing the investment gap for clean heat infrastructure in both developed and emerging economies.

CFB boilers qualify for climate finance if designed to lower emissions or support biomass fuels.True

Projects that reduce fossil fuel dependency or integrate clean technologies are eligible under most climate fund eligibility criteria.

🌍 1. Multilateral Climate Funds

| Fund | Scope | Role in CFB Projects |

|---|---|---|

| Climate Investment Funds (CIF) | Industrial decarbonization | Grants, soft loans for hybrid CFB boilers |

| Green Climate Fund (GCF) | Mitigation in developing countries | Biomass or co-firing CFB funding support |

| Just Energy Transition Partnership (JETP) | Coal transition programs | CFB retrofit or biomass switch |

| Global Environment Facility (GEF) | Clean energy, emissions reduction | Fuel-flexible boiler and FGD projects |

Example:

In South Africa, CIF pledged over $500M for clean industrial heat, including biomass-compatible boilers and low-emission CHP plants—formats ideal for CFB integration.

🏦 2. National Green Banks and Catalytic Finance

| Institution | Country | Support Type |

|---|---|---|

| Green Investment Group | UK/global | Equity co-investment in CFB systems |

| Green Climate Fund Korea | Korea | Programmatic finance for clean heat |

| Climate Catalyst Fund (CA) | USA | Loan guarantees for emissions control retrofits |

| SIDBI Green Finance (India) | India | Concessional finance for industrial biomass |

These agencies provide credit enhancement, first-loss capital, and public-private leverage to derisk complex CFB procurement plans.

Green banks and transition finance agencies offer loan guarantees for low-emission boiler technologies.True

Many national and regional institutions support energy transition infrastructure by de-risking investments in industrial heat systems.

📊 Lifecycle Cost Impact of Climate Finance

| Scenario | Without Climate Funds | With Climate Funds |

|---|---|---|

| CAPEX (100 MW CFB Boiler) | $80 million | $60 million (25% grant) |

| Carbon Credit Income | None | $1.5M/year |

| Blended Loan Interest | 9% | 4% |

| Payback Period | 10 years | 5.5 years |

| NPV (20 yrs, 8%) | $62 million | $105 million |

These improvements cut financial risk, enhance ROI, and attract private lenders.

✅ How to Access Energy Transition and Climate Funds

Align project goals with fund mandates (emissions reduction, renewable integration)

Use certified project developers or climate consultants

Prepare emissions baselines and mitigation impact models

Apply through accredited entities (e.g., UNDP, World Bank, national energy agencies)

Leverage bundled finance (climate grant + commercial loan + carbon revenue)

Only solar and wind projects qualify for international climate mitigation funds.False

Climate finance supports any technology—including CFB boilers—that reduces carbon emissions, replaces fossil fuels, or enables clean energy transitions.

🔚 Summary

Energy transition and climate mitigation funds are powerful enablers for CFB boiler investments. These funds lower upfront capital, reduce financing costs, and increase access to international clean energy programs. Whether it’s a biomass conversion, a hybrid fuel boiler installation, or a coal plant retrofit, CFB projects aligned with emissions reduction goals can secure climate finance to transform their economics and fast-track implementation. For industrial users and utilities, tapping into these funds is not just an option—it’s a strategic imperative.

What Role Do Carbon Credits, RECs, or Clean Energy Incentives Play in Project Payback?

Circulating Fluidized Bed (CFB) boilers are known for their fuel flexibility, low emissions, and adaptability to biomass or hybrid fuels. However, the high capital costs of these systems—especially when integrated with flue gas desulfurization (FGD), selective catalytic reduction (SCR), and other emissions controls—require a robust financial strategy to ensure investment viability. One of the most effective methods to accelerate payback and improve ROI is by leveraging carbon credits, Renewable Energy Certificates (RECs), and clean energy grants. These tools reduce net capital expenditure, improve cash flow, and enable CFB boiler projects to compete favorably with conventional fossil-based systems.

Carbon credits, RECs, and clean energy incentives significantly enhance project payback for CFB boilers by creating additional revenue streams, reducing net emissions costs, and lowering upfront capital through grants or tax relief. Depending on region and emissions savings, these mechanisms can shorten payback by 30–60% and increase internal rates of return by leveraging the boiler’s renewable or low-emission characteristics.

Whether a plant is co-firing biomass, switching from coal, or deploying CFB in a greenfield site, these incentives play a pivotal role in lifecycle financial modeling.

CFB boiler projects can generate carbon credits and qualify for renewable energy incentives.True

Because CFB boilers reduce net CO₂ emissions and support biomass co-firing, they meet eligibility criteria for many global carbon and clean energy support programs.

🌿 1. Carbon Credits and Emissions Markets

CFB boilers operating with biomass or waste-derived fuels emit significantly less CO₂ per MWh, and in many cases qualify for:

| Program | Eligible Projects | Revenue Potential |

|---|---|---|

| EU ETS / Canada OBPS | Biomass-cofired or coal-switch CFBs | €50–€110/tCO₂ |

| Voluntary Carbon Markets (VERs) | Verified co-firing, avoided fossil use | $2–$15/tCO₂ |

| CDM / Gold Standard (legacy) | Developing nation CFB projects | $1–$10/tCO₂ |

Example:

A 100 MW CFB boiler reducing 20,000 tCO₂/year at $60/t yields $1.2 million in annual carbon revenue—directly offsetting fuel or debt costs.

CFB boilers co-firing biomass can earn carbon offset revenue under emissions trading schemes.True

These projects lower net carbon intensity, qualifying for carbon credit issuance in both compliance and voluntary markets.

🔌 2. RECs and Thermal Renewable Energy Credits (T-RECs)

CFB systems producing electricity (or heat in district heating applications) from renewable fuels qualify for:

| REC Type | Description | Value (USD/MWh) |

|---|---|---|

| Electricity RECs | Biomass-fired or hybrid CHP | $5–$25 |

| T-RECs (e.g., Massachusetts, NH) | Renewable thermal output | $10–$30 |

| Compliance RECs (RPS markets) | Obligated utilities purchase RECs | Higher spot prices in peak demand seasons |

These certificates are monetized through regional trading systems or sold to aggregators/utilities.

Annual REC revenue for a 50 MW biomass CFB CHP plant can exceed $1 million.

Only wind and solar systems qualify for RECs.False

Biomass and hybrid CFB boiler projects qualify in most U.S. states and EU countries with renewable portfolio standards.

💰 3. Clean Energy Incentives and Capital Grants

Government subsidies and tax benefits are often available for CFB deployments that:

Co-fire biomass

Replace aging coal systems

Integrate emissions controls

| Program | Region | Incentive Type |

|---|---|---|

| Boiler Upgrade Scheme (UK) | UK | £5,000–£10,000 per installation |

| EECBG (U.S. DOE) | U.S. | Infrastructure grants for low-carbon energy |

| Énergir (Canada) | Québec | Up to $500,000 for high-efficiency boilers |

| Just Transition / ERDF | EU | 40–100% installation cost covered |

These programs reduce CAPEX and shorten loan payback timelines.

📊 Payback Impact Comparison

| Scenario | Without Incentives | With Carbon Credits & RECs |

|---|---|---|

| CAPEX | $50 million | $50 million |

| Annual OPEX | $5 million | $5 million |

| Carbon & REC Revenue | $0 | $2.5 million/year |

| Payback Period | 11 years | 5.5 years |

| NPV (15 years, 8%) | $35 million | $68 million |

Carbon and energy certificates can cut payback time in half, substantially improving investment appeal.

✅ Developer Best Practices

Register boiler output in REC and carbon registries before commissioning.

Use verified emissions monitoring systems (CEMS) to support credit generation.

Partner with aggregators or brokers for REC monetization.

Bundle with green bonds or ESG-linked loans to improve financing terms.

Clean energy incentives are essential for CFB projects competing with conventional fossil boilers.True

These incentives help bridge the upfront cost gap and improve competitiveness of low-emission CFB technologies.

🔚 Summary

Carbon credits, RECs, and clean energy subsidies are not just financial bonuses—they are strategic tools that transform the economics of CFB boiler projects. By monetizing emissions reductions, qualifying for renewable energy incentives, and reducing capital costs, these mechanisms can cut payback times by half or more. For project developers, utilities, and investors, leveraging these incentives is critical to ensure the bankability and profitability of next-generation fluidized bed combustion systems.

How Can ESCO Models or Public-Private Partnerships Reduce Upfront Capital Costs?

Circulating Fluidized Bed (CFB) boilers are advanced, capital-intensive systems that offer significant efficiency and emissions control benefits. However, these technologies require substantial upfront investment—often tens to hundreds of millions of dollars—posing a challenge for utilities, industries, and municipalities. ESCO (Energy Service Company) models and Public‑Private Partnerships (PPPs) offer innovative financing structures that significantly reduce or eliminate the need for upfront capital, aligning payments with achieved performance and cash-flow improvements.

⚙️ 1. ESCO Models (Performance-Based Contracting)

An ESCO provides turnkey services—design, installation, financing, operation, and maintenance—under a performance-based contract, typically structured in one of two ways (reddit.com, iea.org):

Guaranteed Savings Model

The client receives minimal upfront cost. The ESCO finances the project or the client secures a loan with ESCO-backed guarantees. The ESCO guarantees energy cost savings; any shortfall is reimbursed by the ESCO (iea.org).Shared Savings Model

ESCO fully finances and implements the CFB system. The client pays nothing at start; instead, savings in fuel and operations are shared with the ESCO over the contract term until full repayment (iea.org).

In both models:

The ESCO assumes technical, performance, and sometimes financial risk.

Financing is often off-balance sheet, preserving the client’s borrowing capacity (e3p.jrc.ec.europa.eu).

Contracts span 10–20 years, matching the lifecycle of performance savings (iea.org).

For CFB boilers, this means:

Zero to low upfront payment for plant owners

Payments tied to the proven impact—fuel efficiency, emission reductions

Full CFB system included (boiler, controls, emissions mitigation)

🤝 2. Public-Private Partnerships (e.g., BOOT, BOT)

PPPs allocate design, build, finance, operate, and ownership responsibilities between public and private parties:

BOT (Build-Operate-Transfer) contracts involve private entities building and operating the CFB plant, recouping costs via heat/energy payments, then transferring ownership at term end (interregeurope.eu, oneplace.fbk.eu).

BOOT (Build-Own-Operate-Transfer) offers extended ownership before transfer, often used in concession-based energy projects (oneplace.fbk.eu).

Benefits for plant owners include:

No or minimal upfront financing

Transferred construction, operational, and performance risk

Private-sector optimization and innovation

📊 Comparison of Financing Structures

| Financing Model | Upfront Capital | Risk Allocation | Ownership Timing |

|---|---|---|---|

| Guaranteed Savings ESCO | Low (<10%) | ESCO technical; client financial | Immediate (client-funded) |

| Shared Savings ESCO | None | ESCO both technical and financial | Deferred |

| BOT/BOOT PPP | None | Private assumes most risks | After 10–30 years |

📈 Real-World ESCO/PPP CFB Applications

Municipal heating upgrades in Poland: a €750,000 boiler financed via ESCO-PPP, no upfront owner funds, paid via heat charges (pmc.ncbi.nlm.nih.gov, en.wikipedia.org, en.wikipedia.org, interregeurope.eu, mdpi.com, mdpi.com, oneplace.fbk.eu, en.wikipedia.org).

ESCO Performance Contracts globally: widely exploited in buildings and infrastructure; adaptable to district heat or industrial CFB applications .

Super ESCO Aggregation: national-level ESCOs aggregate multiple boiler projects, optimizing financing and lowering transaction costs .

✅ Advantages for CFB Boiler Projects

Minimized upfront capital frees institutional or corporate budgets for other uses.

Aligned payment mechanisms—pay from verified fuel savings and emissions gains.

Risk transfer—design, performance, operations borne by private partner.

Mature models—common structures in global markets for energy-intensive infrastructure.

🔚 Summary

Deploying ESCO models or PPP frameworks with CFB boilers allows project owners to effectively avoid large upfront capital outlays, transfer key project risks, and align payments to actual operational performance. Whether through guaranteed savings, shared savings, or BOT/BOOT agreements, these structures can make cutting-edge clean-combustion boilers financially accessible and strategically strong investments.

What Documentation Is Required to Qualify for Financing and Government Incentives?

Circulating Fluidized Bed (CFB) boilers are widely adopted for industrial and utility-scale power due to their fuel flexibility, high combustion efficiency, and emissions control capabilities. However, these systems often require significant capital investment and regulatory compliance. To offset upfront costs and align with climate goals, many CFB projects pursue clean energy grants, carbon funding, or green financing. Successfully securing these incentives depends on thorough and standardized documentation to prove environmental benefits, technical feasibility, and financial reliability.

To qualify for financing and government incentives for CFB boiler projects, applicants must prepare documentation that includes feasibility studies, engineering designs, emissions projections, sustainability certifications, project financial models, and regulatory approvals. These documents validate the project’s environmental impact, technical soundness, and bankability—critical for accessing grants, loans, and carbon-linked benefits.

This documentation enables lenders, regulators, and grant agencies to evaluate eligibility and quantify emissions reductions or energy efficiency improvements.

CFB boiler projects must submit technical, financial, and environmental documentation to qualify for incentives or funding.True

Governments and financing institutions require a complete review of project viability, emissions performance, and cost-benefit alignment to approve incentives or capital support.

📄 1. Technical Documentation and Feasibility Study

| Document | Purpose | Required For |

|---|---|---|

| Feasibility Report | Confirms technical justification of CFB over alternatives | All major grants and green loans |

| Engineering Drawings | Boiler specifications, piping, emissions systems | EPC financing, permit approval |

| Heat & Load Demand Profile | Demonstrates efficiency and system fit | ESCO contracts, shared savings models |

| Performance Guarantees (OEM) | Minimum efficiency and emissions thresholds | Performance-based incentives |

A detailed feasibility study is necessary for CFB boiler grant and loan applications.True

Lenders and agencies must verify that the system is technically suitable and offers measurable emissions or energy improvements.

🌫️ 2. Emissions & Environmental Compliance Records

| Document | Description | Linked Requirement |

|---|---|---|

| Air Quality Impact Assessment | Modeled NOₓ, SO₂, CO₂ emissions under operation | Environmental permitting, carbon credit eligibility |

| CEMS Plan or Emissions Baseline | Monitoring strategy and baseline vs. project | Voluntary carbon or ETS registration |

| FGD/SCR Control Diagrams | Confirm presence of SO₂ and NOₓ mitigation | Incentives targeting pollution reduction |

| Permit Approvals (Air, Water, Solid) | Local/state environmental authority approvals | Prerequisite for most government programs |

🌱 3. Fuel Supply and Sustainability Verification

| Document | Purpose | Incentive Use |

|---|---|---|

| Fuel Contract / Supply Agreement | Demonstrates secure access to feedstock | Project risk assessment |

| Sustainability Certification | ENplus, FSC, ISCC (for biomass) | Required for biomass grants and RECs |

| Fuel Emissions Profile | Calculated CO₂ impact per MJ or MWh | Carbon credit methodology registration |

Sustainable biomass sourcing documentation is required for CFB projects seeking renewable fuel incentives.True

Most biomass-based CFB systems must provide proof of certified feedstock to access RECs and green funding.

💰 4. Financial and Business Model Documents

| Document | Use | Applies To |

|---|---|---|

| CAPEX/OPEX Model | Project cost structure and LCOE | Loan underwriting, subsidy calculation |

| Cash Flow Forecast | Payback, IRR, NPV analysis | All financial incentives and blended finance |

| ESCO Contract / PPP Framework | Third-party investment structure | Performance-based grants or lease models |

| Creditworthiness Evidence | Tax returns, financial audits, credit rating | Bank loans, government co-finance programs |

🗂️ 5. Application-Ready Submission Checklist

| Item | Included |

|---|---|

| Feasibility Report | ✅ |

| OEM Boiler Specification Sheets | ✅ |

| Emissions Compliance Documents | ✅ |

| Fuel Sustainability Certificates | ✅ |

| Grant/Loan-Specific Forms | ✅ |

| PPA or Offtake Agreement (if applicable) | ✅ |

| Letter of Support from Stakeholders | Optional but recommended |

📈 CFB Boiler Incentive Qualification Flow

flowchart TD

A[Technical Feasibility] --> B[Environmental Impact Analysis]

B --> C[Fuel Sustainability Verification]

C --> D[Financial Model Submission]

D --> E[Grant or Loan Application]

E --> F{Approval}

✅ Best Practices for Fast Approval

Use templates or application guides from relevant agencies (DOE, GCF, CIF, etc.)

Bundle sustainability certifications early—especially for biomass fuels

Partner with certified EPCs or ESCOs for pre-validated documentation

Use third-party consultants to validate emissions models

Submit applications in digital and editable formats where required

🔚 Summary

To qualify for CFB boiler financing and government incentives, applicants must present a well-documented project case covering engineering design, emissions compliance, sustainable fuel sourcing, and financial feasibility. These materials not only satisfy regulatory and funder requirements but also increase the credibility, speed, and success of funding approvals. Whether seeking a climate grant, clean heat subsidy, or EPC loan, complete documentation is the backbone of a bankable CFB project.

🔍 Conclusion

Although Circulating Fluidized Bed boilers require substantial upfront capital, they often qualify for a range of financial supports and incentives thanks to their low-emission performance and fuel versatility. Whether your goal is to reduce compliance costs, lower your carbon footprint, or replace outdated systems, combining strategic financing with environmental subsidies can dramatically improve your CFB boiler project’s affordability and ROI.

📞 Contact Us

💡 Need guidance on financing or incentive programs for your CFB boiler? Our experts provide project consulting, emissions compliance planning, and funding application support to help secure your investment.

🔹 Let us help you finance a CFB boiler system that’s efficient, compliant, and cost-effective for the long term. 🔄🔥💰

FAQ

What financing options are available for purchasing a CFB boiler?

Due to the high capital cost of Circulating Fluidized Bed (CFB) boilers, common financing options include:

Capital equipment loans from banks or energy lenders

Lease-purchase agreements or equipment leasing programs

Vendor financing through boiler manufacturers or EPCs

Energy Performance Contracts (EPCs) for efficiency-focused industrial facilities

Green bonds or clean energy financing, if renewable fuels are involved

These help spread costs over the boiler’s 20–30 year lifespan and improve cash flow.

Are CFB boilers eligible for any tax deductions or depreciation incentives?

Yes. Applicable tax-related incentives include:

Section 179 Deduction for immediate capital depreciation

Modified Accelerated Cost Recovery System (MACRS) for long-term depreciation

Investment Tax Credit (ITC) may apply if CFB boilers are co-fired with biomass or waste fuels

Tax savings can significantly offset upfront capital costs.

Can CFB boiler systems qualify for environmental or emissions funding?

Yes, especially if the project includes:

SO₂/NOx control technologies (e.g., SNCR, FGD)

Low-emission design features

Carbon neutrality via biomass co-firing

Potential sources include:EPA clean air improvement grants

State emissions reduction programs

Utility-funded emissions rebates or low-interest loans

Are there renewable energy incentives for biomass-compatible CFB systems?

Absolutely. When CFB boilers use biomass, RDF, or agricultural waste:

They may qualify for USDA REAP funding, state renewable heat incentives, or carbon offset credits

Renewable Energy Certificates (RECs) or carbon credits can be monetized or traded

This dual eligibility improves project economics and return on investment (ROI).

Where can businesses find relevant CFB boiler funding programs?

Search the DSIRE database for federal and state programs – https://www.dsireusa.org

Explore USDA, DOE, or EPA funding tools

Consult boiler vendors, EPC contractors, or industrial energy consultants who often help secure funding and prepare documentation

References

DSIRE Incentives for Industrial Systems – https://www.dsireusa.org

Section 179 and MACRS Capital Deduction Guidelines – https://www.section179.org

USDA REAP for Renewable Biomass Projects – https://www.rd.usda.gov

EPA Clean Air Technology Incentives – https://www.epa.gov

IEA Reports on Advanced CFB Boiler Efficiency – https://www.iea.org

Boiler Leasing and Performance Contracting Options – https://www.naesco.org

Energy Efficiency Loan Programs – https://www.energy.gov

Carbon Credit and REC Trading Platforms – https://www.bioenergyconsult.com

Utility and Industrial Emissions Funding Opportunities – https://www.energystar.gov

ASME Standards and Project Financing for CFB Systems – https://www.asme.org