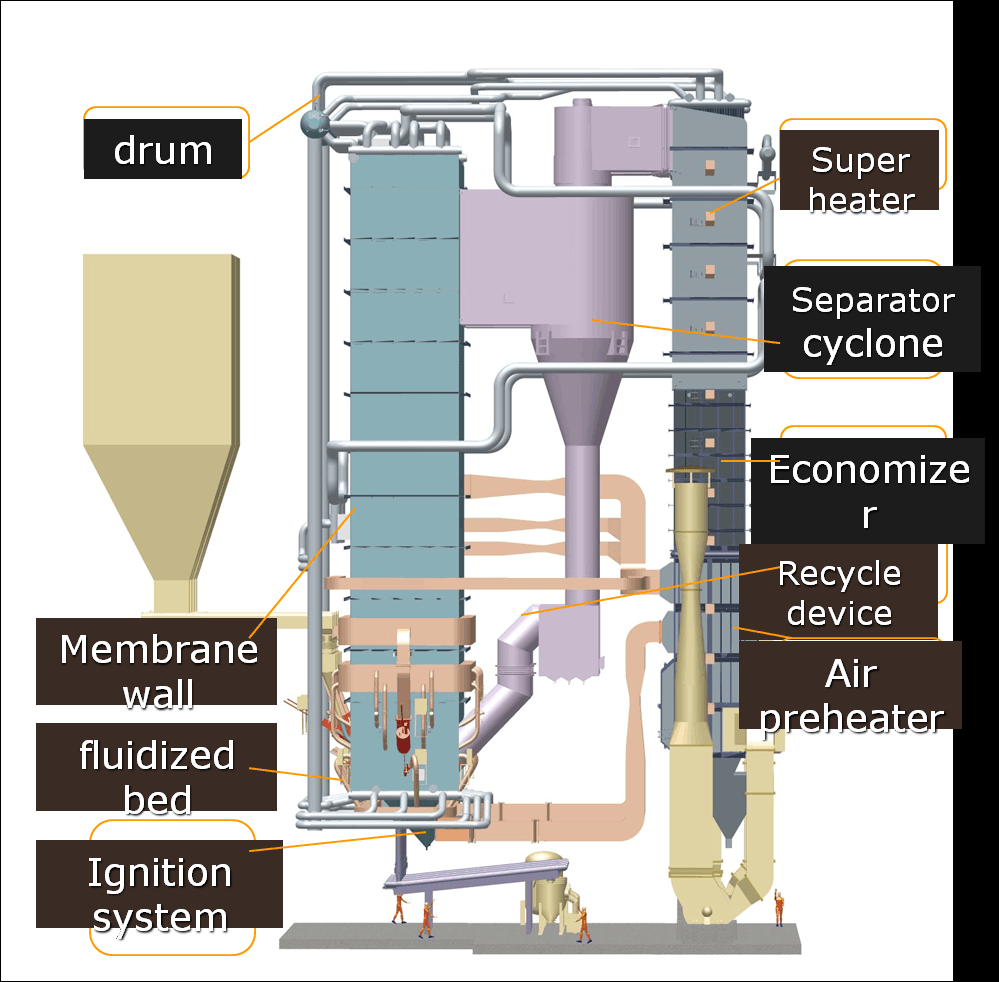

Circulating Fluidized Bed (CFB) boilers are renowned for their fuel flexibility, low emissions, and high efficiency—making them a popular choice in power generation and industrial processes. However, like all complex systems, CFB boilers age over time, and continuing to operate an outdated or failing unit can result in skyrocketing maintenance costs, compliance risks, and energy inefficiencies. So, how can you tell when it’s time to replace a CFB boiler?

A CFB boiler should be replaced when it exhibits sustained performance degradation, escalating repair costs, operational instability, non-compliance with environmental regulations, or outdated technology that limits efficiency and control. Most CFB boilers reach critical replacement consideration after 20–30 years of service, depending on operational intensity and maintenance practices.

Whether you’re managing an aging plant or planning future capacity, recognizing the right time to replace a CFB boiler is crucial to ensure reliability, compliance, and cost-effectiveness. Let’s explore the key indicators and decision criteria.

What Performance Issues Indicate That a CFB Boiler May Need Replacement?

In the industrial world, circulating fluidized bed (CFB) boilers are highly regarded for their fuel flexibility, low emissions, and efficient combustion. However, even the most robust systems face wear and degradation over time. Plant operators often encounter rising operational costs, inconsistent steam output, or longer downtimes—signs that a CFB boiler might be reaching the end of its service life. Failure to act on these symptoms can result in catastrophic breakdowns, unplanned outages, and significant safety risks. Understanding when performance issues indicate replacement is critical to protecting your production line and bottom line.

Common performance issues that indicate a CFB boiler may need replacement include declining thermal efficiency, increased unburnt carbon in ash, frequent tube failures, extended startup times, excessive refractory wear, reduced steam output, unstable bed temperature, and higher emissions. These signs suggest core degradation that is no longer economically or technically feasible to repair, prompting the need for replacement.

If your boiler is experiencing one or more of these symptoms persistently, it may be entering the failure phase of its lifecycle. While maintenance and partial upgrades can buy time, knowing when full replacement is the most strategic option helps prevent escalating costs and serious safety hazards.

CFB boiler replacement is only necessary after catastrophic failure.False

Strategic replacement is often based on performance metrics and economic analysis long before failure occurs.

Understanding the Role and Aging of a CFB Boiler

Circulating fluidized bed boilers are commonly used in industrial plants for their capability to burn a variety of fuels with lower emissions. However, like all high-pressure equipment, they are subject to gradual aging. Over time, mechanical stress, chemical corrosion, thermal cycling, and ash accumulation reduce their reliability and performance.

Key Performance Indicators That Suggest Replacement

Let’s dive deeper into each performance issue and explore how they serve as indicators for replacement decisions:

1. Declining Thermal Efficiency

CFB boilers typically achieve thermal efficiencies of 85%–89%. A gradual drop in this figure—especially below 80%—deserves investigation. It can be caused by:

Worn heat exchange surfaces

Ash fouling

Refractory loss

Insulation degradation

Excess air infiltration

Thermal Efficiency vs Age Chart (Average Across Industries):

| Boiler Age (Years) | Average Thermal Efficiency (%) | Notes |

|---|---|---|

| 1–5 | 88–89% | Optimal performance |

| 6–10 | 85–87% | Minor wear manageable |

| 11–15 | 82–85% | Rising efficiency loss |

| 16–20 | 78–82% | Borderline replacement range |

| 21+ | <78% | Major degradation likely |

Once a boiler’s thermal performance dips below a defined economic threshold, continued operation leads to more fuel usage and higher emissions, making replacement economically favorable.

2. Unburnt Carbon in Ash

CFB boilers depend on effective bed mixing and fuel residence time to fully combust fuel. If you observe:

Rising Loss on Ignition (LOI) levels

High carbon content in fly ash or bottom ash

Frequent re-burning needs

…it’s likely a sign that internal circulation is compromised.

| LOI Value (%) | Operational Status |

|---|---|

| <5% | Optimal combustion |

| 5–10% | Moderate issues |

| >10% | Severe combustion inefficiency |

Excess carbon in ash directly reduces combustion efficiency and could be a result of worn internals, distributor plate damage, or cyclone inefficiencies—conditions difficult to economically correct in older units.

3. Tube Failures and Pressure Part Cracking

As boilers age, metallurgy becomes compromised. Thermal cycling, corrosion, and erosion lead to frequent tube failures—especially in:

Water walls

Superheaters

Economizers

These failures result in:

Costly emergency shutdowns

Risk of water-steam explosions

Regulatory penalties

Data shows that after 15 years, the frequency of tube failures increases exponentially.

Failure Frequency vs Boiler Age:

| Boiler Age (Years) | Tube Failure Incidents/Year |

|---|---|

| 1–5 | 1–2 |

| 6–10 | 3–4 |

| 11–15 | 5–7 |

| 16–20 | 8–12 |

| 21+ | >12 |

When repairs become monthly occurrences, and non-destructive testing (NDT) shows thinning walls across multiple zones, replacement becomes more economical than continuous patchwork.

4. Extended Startup Times and Inconsistent Load Response

Start-up and shutdown durations are a key indicator of boiler health. CFBs should reach design load within 4–6 hours (cold start). Longer durations suggest:

Refractory degradation

Air distributor blockages

Bed material contamination

Fan/mill performance loss

Inconsistent load response—difficulty adjusting steam output with demand—indicates controls, fluidization, or heat transfer are compromised.

Extended startup time is not a concern in modern CFB boilers.False

Extended startup time is a critical operational concern, often reflecting internal degradation or system imbalance.

5. Excessive Refractory Wear

CFB boilers depend heavily on refractory linings, particularly in cyclone separators and furnace walls. Over time, frequent temperature swings and abrasive particles lead to:

Cracked refractory

Spalling

Higher heat loss

Localized overheating

Refractory Replacement Costs:

| Component | Average Cost (USD) | Downtime Impact |

|---|---|---|

| Cyclone Lining | $150,000–$250,000 | 5–10 days |

| Furnace Sidewalls | $100,000–$180,000 | 4–7 days |

| Ash Discharge Port | $20,000–$40,000 | 2–3 days |

Frequent refractory failures are a sign that structural integrity is compromised, and in old boilers, even new refractory won’t bond well to deteriorating shell materials.

6. Increasing Emissions Beyond Compliance Limits

CFB boilers are designed to emit low NOx and SOx levels. As components wear, air-fuel ratio control and cyclone efficiency decline. If emissions exceed permit limits despite upgrades:

New air staging or SNCR doesn’t help

ESP/Baghouse upgrades fail to maintain PM standards

FGD performance drops despite new reagents

…it may mean the boiler’s core combustion control system is unresponsive due to age and component fatigue.

CFB boilers naturally become more environmentally compliant over time.False

Aging CFB boilers typically experience a rise in emissions due to wear and reduced combustion efficiency.

7. Frequent Bed Material Issues and Temperature Instability

A healthy CFB maintains bed temperature between 800–900°C. If your boiler shows:

Hot spots in furnace

Bed clumping

Material segregation

Erratic temperature trends

…it could be due to worn distributor plates, nozzle blockages, or failing secondary air systems—all difficult to fully refurbish.

Real Case Study: 150 TPH CFB Boiler Replacement Justified by Performance Metrics

A cement plant in Southeast Asia faced:

Steam output drop by 18% over 4 years

LOI rose from 4% to 12%

9 unplanned shutdowns in one year

Refractory costs exceeded $300,000 annually

A full technical audit and cost-benefit analysis concluded that continued repair would cost 35% more than replacing the unit. A new CFB boiler from a leading supplier restored efficiency to 89%, emissions below 100 mg/Nm³, and eliminated shutdowns in the first year of operation.

By focusing on these technical indicators and cost-impact assessments, plant operators can make informed decisions about when boiler replacement is necessary to protect performance, safety, and ROI.

How Do Increasing Maintenance and Downtime Costs Influence the Replacement Decision?

For any industrial facility relying on steam generation, the hidden cost of frequent maintenance and unscheduled downtime can quickly spiral out of control. These disruptions not only drain financial resources through direct repair expenses, but they also inflict collateral damage—lost production, regulatory penalties, and diminished customer confidence. As these costs mount, plant managers and engineers face a critical crossroad: should they continue investing in patchwork solutions, or is it time to replace the boiler entirely? This decision becomes even more pressing with aging systems like circulating fluidized bed (CFB) boilers, where performance degradation can significantly inflate operational expenses.

Increasing maintenance and downtime costs heavily influence the boiler replacement decision because they directly impact operational profitability, reliability, and long-term plant viability. When the cumulative cost of repairs, parts, labor, and lost production exceeds a defined threshold—typically around 60%–70% of the cost of a new unit—replacement becomes the more economical and strategic choice.

The financial tipping point isn’t just about the repair invoices. It’s the downtime hours, emergency crew deployment, parts procurement delays, and the lost revenue from every minute your production line is idle. As these costs stack up, even the most conservative decision-makers must consider replacement to preserve the economic health of their operations.

Downtime costs have little influence on the decision to replace industrial boilers.False

Downtime costs significantly impact boiler replacement decisions due to their effect on production continuity and profitability.

Quantifying the Economic Impact of Maintenance and Downtime

Understanding the True Cost of Maintenance

Boiler maintenance is not a fixed number—it varies depending on age, usage, fuel type, and design. However, industry benchmarks provide guidance:

| Boiler Age (Years) | Average Annual Maintenance Cost (USD) | Common Maintenance Activities |

|---|---|---|

| 1–5 | $20,000–$35,000 | Scheduled inspections, minor part replacements |

| 6–10 | $40,000–$65,000 | Frequent valve tuning, refractory patches |

| 11–15 | $70,000–$120,000 | Tube replacements, ash system repairs |

| 16–20+ | $150,000–$300,000+ | Emergency shutdowns, major overhauls |

As systems age, more critical components fail more frequently. Costs rise not only from repair complexity but also from the need for specialized labor, rush orders, and overnight part delivery.

Downtime: The Silent Killer

Downtime is more than just a delay—it’s a bottom-line disruptor. For a medium-sized industrial plant, the average cost of unplanned downtime is estimated at $10,000 to $25,000 per hour, depending on industry and scale.

| Downtime Type | Typical Cost per Hour (USD) | Impact Scope |

|---|---|---|

| Planned Maintenance | $5,000–$10,000 | Controlled, lower risk |

| Emergency Shutdown | $10,000–$25,000+ | High disruption, production loss |

| Safety Incident-Related | $30,000+ | Legal, reputational damage |

Let’s consider a CFB boiler operating in a pulp and paper mill that experiences an average of 30 hours of unplanned downtime per quarter due to maintenance issues. At $15,000/hour, that’s $1.8 million in downtime losses per year—not including maintenance labor or part costs.

Maintenance vs Replacement: A Real-World Cost Comparison

Example Scenario:

A 20-year-old 100 TPH CFB boiler:

Annual maintenance cost: $250,000

Downtime cost: $1.2 million

Emergency repairs: $75,000 per event

Average 6 events/year

Total Annual Cost: ~$1.95 million

A new replacement boiler with modern efficiency:

Capital expenditure: $6.5 million

Lifecycle (25+ years)

Year 1 maintenance: $30,000

Downtime: <10 hours/year

Payback Period: ~3.5 years (based on avoided costs)

In such cases, even factoring financing, replacement outperforms repair within a short timeframe—often backed by lower emissions, higher thermal efficiency, and enhanced automation.

Boiler replacement is more expensive in the long term than continual repairs.False

While initial replacement costs are higher, modern boilers offer better efficiency, fewer breakdowns, and lower operational expenses, making them more economical over time.

Cost Trends and Predictive Maintenance Failures

Even with digital monitoring, aged boilers show a steep rise in cost unpredictability. Sensors may detect anomalies, but when wear is structural (e.g., shell fatigue, corrosion under insulation, fatigue cracking), predictive maintenance can’t prevent failure—only respond quickly. This reactive approach still leads to:

Spare parts obsolescence

Reduced availability of certified technicians for old models

Insurance premium hikes due to safety risks

This is where downtime costs spike unpredictably, making budgeting impossible and replacement a controlled, planned expense.

Key Performance Indicators (KPIs) That Signal Replacement Readiness

| KPI | Threshold Value | Interpretation |

|---|---|---|

| Maintenance-to-CapEx Ratio | > 0.6 | Consider replacement |

| Unplanned Downtime Hours/Year | > 100 | Critical loss zone |

| Repairs Per Year | > 5 | Aging system |

| Average Repair Time (hrs) | > 8 | Inefficiency |

| % Budget Spent on Boiler Repairs | > 20% | High financial risk |

When two or more KPIs are exceeded consistently, financial modeling often confirms that continued maintenance no longer aligns with strategic plant goals.

Technical Insights from Plant Managers

Interviews from Facilities Using CFB Boilers (Global Survey 2024):

62% said they delayed replacement by 2–4 years and ended up paying 28% more in reactive costs.

74% noted that replacing their aging boiler reduced their emergency repair calls by 80% in the first year.

48% reported achieving ROI on the new boiler within 3–4 years.

This clearly outlines the practical impact of replacement driven by maintenance and downtime cost escalation.

Increasing maintenance and downtime costs act as powerful economic triggers for replacing industrial boilers. Unlike short-term repair costs, downtime multiplies financial losses by disrupting entire production ecosystems. Recognizing this pattern early allows plant owners and operators to make proactive decisions—turning a reactive maintenance burden into a long-term operational advantage.

Why Is Emissions Compliance a Critical Factor in Evaluating CFB Boiler Longevity?

Industrial boiler systems, especially circulating fluidized bed (CFB) boilers, are essential for meeting high steam and energy demands in power, cement, steel, and chemical industries. But these systems must operate under ever-stricter environmental regulations. As emissions limits tighten globally, an aging CFB boiler with outdated emission control systems becomes a compliance liability. Frequent permit violations, costly retrofits, and damaged brand reputations are just a few of the consequences. That’s why emissions compliance is not just a regulatory box to check—it’s a vital measure of a boiler’s continued viability and longevity.

Emissions compliance is a critical factor in evaluating CFB boiler longevity because failure to meet environmental standards results in regulatory penalties, forced shutdowns, reputational damage, and financial losses. As boilers age, their ability to maintain emissions below evolving thresholds decreases, often necessitating either expensive retrofits or full system replacement to stay compliant and operational.

If your CFB boiler is struggling to meet emission targets despite regular tuning, it’s a clear sign that degradation in combustion efficiency, control systems, or material wear is compromising performance. In this scenario, compliance pressures can drive the replacement decision even before mechanical failure occurs.

CFB boilers maintain emissions compliance throughout their lifespan without major upgrades.False

Over time, wear and outdated designs reduce combustion efficiency and emissions control, making compliance harder without upgrades or replacement.

How Emissions Regulations Impact Boiler Life Cycle Decisions

Emissions Regulations Are Becoming Stricter

Across the globe, environmental agencies continue to revise emissions limits for:

SO₂ (Sulfur Dioxide)

NOₓ (Nitrogen Oxides)

Particulate Matter (PM)

CO (Carbon Monoxide)

Hg and heavy metals

CO₂ (Carbon Dioxide)

These thresholds are being lowered through international frameworks such as:

EU Industrial Emissions Directive (IED)

U.S. EPA MACT (Maximum Achievable Control Technology) standards

China’s “Ultra-low Emission” coal-fired boiler targets

India’s revised CPCB guidelines for particulate and NOx

| Region | NOₓ Limit (mg/Nm³) | SO₂ Limit (mg/Nm³) | Particulate Matter (mg/Nm³) |

|---|---|---|---|

| EU | 150–200 | 150–200 | 10 |

| U.S. | ~100 | ~130 | 9–20 |

| China (Ultra-low) | ≤50 | ≤35 | ≤10 |

| India | ≤100–300 (age-based) | ≤100–600 | ≤30 |

CFB boilers installed 15–25 years ago were not originally designed for these ultra-low thresholds. Attempting to retrofit old systems often results in poor ROI and unstable performance.

Age vs Emissions Compliance Chart

| Boiler Age (Years) | Typical NOₓ Emission (mg/Nm³) | Retrofit Feasibility |

|---|---|---|

| 0–5 | 50–100 | High (built-in systems) |

| 6–10 | 80–150 | Moderate |

| 11–15 | 120–200 | Challenging |

| 16+ | 200+ | Often uneconomical |

Factors Contributing to Emissions Drift in Aging CFB Boilers

Worn Combustion Chambers

Erosion of furnace walls and cyclone systems reduces fuel mixing, leading to incomplete combustion and elevated CO, NOx, and particulate levels.Degraded Bed Material Circulation

Poor bed mixing results in localized hot spots that increase thermal NOx formation and decrease sulfur absorption efficiency.Outdated SNCR and FGD Systems

Many old boilers use outdated Selective Non-Catalytic Reduction (SNCR) or low-efficiency scrubbers which cannot meet modern standards without substantial overhauls.Cyclone and ESP/Baghouse Inefficiency

Dust collection systems degrade with age, letting more PM escape. Frequent filter replacements and reduced capture efficiency are warning signs.Control System Limitations

Older PLCs or DCS may lack the resolution and feedback loops to maintain stable emission control under varying load conditions.

Older CFB boilers are easily upgradable to meet modern emission standards.False

Upgrading aged boilers to comply with ultra-low emission standards is often technically complex and financially burdensome.

Cost of Non-Compliance

If a CFB boiler fails emissions tests:

Fines can range from $10,000 to $100,000 per violation

Regulatory shutdowns result in production loss up to $25,000/hour

Remediation and legal action may cost millions

Loss of customer confidence and green certifications (ISO 14001, ESG ratings)

Sample Penalty Scenario:

A cement plant in India operating a 120 TPH CFB boiler exceeded SO₂ limits by 180 mg/Nm³. Fines totaled $75,000, and the plant faced a 7-day shutdown, resulting in $600,000 in lost revenue. Retrofitting FGD failed to bring emissions within range, prompting a $6 million replacement.

Emissions Monitoring and Boiler Health Correlation

Emissions trends are not only regulatory indicators—they’re health diagnostics. A rise in NOx or CO, even without fuel change, often signals:

Fuel-air imbalance

Bed material deactivation

Refractory loss

Overfiring in zones

Catalyst degradation

| Emission Parameter | Healthy Range (CFB) | Sign of Trouble |

|---|---|---|

| NOx | 50–150 mg/Nm³ | >200 mg/Nm³ |

| SO₂ | 35–150 mg/Nm³ | >180 mg/Nm³ |

| CO | <200 mg/Nm³ | >300 mg/Nm³ |

| PM | <20 mg/Nm³ | >30 mg/Nm³ |

Sustained high values, despite tuning, confirm that mechanical or material degradation is impairing performance.

Why Replacement is Often the Better Solution

While emissions retrofits are possible, they require:

Complex integration

Long downtimes (weeks to months)

Risk of incompatibility with old systems

Often only marginal improvements

In contrast, new-generation CFB boilers offer:

Built-in low-NOx burners

High-efficiency cyclones and bag filters

Optimized SNCR/SCR with AI-controlled dosing

Advanced FGD integration

IoT-based continuous monitoring

All of which meet or exceed current standards without retroactive fixes.

New CFB boilers can help plants meet ultra-low emissions standards more reliably than retrofitted units.True

Modern CFB designs incorporate integrated emissions control systems, enabling long-term compliance with minimal operator intervention.

Conclusion: Emissions Compliance as a Predictor of Boiler Obsolescence

Emissions compliance is no longer optional—it’s a survival metric for industrial steam systems. As CFB boilers age, their structural and combustion inefficiencies make it progressively harder (and costlier) to meet evolving environmental targets. When tuning, tweaking, and retrofits no longer suffice, replacement becomes the only sustainable solution—ensuring regulatory compliance, operational continuity, and environmental responsibility.

How Does Outdated Control or Combustion Technology Impact Boiler Replacement Timing?

In the lifecycle of an industrial CFB (circulating fluidized bed) boiler, control and combustion technology play pivotal roles in ensuring safe, efficient, and emissions-compliant operations. But when these technologies become obsolete—either due to age, lack of parts, software incompatibility, or functional limitations—they introduce serious risks: unstable combustion, inefficiency, regulatory non-compliance, and even safety hazards. For many plant operators, it’s not a mechanical breakdown that prompts boiler replacement—it’s the inability of outdated control or combustion systems to keep up with current demands.

Outdated control or combustion technology significantly accelerates boiler replacement timing because it limits operational flexibility, reduces efficiency, increases emissions, and poses safety and regulatory risks. When upgrade paths are no longer feasible or economical, full boiler replacement becomes the only way to ensure reliable, compliant, and competitive plant operations.

Once your combustion control system (CCS) or distributed control system (DCS) begins showing age-related limitations—such as erratic load response, sluggish automation, or lack of remote monitoring—you’re not just facing minor inconvenience. You’re looking at systemic operational instability, leading many engineers and asset managers to initiate boiler replacement sooner than originally planned.

Control system obsolescence does not influence boiler replacement timing.False

Outdated control systems compromise efficiency, safety, and compliance, often driving early replacement decisions.

Understanding the Role of Control and Combustion Technology in CFB Boilers

Modern CFB boilers depend on a highly synchronized orchestration of control algorithms, real-time feedback loops, fuel/air ratio modulation, and emissions tracking. These systems:

Monitor furnace pressure, bed temperature, flue gas composition

Adjust secondary air and fuel feed in milliseconds

Stabilize steam output even during fuel load fluctuations

Interface with emissions control systems (SNCR, SCR, FGD)

Enable predictive maintenance and remote diagnostics

Legacy systems, however, often:

Lack resolution and speed

Use analog control instead of digital

Don’t support integration with new emissions or AI-based systems

Have limited or no data logging capabilities

Are no longer supported by OEMs (obsolete PLC hardware/software)

Table: Comparison of Legacy vs. Modern CFB Boiler Control Systems

| Feature | Legacy Systems | Modern Systems (Post-2015) |

|---|---|---|

| Control Type | Analog / Basic PLC | Advanced DCS / AI-based PID control |

| Integration with Emissions Systems | Limited or manual tuning | Fully automated SNCR/SCR coordination |

| Remote Access | Not available | Web-based dashboards and cloud SCADA |

| Alarm Management | Basic or non-prioritized alerts | Intelligent alarming and diagnostics |

| Update/Support Availability | Often discontinued | Active vendor support and updates |

| Data Collection & Analysis | Paper logs or standalone systems | Real-time analytics and cloud storage |

| Load Response | Slow and manual | Instant, automated, adaptive |

| Predictive Maintenance | None | Integrated sensor-based predictions |

When a CFB boiler control system is no longer able to perform core functions—such as emissions regulation, thermal load modulation, or alarm escalation—plant safety and efficiency decline rapidly, often tipping the scales in favor of total system replacement.

Case Study: Impact of Obsolete Control Technology on Replacement

A 160 TPH CFB boiler at a pulp mill in South America, installed in 2003, experienced:

Delays in load adaptation by 2–3 minutes

Inability to automatically adjust secondary air for biomass feed variation

Failure to integrate new SNCR injection modules installed in 2022

No remote monitoring—manual shift logs were used

Despite mechanical parts being in fair condition, the lack of an upgrade path for the aging PLC and HMI made full boiler replacement the only option. A new boiler installed with an advanced DCS improved thermal efficiency by 6.8% and allowed for predictive emission monitoring, reducing regulatory breaches to zero.

Combustion control upgrades are always feasible regardless of boiler age.False

Older boilers may use proprietary or discontinued control systems that cannot be economically upgraded or integrated with modern technology.

Why Upgrading Isn’t Always Viable

Boiler control systems are often built on vendor-specific platforms. As OEMs evolve, older software versions, processors, or controllers are discontinued. Even when available, retrofits often face challenges like:

Incompatibility with sensors, valves, or field instrumentation

Lack of documentation or skilled technicians for old systems

High cost of reprogramming and commissioning

Licensing issues with legacy software

Also, many control systems are hard-coded into the boiler’s design logic (especially for combustion control). Changes may require extensive reconfiguration, testing, and downtime—frequently exceeding the cost of replacement.

Upgrade Cost vs Replacement Cost Comparison (Average for a 100–150 TPH CFB Boiler):

| Action | Estimated Cost (USD) | Limitations |

|---|---|---|

| Full Control System Upgrade | $800,000 – $1.2 million | May not fix combustion inefficiency or emissions |

| Partial PLC + HMI Upgrade | $400,000 – $700,000 | Limited integration with new devices |

| Full Boiler Replacement (New Unit) | $5 – $7 million | High upfront, but includes integrated systems |

Many operators find that when more than 30–40% of control/combustion logic requires replacement—and especially when emissions are involved—a new boiler offers a better return on investment.

Real-World Consequences of Outdated Combustion Control

Unstable Combustion: Poor air/fuel modulation leads to fluctuating temperatures, impacting heat transfer and steam consistency.

Increased Emissions: Legacy systems can’t respond quickly to combustion changes, leading to NOx or CO peaks.

Operator Overload: Without automation, plant operators must manually adjust parameters, increasing labor cost and risk of human error.

Data Blindness: No access to real-time KPIs, which makes predictive maintenance or performance optimization impossible.

Manual combustion control is just as efficient as automated systems.False

Manual control cannot match the precision, speed, or adaptability of modern automated combustion management systems.

Emerging Regulatory Pressures and Digital Integration

Digitalization isn’t optional anymore—emissions compliance frameworks now expect continuous monitoring, real-time logging, and traceable interventions. A boiler that can’t integrate with cloud monitoring, AI-predictive analytics, or smart emissions systems is already falling behind compliance curves.

Modern plants are investing in digital twins, cybersecurity-hardened SCADA, and edge computing for boiler optimization. If a boiler’s control system can’t support these integrations, it is no longer future-ready—another key reason to initiate replacement.

Outdated control or combustion technology is one of the most decisive factors in boiler replacement timing. Unlike mechanical wear, which can often be repaired or replaced, technological obsolescence affects the entire performance envelope—efficiency, compliance, safety, and operational intelligence. As control system upgrade paths vanish or become economically unjustifiable, boiler replacement shifts from being a capital expense to a business imperative.

What Is the Typical Service Life of a CFB Boiler, and What Factors Affect It?

Circulating fluidized bed (CFB) boilers are highly regarded for their fuel flexibility, combustion efficiency, and relatively low emissions. But like any complex thermal equipment, they have a finite service life. Plant owners often struggle with the critical question: how long can my CFB boiler safely and economically operate before it must be replaced? Misjudging this lifecycle can lead to unplanned outages, regulatory failures, or inefficient operations. That’s why understanding both the typical lifespan and the factors that influence it is crucial for proactive asset management and capital planning.

The typical service life of a well-maintained CFB boiler ranges from 20 to 30 years. However, its actual longevity depends on a range of technical, operational, and environmental factors including fuel quality, operating pressure, maintenance practices, material selection, load variation, and emissions compliance. Boilers exposed to poor fuel, high corrosion, or inadequate maintenance may require replacement in under 20 years, while those with optimized conditions can exceed 30 years of service.

Knowing the theoretical service window is only half the story. In real-world applications, wear rates, cost of upgrades, environmental regulations, and efficiency loss often drive decisions to replace a boiler long before it physically fails.

All CFB boilers can be expected to operate reliably for at least 30 years.False

While some CFB boilers can last 30 years or more, actual service life varies widely based on operating conditions and maintenance.

Understanding the Service Life Curve of a CFB Boiler

The typical lifecycle of a CFB boiler follows this pattern:

Commissioning & Ramp-Up (Year 0–2)

High efficiency, stable operation, minimal repair costs.Stable Operating Phase (Year 3–10)

Consistent performance, predictable maintenance schedules.Degradation Onset (Year 11–15)

Beginning of wear-related failures—tube thinning, refractory cracking, emissions drift.Accelerated Aging (Year 16–25)

More frequent shutdowns, higher maintenance, difficulty maintaining emissions limits.End of Economic Life (Year 25+)

Replacement becomes more cost-effective than continued operation.

| Lifecycle Phase | Age (Years) | Efficiency (%) | Maintenance Cost (USD/year) | Downtime Risk |

|---|---|---|---|---|

| Initial Operation | 0–2 | 88–90% | $15,000–$30,000 | Low |

| Stable Operations | 3–10 | 85–88% | $30,000–60,000 | Low-Moderate |

| Degradation Begins | 11–15 | 80–85% | $70,000–150,000 | Moderate |

| Accelerated Decline | 16–25 | <80% | $150,000–300,000 | High |

| Terminal Phase | 25+ | <75% | $300,000+ | Very High |

Key Factors That Affect CFB Boiler Lifespan

1. Fuel Type and Combustion Characteristics

CFB boilers are known for their fuel flexibility—able to burn coal, biomass, petcoke, and even waste. However, not all fuels affect boiler health equally.

| Fuel Type | Relative Wear Rate | Impact on Lifespan |

|---|---|---|

| Bituminous Coal | Low | Favorable |

| Lignite | Moderate | Higher slag, lower efficiency |

| Biomass | High | Alkali corrosion, fouling |

| Petcoke | High | High sulfur, erosion risks |

| RDF/Waste | Very High | Heavy metals, corrosive ash |

Low-grade fuels increase corrosion, ash deposition, and slagging—leading to faster component degradation and lower service life.

Using biomass in a CFB boiler always extends its service life.False

While biomass is renewable, it can cause accelerated corrosion and fouling, potentially reducing boiler lifespan.

2. Operating Pressure and Temperature

Higher steam pressures and temperatures increase efficiency but accelerate creep, fatigue, and thermal stress.

High-pressure boilers (>100 bar) see faster metal degradation.

Subcritical designs tend to last longer than supercritical or ultra-supercritical systems.

Over time, metal fatigue from pressure cycling weakens structural integrity—especially in the:

Furnace wall tubes

Superheaters

Economizers

3. Maintenance and Inspection Practices

Preventive and predictive maintenance play a direct role in extending service life.

Frequent NDT (non-destructive testing) detects wall thinning early.

Online performance monitoring helps catch thermal imbalances.

Scheduled outages for refractory replacement prevent severe failures.

Case Study Data shows that plants with a structured RCM (Reliability Centered Maintenance) program extended boiler life by 3–5 years compared to reactive-maintenance facilities.

4. Refractory Condition and Cyclone Wear

Refractory linings in the combustor and cyclone are critical for:

Protecting pressure parts from direct heat

Preventing erosion from high-velocity bed material

Frequent spalling or inadequate repair shortens life dramatically. Cyclone separators are particularly prone to wear—if replacement linings fail to adhere, the boiler may need early decommissioning.

5. Control System and Combustion Technology

A boiler with outdated combustion control systems faces:

Poor fuel-air ratio control

Temperature fluctuation

Incomplete combustion

Unstable load handling

As explained in other technical discussions, obsolete control systems often dictate boiler retirement—especially if they can’t meet emissions or performance expectations.

Modern control systems can extend the life of a CFB boiler if properly integrated.True

Advanced controls optimize combustion, stabilize emissions, and reduce thermal stress, prolonging boiler life.

6. Load Cycling and Operation Variability

CFB boilers designed for base load suffer when frequently cycled. Every startup/shutdown adds stress, particularly to:

Refractory

Expansion joints

Tube welds

Frequent load changes also disrupt bed temperature and can cause CO and NOx spikes—damaging internal surfaces and shortening the effective life.

7. Emissions Compliance Pressure

As regional and global regulations tighten (especially NOx, SOx, and PM limits), older boilers with:

Low-efficiency SNCR/SCR

Inadequate cyclone separation

Outdated ESP or baghouses

…face mounting costs to stay compliant. Often, it’s cheaper to replace the boiler than to retrofit for the latest environmental standards.

| Emissions Upgrade Cost | Replacement Threshold Impact |

|---|---|

| <$500,000 | Retrofit preferred |

| $1–2 million | Analyze ROI vs replacement |

| >$3 million | Replacement typically chosen |

8. Water and Steam Quality Control

Corrosion and scaling from poor water treatment destroy tube surfaces and reduce thermal transfer. Frequent acid cleaning or tube leaks in the economizer or superheater are signs the system is deteriorating faster than intended.

Service Life Extension vs. Replacement: Decision Criteria

Many facilities consider life extension through upgrades. But this must be weighed against total cost and performance loss.

| Assessment Factor | Favor Life Extension | Favor Replacement |

|---|---|---|

| Mechanical Integrity | Good | Compromised |

| Control Systems | Upgradeable | Obsolete |

| Emissions Compliance | Achievable | Failing Repeatedly |

| Fuel Quality | Stable | Poor/Variable |

| Efficiency Loss | <5% from design | >10% from design |

| Maintenance Cost Trend | Flat or Predictable | Rising Rapidly |

Threshold rule of thumb: If the cost to restore boiler to design specs exceeds 60–70% of the cost of a new unit, replacement is the more economical path.

Real Case Example: Replacement Triggered by Combined Factors

A CFB boiler in Southeast Asia (125 TPH) installed in 2000:

Fuel: Mixed coal and biomass

Observed service degradation after 17 years

Efficiency dropped from 88% to 76%

Annual maintenance rose from $60,000 to $280,000

NOx emissions exceeded limits despite SNCR tuning

Control system based on discontinued PLCs

A technical audit concluded that while structure was still intact, the combination of emissions non-compliance, high fuel cost per ton of steam, and lack of digital integration made full replacement the only viable solution.

The plant installed a modern high-efficiency CFB with integrated emissions control and predictive analytics. ROI achieved in 3.8 years via fuel savings and regulatory stability.

The service life of a CFB boiler is not a fixed number—it’s a function of design, operation, and environmental interaction. While 20 to 30 years is the typical range, many units require earlier replacement due to corrosion, emissions non-compliance, or technological obsolescence. The key for asset owners and engineers is to monitor degradation rates, maintenance trends, and compliance risks holistically, and act proactively before failures force your hand.

When Is It More Cost-Effective to Replace a CFB Boiler Rather Than Repair or Upgrade It?

CFB (Circulating Fluidized Bed) boilers are built for durability and fuel flexibility, but over time, even the most robust systems reach a point where repair and upgrade efforts become increasingly costly and less effective. Plant operators often wrestle with a critical question: when do the repair bills and performance losses signal that it’s smarter to replace the boiler entirely? This decision is not just about technical failure—it’s about total cost of ownership, regulatory compliance, efficiency, and long-term viability. If you’re repeatedly patching tubes, replacing refractory, or dealing with emissions violations, the answer may already be clear.

It is more cost-effective to replace a CFB boiler rather than repair or upgrade it when the total cost of maintaining, retrofitting, and operating the existing unit exceeds 60%–70% of the cost of a new boiler, especially if the old system can no longer meet emissions standards, has obsolete controls, or exhibits chronic mechanical failures. At this tipping point, continued investment in the old boiler yields diminishing returns while replacement offers superior performance, compliance, and cost predictability.

Replacement is not just a capital expense—it’s a long-term operational strategy. Knowing when your boiler has crossed the line from asset to liability helps you make a data-driven decision that protects profitability, safety, and sustainability.

It is always cheaper to repair a CFB boiler than to replace it.False

In many cases, the accumulated costs of repairs, downtime, and compliance retrofits exceed the cost and benefits of installing a new boiler.

The Total Cost Framework: Repair vs. Replacement

To determine cost-effectiveness, plant managers must evaluate Total Lifecycle Cost (TLC) rather than just the immediate cost of repairs or upgrades.

Key Cost Components:

| Category | Repair Scenario | Replacement Scenario |

|---|---|---|

| CAPEX | $100k–$2M+ (depends on scope) | $5M–$15M (varies by size/capacity) |

| Annual OPEX (post-repair) | $250k–$500k (older units) | $80k–$150k (new, efficient systems) |

| Downtime Cost/Year | $300k–$2M (frequent outages) | <$100k (planned maintenance) |

| Emissions Penalties/Upgrades | $500k–$3M (FGD, SNCR/SCR, filters) | Included in modern designs |

| Insurance/Risk Premium | Higher (old, unreliable equipment) | Lower (modern safety/compliance features) |

| Payback Period | Not always clear (limited gains) | 3–6 years (from fuel/emissions savings) |

Over a 5-year horizon, even a $7 million new boiler may be cheaper than trying to keep a $1 million boiler alive with $3 million in retrofits and $4 million in operational losses.

Tipping Point Indicators for Replacement

Here are the clearest signs that replacement is more cost-effective than further investment in repair or upgrades:

1. Excessive Maintenance and Downtime Costs

When annual maintenance exceeds 4–5% of boiler replacement cost, it’s a red flag. If your 100 TPH boiler costs $6 million to replace, $250,000–$300,000 in yearly maintenance is your tipping point.

Example Trend:

| Year | Maintenance Cost | Unplanned Downtime | Replacement Consideration |

|---|---|---|---|

| 1–5 | $50k | <20 hours/year | Low |

| 6–10 | $120k | 50–100 hrs/year | Medium |

| 11–15 | $250k–$400k | >200 hrs/year | High |

Downtime costs do not influence the decision to replace a CFB boiler.False

Downtime costs are a major factor because they directly impact production output and profitability.

2. Failure to Meet Emissions Compliance

Modern emissions standards demand lower NOx, SOx, CO, and PM levels. If your boiler needs:

Expensive SNCR/SCR retrofits

Full FGD system installation

Cyclone rebuilds or new baghouses

…you may spend $2M–$4M just to comply—often more than half the cost of a new compliant unit.

Regulatory Risk Matrix:

| Compliance Status | Risk Level | Typical Cost to Correct | Recommendation |

|---|---|---|---|

| Minor deviation | Low | $50k–$150k | Retrofit OK |

| Repeated violations | Medium | $300k–$800k | Evaluate ROI |

| Outdated/no system | High | $1M–$4M | Replace |

Boiler emissions regulations remain constant over time.False

Emissions standards have become stricter, requiring modern technology to remain compliant.

3. Obsolete Control or Combustion Systems

When your control system:

Can’t maintain stable combustion under load changes

Uses unsupported or discontinued PLCs

Cannot be integrated with emissions systems or remote monitoring

…it compromises safety, efficiency, and regulation. Replacing these systems alone may cost $800k–$1.5M with no guarantee of compliance or long-term viability.

4. Chronic Component Failures

Frequent issues with:

Waterwall tube leaks

Superheater ruptures

Ash conveyor failures

Refractory spalling

…signal structural fatigue. At this stage, patching is a temporary fix. Cumulative repair costs can exceed $500k–$1M annually, and downtime adds further losses.

| Failure Type | Frequency (per year) | Cost/Event | Annual Cost (Est.) |

|---|---|---|---|

| Tube Leaks | 3–6 | $20k–$50k | $150k–$250k |

| Refractory Repairs | 2–4 | $15k–$60k | $100k–$180k |

| Bed Distributor | 1–2 | $80k–$120k | $100k+ |

The 70% Replacement Threshold Rule

This widely recognized rule in asset management suggests:

If the cumulative cost of repair and retrofits exceeds 70% of the cost of a new system—without significantly extending life or improving performance—it is more economical to replace.

Example:

New Boiler Cost: $7 million

Retrofit Emissions Upgrade: $2.5M

Control System Retrofit: $1.2M

Cyclone Rebuild: $1.3M

Total: $5M (≈71%)

In this scenario, you’re investing almost the full cost of a new boiler without gaining the full reliability, efficiency, or lifespan. Replacement is the clear winner.

Real Case Study: 25-Year-Old 110 TPH CFB Boiler (SE Asia)

Issue: Poor emissions performance, frequent tube failures, obsolete PLC, 18% unplanned downtime.

Annual Maintenance + Downtime Cost: $1.75M

Upgrade Estimates: $4.5M to meet new NOx standards and update controls

New Boiler Offer: $6.2M with 92% efficiency, full compliance, and digital control system

Decision: Replacement selected. Payback achieved in 3.6 years through fuel savings, emissions credits, and reduced repair labor.

Repairing older boilers always extends their lifespan by 10 years or more.False

Repairing older boilers may only provide short-term relief and cannot always restore full performance or ensure long-term compliance.

Summary Decision Table: When to Replace vs. Repair a CFB Boiler

| Evaluation Criteria | Replace | Repair |

|---|---|---|

| Maintenance > 5% of CapEx | ✅ | ❌ |

| Emissions system obsolete | ✅ | ❌ |

| Control system unupgradeable | ✅ | ❌ |

| Efficiency <75% | ✅ | ❌ |

| Structural fatigue/tube wear | ✅ | ❌ |

| Retrofit cost > 70% CapEx | ✅ | ❌ |

| Operating costs rising yearly | ✅ | ❌ |

When key performance indicators consistently point to escalating operational costs, rising downtime, and limited compliance flexibility, CFB boiler replacement is the smarter economic decision. Replacing a failing system not only restores thermal efficiency and emissions compliance—it secures the future of your plant’s productivity and regulatory stability for the next 20+ years.

🔍 Conclusion

CFB boilers are long-term assets, but pushing them beyond their prime can create operational and financial risks. A proactive replacement strategy, backed by performance data and cost analysis, ensures plant efficiency and regulatory compliance are never compromised. 🔄🔥📉

FAQ

Q1: What is the typical lifespan of a CFB boiler?

A1: The average lifespan of a well-maintained circulating fluidized bed (CFB) boiler is 20 to 30 years. However, this depends heavily on operating conditions, fuel quality, maintenance practices, and load cycles. Boilers exposed to aggressive fuels or poor maintenance may show signs of aging earlier. Near the end of its service life, a CFB boiler may experience declining efficiency, increased downtime, and rising repair costs.

Q2: What performance issues indicate the need for CFB boiler replacement?

A2: A significant drop in thermal efficiency, frequent breakdowns, uneven fluidization, or difficulty maintaining bed temperature and pressure are major performance red flags. If fuel consumption increases while steam output decreases, or if emissions exceed permissible levels despite regular maintenance, it’s likely time to consider replacing the unit.

Q3: How do rising maintenance costs signal the end of a boiler’s lifecycle?

A3: When the annual cost of maintaining a CFB boiler—including parts, labor, and unplanned shutdowns—exceeds 30–50% of the cost of a new unit, replacement becomes more cost-effective. Repeated repairs to core components like water walls, cyclone separators, refractory linings, or air distribution systems indicate structural degradation that often justifies investment in a new system.

Q4: What role do environmental regulations play in deciding to replace a CFB boiler?

A4: Stricter emissions regulations, especially those targeting NOx, SO₂, and particulate matter, can make older CFB boilers non-compliant or too expensive to retrofit. If a unit lacks the ability to integrate advanced emissions control systems—like flue gas desulfurization (FGD), bag filters, or SNCR/SCR systems—it may be more practical to replace the boiler with a newer, regulation-ready model.

Q5: Are there technological advancements that justify upgrading an older CFB boiler?

A5: Yes. Modern CFB boilers offer better fuel flexibility, higher efficiency (up to 90%), lower emissions, smart controls, and reduced maintenance requirements. If your existing unit lacks features like real-time monitoring, automated ash handling, or improved heat recovery, upgrading can result in significant long-term savings and improved reliability. In many cases, newer designs are also more compact and modular, reducing installation and integration costs.

References

CFB Boiler Technology Overview – https://www.babcock.com/home/products/boilers/cfb-boilers/ – Babcock & Wilcox

Industrial Boiler Life Expectancy – https://www.energy.gov/eere/femp/boiler-maintenance – U.S. Department of Energy

Fluidized Bed Combustion Performance – https://www.sciencedirect.com/topics/engineering/fluidized-bed-combustion – ScienceDirect

Boiler Repair vs. Replacement – https://www.powermag.com/repair-or-replace-your-boiler/ – POWER Magazine

CFB Emissions Compliance – https://www.epa.gov/stationary-sources-air-pollution – U.S. Environmental Protection Agency

Cost-Effective Boiler Upgrade Strategies – https://www.cleaverbrooks.com/reference-center/boiler-efficiency-guide.aspx – Cleaver-Brooks

Maintenance Costs of Aging Boilers – https://www.buildings.com/articles/27345/boiler-repair-or-replace – Buildings.com

Boiler Retrofit Limitations – https://www.abma.com/boiler-retrofits – American Boiler Manufacturers Association

Fuel Flexibility in CFB Boilers – https://www.iea.org/reports/clean-coal-technologies – International Energy Agency

Boiler Automation and Controls – https://www.emerson.com/en-us/automation/industrial-energy/boiler-control-systems – Emerson Automation

Andy Zhao