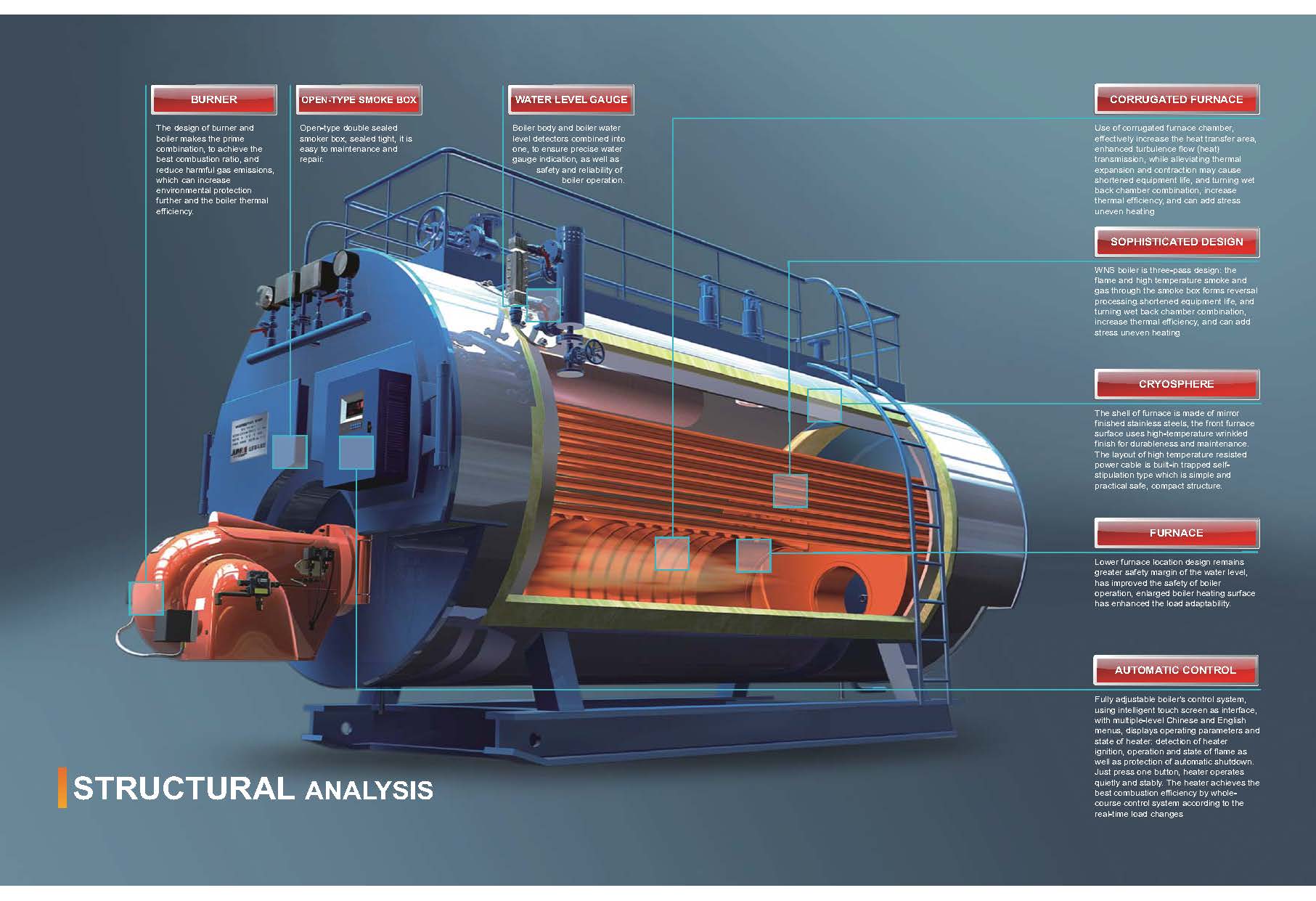

Industrial oil-fired boilers are widely used for their high heat output, stable combustion, and fast response, especially in regions with reliable oil supply. However, rising fuel prices, environmental regulations, and long-term operating expenses often raise concerns about their true lifecycle cost-effectiveness. Evaluating only the initial investment can be misleading, as the long-term economics depend on multiple operational and regulatory factors.

In the long run, industrial oil-fired boilers can be cost-effective when applied in the right scenarios—such as backup systems, peak-load operation, or locations with stable oil pricing. While fuel costs are generally higher than gas or biomass, oil-fired boilers offer lower initial capital cost, compact installation, high reliability, and flexible operation. With high-efficiency burners, heat recovery systems, and proper maintenance, their total lifecycle cost can remain competitive over a 10–20 year service life.

A lifecycle-based evaluation helps determine whether oil-fired boilers provide economic and operational value for specific industrial applications.

How Do Fuel Price Volatility and Oil Supply Affect Long-Term Operating Costs?

For industries relying on oil-fired boilers, fuel cost uncertainty is often the single largest threat to long-term operating stability. Unlike capital expenditure, which is fixed at the time of purchase, fuel costs are exposed to global oil markets, geopolitical disruptions, logistics constraints, and policy-driven shocks. Many boiler projects appear economically sound during feasibility studies, only to become cost burdens when oil prices spike or supply chains tighten. Ignoring fuel price volatility and oil supply risk can therefore undermine even the most efficient boiler system, turning predictable energy costs into a source of sustained financial pressure.

Fuel price volatility and oil supply conditions have a dominant influence on long-term boiler operating costs because fuel typically represents 50–75% of total lifecycle expenditure for oil-fired systems. Price fluctuations, supply disruptions, and logistics constraints can increase lifetime operating costs by 30–100% compared with base-case assumptions, making fuel strategy as important as boiler efficiency in determining true cost-effectiveness.

Understanding this dynamic is essential for realistic lifecycle cost analysis and energy strategy planning.

Fuel price volatility has only a minor impact on long-term boiler operating costs.False

Fuel expenses dominate lifecycle cost and are highly sensitive to price fluctuations.

Oil supply stability directly affects the economic viability of oil-fired boilers.True

Supply disruptions and price spikes significantly increase operating cost.

The sections below explain in depth how fuel price volatility and oil supply shape long-term operating economics.

1. Fuel Cost Share in Oil-Fired Boiler Lifecycle Economics

Oil-fired boilers are particularly fuel-cost intensive.

| Cost Component | Typical Share of Lifecycle Cost |

|---|---|

| Initial boiler & installation | 10–20% |

| Fuel consumption | 50–75% |

| Operation & maintenance | 10–15% |

| Downtime & compliance | 5–10% |

Fuel cost is the largest contributor to oil-fired boiler lifecycle cost.True

Continuous fuel consumption over decades outweighs initial CAPEX.

This means even small fuel price changes have outsized long-term financial effects.

2. Nature of Oil Price Volatility

Oil prices are inherently volatile due to multiple external drivers.

| Volatility Driver | Impact Mechanism |

|---|---|

| Geopolitical conflict | Supply disruption |

| OPEC production policy | Price swings |

| Currency fluctuations | Import cost changes |

| Speculative trading | Short-term spikes |

| Environmental policy | Structural price pressure |

Oil prices are influenced more by global factors than local demand.True

International markets dominate oil pricing dynamics.

Industrial users have little control over these drivers.

3. Long-Term Cost Impact of Price Fluctuations

Price volatility compounds over time.

| Average Oil Price Scenario | 20-Year Fuel Cost Index |

|---|---|

| Stable low-price | 1.00 |

| Moderate volatility | 1.25 |

| High volatility with spikes | 1.50–2.00 |

Fuel price volatility can double long-term operating cost.True

Repeated price spikes compound fuel expenditure.

This impact often exceeds the entire boiler purchase price.

4. Oil Supply Security and Availability Risk

Supply reliability is as critical as price.

| Supply Condition | Operational Impact |

|---|---|

| Stable domestic supply | Predictable operation |

| Import dependence | Exposure to logistics risk |

| Single-source supply | High vulnerability |

| Multi-source strategy | Reduced risk |

Oil supply disruptions directly threaten boiler operation continuity.True

Fuel shortages can force shutdowns regardless of boiler condition.

Supply risk translates into both direct cost and lost production.

5. Storage, Logistics, and Hidden Cost Amplifiers

Oil-fired systems depend on logistics infrastructure.

| Logistics Factor | Cost Impact |

|---|---|

| Limited storage capacity | Forced spot purchasing |

| Remote location | Higher transport cost |

| Seasonal supply constraints | Price premiums |

Insufficient fuel storage increases exposure to price spikes.True

Operators lose the ability to hedge or bulk-purchase fuel.

Infrastructure decisions strongly influence long-term fuel economics.

6. Interaction Between Boiler Efficiency and Fuel Volatility

High efficiency mitigates but does not eliminate volatility risk.

| Boiler Efficiency | Fuel Sensitivity |

|---|---|

| Low efficiency | Very high |

| Standard efficiency | High |

| High efficiency | Reduced but significant |

Higher boiler efficiency reduces exposure to fuel price volatility.True

Less fuel is consumed at any given price level.

Efficiency improvements act as a hedge, not a shield.

7. Comparison with Alternative Fuels

Oil volatility contrasts sharply with other fuels.

| Fuel Type | Price Stability |

|---|---|

| Heavy fuel oil | Low |

| Diesel | Low |

| Natural gas | Medium |

| Coal | Medium–high |

| Biomass | High (local sourcing) |

Oil-fired boilers face higher fuel price volatility than solid-fuel systems.True

Oil is globally traded and geopolitically sensitive.

This comparison is central to long-term energy strategy decisions.

8. Impact on Budgeting and Financial Planning

Volatile fuel costs complicate financial management.

| Financial Aspect | Impact |

|---|---|

| Operating budget | Unpredictable |

| Product pricing | Margin pressure |

| ROI forecasting | Reduced accuracy |

| Financing risk | Higher perceived risk |

Fuel price volatility increases financial risk for boiler operators.True

Uncertain operating costs weaken predictability.

This risk often raises cost of capital indirectly.

9. Hedging, Contracts, and Risk Mitigation Limits

Some risk mitigation tools exist, but with limitations.

| Strategy | Limitation |

|---|---|

| Long-term fuel contracts | Limited availability |

| Financial hedging | Costly, complex |

| Strategic reserves | Capital-intensive |

Fuel hedging only partially mitigates oil price risk.True

Structural volatility cannot be fully eliminated.

Technical solutions alone cannot solve fuel market exposure.

10. Lifecycle Cost Comparison Example

| Scenario | 25-Year Total Cost Index |

|---|---|

| Oil-fired boiler, stable prices | 1.00 |

| Oil-fired boiler, volatile prices | 1.40–1.80 |

| Fuel-flexible or alternative fuel | 0.90–1.10 |

Fuel volatility can outweigh differences in boiler capital cost.True

Operating cost dominates lifecycle economics.

This explains why many plants reassess fuel strategy mid-life.

11. Strategic Implications for Boiler Selection

Fuel volatility drives strategic decisions such as:

- Fuel-flexible boiler design

- Dual-fuel or hybrid systems

- Transition pathways to alternative fuels

- Conservative lifecycle cost modeling

Fuel strategy should be considered as early as boiler selection.True

Design decisions lock in long-term cost exposure.

Ignoring this link is a common and costly mistake.

12. When Oil-Fired Boilers Remain Justified

Despite volatility, oil-fired boilers can still be viable when:

- Oil supply is locally abundant

- Short project lifespan is expected

- High operational flexibility is required

- Backup or peaking duty dominates

Oil-fired boilers can be economical in specific, well-defined scenarios.True

Context determines cost-effectiveness.

Careful boundary definition is essential.

Fuel price volatility and oil supply conditions are decisive factors in determining the long-term operating costs of oil-fired boilers. Because fuel expenses dominate lifecycle economics, exposure to global oil market fluctuations and supply disruptions can dramatically increase total cost of ownership—often by far more than initial capital differences between boiler options. While high efficiency, storage capacity, and hedging strategies can mitigate risk, they cannot eliminate it. For long-term projects, fuel strategy must be evaluated with the same rigor as boiler design, ensuring that operating cost assumptions remain realistic under volatile market conditions. In energy systems, stability—not just efficiency—defines true cost-effectiveness.

How Does Initial Capital Cost Compare with Gas- and Biomass-Fired Boilers?

When industrial users compare boiler options, the initial capital cost often becomes the first—and sometimes the only—decision criterion. Gas-fired boilers are frequently perceived as “cheap and simple,” biomass boilers as “expensive and complex,” and coal-fired systems as “somewhere in between.” While these generalizations are not entirely wrong, they are incomplete and often misleading. Capital cost is shaped not only by the boiler itself, but also by fuel handling systems, emission controls, civil works, automation, and regulatory compliance. Misunderstanding these differences can lead to incorrect technology selection and long-term economic disappointment.

In general, gas-fired boilers have the lowest initial capital cost, biomass-fired boilers have the highest, and coal-fired boilers fall in between. However, the capital cost gap is highly dependent on capacity, emission standards, fuel logistics, and project scope, and it does not reflect long-term cost-effectiveness or lifecycle value.

A clear, structured comparison is essential for making informed investment decisions.

Gas-fired boilers always have the lowest capital cost regardless of project conditions.False

Gas boiler CAPEX increases significantly with capacity, redundancy, and emission requirements.

Biomass boilers require higher upfront investment due to fuel handling and combustion complexity.True

Solid fuel systems require extensive auxiliary and material handling infrastructure.

The sections below compare initial capital cost drivers across gas-, biomass-, and coal-fired boiler systems in detail.

1. Baseline Capital Cost Comparison

At a high level, typical relative capital costs for industrial boilers are as follows.

| Boiler Type | Relative Initial CAPEX Index |

|---|---|

| Gas-fired boiler | 1.0 |

| Coal-fired boiler | 1.4–1.8 |

| Biomass-fired boiler | 1.6–2.2 |

Solid-fuel boilers require higher capital investment than gas-fired boilers.True

Fuel handling, ash systems, and larger furnaces increase cost.

This baseline comparison assumes similar steam capacity and pressure but does not yet account for site-specific factors.

2. Why Gas-Fired Boilers Have Lower Initial Cost

Gas-fired boilers benefit from fuel simplicity and compact design.

| Cost Driver | Gas-Fired Impact |

|---|---|

| Fuel handling | Minimal |

| Furnace size | Compact |

| Ash handling | None |

| Startup systems | Simple |

| Installation time | Short |

Gas-fired boilers are cheaper primarily due to simpler system configuration.True

Gaseous fuel eliminates material handling and ash systems.

As a result, gas boilers typically have lower equipment, civil, and installation costs.

3. Capital Cost Structure of Coal-Fired Boilers

Coal-fired boilers require more robust systems than gas but less than biomass in many cases.

| Coal Boiler Cost Component | CAPEX Share |

|---|---|

| Boiler island | 40–50% |

| Coal handling & storage | 15–20% |

| Ash handling | 10–15% |

| Emission control | 10–20% |

Coal-fired boiler capital cost is driven by balance-of-plant systems.True

Auxiliary systems often rival the boiler island cost.

Coal systems strike a balance between fuel cost advantage and capital complexity.

4. Why Biomass Boilers Have the Highest Initial Cost

Biomass fuels are bulky, variable, and often low in energy density.

| Biomass-Specific Requirement | CAPEX Impact |

|---|---|

| Large furnace volume | +10–20% |

| Extensive fuel storage | +10–15% |

| Complex fuel feeding | +5–10% |

| Robust ash handling | +10–15% |

| Corrosion-resistant materials | +5–10% |

Low energy density of biomass drives larger and more expensive boiler designs.True

More fuel volume must be processed for the same output.

These factors explain why biomass boilers carry higher upfront cost despite renewable benefits.

5. Effect of Capacity on Capital Cost Differences

Capital cost differences widen with increasing capacity.

| Steam Capacity Range | CAPEX Difference Trend |

|---|---|

| <20 t/h | Moderate |

| 20–75 t/h | Significant |

| >100 t/h | Very large |

Capital cost differences between boiler types increase with scale.True

Fuel handling and emission systems grow disproportionately at larger sizes.

Large biomass and coal projects require substantial infrastructure investment.

6. Emission Control Impact on Capital Cost

Emission standards can dramatically alter cost comparisons.

| Boiler Type | Emission CAPEX Sensitivity |

|---|---|

| Gas-fired | Low |

| Coal-fired | High |

| Biomass-fired | Medium–high |

Emission compliance costs narrow the capital cost gap between boiler types.True

Advanced controls add significant CAPEX to solid-fuel systems.

Under strict regulations, coal and biomass CAPEX can converge.

7. Fuel Infrastructure and Site Dependency

Fuel availability influences capital requirements.

| Fuel Situation | Capital Cost Effect |

|---|---|

| Existing gas pipeline | Lowest |

| No gas infrastructure | Gas CAPEX increases |

| Local biomass supply | Biomass CAPEX optimized |

| Imported biomass | Biomass CAPEX increases |

Site-specific fuel infrastructure strongly affects initial boiler cost.True

Infrastructure gaps must be filled with capital investment.

Capital cost must always be evaluated in local context.

8. Installation Time and Indirect Capital Costs

Indirect costs also differ significantly.

| Boiler Type | Typical Installation Time |

|---|---|

| Gas-fired | 6–9 months |

| Coal-fired | 12–18 months |

| Biomass-fired | 15–24 months |

Longer installation periods increase indirect capital cost.True

Extended construction ties up capital and increases financing cost.

This hidden cost often favors gas-fired systems in short-term projects.

9. Capital Cost vs. Scope Definition (EPC vs Supply-Only)

Project scope affects perceived CAPEX.

| Boiler Type | EPC Sensitivity |

|---|---|

| Gas-fired | Low |

| Coal-fired | Medium |

| Biomass-fired | High |

Turnkey EPC scope is more critical for solid-fuel boilers.True

System integration complexity is higher.

Poor scope definition disproportionately impacts biomass projects.

10. Example: Capital Cost Comparison for Similar Output

| Boiler Type | Relative Initial CAPEX |

|---|---|

| Gas-fired (natural gas) | 1.00 |

| Coal-fired (CFB) | 1.55 |

| Biomass-fired (wood chips) | 1.85 |

Gas-fired boilers offer the lowest upfront investment for equivalent output.True

Simpler systems reduce equipment and installation cost.

This comparison excludes fuel and operating cost considerations.

11. Why Initial Capital Cost Alone Is Misleading

Focusing only on CAPEX ignores key economic realities.

- Fuel cost dominance in lifecycle economics

- Carbon pricing and policy risk

- Fuel supply security

- Long-term operating stability

Lowest capital cost does not guarantee lowest total cost of ownership.True

Operating costs and risks dominate long-term economics.

This is especially true in long-life industrial boiler projects.

12. Strategic Interpretation of Capital Cost Differences

Initial capital cost should be interpreted as:

- An entry price to a fuel strategy

- A reflection of system complexity

- A proxy for future operating flexibility

Higher initial boiler cost can represent lower long-term risk.True

Fuel flexibility and compliance resilience add strategic value.

Capital cost must therefore be balanced against lifecycle objectives.

Initial capital cost differs significantly among gas-, coal-, and biomass-fired boilers. Gas-fired boilers typically offer the lowest upfront investment due to compact design and minimal auxiliary systems. Coal-fired boilers occupy a middle ground, balancing higher capital complexity with lower fuel cost potential. Biomass-fired boilers generally require the highest initial capital investment because of extensive fuel handling, larger furnaces, and material durability requirements. However, capital cost alone does not determine economic success. Long-term fuel pricing, supply security, emission compliance, and lifecycle operating costs often outweigh upfront differences. A rational boiler selection strategy evaluates capital cost as one component of a broader, lifecycle-focused investment decision.

What Role Does Boiler Efficiency and Heat Recovery Play in Lifecycle Economics?

In industrial energy projects, decision-makers often underestimate how profoundly boiler efficiency and heat recovery shape long-term economics. While capital cost is visible and immediate, inefficiencies quietly drain value year after year through excess fuel consumption, higher emissions, increased maintenance, and regulatory exposure. Many plants operate for decades, and even a small efficiency gap—often overlooked during procurement—can translate into millions in avoidable operating expenses over the boiler’s lifecycle. Understanding efficiency not as a technical metric but as an economic multiplier is essential for rational investment decisions.

Boiler efficiency and heat recovery directly determine lifecycle economics by controlling fuel consumption, emission-related costs, operating stability, and asset longevity. High-efficiency boilers equipped with effective heat recovery systems can reduce lifetime fuel costs by 10–30%, lower emission compliance expenses, and significantly improve return on investment compared with low-efficiency designs.

This makes efficiency one of the most powerful levers for improving total cost of ownership.

Boiler efficiency has limited impact on long-term operating costs.False

Fuel consumption dominates lifecycle cost and is directly tied to efficiency.

Heat recovery systems significantly improve boiler lifecycle economics.True

Recovered waste heat reduces fuel demand and emissions over decades.

The following sections explain in depth how boiler efficiency and heat recovery shape lifecycle economics from multiple technical and financial perspectives.

1. Lifecycle Cost Structure of Industrial Boilers

To understand the economic role of efficiency, lifecycle cost must be broken down clearly.

| Cost Component | Typical Share of Lifecycle Cost |

|---|---|

| Initial capital investment | 10–20% |

| Fuel consumption | 50–75% |

| Operation & maintenance | 10–15% |

| Emission compliance & downtime | 5–10% |

Fuel cost is the dominant factor in boiler lifecycle economics.True

Fuel expenses accumulate continuously throughout the operating life.

Efficiency primarily acts on the largest cost component: fuel.

2. Boiler Efficiency as a Fuel Cost Multiplier

Boiler efficiency determines how much useful steam or heat is produced per unit of fuel.

| Boiler Efficiency | Relative Fuel Consumption |

|---|---|

| 75% | 1.33 |

| 80% | 1.25 |

| 85% | 1.18 |

| 90% | 1.11 |

Small efficiency improvements yield large fuel savings over time.True

Fuel consumption decreases nonlinearly as efficiency rises.

Over a 20–30 year lifespan, this difference compounds dramatically.

3. Heat Recovery as an Extension of Boiler Efficiency

Heat recovery systems convert waste heat into usable energy.

| Heat Recovery Device | Function |

|---|---|

| Economizer | Recovers flue gas heat to preheat feedwater |

| Air preheater | Uses exhaust heat to preheat combustion air |

| Condensing economizer | Recovers latent heat from flue gas |

| Waste heat boiler | Generates steam from exhaust sources |

Heat recovery effectively increases overall system efficiency beyond furnace limits.True

Recovered heat offsets additional fuel consumption.

These systems often deliver the highest ROI among efficiency upgrades.

4. Impact on Long-Term Fuel Expenditure

The economic effect of efficiency is best illustrated through fuel savings.

| Efficiency Scenario | 20-Year Fuel Cost Index |

|---|---|

| Low efficiency, no recovery | 1.00 |

| Standard efficiency | 0.88 |

| High efficiency + recovery | 0.70–0.75 |

High-efficiency boilers can cut lifetime fuel costs by up to 30%.True

Reduced fuel consumption accumulates over decades.

In many projects, fuel savings alone exceed the boiler CAPEX.

5. Emission Reduction and Compliance Economics

Efficiency and heat recovery reduce emissions per unit of output.

| Effect | Economic Outcome |

|---|---|

| Lower CO₂ emissions | Reduced carbon cost |

| Lower NOx/SOx | Smaller emission control systems |

| Lower particulate loading | Reduced ash handling cost |

Higher boiler efficiency lowers emission compliance cost.True

Less fuel burned produces fewer pollutants.

This becomes increasingly important under tightening regulations.

6. Interaction with Fuel Price Volatility

Efficiency acts as a hedge against fuel price volatility.

| Fuel Price Scenario | Low Efficiency Impact | High Efficiency Impact |

|---|---|---|

| Stable prices | Moderate savings | Higher savings |

| Volatile prices | Severe cost exposure | Reduced exposure |

Efficient boilers reduce sensitivity to fuel price volatility.True

Lower fuel usage limits exposure to price spikes.

Efficiency improves economic resilience, not just average cost.

7. Effect on Operation and Maintenance Costs

Heat recovery and efficient combustion improve operational stability.

| Efficiency Feature | O&M Benefit |

|---|---|

| Stable combustion | Reduced tube fouling |

| Lower flue gas temperature | Less thermal stress |

| Optimized heat flux | Longer component life |

Efficient heat transfer reduces maintenance frequency.True

Lower stress and fouling extend service intervals.

This translates into lower indirect operating costs.

8. Capital Cost vs. Lifecycle Payback

Efficiency measures increase CAPEX but shorten payback.

| Upgrade | Typical Payback Period |

|---|---|

| Economizer | 1–3 years |

| Air preheater | 2–4 years |

| Advanced controls | 1–2 years |

| Condensing heat recovery | 3–6 years |

Most heat recovery systems pay back faster than boiler lifespan.True

Fuel savings quickly offset initial investment.

Ignoring these options often leads to false economy.

9. Role in Fuel-Flexible and Future-Proof Design

Efficient boilers adapt better to changing fuels.

| Scenario | Economic Advantage |

|---|---|

| Fuel switching | Maintains performance |

| Co-firing | Stable efficiency |

| Renewable integration | Lower transition cost |

High-efficiency boilers are more future-proof.True

They adapt better to fuel and policy changes.

This strategic flexibility has long-term economic value.

10. Case Example: Efficiency-Driven Lifecycle Comparison

| System Type | 25-Year Total Cost Index |

|---|---|

| Low efficiency, no recovery | 1.00 |

| Standard efficiency | 0.85 |

| High efficiency + recovery | 0.68 |

Lifecycle cost differences far exceed initial efficiency investment.True

Fuel savings dominate total cost.

Such differences are decisive in industrial projects.

11. Common Misconceptions About Efficiency Economics

Frequent errors include:

- Overvaluing low CAPEX

- Underestimating operating life

- Ignoring regulatory escalation

- Treating efficiency as optional

Efficiency should be treated as a core economic parameter, not a technical add-on.True

It directly drives long-term financial outcomes.

Correcting these misconceptions improves decision quality.

12. Strategic Interpretation for Decision-Makers

From a lifecycle perspective, boiler efficiency and heat recovery represent:

- Long-term fuel price insurance

- Emission compliance cost control

- Maintenance cost reduction

- Asset value preservation

Efficiency investment is a financial strategy, not just an engineering choice.True

It reshapes long-term cash flow.

This framing aligns engineering decisions with financial objectives.

Boiler efficiency and heat recovery play a central role in lifecycle economics by directly influencing fuel consumption, emission costs, maintenance requirements, and financial risk exposure. Because fuel dominates total cost of ownership, even modest efficiency improvements generate outsized economic returns over the long operating life of industrial boilers. Heat recovery systems further amplify these benefits by converting waste energy into productive output. While high-efficiency designs may require higher initial investment, their cumulative savings consistently outweigh upfront costs, making efficiency one of the most reliable drivers of long-term economic value in boiler projects.

How Do Maintenance Requirements and Reliability Impact Total Cost of Ownership?

In boiler investment decisions, maintenance requirements and reliability are often underestimated because they do not appear prominently in initial quotations. While capital cost is paid once, maintenance and reliability-related costs accumulate silently over decades through spare parts, labor, efficiency degradation, unplanned shutdowns, production losses, and shortened equipment life. Many industrial plants discover too late that a “low-cost” boiler becomes one of the most expensive assets when maintenance complexity and poor reliability are factored into real operating conditions. Understanding how these factors shape total cost of ownership (TCO) is essential for long-term economic sustainability.

Maintenance requirements and reliability have a decisive impact on total cost of ownership because they directly affect operating expenditure, plant availability, fuel efficiency retention, compliance risk, and asset lifespan. Boilers with higher reliability and maintenance-friendly design can reduce lifetime ownership costs by 20–40% compared with systems that prioritize low upfront cost but suffer frequent failures and downtime.

This makes reliability and maintainability strategic economic parameters, not merely operational concerns.

Maintenance costs are insignificant compared to boiler purchase price.False

Over the operating life, maintenance and downtime costs can exceed initial CAPEX.

High boiler reliability directly reduces total cost of ownership.True

Reliable systems minimize downtime, repair cost, and efficiency losses.

The following sections examine in depth how maintenance and reliability influence total cost of ownership from both technical and financial perspectives.

1. Breakdown of Total Cost of Ownership for Boilers

To understand the role of maintenance, TCO must be clearly structured.

| Cost Category | Typical Share of TCO |

|---|---|

| Initial capital investment | 10–20% |

| Fuel consumption | 50–70% |

| Maintenance & spare parts | 8–15% |

| Unplanned downtime & production loss | 5–15% |

| Compliance, inspections, retrofits | 3–8% |

Maintenance-related costs represent a substantial share of boiler TCO.True

They accumulate continuously throughout the boiler life.

Reliability affects not only maintenance cost but also downtime and fuel efficiency retention.

2. Maintenance Intensity and Its Economic Consequences

Different boiler designs impose very different maintenance burdens.

| Maintenance Aspect | Economic Impact |

|---|---|

| Frequency of shutdowns | Lost production |

| Labor intensity | Higher OPEX |

| Spare part complexity | Inventory cost |

| Specialized skills | Higher service cost |

Complex maintenance requirements increase indirect operating costs.True

Labor, planning, and downtime costs escalate.

High-maintenance systems reduce effective plant utilization.

3. Reliability as a Driver of Plant Availability

Reliability determines how consistently a boiler delivers steam or power.

| Reliability Level | Typical Availability |

|---|---|

| Low reliability | 85–90% |

| Average reliability | 92–95% |

| High reliability | 97–99% |

Boiler availability has a direct economic value.True

Higher availability increases productive output.

Even a few percentage points of availability loss can translate into major revenue losses.

4. Cost of Unplanned Downtime

Unplanned failures are among the most expensive events in boiler operation.

| Downtime Cost Component | Impact |

|---|---|

| Emergency repair | High labor cost |

| Spare part express delivery | Premium pricing |

| Production interruption | Revenue loss |

| Safety and compliance risk | Potential penalties |

Unplanned boiler outages are far more expensive than planned maintenance.True

Emergency conditions magnify all cost components.

Reliability engineering aims to convert unplanned downtime into scheduled maintenance.

5. Maintenance Quality and Efficiency Degradation

Poor maintenance accelerates efficiency loss.

| Maintenance Condition | Efficiency Impact |

|---|---|

| Proactive maintenance | Minimal degradation |

| Reactive maintenance | Gradual efficiency loss |

| Neglected maintenance | Severe efficiency drop |

Maintenance quality affects long-term boiler efficiency.True

Fouling, corrosion, and wear reduce heat transfer.

Efficiency degradation increases fuel cost, amplifying TCO.

6. Design Features That Reduce Maintenance Cost

Maintenance-friendly design directly lowers TCO.

| Design Feature | Economic Benefit |

|---|---|

| Easy access to pressure parts | Reduced labor time |

| Modular components | Faster replacement |

| Robust materials | Longer service life |

| Automated monitoring | Early fault detection |

Boiler design strongly influences lifetime maintenance cost.True

Maintenance accessibility reduces time and expense.

Design decisions made at procurement stage lock in maintenance economics.

7. Reliability and Spare Parts Strategy

Spare part availability influences both cost and downtime duration.

| Spare Strategy | TCO Impact |

|---|---|

| Proprietary parts only | High cost, long lead time |

| Standardized components | Lower cost, faster repair |

| Local supply chain | Reduced downtime |

Standardized components reduce lifetime ownership cost.True

They simplify inventory and shorten repair cycles.

Supply-chain resilience is a hidden reliability factor.

8. Predictive Maintenance and Digital Reliability Tools

Modern boilers increasingly rely on condition monitoring.

| Technology | Economic Effect |

|---|---|

| Online vibration monitoring | Failure prevention |

| Flue gas analysis | Combustion optimization |

| Tube metal temperature tracking | Life extension |

| AI diagnostics | Maintenance cost reduction |

Predictive maintenance lowers total cost of ownership.True

Failures are avoided before they occur.

Digital reliability tools shift maintenance from reactive to strategic.

9. Reliability and Asset Lifetime Extension

Reliable boilers last longer.

| Reliability Level | Typical Service Life |

|---|---|

| Low reliability | 15–20 years |

| Average reliability | 20–25 years |

| High reliability | 25–35 years |

Higher reliability extends boiler service life.True

Reduced stress and failure slow aging.

Longer life spreads capital cost over more operating years.

10. Maintenance Cost Comparison by Boiler Type

| Boiler Type | Maintenance Cost Index |

|---|---|

| Gas-fired boiler | 1.0 |

| Oil-fired boiler | 1.2 |

| Coal-fired boiler | 1.6 |

| Biomass-fired boiler | 1.8 |

Solid-fuel boilers require higher maintenance expenditure.True

Ash, erosion, and fuel variability increase wear.

This must be weighed against fuel cost advantages.

11. False Economy of Low-Cost, Low-Reliability Boilers

Common pitfalls include:

- Underspecified materials

- Poor-quality fabrication

- Lack of diagnostic instrumentation

- Weak after-sales support

Low upfront boiler cost often leads to higher total ownership cost.True

Maintenance and downtime costs escalate over time.

This is a frequent cause of project underperformance.

12. Strategic Interpretation of Maintenance and Reliability

From a lifecycle perspective, maintenance and reliability represent:

- Insurance against downtime

- Protection of fuel efficiency

- Compliance risk reduction

- Preservation of asset value

Reliability should be treated as a core investment criterion.True

It shapes long-term cash flow and risk.

This aligns engineering quality with financial performance.

Maintenance requirements and reliability have a profound and lasting impact on total cost of ownership for industrial boilers. While they may seem secondary during procurement, their cumulative effect on operating costs, fuel efficiency retention, downtime risk, and equipment lifespan often exceeds the influence of initial capital cost. Boilers designed for high reliability and ease of maintenance consistently deliver lower lifetime costs, higher availability, and greater economic resilience. For long-term projects, investing in robust design, predictive maintenance capability, and proven reliability is not an expense—it is one of the most effective strategies for minimizing total cost of ownership.

How Do Environmental Regulations and Emission Compliance Affect Long-Term Costs?

For industrial boiler owners, environmental regulations are no longer a peripheral concern—they are a defining factor in long-term operating economics. While emission compliance costs may appear manageable at the commissioning stage, regulatory requirements rarely remain static. Over time, tightening limits on CO₂, NOₓ, SO₂, particulate matter, and hazardous air pollutants can trigger costly retrofits, increased operating expenses, and even premature asset obsolescence. Projects that underestimate regulatory impact often face escalating costs that erode profitability and undermine the original investment rationale. Understanding environmental compliance as a long-term cost driver, rather than a one-time obligation, is essential for sustainable boiler economics.

Environmental regulations and emission compliance significantly affect long-term costs by increasing capital expenditure, operating and maintenance expenses, energy consumption, monitoring requirements, and regulatory risk exposure. Over a boiler’s lifecycle, compliance-related costs can add 15–40% to total cost of ownership, particularly for solid-fuel systems operating under increasingly stringent emission standards.

This makes regulatory foresight a critical component of lifecycle cost planning.

Environmental compliance costs are limited to initial installation of emission control equipment.False

Ongoing operation, maintenance, monitoring, and future retrofits drive long-term costs.

Stricter emission regulations increase the total cost of ownership of industrial boilers.True

They raise CAPEX, OPEX, and compliance risk over time.

The following sections analyze in detail how environmental regulations shape long-term boiler costs across technical, operational, and financial dimensions.

1. Evolution of Environmental Regulations Over Boiler Lifetimes

Industrial boilers typically operate for 20–35 years, during which regulations almost always tighten.

| Regulatory Trend | Economic Implication |

|---|---|

| Lower emission limits | Equipment upgrades |

| Expanded pollutant scope | Additional control systems |

| Carbon pricing | Direct operating cost |

| Reporting requirements | Administrative burden |

Emission regulations tend to become stricter over time.True

Historical trends show continuous tightening of standards.

Designing only for current limits exposes projects to future retrofit risk.

2. Capital Cost Impact of Emission Compliance

Meeting emission limits requires substantial upfront investment.

| Emission Control System | CAPEX Impact |

|---|---|

| Low-NOx burners | Low–medium |

| ESP or baghouse | Medium |

| FGD (desulfurization) | High |

| SCR/SNCR | Medium–high |

| Continuous emission monitoring | Medium |

Emission control equipment can rival boiler cost in large projects.True

Balance-of-plant systems add significant capital burden.

This impact is most pronounced for coal and biomass boilers.

3. Operating Cost of Emission Control Systems

Compliance is not a passive function—it consumes energy and materials.

| OPEX Component | Cost Driver |

|---|---|

| Auxiliary power | Fans, pumps, heaters |

| Reagents | Lime, ammonia, urea |

| Catalyst replacement | SCR systems |

| Ash and residue disposal | Secondary waste streams |

Emission control systems increase ongoing operating costs.True

They consume power, reagents, and maintenance resources.

These costs persist throughout the boiler’s operating life.

4. Efficiency Penalty and Indirect Fuel Costs

Emission controls often reduce net plant efficiency.

| Compliance Measure | Efficiency Impact |

|---|---|

| Increased draft loss | Higher fan power |

| Flue gas reheating | Additional fuel |

| Over-fire air systems | Combustion complexity |

Emission compliance can indirectly increase fuel consumption.True

Auxiliary losses reduce net efficiency.

Fuel cost amplification is a hidden but powerful long-term effect.

5. Carbon Regulations and CO₂ Cost Exposure

Carbon emissions are increasingly monetized.

| Carbon Policy Mechanism | Cost Impact |

|---|---|

| Carbon tax | Direct fuel cost increase |

| Emission trading | Market price exposure |

| Mandatory reporting | Compliance overhead |

Carbon pricing directly increases boiler operating cost.True

CO₂ emissions translate into financial liability.

High-emission fuels face escalating long-term cost pressure.

6. Risk of Retrofits and Forced Upgrades

Older boilers often require mid-life upgrades.

| Retrofit Trigger | Cost Consequence |

|---|---|

| New emission limits | Capital retrofit |

| Permit renewal | System replacement |

| Public pressure | Accelerated compliance |

Mid-life emission retrofits are more expensive than upfront compliance.True

Retrofits disrupt operation and lack design optimization.

Future-proofing reduces this risk significantly.

7. Compliance Monitoring and Administrative Costs

Modern regulations emphasize transparency and traceability.

| Requirement | Long-Term Cost |

|---|---|

| Continuous emission monitoring (CEMS) | Capital + O&M |

| Data reporting | Staffing and IT |

| Third-party audits | Recurring fees |

Monitoring and reporting create permanent compliance costs.True

They extend beyond physical equipment.

These costs are often underestimated in feasibility studies.

8. Penalties, Downtime, and Legal Exposure

Non-compliance carries severe financial consequences.

| Non-Compliance Outcome | Economic Impact |

|---|---|

| Fines and penalties | Direct cost |

| Forced shutdown | Production loss |

| Permit suspension | Asset stranding |

Regulatory non-compliance poses significant financial risk.True

Penalties and downtime can exceed OPEX savings.

Reliability in compliance is as critical as mechanical reliability.

9. Comparative Impact by Boiler Fuel Type

| Boiler Type | Compliance Cost Sensitivity |

|---|---|

| Gas-fired | Low |

| Oil-fired | Medium |

| Biomass-fired | Medium–high |

| Coal-fired | High |

Solid-fuel boilers face higher emission compliance costs.True

They emit more regulated pollutants.

Fuel choice strongly influences regulatory cost exposure.

10. Long-Term Cost Index Including Compliance

| Scenario | 25-Year Cost Index |

|---|---|

| Minimal compliance planning | 1.00 |

| Current-standard compliance | 1.20 |

| Future-ready compliance | 1.10 |

Designing for future regulations reduces long-term cost.True

It avoids expensive retrofits and downtime.

Proactive compliance often pays back economically.

11. Strategic Value of Low-Emission and Flexible Designs

Compliance-ready boilers offer strategic benefits:

- Easier permit renewal

- Lower financing risk

- Improved ESG ratings

- Higher asset resale value

Environmental compliance enhances long-term asset value.True

Low-risk assets retain economic relevance.

Regulatory resilience is increasingly valued by investors.

12. Common Mistakes in Regulatory Cost Planning

Typical errors include:

- Designing only to minimum current limits

- Ignoring carbon cost scenarios

- Underestimating OPEX of control systems

- Treating compliance as static

Underestimating regulatory evolution leads to higher lifetime cost.True

Future upgrades are costly and disruptive.

Avoiding these mistakes requires lifecycle-based thinking.

Environmental regulations and emission compliance exert a profound influence on long-term boiler costs. Beyond initial investment in emission control equipment, compliance drives ongoing operating expenses, efficiency penalties, monitoring requirements, retrofit risks, and carbon-related liabilities. Over a typical boiler lifetime, these factors can add a substantial premium to total cost of ownership—especially for coal- and biomass-fired systems. Projects that anticipate regulatory evolution, invest in future-ready designs, and integrate compliance into lifecycle cost analysis consistently achieve lower long-term costs and greater economic resilience. In modern energy systems, environmental compliance is not just a regulatory obligation—it is a core determinant of financial sustainability.

In Which Industrial Scenarios Are Oil-Fired Boilers Most Cost-Effective?

Oil-fired boilers are often viewed as a transitional or secondary energy solution, overshadowed by gas, biomass, or coal systems in long-term cost discussions. However, this perception can be misleading. In certain industrial contexts, oil-fired boilers deliver superior economic performance due to their operational flexibility, compact footprint, rapid response, and lower upfront complexity. When fuel availability, project duration, load profile, and risk exposure are carefully considered, oil-fired boilers can outperform alternatives on a total cost of ownership basis rather than merely initial cost. Understanding where oil-fired technology truly excels is essential for rational energy system planning.

Oil-fired boilers are most cost-effective in industrial scenarios that require fast deployment, high reliability, flexible operation, limited project lifespan, or backup and peak-load service—particularly where gas infrastructure is unavailable and solid-fuel systems would impose excessive capital and operational complexity.

This makes oil-fired boilers a strategic choice in well-defined, context-specific applications.

Oil-fired boilers are always more expensive to operate than other boiler types.False

In specific scenarios, oil-fired boilers deliver lower total cost of ownership due to flexibility and low capital complexity.

Oil-fired boilers offer high operational reliability and fast response.True

Liquid fuel combustion enables stable, controllable operation.

The following sections analyze the industrial scenarios where oil-fired boilers provide the greatest economic advantage.

1. Short- to Medium-Term Industrial Projects

Project duration strongly influences boiler economics.

| Project Time Horizon | Cost-Effective Boiler Choice |

|---|---|

| <5 years | Oil-fired |

| 5–10 years | Oil or gas |

| >10–15 years | Gas, coal, or biomass |

Oil-fired boilers are well suited to short project lifecycles.True

Lower capital cost improves payback in limited timeframes.

Industries with temporary production lines or phased investments benefit significantly from oil-fired systems.

2. Remote or Infrastructure-Limited Locations

Oil-fired boilers require minimal external infrastructure.

| Infrastructure Condition | Economic Outcome |

|---|---|

| No gas pipeline | Oil competitive |

| Weak power grid | Oil reliable |

| Remote location | Oil logistics viable |

Oil-fired boilers are cost-effective where gas infrastructure is unavailable.True

Fuel can be transported and stored onsite.

This makes oil-fired boilers attractive in mining, construction, and remote manufacturing zones.

3. Backup, Standby, and Emergency Steam Supply

Reliability and availability dominate cost considerations in backup roles.

| Requirement | Oil-Fired Advantage |

|---|---|

| Instant start-up | Yes |

| Long idle periods | Suitable |

| High reliability | Proven |

Oil-fired boilers are ideal for standby and emergency applications.True

They remain reliable despite intermittent operation.

In such scenarios, fuel cost is secondary to reliability and readiness.

4. Peak-Load and Load-Following Applications

Oil-fired boilers excel at variable load operation.

| Load Profile | Economic Benefit |

|---|---|

| Frequent load swings | Stable combustion |

| Peak shaving | Fast response |

| Seasonal demand | Flexible operation |

Oil-fired boilers handle load fluctuations better than many solid-fuel systems.True

Liquid fuel combustion allows precise control.

This reduces efficiency penalties and maintenance stress under cycling operation.

5. Industries Requiring High Process Reliability

Certain industries value reliability above fuel cost.

| Industry | Cost-Critical Factor |

|---|---|

| Petrochemical | Process continuity |

| Pharmaceuticals | Quality and sterility |

| Food processing | Batch reliability |

Process-critical industries favor oil-fired boilers for reliability.True

Unplanned downtime carries high economic penalties.

In these sectors, avoiding shutdowns outweighs higher fuel prices.

6. Sites with Existing Oil Storage and Handling

Legacy infrastructure changes the economic equation.

| Existing Asset | Cost Impact |

|---|---|

| Oil tanks | Reduced CAPEX |

| Transfer pumps | Faster deployment |

| Permits | Simplified compliance |

Existing oil infrastructure improves oil-fired boiler economics.True

It reduces capital and implementation cost.

Refineries and terminals often fall into this category.

7. Regions with Volatile or Unreliable Gas Supply

Fuel security can outweigh nominal fuel price.

| Fuel Risk Scenario | Oil Advantage |

|---|---|

| Gas curtailment | Oil independence |

| Seasonal shortages | Stockpiling possible |

| Price volatility | Hedging via storage |

Fuel availability stability enhances oil-fired boiler cost-effectiveness.True

Stored fuel reduces supply risk.

Energy security is an economic factor, not just a technical one.

8. Small to Medium Steam Capacity Requirements

Oil-fired boilers scale economically at smaller sizes.

| Steam Capacity | Cost Competitiveness |

|---|---|

| <10 t/h | Very high |

| 10–30 t/h | High |

| >50 t/h | Decreasing |

Oil-fired boilers are most cost-effective at small to medium capacities.True

Capital simplicity favors lower output ranges.

At large scale, fuel cost dominance shifts preference to alternatives.

9. Projects with Tight Capital Budgets or Timelines

Speed and simplicity reduce indirect costs.

| Constraint | Oil-Fired Benefit |

|---|---|

| Limited CAPEX | Lower upfront cost |

| Tight schedule | Faster installation |

| Financing risk | Reduced exposure |

Oil-fired boilers minimize project execution risk.True

Simpler systems shorten construction and commissioning.

This is critical in fast-moving industrial investments.

10. Comparative Cost-Effectiveness by Scenario

| Scenario | Most Cost-Effective Option |

|---|---|

| Temporary plant | Oil-fired |

| Remote industrial site | Oil-fired |

| Backup steam supply | Oil-fired |

| Long-term baseload | Gas / biomass |

| Large-scale power | Coal / biomass |

Oil-fired boilers excel in niche but economically important scenarios.True

Context defines cost-effectiveness.

This reinforces the importance of scenario-based evaluation.

11. Common Misjudgments About Oil-Fired Boilers

Frequent misconceptions include:

- Evaluating only fuel price

- Ignoring project duration

- Overestimating solid-fuel viability

- Underestimating downtime cost

Fuel price alone does not determine boiler cost-effectiveness.True

Capital, reliability, and flexibility matter.

Correcting these errors leads to better investment outcomes.

12. Strategic Role of Oil-Fired Boilers in Modern Industry

Oil-fired boilers increasingly serve as:

- Transitional energy solutions

- Backup systems in diversified plants

- Risk-mitigation assets

- Fast-response capacity

Oil-fired boilers retain strategic relevance in modern energy systems.True

They provide flexibility and resilience.

Their value lies in adaptability, not baseload dominance.

Oil-fired boilers are most cost-effective not as universal solutions, but in specific industrial scenarios defined by short project lifecycles, infrastructure constraints, high reliability requirements, variable load profiles, and tight capital or schedule limits. While fuel costs may be higher than gas or biomass, the advantages of low upfront investment, fast deployment, operational flexibility, and fuel security often outweigh these disadvantages in the right context. When evaluated through a lifecycle and risk-aware lens, oil-fired boilers remain a rational and economically sound choice for many industrial applications.

🔍 Conclusion

Industrial oil-fired boilers are not universally the cheapest option, but they can be economically viable and strategically valuable when reliability, fast startup, and installation simplicity are priorities. By improving efficiency, controlling emissions, and optimizing operating strategies, industries can achieve reasonable long-term cost performance from oil-fired boiler systems.

🔹 Contact us today to evaluate whether an industrial oil-fired boiler is the right long-term investment for your application. ⚙️🔥🏭✅

FAQ

Q1: Are industrial oil-fired boilers cost-effective in the long run?

A1: Industrial oil-fired boilers can be cost-effective in the long run, particularly for facilities that require reliable, high-load, and flexible steam or heat supply. Although fuel oil prices are generally higher and more volatile than coal or biomass, oil-fired boilers compensate with high combustion efficiency (up to 90–92%), quick start-up, and stable operation. For industries where downtime is costly—such as chemicals, pharmaceuticals, food processing, and backup power—oil-fired boilers offer strong economic value through reliability and operational simplicity over a 20–25 year service life.

Q2: How do fuel oil costs impact long-term operating expenses?

A2: Fuel cost is the dominant factor in the long-term economics of oil-fired boilers, often accounting for 60–70% of total lifecycle costs. Compared to coal or biomass, fuel oil prices fluctuate with global energy markets, which can increase operating risk. However, oil-fired boilers achieve higher combustion efficiency and produce less ash and residue, partially offsetting higher fuel prices. Facilities using low-sulfur fuel oil, waste oil, or regions with favorable fuel supply contracts can significantly improve long-term cost predictability and overall profitability.

Q3: How do maintenance and operational costs compare to other boiler types?

A3: Maintenance costs for industrial oil-fired boilers are generally lower than coal-fired and biomass boilers. Oil combustion is cleaner, producing minimal ash and slag, which reduces tube fouling, corrosion, and cleaning frequency. Modern oil-fired boilers use automated burners, electronic ignition, and intelligent control systems, lowering labor requirements and unplanned downtime. Annual operation and maintenance costs typically represent 1.5–3% of total system investment, making oil-fired boilers attractive for industries prioritizing low maintenance and high availability.

Q4: How do emission regulations affect long-term cost-effectiveness?

A4: Emission compliance plays a significant role in the long-term economics of oil-fired boilers. Compared to coal, oil-fired systems emit lower particulate matter and SO₂, especially when using low-sulfur fuels. This reduces the need for complex flue gas treatment systems. However, NOx emissions may still require control technologies such as low-NOx burners or flue gas recirculation (FGR). As environmental regulations tighten, oil-fired boilers often face lower compliance upgrade costs than coal-fired systems, improving their long-term financial viability.

Q5: Which industries benefit most from long-term investment in oil-fired boilers?

A5: Industrial oil-fired boilers are most cost-effective for sectors that require high reliability, fast response, and consistent steam quality, including:

- Chemical and petrochemical plants

- Pharmaceutical manufacturing

- Food and beverage processing

- Textile and dyeing industries

- Hospitals and district heating systems

They are also widely used as backup or peak-load boilers, where their fast start-up capability minimizes production risk. In such applications, the value of operational reliability often outweighs higher fuel costs, resulting in strong long-term returns.

References

- International Energy Agency (IEA) – Oil-Fired Industrial Heating Systems – https://www.iea.org/ – IEA

- U.S. Department of Energy – Industrial Boiler Cost and Efficiency – https://www.energy.gov/ – DOE

- ASME Boiler and Pressure Vessel Code (BPVC) – https://www.asme.org/ – ASME

- Carbon Trust – Reducing Fuel and Emissions in Oil-Fired Boilers – https://www.carbontrust.com/ – Carbon Trust

- Spirax Sarco – Boiler Lifecycle Cost Analysis – https://www.spiraxsarco.com/ – Spirax Sarco

- Engineering Toolbox – Fuel Oil Boiler Efficiency and Costs – https://www.engineeringtoolbox.com/ – Engineering Toolbox

- ScienceDirect – Economic Performance of Oil-Fired Boilers – https://www.sciencedirect.com/ – ScienceDirect

- ISO 50001 – Energy Management for Industrial Boilers – https://www.iso.org/ – ISO

- MarketsandMarkets – Industrial Boiler Market Outlook – https://www.marketsandmarkets.com/ – Markets and Markets

- World Bank – Industrial Energy Efficiency and Fuel Switching – https://www.worldbank.org/ – World Bank

-300x225.jpg)